Category Archive: 1) SNB and CHF

Andréa M. Maechler: Introductory remarks, news conference

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

Read More »

Read More »

Börsen-Ticker: Wall Street nach Fed-Zinsentscheid erneut im Minus – Schweizer Börse legt dank Indexriesen Nestlé und Novartis zu

Der SMI fällt 0,40 Prozent auf 11'091,93 Punkte. Vor der am Abend erwarteten Zinsentscheidung der US-Notenbank haben die Anleger einen Gang zurückgeschaltet. Die Freude von Vortag, als die Nachricht über den nachlassenden Inflationsdruck in den USA die Märkte angetrieben hatte, sei wieder der Vorsicht gewichen, heisst es in Börsenkreisen.

Read More »

Read More »

Week Ahead: Highlights include Fed, US CPI; ECB, BoE, SNB, Norges Bank

MON: UK GDP Estimate (Oct), Chinese M2/New Yuan Loans (Nov).TUE: OPEC MOMR; BoE Financial Stability Report; German CPI Final (Nov), UK

Unemployment Rate (Oct)/Claimant Count (Nov), EZ ZEW (Dec), US CPI (Nov),

Japanese Tankan (Q4), New Zealand Current Account (Q3).WED: FOMC Policy Announcement, IEA OMR; UK CPI (Nov), Swedish CPIF (Nov), EZ

Industrial Production (Oct), US Export/Import Prices (Nov), Japanese

Exports/Imports (Nov).THU: ECB, BoE,...

Read More »

Read More »

Issuance calendar for Confederation bonds and money market debt register claims in 2023

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The FFA plans to issue bonds with a face value of CHF 8 billion in 2023. Taking account of bonds maturing in 2023, the volume of bonds outstanding will increase by CHF 3.4 billion.

Read More »

Read More »

SNB-Vize Schlegel signalisiert neuen Zinsschritt im Dezember

SNB-Vize Martin Schlegel hat angedeutet, dass die Schweizerische Nationalbank die Leitzinsen im Dezember erneut anheben wird. Er betonte die Notwendigkeit, das starke Wachstum der Konsumentenpreise zu bekämpfen.

Read More »

Read More »

Andréa M. Maechler / Thomas Moser: Return to positive interest rates: Why reserve tiering?

It is with great pleasure that my colleague Thomas Moser and I welcome you to this year’s Swiss National Bank (SNB) Money Market Event in Geneva. We are very glad that so many of you have joined us this evening, be it on site or remotely.

Read More »

Read More »

SNB-Maechler: Rückkehr zu positiven Zinsen bedingt neuen Ansatz für Geldpolitik

Die erste Leizins-Erhöhung seit 15 Jahren im Juni bezeichnet SNB-Direktoriumsmitglied Andréa Maechler als historischen Moment.

Read More »

Read More »

Barclays forecasts EURCHF trading around parity for the next few quarters

Barclays Research discusses CHF outlook and targets EUR/CHF around 0.97, 0.97, 0.98, and 1.00 by end of Q1, Q2, Q3, and Q4 of next year respectively.

Read More »

Read More »

SNB’s Jordan: Monetary policy is is still expansionary

SNB's Jordan, who has been chatting more in the NY session at least of late, is no the wires saying:monetary policy is a still expansionarywe have most likely to adjust monetary policy againinflation is very thorny and there is still a risk that inflation will rise furtherinflation rate is above our target now.

Read More »

Read More »

SNBs Jordan: IN 2023, sees Swiss growth weaker than this year. USDCHF trades near lows.

SNB's Jordan is on the wires saying that:He sees weaker growth in 2023 than this year.SNB still has credibility that inflation will moderateInflation has broadenedSees limited 2nd round wage effects in SwitzerlandThere is a great probablility that SNB will need to further tighten monetary policy.

Read More »

Read More »

EZB-Ratsmitglied Holzmann: Fiskalpolitik im Euroraum gibt mehr Geld aus als nötig

Der Kampf der EZB gegen die Rekordinflation wird zum Teil von einer Haushaltspolitik konterkariert, die zu viel Geld ausgibt, um die steigenden Lebenshaltungskosten abzufedern, sagte Ratsmitglied Robert Holzmann.

Read More »

Read More »

How to Lose $143 Billion Trading Stocks

Now here’s the headline! Swiss National Bank loses nearly $143 billion in first nine months Reuters reported the Q3 result last week, in which Switzerland’s publicly traded central bank (SNB) suffered its largest loss in its 115-year history.

Read More »

Read More »

Federal Reserve speakers coming up on Wednesday, 9 November 2022 – Williams, Barkin

The talking heads at the US Federal Reserve have pivoted to talking about how high rates will go before they top out as against how quickly they will rise.

Read More »

Read More »

Thomas Jordan: Decision-making under uncertainty: The importance of pragmatism, consistency and determination

It is my pleasure to welcome you to this high-level conference on global risk, uncertainty and volatility. Thank you all for accepting our invitation to join the discussions. I am very pleased to see such a distinguished group of central bank officials and academics. I would like to thank our colleagues at the Bank for International Settlements and the Federal Reserve Board for working together with us in organising this event.

Read More »

Read More »

Swiss National Bank, Banque de France, Monetary Authority of Singapore and BIS Innovation Hub to explore cross-border trading and settlement of wholesale CBDCs using DeFi protocols

Project Mariana explores automated market makers (AMM) for the cross-border exchange of hypothetical central bank digital currencies (CBDCs) in Swiss francs, euros and Singapore dollars between financial institutions to settle foreign exchange trades in financial markets.

Read More »

Read More »

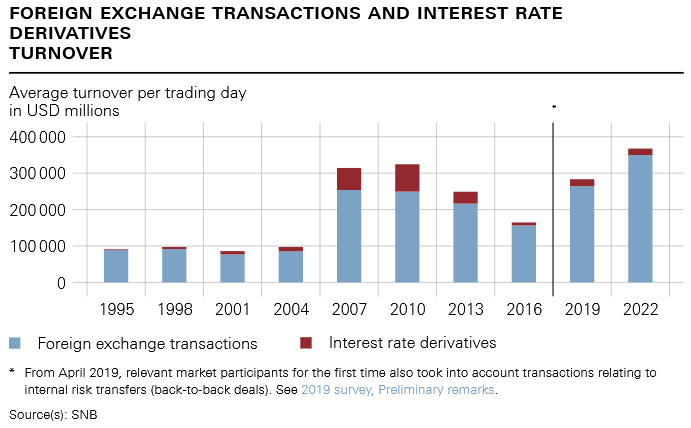

Turnover in foreign exchange and derivatives markets in Switzerland

The SNB has today published the results of the survey on turnover in foreign exchange and over-the-counter (OTC) derivatives markets in Switzerland. The data reflect the turnover in April 2022 of the banks surveyed.

Read More »

Read More »

Thomas Jordan: Current challenges to central banks’ independence

In the recent past, the political and economic backdrop has changed dramatically. Inflation is far too high almost everywhere, and central banks are raising their policy interest rates at a time when stocks of government debt are large. In some places, central bank independence is being publicly called into question.

Read More »

Read More »

SNB’s Jordan: Central Bank Independence is crucial to fight inflation effectively

SNB Jordan is on the wires speaks in general terms:

Central bank independence is crucial to fight inflation effectively.

Read More »

Read More »