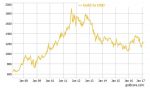

Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV). Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world. Investors to be reminded that all mined gold is rare and homogenous. Nothing chemically different between Welsh gold and that mined elsewhere. Investors led to believe Welsh gold is more valuable, despite lack of authenticity in some Welsh gold products.

Read More »2018-05-18