Category Archive: 6b.) Mises.org

The Economics of the AI Revolution

In a recent article, we briefly summarized what it is that we today call artificial intelligence (AI). Whereas these technologies are certainly impressive and may even pass the Turing test, they are not beings and have no consciousness.

Read More »

Read More »

Grover Cleveland: The Last Good Democrat

After the War to Prevent Southern Independence and the assassination of Lincoln the federal government was said to possess a "treasury of virtue." The Republican Party, which was the federal government, with a decades-long monopoly of power rivaled only by the Bolsheviks in Russia, made sure that the government-run schools would preach this Virtuous State Philosophy to generations of school children.And what did the Party of Virtue do with its...

Read More »

Read More »

Not Altogether Honest Abe

Lincoln’s God: How Faith Transformed a President and a Nationby Joshua ZeitzViking, 2023; 313 pp.Joshua Zeitz, a contributing writer to Politico, has written a very useful book. It belongs to an increasingly common genre: books that are very favorable to Abraham Lincoln, in some cases approaching a deification of him, which nevertheless present material that show Lincoln in a less-than-flattering light.

Read More »

Read More »

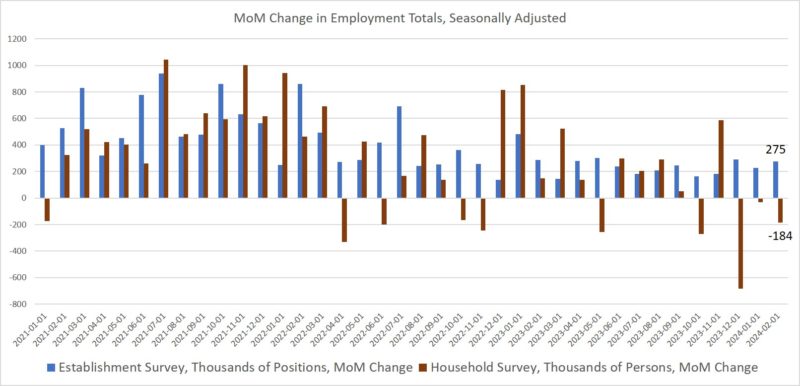

Employment Falls for the Third Month In Spite of 50,000 New Government Jobs

According to a new report from the federal government's Bureau of Labor Statistics this week, the US economy added 275,000 jobs for the month of February while the unemployment rate rose to 3.9%. In what has become a predictable ritual, reporters from the legacy media were sure to declare "another strong jobs report."

Read More »

Read More »

Understanding the AI Revolution

The artificial intelligence (AI) revolution is here, and it is bound to change the world as we know it—or so proclaims the hype following the release of OpenAI’s ChatGPT version 3.5 in November 2022, which was only the beginning. Indeed, much has happened since then with the release of the much-improved version 4.0, which was integrated into Microsoft’s Bing search engine, and the recent beta release of Google’s Gemini.

Read More »

Read More »

Marxist Women’s Day

In April 1845, Karl Marx’s mother-in-law sent to the Marx family a nanny named Helene Demuth, known as “Lenchen.” Marx’s long-suffering wife, Jenny, was thrilled. After all, she had long expressed the wish that Karl would “earn some capital rather than just writing about capital.”But Karl refused to earn money. Just as he refused soap and bathing, which spawned boils all over his body.

Read More »

Read More »

The Absurdity and Danger of the State of the Union

On Thursday night, tens of millions of Americans from across the political spectrum tuned in to see how President Joe Biden would perform in his third State of the Union Address. The president’s age and cognitive ability has become a top issue facing his re-election campaign.

Read More »

Read More »

The Great Depression and Great Depression II: Similarities, Differences

Comparing Great Depression I with the current Great Depression II, the cause has been the same, and the responses have been similar.But it’s important to not take the parallels too far. The circumstances differ, so the impacts will differ.First, the similarities.Same Cause, Similar ResponsesBoth depressions, like recessions, originated with unsustainable booms.

Read More »

Read More »

Global Debt Levels Are a Ticking Time Bomb

The relentless increase in global debt is an enormous problem for the economy. Public deficits are neither reserves for the private sector nor a tool for growth. Bloated public debt is a burden on the economy, making productivity stall, raising taxes, and crowding out financing for the private sector.

Read More »

Read More »

No, There Is Not a Perfect Open Border System between the States

Jonathan Casey, in his opening remarks during a debate with Ryan McMaken on national divorce, criticized national divorce on the grounds that it throws away the open borders compact between the states.

Read More »

Read More »

Help Us Give Scholarships for AERC!

This month, we will host the Austrian Economics Research Conference (AERC), one of our most important programs. We’ll have thirty-one students attending, and nineteen students will deliver papers of their own. How encouraging!

Read More »

Read More »

Central Banks and Housing Finance

Although manipulating housing finance is not among the Federal Reserve’s statutory objectives, the U.S. central bank has long been an essential factor in the behavior of mortgage markets, for better or worse, often for worse.

Read More »

Read More »

A Circus of Errors

When Nvidia reported high fourth quarter earnings for 2023 in February 2024, it sparked a general rally in stock markets. Stock markets in the United States, Japan, and Europe jumped to all-time highs after a few days of slight declines.

Read More »

Read More »

The American Economy: A House of Cards

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Politician BehindTrump v. Anderson Still Doesn’t Understand Why She Lost

The US Supreme Court released its ruling on Trump v. Anderson this week and unanimously slapped down the Colorado Supreme Court which had tried to disqualify candidate Donald Trump from the Colorado ballot using section 3 of the Fourteenth Amendment to the US constitution.

Read More »

Read More »

Juvenal’s Greatest Poser: “Who Will Guard the Federal Reserve?”

[This article was first published in the New York Sun.]“Who will guard these guardians?” That poser of Juvenal, satirist of Rome, is an immortal question — nowhere more pertinent, though, than in deciding who should oversee the Federal Reserve.

Read More »

Read More »

Smedley Butler Explains the Latest Excuse for American Intervention in Ukraine

Senior Fellow Alex Pollock drew my attention to an important quotation by Smedley Butler: 1935 speech and later a book by Major General Smedley D. Butler (USMC), includes “… A racket is best described, I believe, something that is not what it seems to the majority of people.

Read More »

Read More »

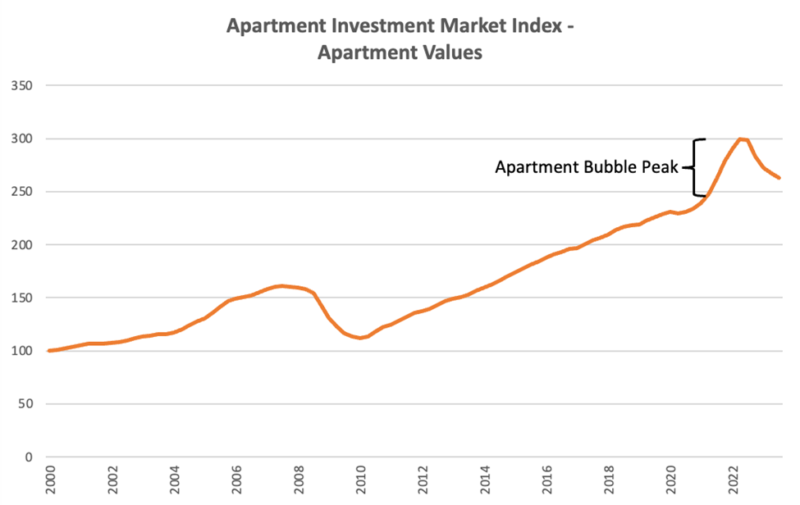

Apartment Bridge Loans Are Collapsing

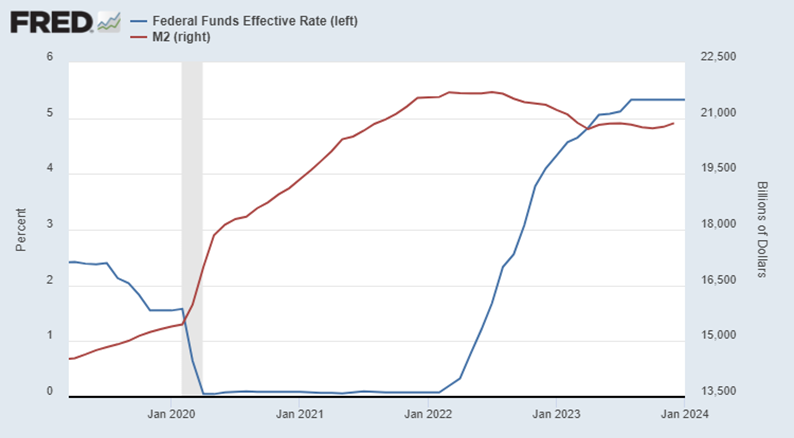

Stoked by ultra-loose monetary policy from the Federal Reserve, capital markets have been in a persistent bubble for several years. Printing trillions of new dollars and maintaining a zero-interest rate policy (“ZIRP”) was marketed by politicians and bureaucrats as supportive of the “main street economy,” but those trillions were directed primarily towards speculation in capital markets.

Read More »

Read More »

Be on the Lookout for These Lies in Biden’s State of the Union Address

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize.

Read More »

Read More »

Dissecting Lincoln

Thomas DiLorenzo, the president of the Mises Institute, has already reviewed Paul C. Graham’s Nonsense on Stilts: The Gettysburg Address and Lincoln’s Imaginary Nation (Shotwell Publishing, 2024) in characteristically excellent fashion, but the book is so insightful that some further comments are warranted.

Read More »

Read More »