Category Archive: 1) SNB and CHF

Swiss National Bank expects annual profit of around CHF 26 billion for 2021

According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion.

Read More »

Read More »

SNB profitiert von starker Aktienmarktperformance

Die SNB dürfte laut UBS für das Gesamtjahr 2021 einen Gewinn von fast 20 Mrd. Franken ausweisen. Dieser ist einer starken Aktienmarktperformance zu verdanken trotz belastender Zins- und Währungsveränderungen. Im letzten Quartal hingegen dürfte die Nationalbank wegen der deutlichen Aufwertung des Frankens gegenüber den meisten Währungen einen Verlust von über 20 Mrd. Franken erlitten haben.

Read More »

Read More »

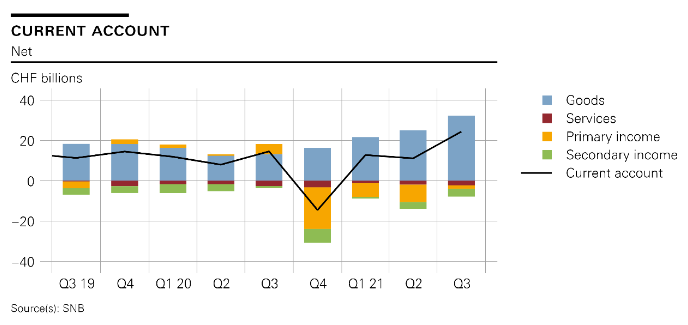

Swiss balance of payments and international investment position: Q3 2021

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting.

Read More »

Read More »

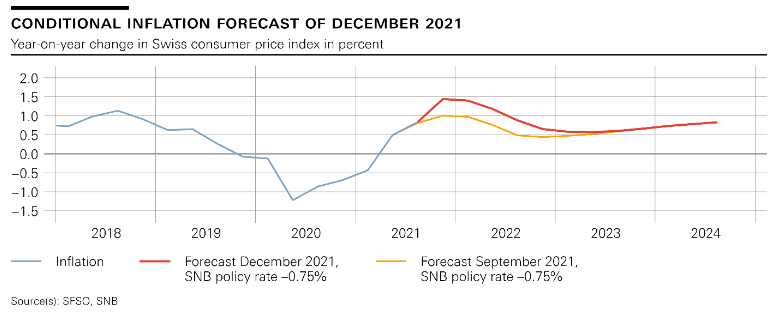

Monetary policy assessment of 16 December 2021: Swiss National Bank maintains expansionary monetary policy

The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc.

Read More »

Read More »

BBVA Switzerland Adds Ether to Its Crypto Trading Service

BBVA Switzerland, the Swiss franchise of Spanish multinational financial institution BBVA, has expanded its cryptocurrency custody and trading service with the addition of Ether to its investment portfolio.

Its private banking clients and new gen customers will now have access to both Bitcoin and Ether, a statement from the company said.

Read More »

Read More »

Börse – Profiteure des Tiefzinszeitalters: Die besten Aktien in der Schweiz und USA in den letzten zehn Jahren

Wer als Schweizer oder Schweizerin im Jahr 2011 im Euroraum Sommerferien machte, merkte plötzlich: Jeden Tag wird alles rasant billiger. Der Euro, der Anfang Juli noch 1,23 Franken gekostet hatte, stürzte bis zum 10. August auf 1,0070 Franken ab. Es waren dramatische Tage an den Märkten und eine Folge der sich ausweitenden Eurokrise – was die Schweizerische Nationalbank im September 2011 dazu veranlasste, die Kursuntergrenze von 1,20 Franken zum...

Read More »

Read More »

Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS).

Read More »

Read More »

“Digitales Notenbankgeld – und nun? (CBDC—What Next?),” FuW, 2021

I draw some conclusions from the CEPR eBook on CBDC, namely: Banks will change, whatever happens to CBDC. The main risk of retail CBDC is not bank disintermediation. CBDC may not be the best option even if it has net benefits. It should be for parliaments and voters, not central banks, to decide about the introduction of CBDC.

Read More »

Read More »

SNB-Vize Fritz Zurbrügg tritt Ende Juli 2022 zurück

Fritz Zurbrügg (links) tritt Ende Juli 2022 zurück. Andréa M. Maechler (rechts) dürfte ihm als Direktorin des III. ins II. Departement folgen. (Bild: PD)Fritz Zurbrügg leitete zunächst das III. Departement (Finanzmärkte, Operatives Bankgeschäft und Informatik) der Schweizerischen Nationalbank. Seit Juli 2015 führt er als Vizepräsident des Direktoriums das II. Departement (Finanzstabilität, Bargeld, Finanzen und Risiken).

Read More »

Read More »

Devisen: Euro gibt zum Dollar moderat nach – Franken etwas leichter

Der Franken neigt dagegen zum Wochenstart etwas zur Schwäche. Entsprechend legen sowohl Euro als auch Dollar zum Schweizer Franken etwas zu. So hat sich das Euro/Franken-Paar bei einem Stand von 1,0418 die 1,04er Marke zurückerobert, nachdem es am vergangenen Freitag so tief notiert hatte wie zuletzt vor sechseinhalb Jahren.

Read More »

Read More »

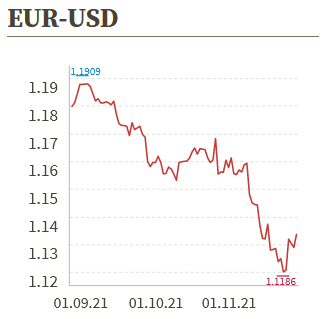

Devisen: Euro fällt deutlich unter 1,13 US-Dollar

Zum Franken verliert der Euro weiter an Wert und nähert sich der Euro bei einem Stand von 1,0424 langsam der 1,04er Marke an. Der US-Dollar macht mit 0,9252 Franken die Verluste wieder wett und notiert etwa auf dem Niveau vom Morgen.

Read More »

Read More »

Swiss franc highest against Euro since July 2015

On 19 November 2021, the Euro went below 1.05 Swiss francs, the lowest it has been since July 2015. The Swiss franc is viewed as a safe haven currency and tends to rise when markets are bearish. However, this week the shift in exchange rate may have had more to do with the situation in Euro zone than a shift to safety.

Read More »

Read More »

Swiss National Bank Fights Climate Change

The latest quarterly filing statement of the Swiss National Bank (SNB) has been issued. Switzerland’s publicly traded central bank had a decrease in the value of its US stock holdings by around $5 billion in Q3 of 2021, ending the quarter with a value of $157 billion. SNB currently has a profit of over $40 billion for the 9 months ended in the year.

Read More »

Read More »

Devisen: Euro weiter unter Druck – EUR/CHF knapp über 1,05

Zum Franken blieb der Euro auch im Tagestief nur noch knapp oberhalb der Marke von 1,05. Aktuell wird die Gemeinschaftswährung mit 1,0511 Franken tiefer bewertet als noch am Morgen und am Vortag. "Die Devisenhändler bei der Schweizerischen Nationalbank dürften wieder etwas strammer vor ihren Bildschirmen sitzen", heisst es in einem Kommentar der Commerzbank. Die SNB sehe die Marke von 1,05 als aktuelle "Schmerzgrenze", welche mit...

Read More »

Read More »

Nationalbank – SNB-Devisenreserven sinken im Oktober deutlich

Per Ende des Berichtsmonats lag der Wert bei 922,98 Milliarden Franken, nachdem es Ende September noch 939,29 Milliarden Franken gewesen waren.

Read More »

Read More »

Interim results of the Swiss National Bank as at 30 September 2021

The Swiss National Bank reports a profit of CHF 41.4 billion for the first three quarters of 2021. The profit on foreign currency positions amounted to CHF 42.2 billion. A valuation loss of CHF 1.3 billion was recorded on gold holdings. The profit on Swiss franc positions amountedto CHF 0.8 billion.

Read More »

Read More »

FATF hat ihre Bekanntgabe aktualisiert

Die FATF hat an ihrer Plenarsitzung im Oktober 2021 ihre Bekanntgabe zu Hochrisiko- und weiteren unter Beobachtung stehenden Ländern aktualisiert. Weiterführende Informationen sind verfügbar unter:The Financial Action Task Force (FATF) ist ein internationales Gremium, das Massnahmen zur Bekämpfung von Geldwäscherei, Terrorismus- und Proliferationsfinanzierung entwickelt und fördert. Die Schweiz ist eines der FATF-Mitgliedsländer. Basierend auf den...

Read More »

Read More »

Aktualisierte Sanktionsmeldung

Das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF hat eine Änderung des Anhangs 3 der Verordnung vom 27. August 2014 über Massnahmen zur Vermeidung der Umgehung internationaler Sanktionen im Zusammenhang mit der Situation in der Ukraine (SR 946.231.176.72) publiziert.

Read More »

Read More »

Bundesrat wählt zwei neue Mitglieder in den FINMA-Verwaltungsrat

Der Bundesrat hat Dr. Alberto Franceschetti und Marzio Hug in den Verwaltungsrat der Eidgenössischen Finanzmarktaufsicht FINMA gewählt. Die beiden italienischsprachigen Experten aus dem Finanzsektor treten am 1. Januar 2022 die Nachfolge der per Ende Jahr ausscheidenden Mitglieder Franz Wipfli und Bernard Keller an.

Read More »

Read More »

Credit Suisse “Beschattungsaffäre”: FINMA stellt schwere Aufsichtsrechtsverletzungen fest

Die Eidgenössische Finanzmarktaufsicht FINMA schliesst ihr Verfahren gegen die Credit Suisse im Zusammenhang mit der sogenannten Beschattungsaffäre ab. Sie stellt fest, dass bei der Credit Suisse im Zusammenhang mit Observationstätigkeiten gravierende organisatorische Mängel bestanden.

Read More »

Read More »