Category Archive: 8) Economics

Unveiling the Advantages of a Free Economic Model

When discussing different ways to run an economy, one idea that stands out is the “free market” system. Instead of being a mouthful, it’s essentially a way of doing things where the government doesn’t get too involved, and businesses are free to compete. This setup has some pretty cool perks that can make life …

Read More »

Read More »

Helicopter Money and the End of Taxes

Rather than right the ship, the "easy fix" is to distribute "free money"--not just to billionaires and corporations but to everyone.

Read More »

Read More »

Albert Edwards: Investors Should Brace For A World Of Negative Rates, 15percent Budget Deficits And Helicopter Money

Eariler this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative "empirical evidence" that greenlights this unprecedented NIRPy step (in addition to QE of course).

Read More »

Read More »

Revenu universel, du néo-libéralisme jusqu’au bout

Les quantitative easing de la dernière décennie ont créé un assèchement de liquidités locales. Ceci est un fait observable. Les banques locales sont étranglées par diverses directives imposées par les tenants et « régulateurs » de la haute finance internationale (Finma pour la Suisse). L’échec économique se propage, avec de multiples faillites de commerces et d’entreprises? Vous n’avez plus accès à vos capitaux-épargne?

Read More »

Read More »

The Path to Inflation: “Helicopter Money”

Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a "good thing" we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see.

Read More »

Read More »

100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Read More »

The Point of War Is Not to Win

In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s.

Read More »

Read More »

Interview with Doug Casey

Our friend Natalie Vein recently had the opportunity to conduct an extensive interview with Doug Casey for BFI, the parent company of Global Gold. Based on his decades-long experience in investing and his many travels, he shares his views on the state of the world economy, his outlook on critical political developments in the US and in Europe, as well as his investment insights and his approach to gold, as part of a viable strategy for value...

Read More »

Read More »

Japan’s Planners Ratchet up Monetary Experimentation

It was widely expected that the BoJ would announce something this week after it promised to perform a comprehensive review of its monetary policy. It certainly did deliver a major tweak to its inflationary program, but its implications were seemingly not entirely clear to everybody (probably not even to the BoJ).

Read More »

Read More »

A Convocation of Interventionists – Part 1

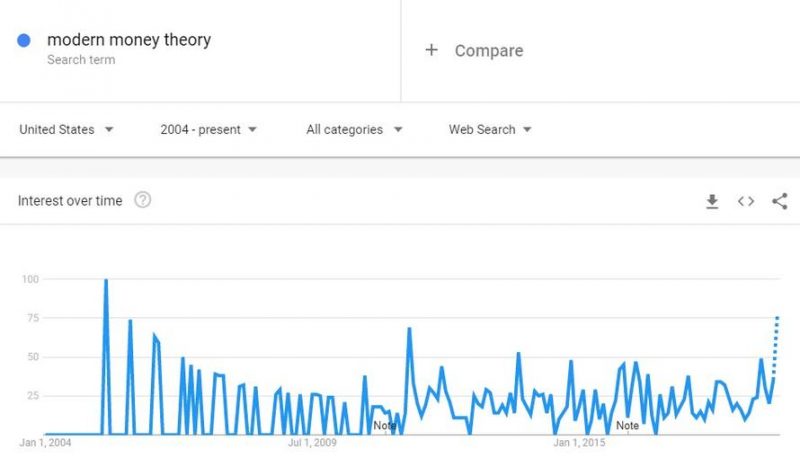

Modern Economics – It’s All About Central Planning. We are hereby delivering a somewhat belated comment on the meeting of monetary central planners and their courtier economists at Jackson Hole. Luckily timing is not really an issue in this context.

Read More »

Read More »

Finland Unleashes Helicopter Money In “Greatest Societal Transformation Of Our Time”

Finland is about to launch an experiment in which a randomly selected group of 2,000–3,000 citizens already on unemployment benefits will begin to receive a monthly basic income of 560 euros (approx. $600). That basic income will replace their existing benefits. The amount is the same as the current guaranteed minimum level of Finnish social security support.

Read More »

Read More »

‘Last Economist Standing’ John Taylor Urges “Less Weird Policy” At Jackson Hole

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it.

Read More »

Read More »

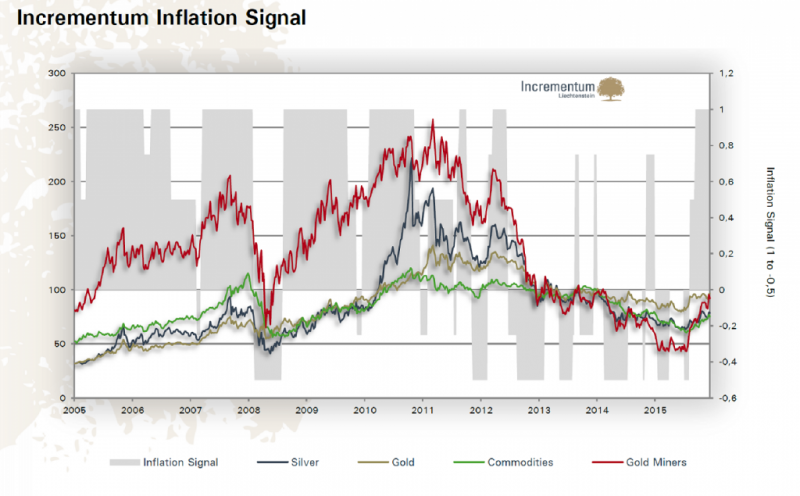

Incrementum Advisory Board Meeting, July 2016

The quarterly meeting of the Incrementum Fund’s advisory board was held on July 19. A pdf transcript of the discussion can be downloaded via the link below. We were once again joined by special guest Brent Johnson, the CEO of Santiago Capital. One topic: Helicopter money.

Read More »

Read More »

The Helicopter Mortgage

Medical vs. Financial Engineering. I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

A Nation of Crooks?

Apples to Oranges. PARIS – The stock market seemed chilled last week, like a corpse waiting for an autopsy. Monday morning, gold was falling in Europe… as investors anticipate a higher dollar. But we’ll return to the markets, the dollar and the absurdities wrought by our money system, tomorrow.

Read More »

Read More »

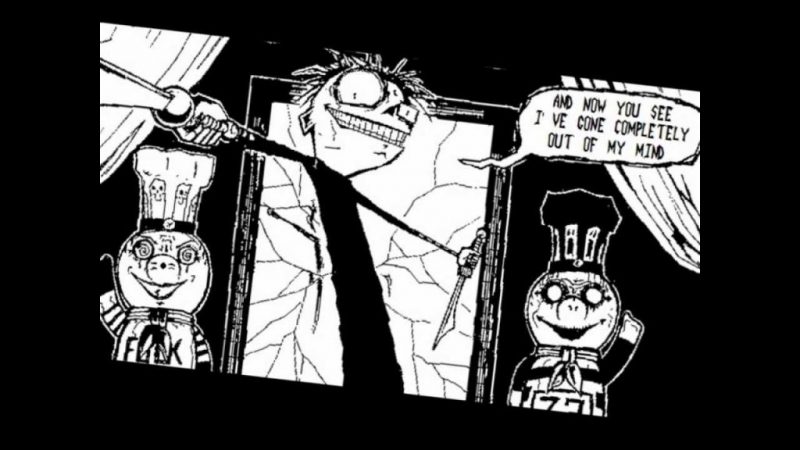

Unsound Money Has Destroyed the Middle Class

DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal. You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane.

Read More »

Read More »

More Signs the End is Nigh

Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be.

Read More »

Read More »

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »

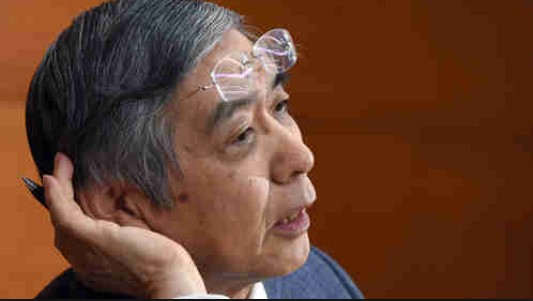

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »