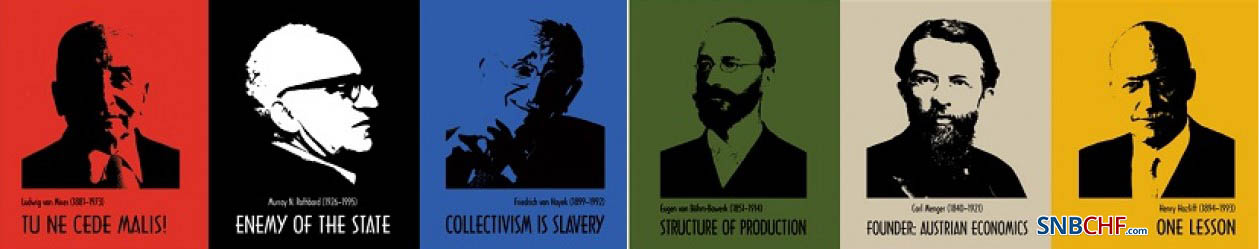

Category Archive: 6b) Austrian Economics

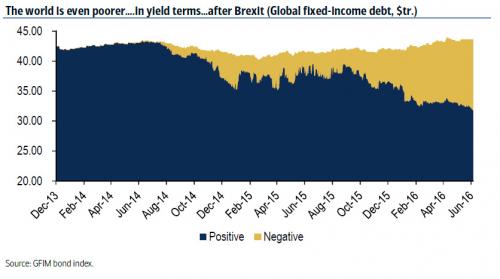

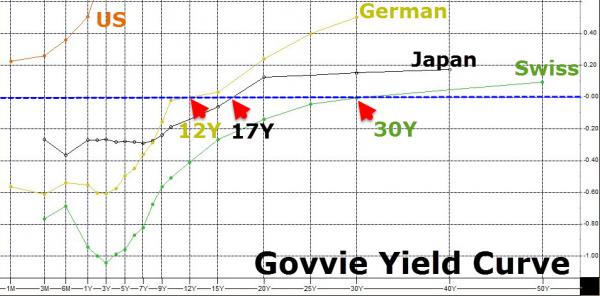

There Is Now A Staggering $11.7 Trillion In Negative Yielding Debt

It was not even a month ago when we last looked at the total amount of negative yielding debt around the globe, and were shocked to find that according to Fitch, for the first time in history (obviously), there was over $10 trillion in negative yielding debt. Fast forward 4 weeks later, and the grand total is now $1.3 trillion higher, or $11.7 trillion.

Read More »

Read More »

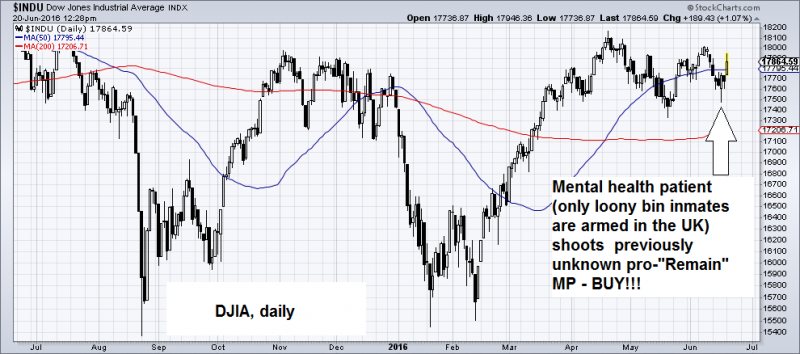

Vive la Revolution! Brexit and a Dying Order

A Dying Order Last Thursday, the Brits said auf Wiedersehen and au revoir to the European Union. On Friday, the Dow sold off 611 points – a roughly 3.5% slump. What’s going on?

Read More »

Read More »

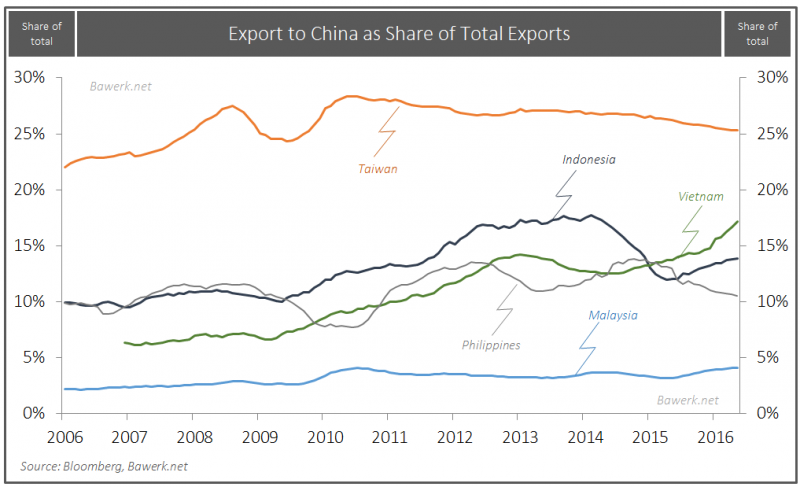

South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters.

Read More »

Read More »

Towards Freedom: Will The UK Write History?

Every freedom loving person on the planet has their eyes fixed on this referendum. A clear majority voting for Brexit and therefore for more decentralization, would show that the British realized they can break free from their self-imposed nonage, and reclaim individual liberty.

Read More »

Read More »

The Fed Doomsday Device

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply.

The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic.

Read More »

Read More »

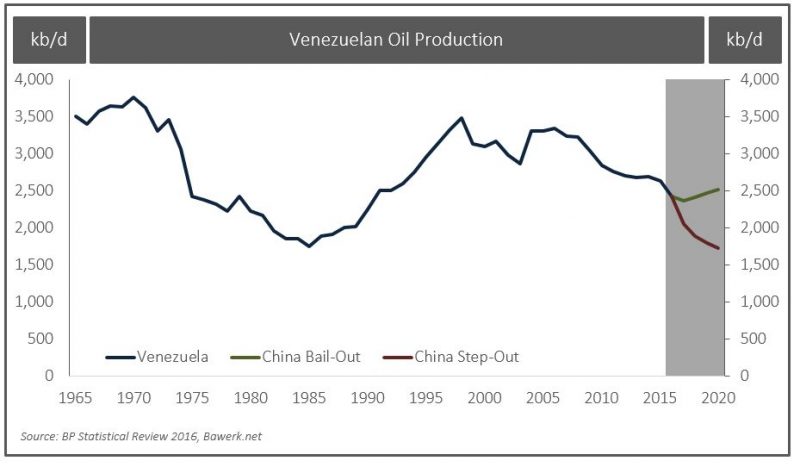

China the lender of last resort for many oil producers

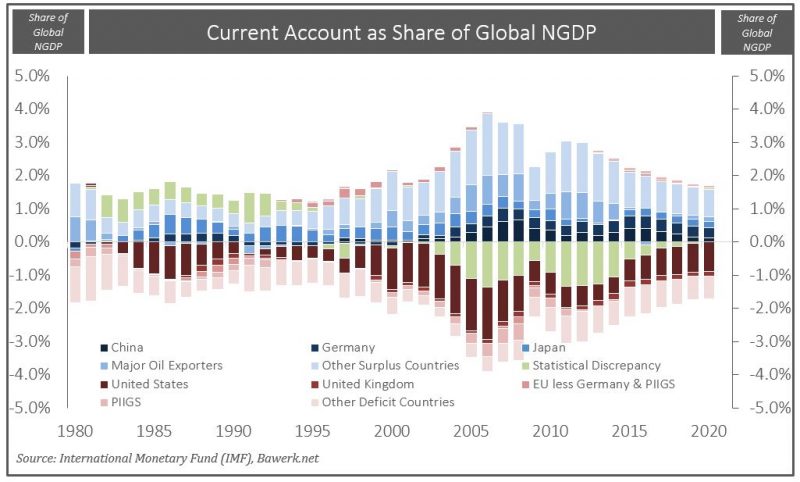

Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs.

Read More »

Read More »

Money Supply Arguments Are Flawed

It goes without question, among economists of the central planning mindset, that if a central bank can just set the right quantity of dollars, then the price level, GDP, unemployment, and everything else will be right at the Goldilocks Optimum. One such approach that has become popular in recent years is nominal GDP targeting.

Read More »

Read More »

Janet Yellen’s $200-Trillion Debt Problem

More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations.

And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it?

Read More »

Read More »

A Market Ready to Blow and the Flag of the Conquerors

The U.S. is too big, too varied, too much of everything. You can’t fix a single view of it, even in your mind.

But now our problems, challenges, and discontents are big. They are national and international. We cannot see them. We cannot understand them.

Instead, we draw their measure from the news media – based on a flag that flutters and sags, depending on which way the wind is blowing.

Read More »

Read More »

How the Welfare State Dies

People have become used to the idea that the State is their sugar daddy. Many apparently believe that it has some undisclosed, infinite stash of resources at its disposal which it can shower them with at will. The reality is unfortunately different.

Read More »

Read More »

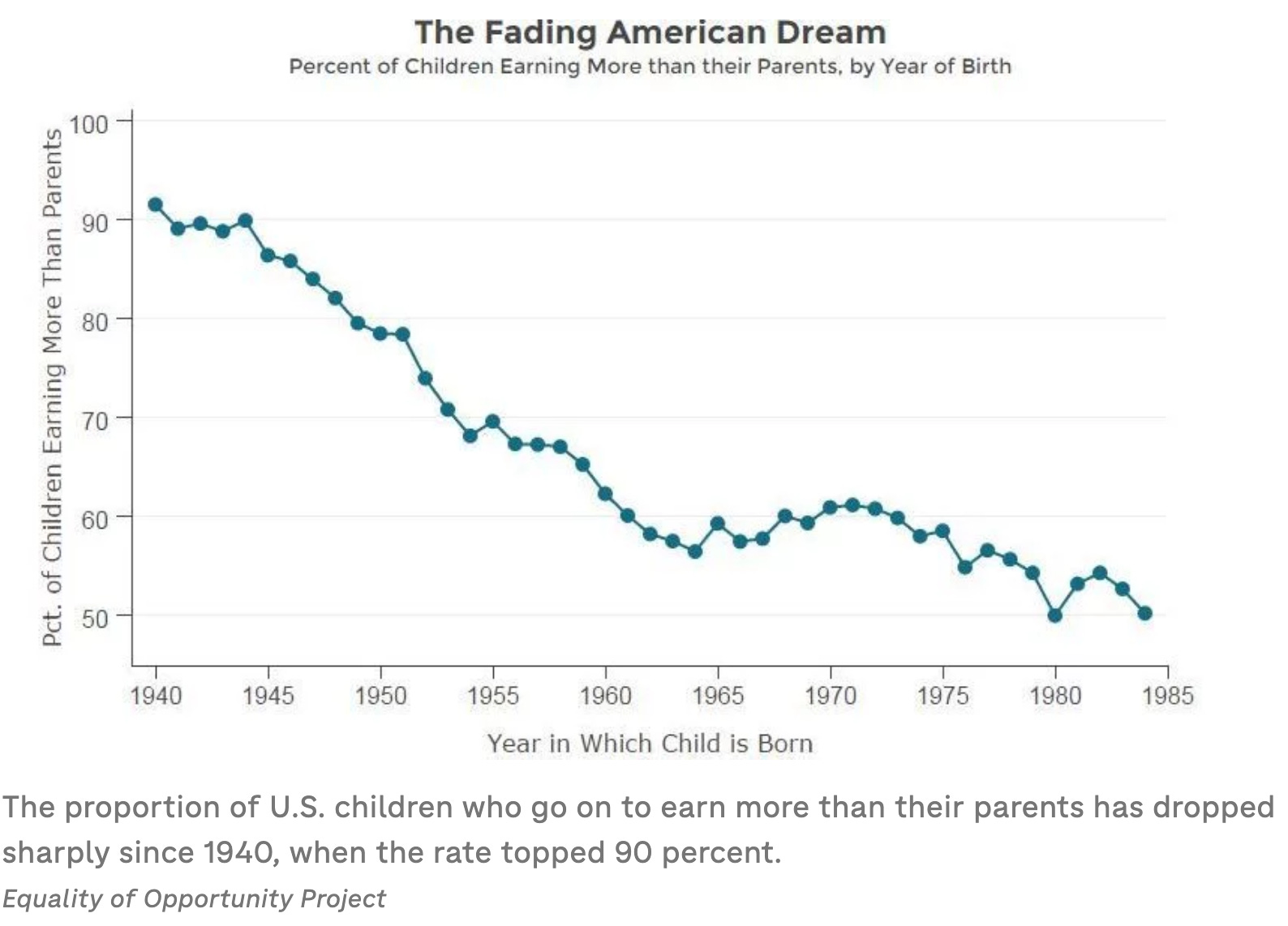

Down Go the Hopes and Dreams of Three Generations

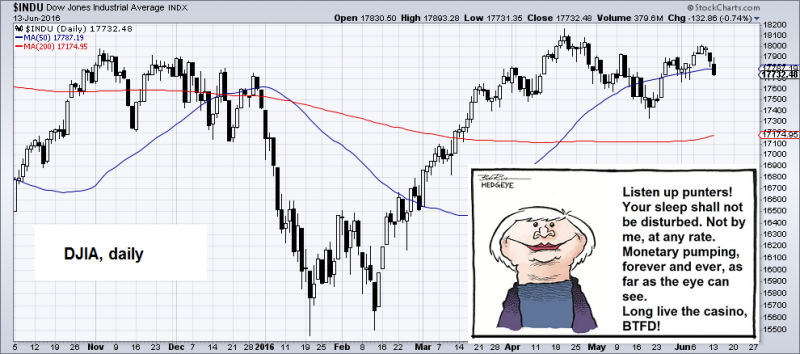

On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this?

If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three generations of retirees.

Read More »

Read More »

Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

The Greatest Keynesian monetary experiment is not sustainable. It will not continue ad infinitum. Our money masters are just postponing the inevitable bust that will eventually correct these imbalances through worldwide capital re-allocation. Bawerk shows 3 graphs how investment growth gets slower and slower since the End of Bretton, how debt is increasing and how cheap dollar fuel debt-driven growth.

Read More »

Read More »

US Negative Interest Rate Bets Surge To Record Highs

As the "deflationary supernova" sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the 'cheapness' of Treasury bonds lures the world's yield-hunters dragging ...

Read More »

Read More »

Claudio Grass Talks to Godfrey Bloom

Introductory Remarks – About Godfrey Bloom [ed note by PT: Readers may recall our previous presentation of “Godfrey Bloom the Anti-Politician”, which inter alia contains a selection of videos of speeches he gave in the European parliament. Both eru...

Read More »

Read More »

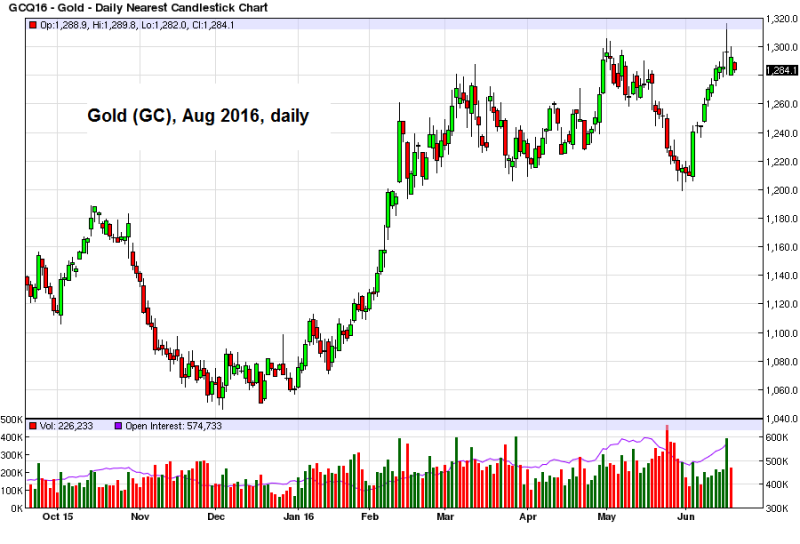

The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock...

Read More »

Read More »

Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. Th...

Read More »

Read More »

Brexit Paranoia Creeps Into the Markets

European Stocks Look Really Bad… Late last week stock markets around the world weakened and it seemed as though recent “Brexit” polls showing that the “leave” campaign has obtained a slight lead provided the trigger. The idea was supported by a not...

Read More »

Read More »

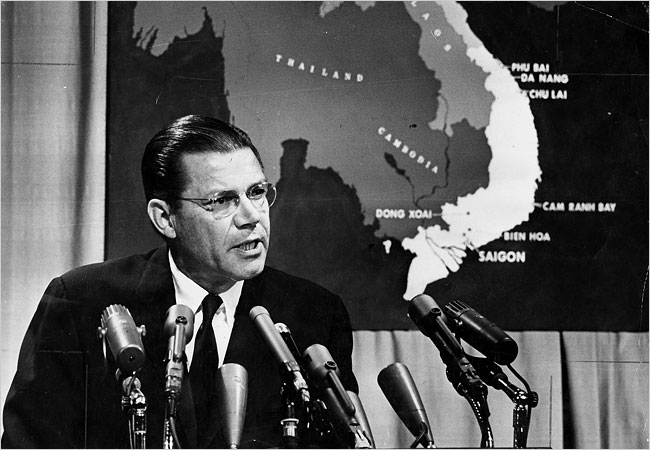

Is It Our Duty to Fight When the Deep State Asks?

Hero or Traitor? And it’s one, two, three, What are we fighting for? Don’t ask me, I don’t give a damn, Next stop is Vietnam; And it’s five, six, seven, Open up the pearly gates, Well there ain’t no time to wonder why, Whoopee! We’re all gonna di...

Read More »

Read More »

What Congress Really Thinks of Voters

Battle of Wits BALTIMORE – On Wednesday, the Dow rose over 18,000, for the first time since April. Hillary is riding high, too. She is a pro. She has the entire Deep State behind her – including almost every crony and zombie in the country – and a...

Read More »

Read More »