Category Archive: 4.) Marc to Market

Marc Chandler on Global Monetary Policy

Jan.08 — Marc Chandler, global head of markets strategy and FX at Brown Brothers Harriman, discusses monetary policy from the Federal Reserve and other central banks. He speaks on “Bloomberg Daybreak: Americas.”

Read More »

Read More »

Italian Election–Two Months and Counting

Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members.

Read More »

Read More »

FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to have helped the dollar to move off the mat. Quickly summarized, these considerations are a larger than expected Australian trade deficit, slippage in Japan's service sector PMI, a larger than expected drop in the...

Read More »

Read More »

Headline US Jobs Disappoint, but Earnings as Expected

The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story.

Read More »

Read More »

FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year.

Read More »

Read More »

Cool Video: Is the Third Major Dollar Rally Since Bretton Woods Over?

To many, the question about the fate of the third major dollar rally since the end of Bretton Woods was resolved last year. The dollar fell broadly. It marked the end the greenback's ride higher. However, I remain less convinced that this is really the case. And that is what I discuss in this three-minute clip from Bloomberg's What'd You Miss.

Read More »

Read More »

FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year's high set in September near $1.2090. Yesterday was also the third consecutive close above the upper Bollinger Band, which is found today near $1.2060.

Read More »

Read More »

The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month.

Read More »

Read More »

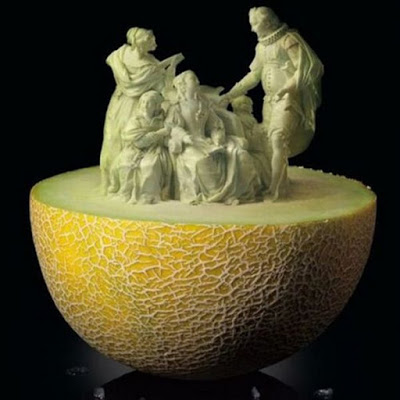

Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective.

Read More »

Read More »

FX Daily, January 2: Dollar Slump Accelerates

The US dollar's slump seen in the final two weeks of 2017 is carried into today's activity. The greenback's sell-off extends to the emerging market currencies as well. The Hungarian forint is the strongest rising nearly 1%, ostensibly helped by the euro approaching last year's high. However, our sense that fumes and momentum more than fresh news is pushing the dollar down is illustrated by the Korean won. It has gained nearly 0.9% today even though...

Read More »

Read More »

Petro-Yuan? Really?

The launch of futures on Bitcoins was rushed so quickly through the regulatory channels that the anticipation was short-lived. And as the recent price action amply demonstrates, the existence of a derivative market has not tamed the digital token's volatility. It is still the early days, but Bitcoin futures do not look likely to change the world.

Read More »

Read More »

FX Daily, December 27: What Happened on Boxing Day?

There were several developments on the day after Christmas, while many markets remained closed and investors sidelined. One of the most important developments was the euro's complete recovery from the flash crash of nearly three percent on Christmas day in the North American time zone.

Read More »

Read More »

FX Daily, December 19: US Equities Set Pace, While Greenback Consolidates Inside Monday’s Ranges

US tax changes appear to be providing fuel for the year-end advance that has carried the major indices to new record highs. The coattails are a bit short, and while global equity markets are firm, they are unable to match the strength of US. Despite a heavier tone in Japan, Taiwan, and Korea, the MSCI Asia Pacific Index edged higher for the second session but remains around one percent below the record highs set in late November.

Read More »

Read More »

Great Graphic: Sterling Toys with Three-Year Downtrend Line

Sterling is the second major currency this year after the euro (and its shadow the Danish krone). The downtrend line from mid-2014 is fraying. Is this the breakout?

Read More »

Read More »

FX Daily, December 18: Trade Tensions with China Set to Escalate

The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure initiative is likely to be unveiled as early as next month. Before that, the US is poised to ratchet up the tension on China.

Read More »

Read More »

FX Weekly Preview: Policy Mix Underlines Positive Fundamental Backdrop for the Dollar

The prospects that the Republican-controlled legislative branch would find a compromise to tax cuts were enhanced when a few senators appeared to capitulate without much to show for it may have helped lift US stocks and dollar ahead of the weekend.

Read More »

Read More »

FX Daily, December 15: Premium for Dollar-Funding is not Helping Greenback Very Much

The cross-currency basis swap continues to lurch in the dollar's direction, especially against the euro, and yet the dollar is not drawing much support from it. The increasing cost reflects pressure for the year-end and does not appear to reflect systemic issues. Dollar auction by the ECB and BOJ do not show any strain. The dollar has a downside bias today against most of the major currencies. And is what is true of the day is true for the week....

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

FX Daily, December 13: Greenback Quiet Ahead of Five Central Bank Meetings

The Federal Reserve gets the balling rolling today with the FOMC meeting, which is most likely to deliver the third hike of the year. Tomorrow, four European central banks meet: Norway, Switzerland, the UK, and the ECB. The MSCI Asia Pacific Index rose nearly 0.3%, though Japanese and Indian shares were lower. In Europe, the Down Jones Stoxx 600 is paring yesterday's gains (-0.2%) led by utilities and telecom. Consumer discretion and financials are...

Read More »

Read More »

FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden's inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining 1.1% against the dollar and nearly as much against the euro, which is in a third of a cent range below $1.18.

Read More »

Read More »