Category Archive: 1) SNB and CHF

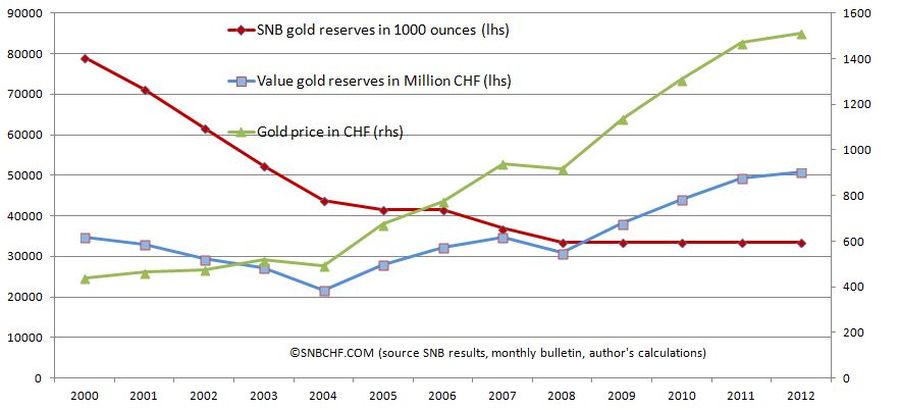

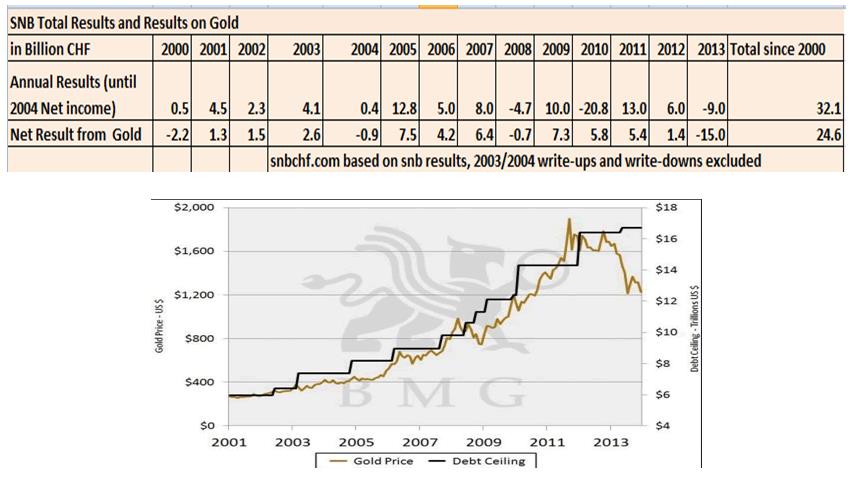

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

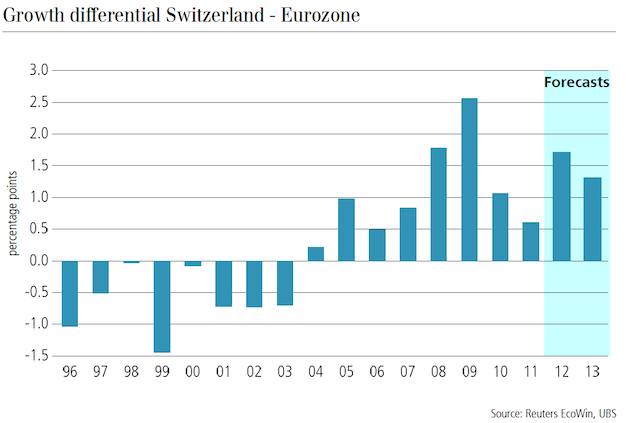

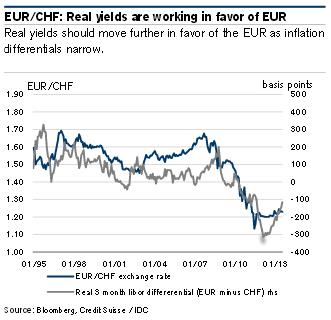

Swiss Franc History, from 2004 to 2009: The undervalued franc

A Critical History of the Swiss Franc: During the "global carry trade" period between 2004 and 2007, the euro strongly appreciated against the Swiss franc. Most astonishingly this happened, despite the fact that the Swiss GDP growth was on average 0.5% higher

Read More »

Read More »

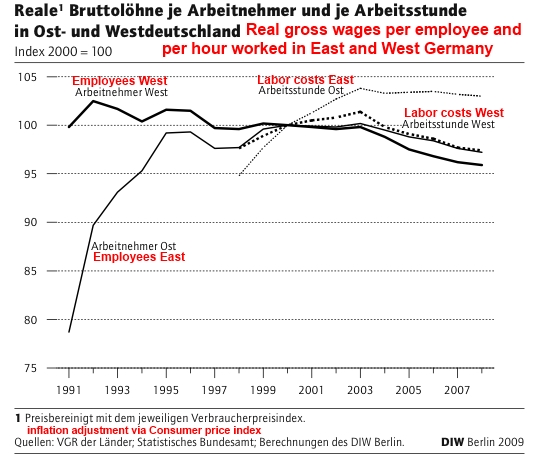

Swiss Franc History: Weak German and Swiss growth between 1996 and 2004

A critical Swiss Franc History: Between 1996 and 2004 Switzerland and its main trading partner and FX proxy Germany saw slower growth compared to other European countries. We explain the reasons

Read More »

Read More »

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

Swiss Franc History: Volcker Shock, Oil Glut and the Breakdown of Gold and Emerging Markets

After the Volcker moment or sometimes called "Volcker shock", commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker's tight monetary policy with high interest rates and the dependency on US funds.

Read More »

Read More »

Volckers Attack on Stagflation

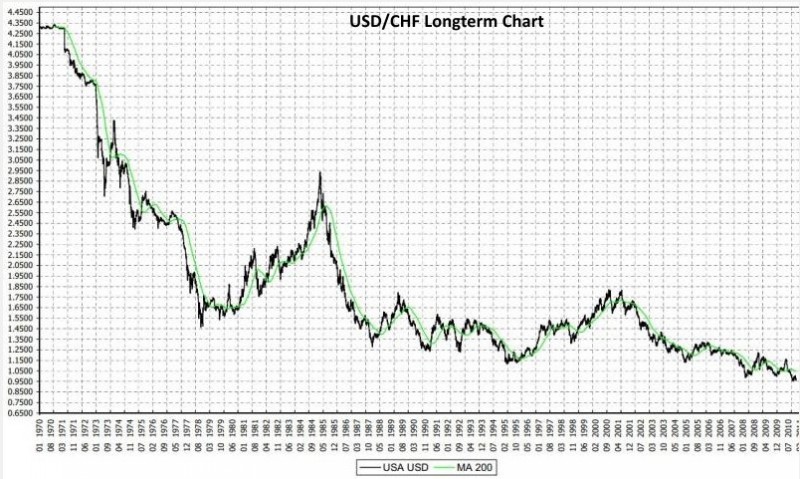

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

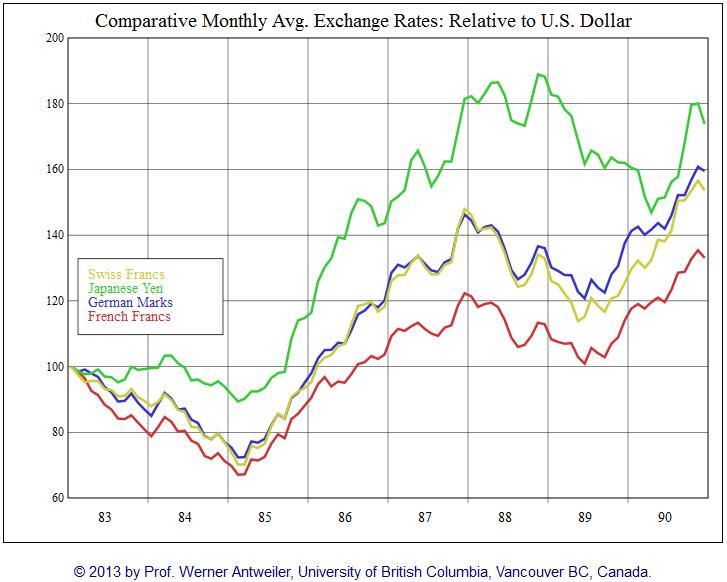

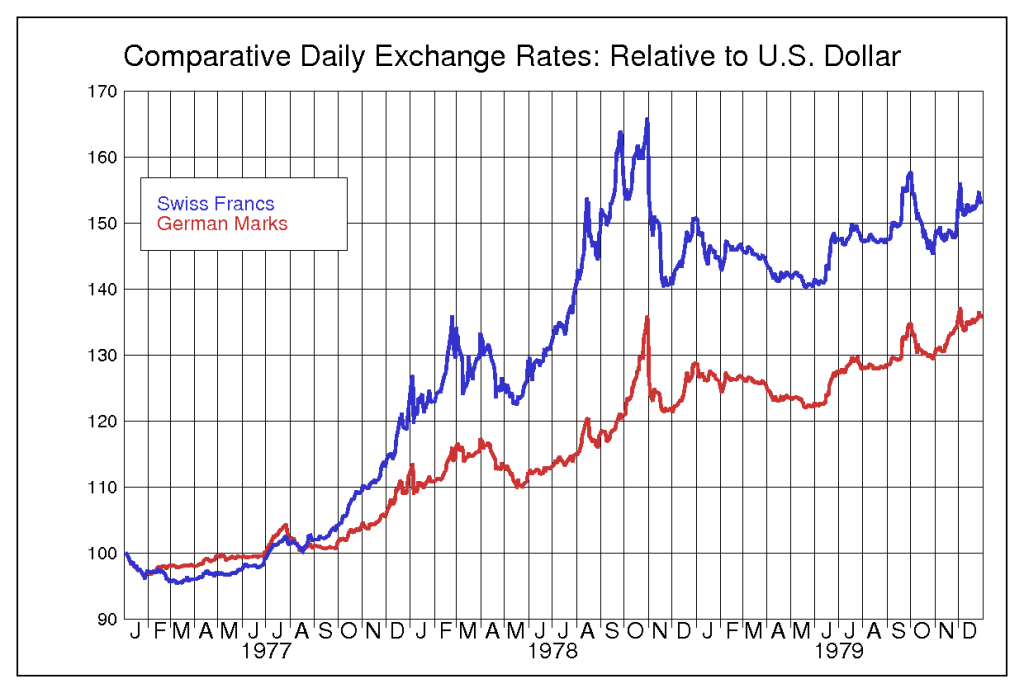

Swiss Franc History, 1970s: Due to US Stagflation CHF Strengthens Massively

We shows the massive appreciation of Swiss franc and German mark in the 1970s, the reasons were: stagflation and the wage-price spiral.

Read More »

Read More »

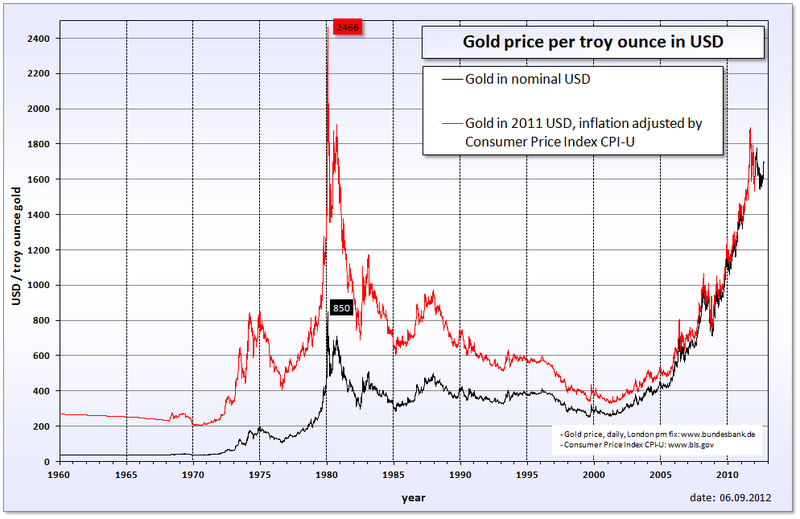

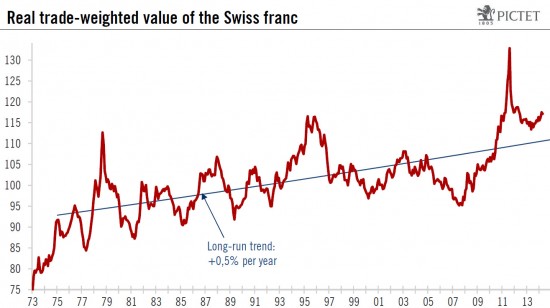

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

Private markets, public investors: The march of the sovereigns

SOVEREIGN wealth funds, typically set up by oil-exporting nations, have been around for decades, in the case of Kuwait since 1953. But their influence has increased in recent years, as China has adopted a similar strategy for investing some of its vast foreign-exchange reserves while existing funds have been fuelled by gains from high oil prices.

Read More »

Read More »

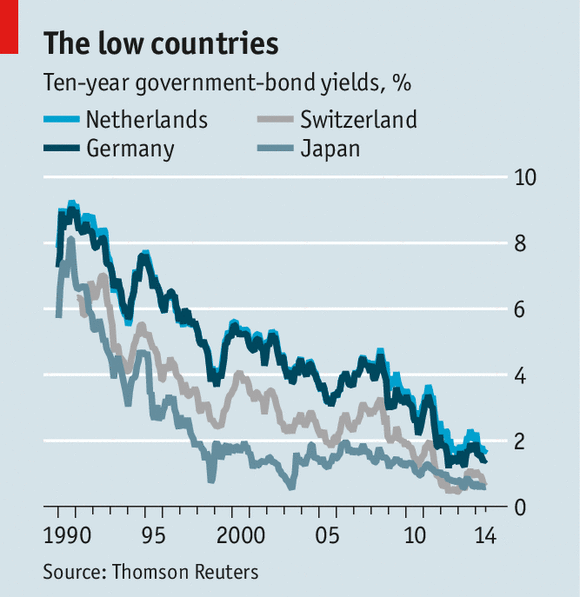

SNB Follows ECB? Pictet’s Negative SNB Interest Call

Pictet calls for negative interest rates in Switzerland in order to maintain rate differentials between the euro zone and Switzerland. Maintaining rate differentials would be useful for FX speculators and for money market funds that still invest in the euro zone.

Read More »

Read More »

Swiss Franc, Pseudo-Mathematics And Financial Charlatanism: Extended Version

We have published the extended version of “The Swiss Franc, Pseudo-Mathematics And Financial Charlatanism” on the investor site Seeking Alpha. The version is longer than the one published previously.

Read More »

Read More »

SNB First Quarter Results: 1.7% annualized Yield on Seigniorage, 2% annualized Loss on FX Rate Change

The main task of a central bank occupied with QEE (quantitative easing or exchange intervention) is to obtain higher gains on seigniorage than it loses with its “ever appreciating” currency. Otherwise its equity capital would be absorbed. In the first quarter of 2014, the Swiss National Bank (SNB) was unable to accomplish this task.

Read More »

Read More »

Is the SNB Intervening Again?

Update March 21, 2014: Total SNB sight deposits increased to 367.8 bln. CHF, but flows reverted a bit. Foreign banks and “non-banks” reduced their CHF exposure at the SNB to 50.8 bln, possibly converting a part of the difference into USD. Dollars are more useful when sanctions will hurt both Russian and German firms. On … Continue...

Read More »

Read More »

The IMF Assessment for Switzerland and our Critique

In the 2014 assessment for Switzerland by the International Monetary Fund several sentences caught our eyes; we will contrast them with our recent critique. The most important one was that for the IMF is only "moderately overvalued", this would have no negative effect for exporters.

Read More »

Read More »