Category Archive: 4.) Marc to Market

FX Daily, April 24: Dramatic Response to French Election

The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesis that there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France.

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

Provided Le Pen and Macron or Fillion make to the second round, the market response to the French election results may be short lived. BOJ, Riksbank and ECB meetings. Spending authorization and some announcement from the White House on tax policy are in focus as Trump's 100th day in office approaches.

Read More »

Read More »

State of Dollar Bull Market

The dollar market is intact, despite the pullback here at the start of 2017. We have seen similar pullbacks in 2016 and 2015. Divergence remains the key driver.

Read More »

Read More »

FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen's hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week's gains, which are the most here in 2017.

Read More »

Read More »

FX Daily, April 20: Dollar and Yen Push Lower

With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday's rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00.

Read More »

Read More »

May’s Early Election Bid Sends Sterling on Roller Coaster

May calls snap election for June 8. Tories running 20 percent point lead over Labour. Next election would be in 2022, after the Brexit negotiations conclude.

Read More »

Read More »

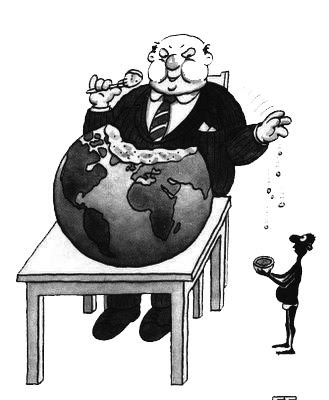

More Thinking about Trade as Pence and Ross Head to Tokyo

Pence and Ross may "feel out" Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem.

Read More »

Read More »

FX Daily, April 18: US Dollar Consolidates Yesterday’s Gains

The US dollar is consolidating the gains scored late in the US session yesterday in response to a Financial Times interview with US Treasury Secretary Munchin who seemed to play down the strategic importance of Trump's recent complaint about the greenback's strength.

Read More »

Read More »

FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to open, the dollar is softer against the all major currencies and many emerging market currencies.

Read More »

Read More »

Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out.

Read More »

Read More »

FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump's "American First" rhetoric. Trump's earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump's use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism.

Read More »

Read More »

Decoupling of Oil and US Interest Rates

US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top.

Read More »

Read More »

Euro’s Record Losing Streak Against the Yen

The euro has fallen for 11 consecutive sessions against the yen. Interest rates, US and German in particular, seem to be the main driver. Technicals are stretched, but have not signaled a reversal yet.

Read More »

Read More »

Cool Video: Making Sense of the New Administration

I was on Bloomberg TV earlier today, chatting with David Gura about how to try to make sense of new Trump Administration. I suggest that the decision-making style and practical concerns have created two wing to the Administration. There is a populist-nationalist wing that is home to America First ideas.

Read More »

Read More »

FX Daily, April 14: Holiday Markets Remain on Edge

The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar's strength from the sitting US President. While sending an "armada" toward the Korean peninsula, the US ordered a missile strike against Syria in retaliation for the use of chemical weapons and dropped the largest bomb in the world on Afghanistan.

Read More »

Read More »

Trade Notes: China and Prospects for a New Executive Order

China's trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive.

Read More »

Read More »

FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday.

Read More »

Read More »

FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was also initially extended in Asia before stabilizing and returning to levels seen in the US afternoon.

Read More »

Read More »

FOMC Minutes Suggest Balance Sheet May Begin Shrinking This Year

FOMC minutes increased likelihood that Fed will begin reducing its balance sheet late this year. There does not seem to be a consensus on other issues. The strength of the ADP report contrasts with softness seen in the ISM and PMI non-manufacturing surveys.

Read More »

Read More »

FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

The US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey.

Read More »

Read More »