Category Archive: 6b) Austrian Economics

Cashkurs*Trends Webinar zum Megatrend Cybersecurity

Am Donnerstag, 12. Mai 2017 fand ein exklusives Cashkurs*Trends-Webinar mit Dirk Müller und Dr. Eike Wenzel statt, und zwar zum spannenden Thema “Cybersecurity: Das digitale Wettrennen um die eigene Reputation” Wie funktioniert dieser Zukunftsmarkt? In welche Richtung gehen die Entwicklungen? Und wie können Sie von diesem Trend profitieren? Zusammen mit Charttechnikexperte Henry Philippson und Fundamentalspezialist …

Read More »

Read More »

The Triumph of Hope over Experience

On Wednesday the socialist central planning agency that has bedeviled the market economy for more than a century held one of its regular meetings. Thereafter it informed us about its reading of the bird entrails via statement (one could call this a verbose form of groping in the dark).

Read More »

Read More »

Ursula von der Leyen plant massive Aufrüstung der Bundeswehr

Dirk Müller im Tagesausblick vom 11.05.2017 – Weitere Themen: Märkte: Konsolidierung auf hohem Niveau? • Betrugsverdacht bei Kryptowährung “One Coin” • News und Zahlen zu Snap, Schaeffler, Gamesa, Deutsche Post und Solarworld • Trump wegen Entlassung des FBI-Chefs unter Druck www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse, Wirtschaft, Finanzmarkt von und mit Dirk …

Read More »

Read More »

Keynote Speaker: Professor Otmar Issing

Professor Issing speaks to the future of the European and global economic order, including the European Union and European monetary union, in the context of the challenges thereto posed by current global pressures including Brexit, the dynamics of the current European national political and economic situation and the economic policies of the new US administration.

Read More »

Read More »

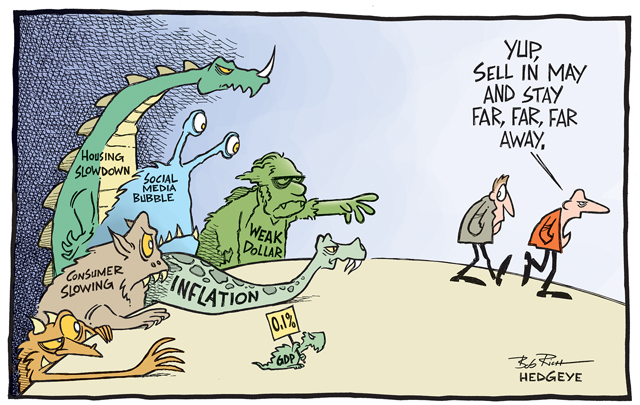

“Sell in May and Go Away” – in 9 out of 11 Countries it Makes Sense to Do So

An Old Seasonal Truism Most people are probably aware of the saying “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months.

Read More »

Read More »

Ronald Stöferle: “Wir befinden uns in einem positiven Umfeld für Gold”

Interview mit dem Fondsmanager der Incrementum AG Get our free Newsletter (English) ►: http://eepurl.com/bScRBX Get our free Newsletter (German) ►: http://eepurl.com/08pAn Subscribe to our YouTube channel ►: https://www.youtube.com/user/ResourceCapitalAG?sub_confirmation=1 *Stay ahead of the investment-crowd* Commodity-TV and Rohstoff-TV offer you free interviews and company presentations across the Metals-, Mining- and Commodity sector.

Read More »

Read More »

Central Banks’ Obsession with Price Stability Leads to Economic Instability

For most economists the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index. According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, and enables businesses to see clearly market signals that are conveyed by the relative changes in the prices of goods and services.

Read More »

Read More »

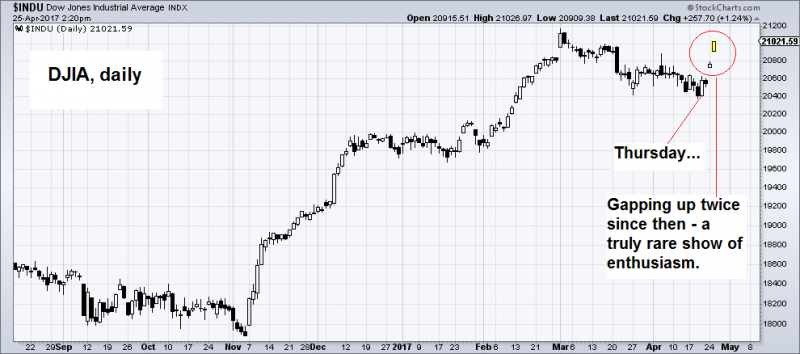

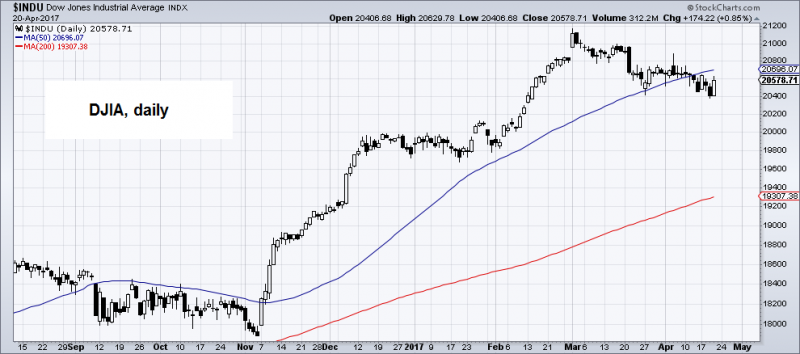

The Fed Will Blink

GUALFIN, ARGENTINA – The Dow rose 174 points on Thursday. And Treasury Secretary Steve Mnuchin said we’d have a new tax system by the end of the year. Animal spirits were restless. But which animals? Dumb oxes? Or wily foxes? Probably both.

Read More »

Read More »

Stichwahl in Frankreich: Marine Le Pen gegen den “neuen Kennedy”

Ist Emmanuel Macron tatsächlich ein “neuer Kennedy”? Wie Le Pens Chancen stehen und on ihr Gegner der Wunderheiler für Frankreich ist, kommentiert Dirk Müller im heutigen Tagesausblick. Die weiteren Themen des Tages: Nordkorea: Wird “eingefrorener” Konflikt heißer & Trumps Pläne für die Banken www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse, Wirtschaft, Finanzmarkt von …...

Read More »

Read More »

Why Does Freedom Work? | Robert P. Murphy

Research Fellow Robert P. Murphy’s presentation at the “New Bridges: San Francisco” conference, held in San Francisco, on April 7, 2017 Robert P. Murphy is a Research Fellow at the Independent Institute, Research Assistant Professor with the Free Market Institute at Texas Tech University, President of Consulting by RPM, Senior Economist with the Institute for …

Read More »

Read More »

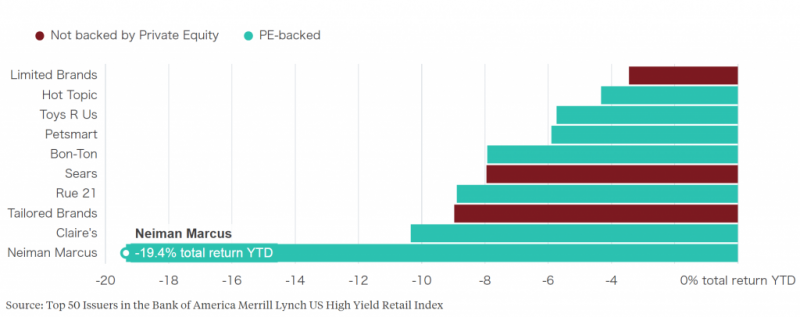

Cracks in Ponzi-Finance Land

Retail Debt Debacles

The retail sector has replaced the oil sector in a sense, and not in a good way. It is the sector that is most likely to see a large surge in bankruptcies this year. Junk bonds issued by retailers are performing dismally, and within the group the bonds of companies that were subject to leveraged buyouts by private equity firms seem to be doing the worst (a function of their outsized debt loads).

Read More »

Read More »

French Selection Ritual, Round Two

The nightmare of nightmares of the globalist elites and France’s political establishment has been avoided: as the polls had indicated, Emmanuel Macron and Marine Le Pen are moving on to the run-off election; Jean-Luc Mélenchon’s late surge in popularity did not suffice to make him a contender – it did however push the established Socialist Party deeper into the dustbin of history.

Read More »

Read More »

Wendet Erdogan sich von der EU ab?

Dirk Müller im Tagesausblick vom 26. April 2017 zur sich abzeichnenden endgültigen Abkehr der Türkei von der EU und einem erstaunlichen geostrategischen Gleichlauf bei der Vergrößerung von EU und NATO. www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse, Wirtschaft, Finanzmarkt von und mit Dirk Müller

Read More »

Read More »

Ronald Stöferle:„In gold we trust?! Anfang des Bullenmarktes oder dead cat bounce?“

Fondsmanager Incrementum AG, Liechtenstein & Goldanalyst – Autor Get our free Newsletter (English) ►: http://eepurl.com/bScRBX Get our free Newsletter (German) ►: http://eepurl.com/08pAn Subscribe to our YouTube channel ►: https://www.youtube.com/user/ResourceCapitalAG?sub_confirmation=1 *Stay ahead of the investment-crowd* Commodity-TV and Rohstoff-TV offer you free interviews and company presentations across the Metals-, Mining- and...

Read More »

Read More »

Central Banks Have a $13 Trillion Problem

GUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy.

Read More »

Read More »

Simple Math of Bank Horse-Puckey

We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights.

Read More »

Read More »

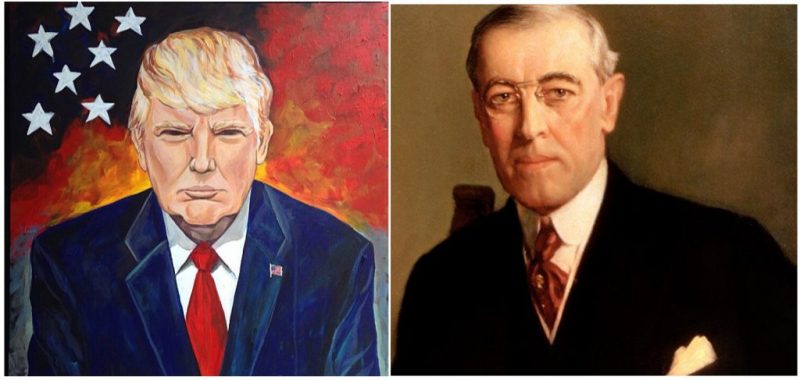

On the Commemoration of World War I: From Woodrow Wilson to Donald Trump

It is altogether fitting that the US attack on a Syrian airport, the dropping of a MOAB on defenseless Afghanistan, and the potential outbreak of nuclear war with North Korea have all come in the very month in which an American president led the nation on its road to empire one hundred years earlier.

Read More »

Read More »

India – Is Kashmir Gone?

Everything Gets Worse (Part XII) – Pakistan vs. India After 70 years of so-called independence, one has to be a professional victim not to look within oneself for the reasons for starvation, unnatural deaths, utter backwardness, drudgery, disease, and misery in India.

Read More »

Read More »

French Election – Bad Dream Intrusion

The French presidential election was temporarily relegated to the back-pages following the US strike on Syria, but a few days ago, the Economist Magazine returned to the topic, noting that a potential “nightmare option” has suddenly come into view. In recent months certainty had increased that once the election moved into its second round, it would be plain sailing for whichever establishment candidate Ms. Le Pen was going to face. That certainty...

Read More »

Read More »