Category Archive: 1.) CHF

Izabella Kaminska: Uberisation of the Economy: Gosplan 2.0.

SERIES 2.2: POST-CAPITALISM 7 MAR – IZABELLA KAMNISKA (FINANCIAL TIMES): UBERISATION OF THE ECONOMY: GOSPLAN 2.0 The sharing economy isn’t what you think it is. Nor is the platform economy. Furthermore, we’ve been here before. Last time it was under the guise of ‘red plenty’. Could we be sleep walking our way into a technocratic …

Read More »

Read More »

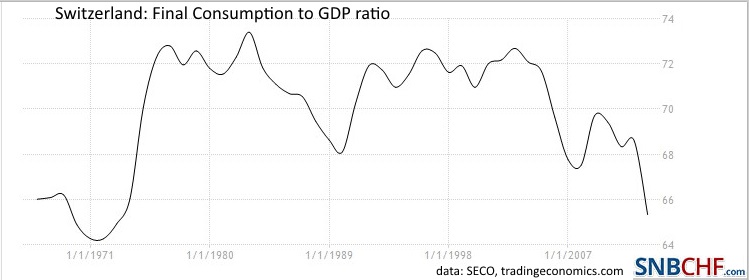

Swiss GDP and Swiss Franc Shock Propaganda

For George Dorgan the "Swiss Franc Shock" celebrated by the Swiss press did not affect the Net Exports component of Swiss GDP, but it rather suppressed growth in consumption. Therefore the Swiss economy could not replace lost export jobs by new jobs in the internal economy.

Read More »

Read More »

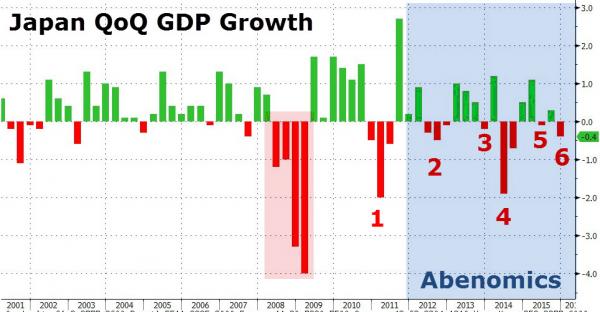

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »

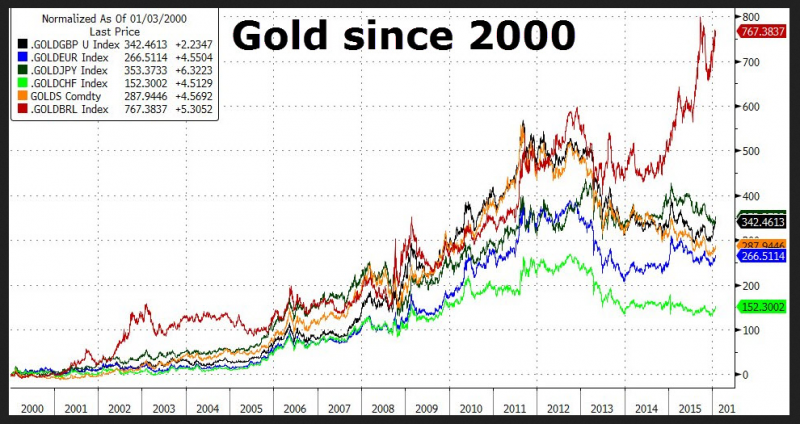

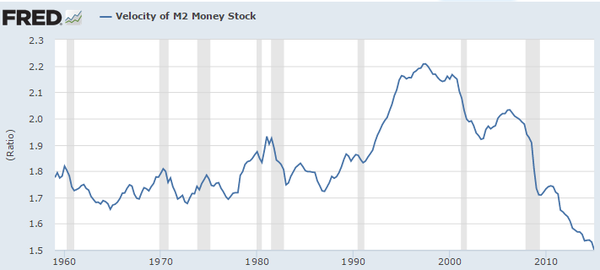

Weak CHF during the Fat Years of the Joseph Cycle

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging...

Read More »

Read More »

Switzerland Was Right to Scrap Its Franc Cap, Economists Say

The Swiss National Bank’s surprise decision a year ago to remove its ceiling on the franc was justified, according to the vast majority of economists in Bloomberg’s monthly survey. The SNB abandoned the cap on Jan. 15 of last year, saying interventions to sustain it would have been out of proportion to its economic advantages. With the benefit of 12 months of hindsight, all but two of 23 economists answered that the move was indeed right.

Read More »

Read More »

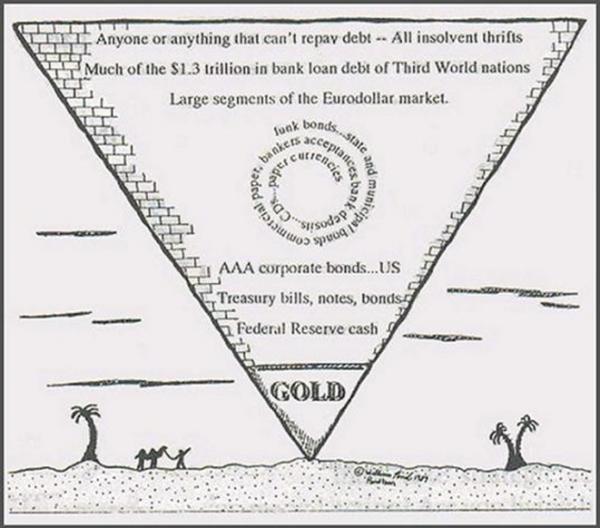

Square Holes And Currency Pegs

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years....

Read More »

Read More »

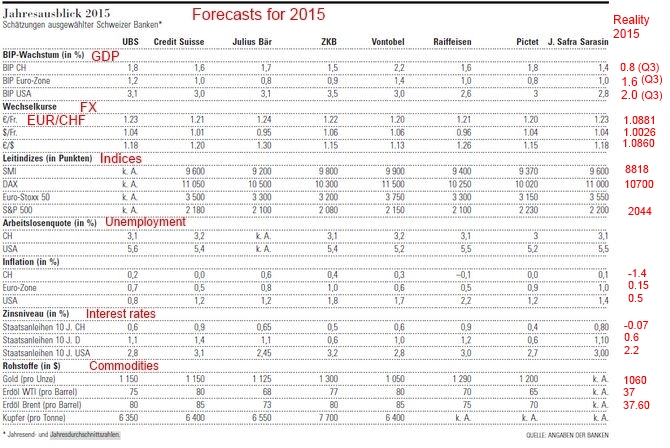

Economic Forecasts for 2015: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates are far lower than expected. The errors for stock indices were smaller.

Read More »

Read More »

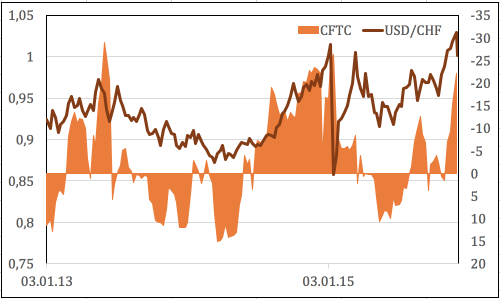

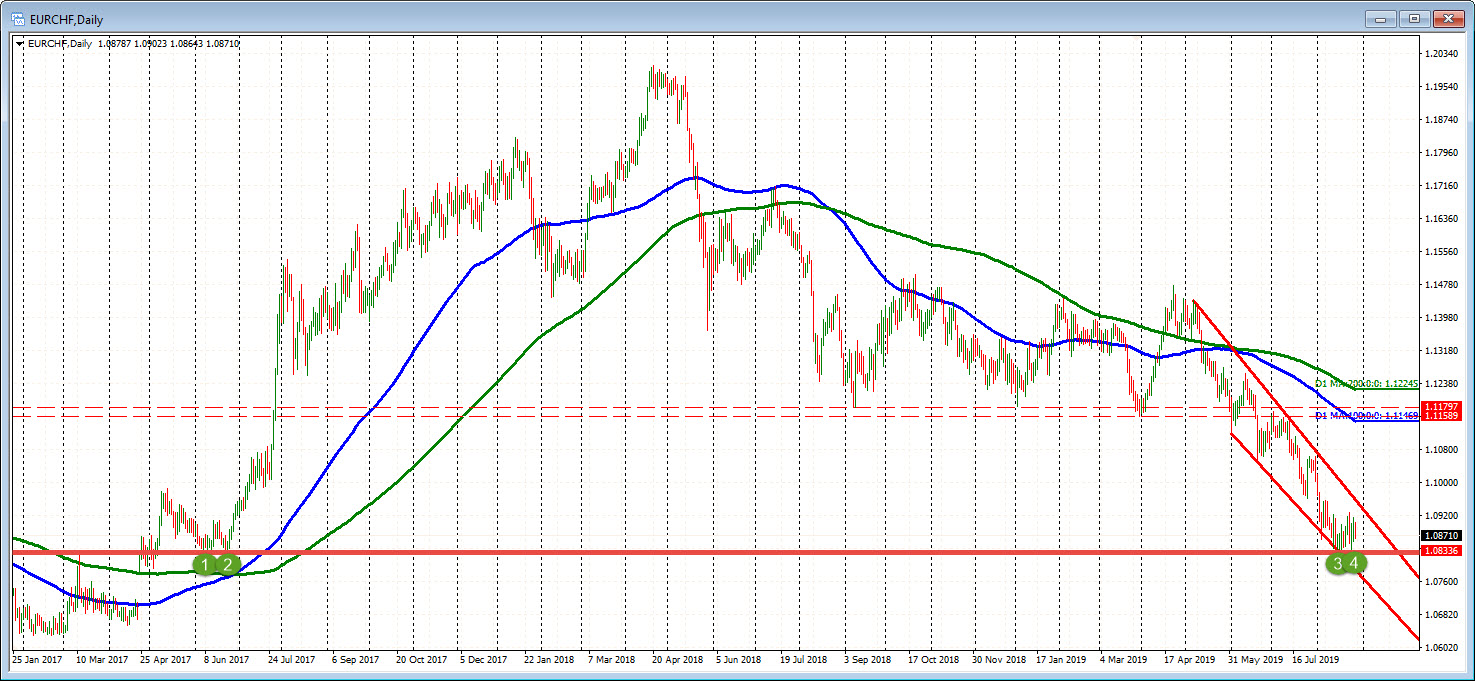

Will The Franc Follow In The Euro’s Footsteps?

The SNB's expected December 10 rate cuts have already been priced in to the Swiss Franc.

The central bank's failure to do more than the market expected resulted in a stronger CHF.

Growing uncertainty over the Fed's 2016 monetary policy is a bullish factor for the franc.

Read More »

Read More »