Category Archive: 6b.) Debt and the Fallacies of Paper Money

Smart Programs of Capital Destruction

These days everything must be smart. There are smart cities, smart grids, smart policies, smart TVs, smart cars, smart phones, smart watches, smart shoes, and smart glasses. There’s even something called smart underwear. Before long everything around us will be so smart we’ll no longer have to do one critically important thing. We’ll no longer have to think; smart algorithms will think for us. What’s more, the possibilities for not thinking are...

Read More »

Read More »

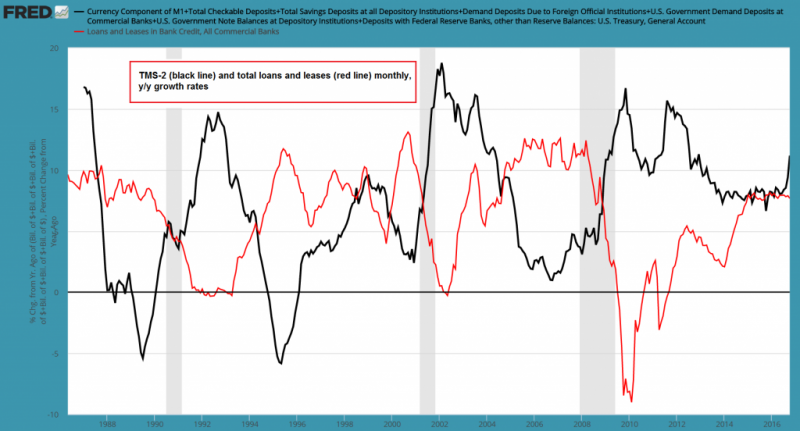

US True Money Supply Growth Jumps, Part 1: A Shift in Liabilities

The growth rates of various “Austrian” measures of the US money supply (such as TMS-2 and money AMS) have accelerated significantly in recent months. That is quite surprising, as the Fed hasn’t been engaged in QE for quite some time and year-on-year growth in commercial bank credit has actually slowed down rather than accelerating of late. The only exception to this is mortgage lending growth – at least until recently. Growth in mortgage loans is...

Read More »

Read More »

Attaining Self-Destruct Velocity

Some Monday mornings are better than others. Others are worse than some. For one Amazon employee, this past Monday morning was particularly bad. No doubt, the poor fellow would have been better off he’d called in sick to work. Such a simple decision would have saved him from extreme agony. But, unfortunately, he showed up at Amazon’s Seattle headquarters and put on a public and painful display of madness.

Read More »

Read More »

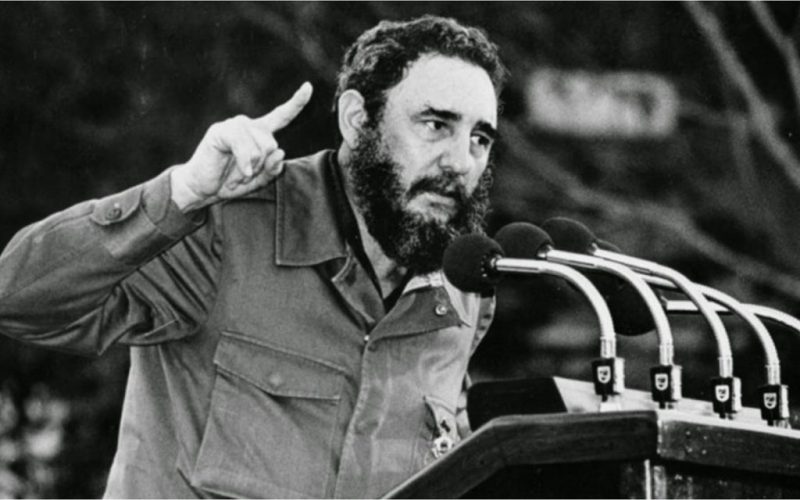

Fidel Castro and the American Empire

The death of the brutal Cuban Communist dictator Fidel Castro closes the door, in some respect, on another disastrous page in US foreign policy history. For all the denunciations and criticism of Castro from conservative elements and exiled Cubans, his despotic rule was the outcome of decades of American imperialism which began with President William McKinley’s infamous decision to wage war on hapless Spain in 1898.

Read More »

Read More »

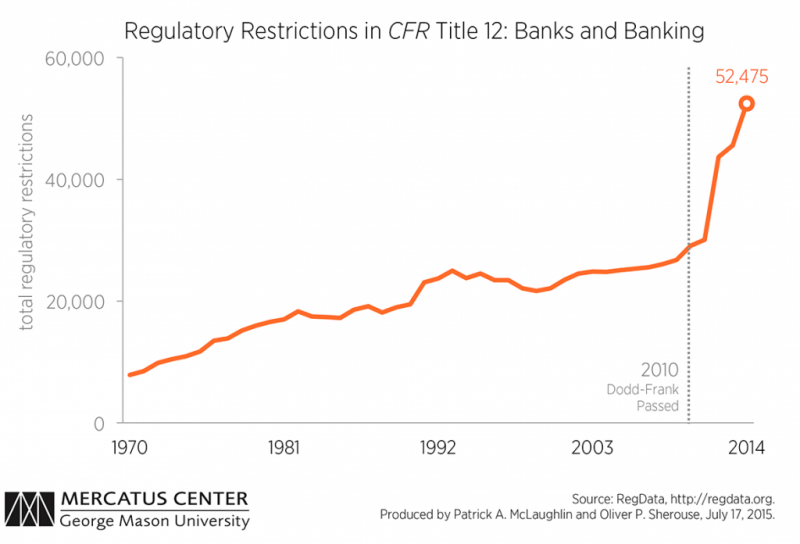

Celebrating this Land of Absurdity

“Myths and legends die hard in America,” remarked Hunter S. Thompson in The Great Shark Hunt, nearly 40-years ago. These great myths and legends of America died long ago. Freedom. Liberty. Independence. Limited representative government. Sound money. Private property rights. All getting more and more replaced by regulation.

Read More »

Read More »

The Problem with Corporate Debt

There are actually two problems with corporate debt. One is that there is too much of it… the other is that a lot of it appears to be going sour. As a brief report at Marketwatch last week (widely ignored as far as we are aware) informs us.

Read More »

Read More »

Good Money and Bad Money

OUZILLY, France – Last week’s U.S. jobs report came in better than expected. Stocks rose to new records. As we laid out recently, a better jobs picture should lead the Fed to raise rates. This should cause canny investors to dump stocks.

Read More »

Read More »

Too Early for “Inflation Bets”?

After 35 years of waiting… so many false signals… so often deceived… so often disappointed… bond bears gathered on rooftops as though awaiting the Second Coming. Many times, investors have said to themselves, “This is it! This is the end of the Great Bull Market in Bonds!”

Read More »

Read More »

Putting an End to the Regulatory Industry

Corporate life in America these days is fraught with tedium. First the MBAs imposed their silly six sigma processes and reduced workers to mere widgets. Then the regulators went through and squashed out any fun that remained.

Read More »

Read More »

Two Types of Credit — One Leads to Booms and Busts

In the slump of a cycle, businesses that were thriving begin to experience difficulties or go under. They do so not because of firm-specific entrepreneurial errors but rather in tandem with whole sectors of the economy. People who were wealthy yesterday have become poor today. Factories that were busy yesterday are shut down today, and workers are out of jobs.

Read More »

Read More »

About that Economic Inequality

I address this essay to two groups. One group is those among the liberty movement, who believe that there’s nothing wrong with inequality. These are often Objectivists, who unknowingly defend a regime that artificially suppresses working people.

Read More »

Read More »

Inflation Expectations Rise Sharply

We have witnessed truly astonishing short term market conniptions following the Donald Trump’s election victory. In this post we want to focus on one aspect that seems to be exercising people quite a bit at present, namely the recent surge in inflation expectations reflected in the markets. Will we have to get those WIN buttons out again?

Read More »

Read More »

The Fed’s “Hothouse” Is in Danger

RHINEBECK, New York – It is a beautiful autumnal day here in upstate New York. The trees are red, brown, and yellow. Squirrels hop across the lawn, collecting their nuts. Unseasonably warm the last few days, rain showers are moving in from across the Hudson, driven by a chilly wind.

Read More »

Read More »

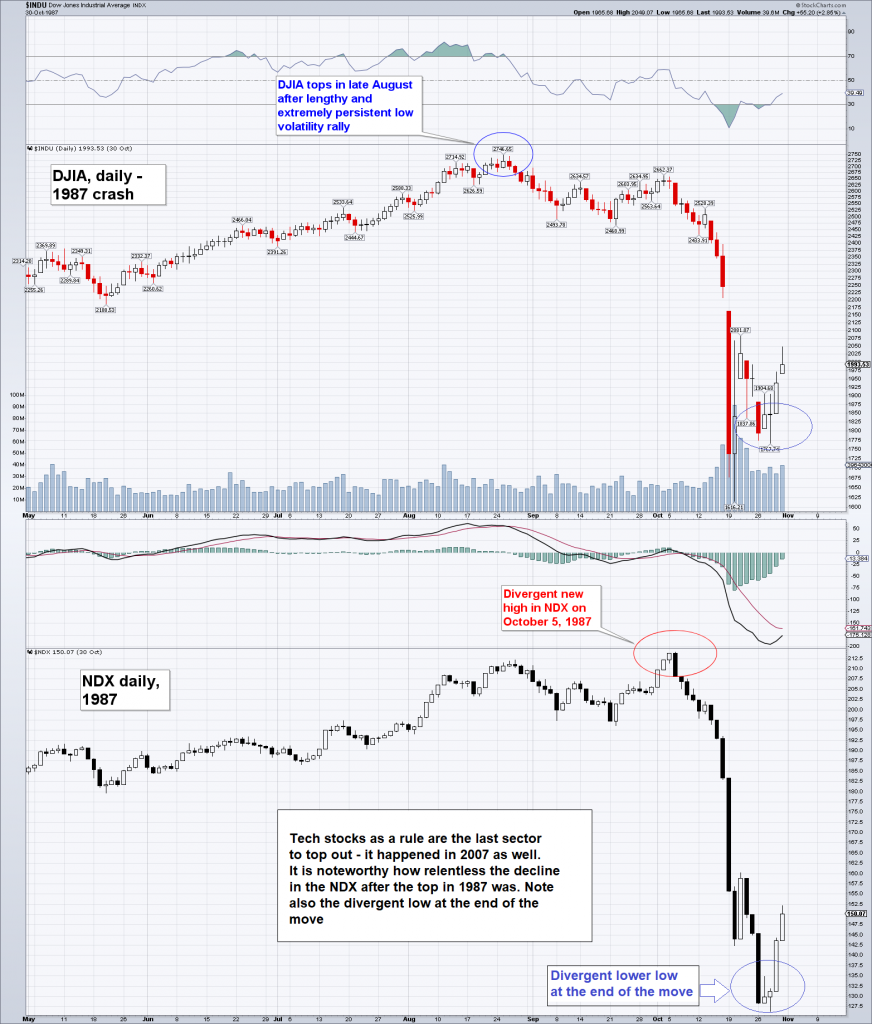

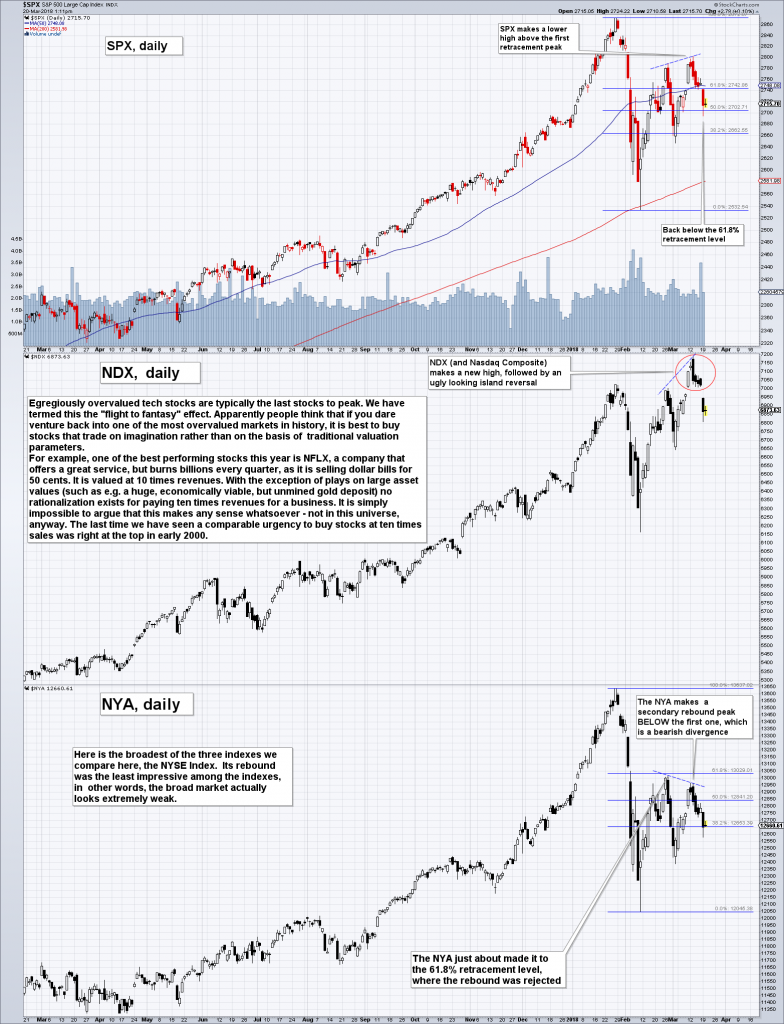

Dissection of the Long-Term Asset Bubble

The Long Term Outlook for the Asset Bubble Due to strong internals, John Hussman has given the stock market rally since the February low the benefit of the doubt for a while. Lately he has returned to issuing warnings about the market’s potential to deliver a big negative surprise once it runs out of greater fools.

Read More »

Read More »

The One Thing that Will Change Everything

The American populace counts down to Election Day with impatient intent. Will their party man occupy the White House come January 21, 2017? Or will their party woman occupy a federal prison cell? These are questions that only the good wisdom of time can answer. Here at the Economic Prism we watch with indifferent curiosity. We don’t think either candidate’s worthy of high office. But we’re eager to know the election outcome, nevertheless.

Read More »

Read More »

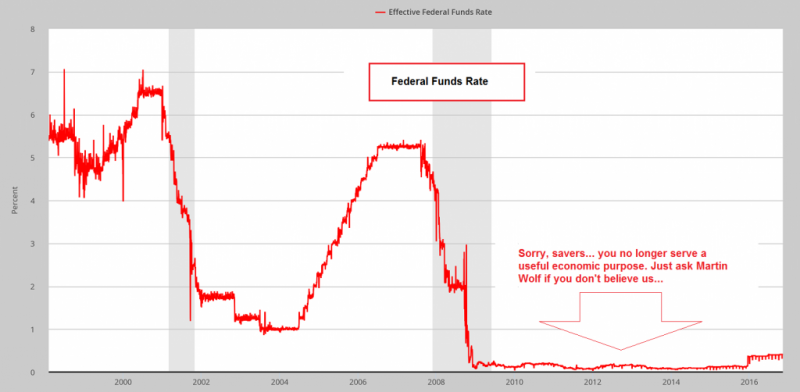

Is there a Savings Glut?

In his speech at the New York Federal Reserve of New York on October 5, 2016, the Federal Reserve Vice Chairman Stanley Fischer has suggested that a visible decline in the natural interest rate in the US could be on account of the world glut of saving. According to Fischer, both increased saving and reduced investments have potentially significantly lowered the natural rate of interest.

Read More »

Read More »

Crude Oil Has Entered a Seasonal Downtrend

Many market observers are probably expecting crude oil prices to enter a seasonal uptrend due the beginning heating season. After all, the heating season in the Northern hemisphere means that energy consumption will rise. The effect of the heating season on demand is however offset by other factors, such as the use of alternative energy sources and fixed prices agreements made in advance. The question is: what is the actual seasonal trend in crude...

Read More »

Read More »

D-day for Australia’s Real Estate Bubble?

Unknowable Degrees of Bubble Insanity Back in February, we brought you an update on the truly insane real estate bubble in Australia (see: “Australia’s Housing Bubble – In the Grip of Insanity” for details) in the wake of Jonathan Tepper of Variant Perception reporting on an eye-opening fact-finding tour in Sydney.

Read More »

Read More »

Recessions, Predictions and the Stock Market

Only Sell Stocks in Recessions? We were recently made aware of an interview at Bloomberg, in which Tony Dwyer of Cannacord and Brian Wieser of Pivotal Research were quizzed on the recently announced utterly bizarre AT&T – Time Warner merger. We were actually quite surprised that AT&T wanted to buy the giant media turkey. Prior to the offer, TWX still traded 50% below the high it had reached 17 years ago.

Read More »

Read More »