Category Archive: 6b) Austrian Economics

Latin America – Seven Ugly Sisters in Deep Political Trouble

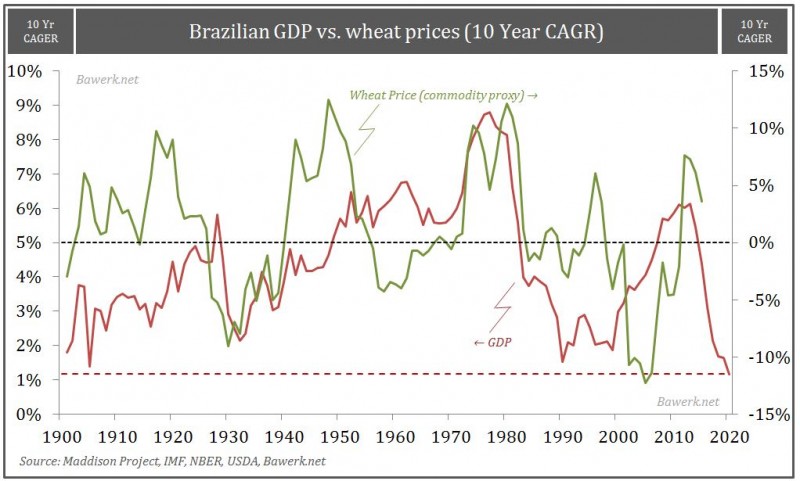

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices.

Read More »

Read More »

Is that Buzzing Sound Helicopter Money?

Helicopter money is the rage. Central banks are talking about it. Economists are debating it. The media is rife with coverage. While it sounds important, it is not precisely clear what helicopter money means. It appears to have originated with Milton Friedman. In 1969, he wrote: "Let us suppose now that one day a helicopter … Continue reading »

Read More »

Read More »

Greenspan, the Sheepherder

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated,...

Read More »

Read More »

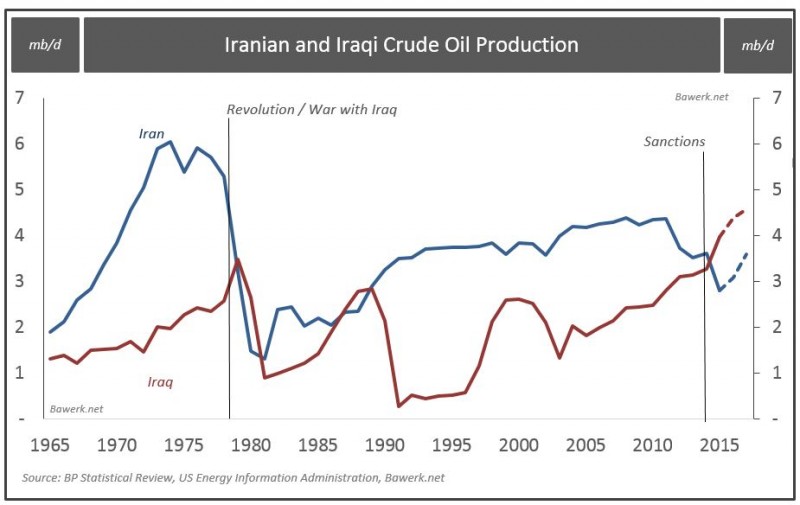

Revolutionary Guards: The Way of the Iranian Future

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for Pres...

Read More »

Read More »

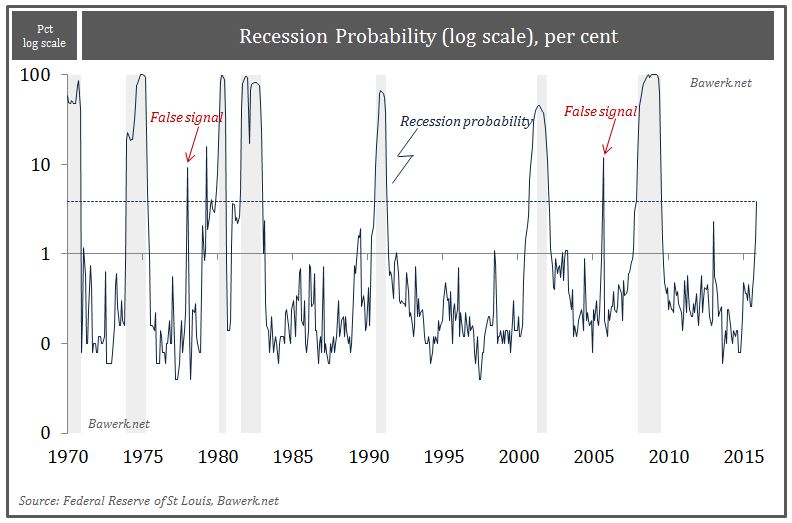

Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beg...

Read More »

Read More »

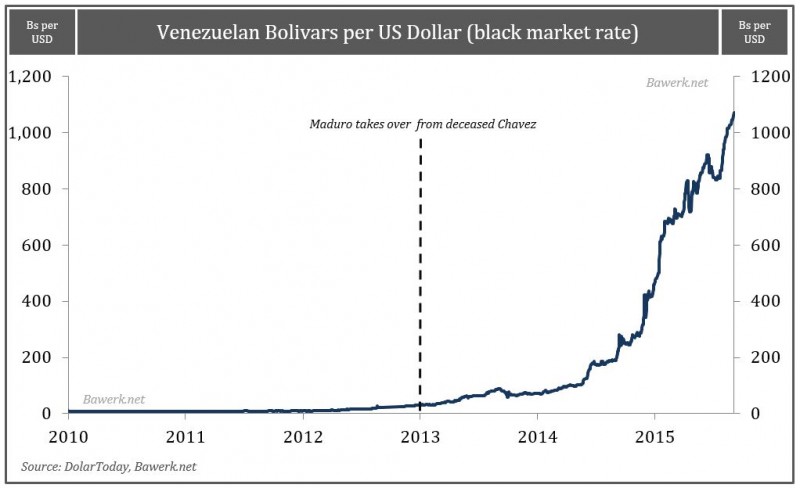

Can Maduro Mayhem Last to 2017

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legi...

Read More »

Read More »

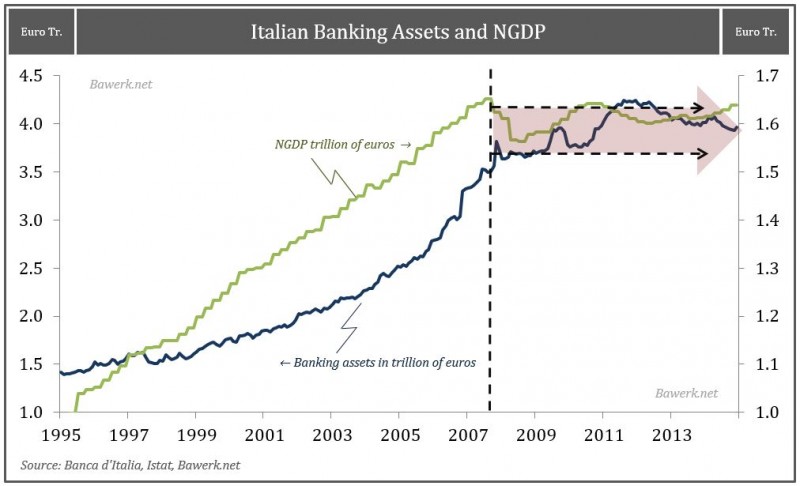

How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real.

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:24:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:22:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:21:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:20:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-08 20:33:35

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-08 20:33:09

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

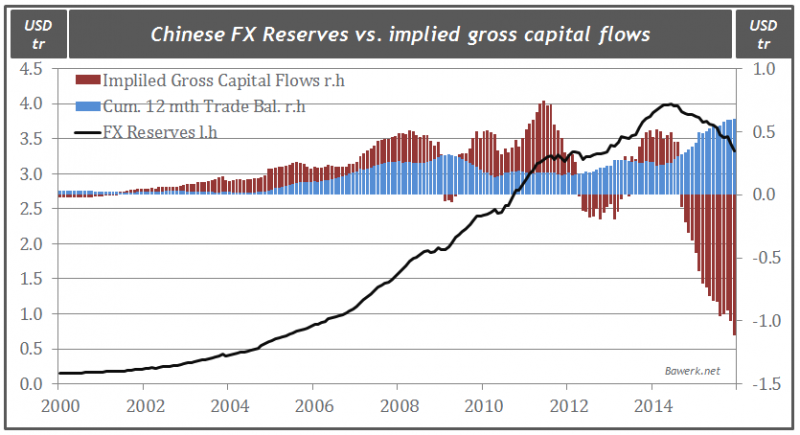

China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the Unit...

Read More »

Read More »

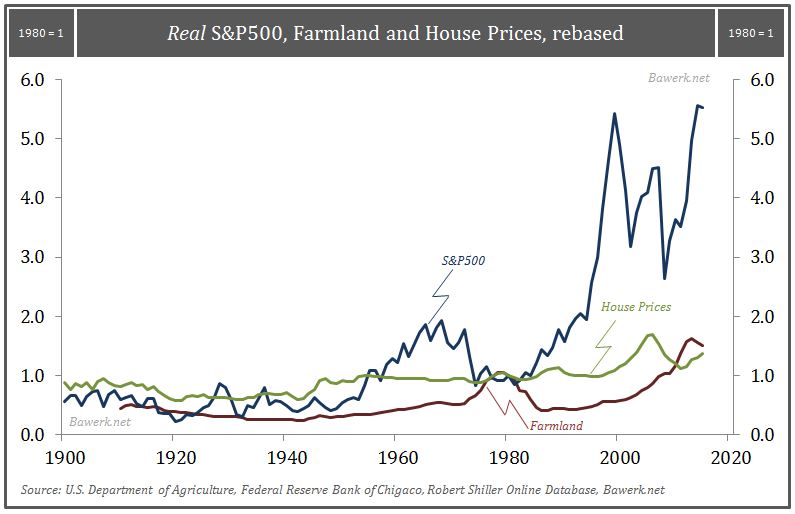

The Bull Market in Stocks May Be Done

The great stock bull market is, perhaps, done. To most people, a bull market is good, and its end is bad. After all, a rising market signifies a healthy economy. Investors are making money. Share prices are connected to business productivity, aren’t they?

Read More »

Read More »

Open Letter to the Banks

On Friday, I attended a digital money summit at the Consumer Electronics Show. I am writing to you to warn you about the disruption that is about to occur in banking. There are many startups (and larger companies too) that are gunning for you. Perhaps you have watched what Uber has done to the taxi business? Well, these guys are planning the same thing for the banking business.

Read More »

Read More »

What Is Money Printing?

There is a populist idea of money printing. The idea is that banks can just print what they want, enriching themselves in a massive fraud. But, does it really work this way?

Read More »

Read More »

Janet Yellen Fights the Tide of Falling Interest

The Fed is going to have to take back this interest rate hike (Dec 16). The process that sets the interest rate is complex. I have written many words on its terminal decline. However, there are two simple reasons why the trend remains downward.

Read More »

Read More »

What the Fed Did NOT do

We will not spend much time discussing what the FOMC did as tons of ink have been spilled on that already. We will rather spend more time on what the FOMC did not do. A short recap will suffice; the FOMC did raise the interest rate band by 25 basis p...

Read More »

Read More »

Falling Interest Causes Falling Profits

Most people assume that prices move as a result of changes in the money supply. Instead, let’s look at the effect of falling interest. To start, consider a hamburger restaurant. Suppose that the average profit in the burger business is ten percent of invested capital. If MacDowell’s is thinking about expanding, it has to consider the interest rate. Why?

Read More »

Read More »