Category Archive: 1) SNB and CHF

Great Graphic: What Is the Swiss Franc Telling Us?

Swiss franc weakness is a function of the demand for euros. SNB indicates it will lag behind the other major central banks in normalization process. Easing of political anxiety in Europe is also negative for the franc.

Read More »

Read More »

Swiss franc weakens to symbolic low

The Swiss franc has fallen to its lowest point since the January 2015 unpegging of the currency from the euro. The symbolic moment will be a huge relief to Swiss exporters and the tourism industry. As of Thursday morning, the franc was trading at 1.12 to the euro, a drop of 1.8 percent since Monday. It is the weakest level reached since the decision by the Swiss National Bank (SNB) to remove the cap two-and-a-half years ago.

Read More »

Read More »

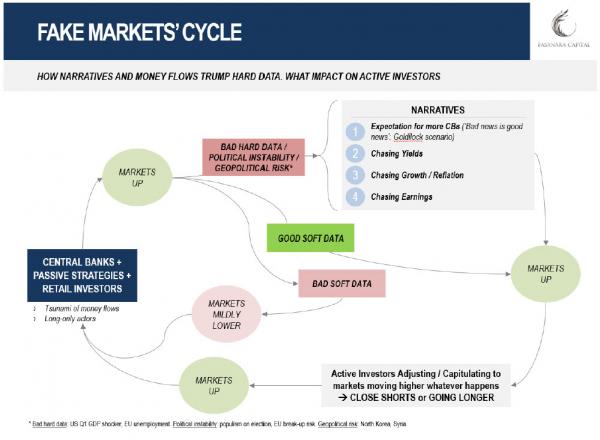

When Do We Know These Are Delusional Markets

Signs of complacency and disconnect from fundamentals abound. So to sanity check, it may still be helpful to periodically remind ourselves of a few recent ones. In no particular order. The Swiss National Bank bought $ 100bn between US and European stocks. It now owns 26 million Microsoft shares (read).

Read More »

Read More »

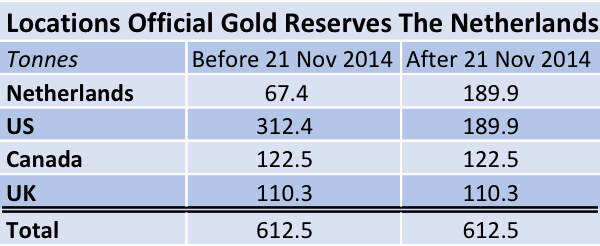

Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this...

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

Swiss franc more overvalued than 6 months ago according to Economist burger index

The Economist magazine’s 6-monthly Big Mac index shows the Swiss franc to be even more overvalued than it was in January 2017. The index, which compares the US$ price of a Big Mac around the world places Switzerland at the top with a price of US$ 6.74. This is 27.2% more expensive than the United States where the same burger costs US$ 5.30.

Read More »

Read More »

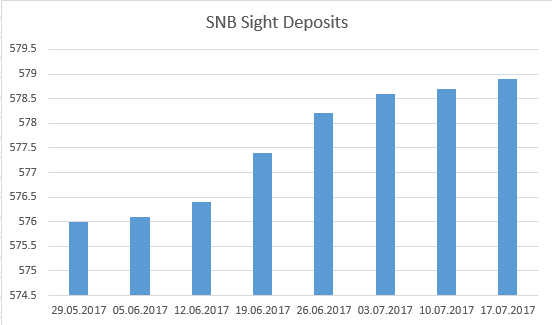

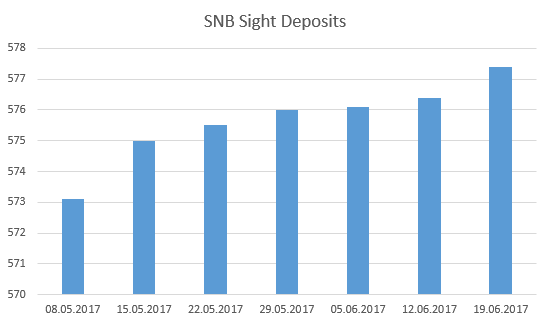

Weekly SNB Interventions and Speculative Positions: Hawkish ECB, less SNB interventions

Hawkish comments by Mario Draghi boosted the EUR against both USD and CHF. It also reduced the need for SNB interventions. The question is how long Draghi will remain hawkish, especially next winter, when headline inflation in the euro zone may fall under 1%.

Read More »

Read More »

Worin die populäre Geldschöpfungskritik irrt – Teil 1

Eine Kritik ist im Aufwind. Was vor ein paar Jahren noch als Phantasterei verrückter Verschwörungstheoretiker abgetan wurde, beschäftigte jüngst sogar die Deutsche Bundesbank. Gemeint ist die Idee des Vollgeldes und der damit zusammenhängenden Abrechnung mit unserem modernen Geldsystem.

Read More »

Read More »

Swiss franc outstrips other currencies over last 117 years

Recent analysis by Credit Suisse, London Business School and Cambridge Judge Business School shows the Swiss franc’s enduring strength. The reports says that for a small country with just 0.1% of the world’s population and less than 0.01% of its land mass, Switzerland punches well above its weight financially.

Read More »

Read More »

Moderne Portfoliotheorie bringt dem Anleger mehr Schaden als Nutzen

Die Bankiervereinigung zeigt in einer Studie (SBS) auf, dass einschränkende Anlagevorschriften für Pensionskassen kontraproduktiv sind. Dies deckt sich mit meinen jüngst propagierten Forderungen unter anderem in der NZZ nur scheinbar. Die SBS argumentiert nämlich auf der Basis der modernen Portfoliotheorie (MPT), die volatilitätsarme alternative Anlagen angeblich als interessante Diversifikatoren erscheinen lässt. Das ihr zugrundeliegende...

Read More »

Read More »

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

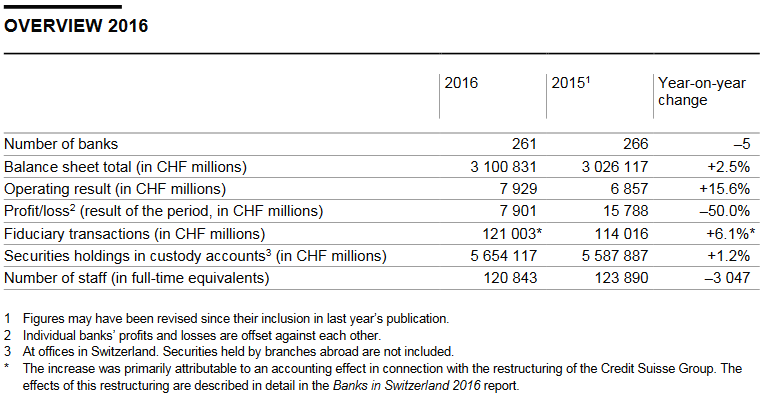

Banks in Switzerland 2016

Summary of the 2016 banking year. In 2016, 226 of the 261 banks in Switzerland reported a profit, taking total profit to CHF 11.8 billion. The remaining 35 institutions recorded an aggregate loss of CHF 3.9 billion. The result of the period for all banks was thus CHF 7.9 billion.

Read More »

Read More »

Vernissage der Festschrift “Monetary Economic Issues Today”, 16.06.2017

00:00 Ehrung, Thomas J. Jordan 13:15 Ansprache, Ernst Baltensperger 22:55 Ansprache, Andréa M. Maechler 30:20 Podiumsdiskussion “Aktuelle Fragen der monetären Ökonomie”

Read More »

Read More »

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

Wer trägt Risiko für SNB-Schuldenberg: Banken oder Volk? Darum gehts beim Staatsfonds.

Quengelware – wer kennt sie nicht? Ware, die an den Kassen der Einkaufszentren auf Augenhöhe unerzogener Kids aufgestellt ist, damit deren Quengeln Eltern zum Kaufen drängen. Ähnlich beim Schweizer Staatsfonds. Als Quengelpolitik könnte man nämlich die Begehrlichkeiten vieler Politiker bezeichnen, die lauthals deinen solchen Fonds oder sonst etwas Unnützes fordern, um die Aufmerksamkeit der Wählerinnen und Wähler zu erheischen.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 15.06.2017

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 15.06.2017 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

Weekly SNB Interventions Update: Slight Rise after Weeks of Near-Zero Interventions

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »

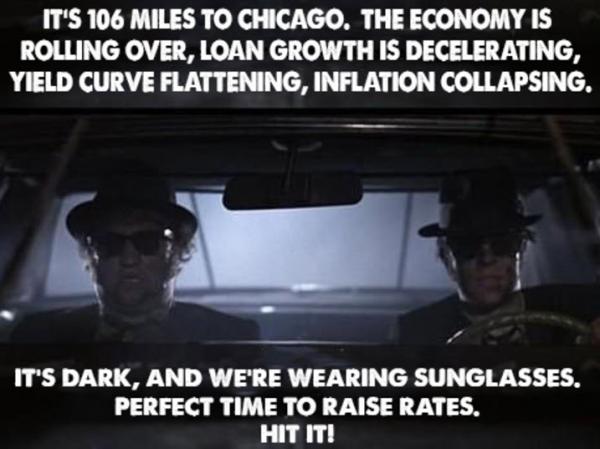

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will then hand over to Fritz Zurbrügg, who will present this year’s Financial Stability Report. After that, Andréa Maechler will review developments on the financial markets. Finally, we will – as ever – be pleased to take your questions.

Read More »

Read More »