Sentiment ExtremesBelow is an update of a number of interesting data points related to the gold market. Whether “interesting” will become “meaningful” remains to be seen, as most of gold’s fundamental drivers aren’t yet bullishly aligned. One must keep in mind though that gold is very sensitive with respect to anticipating future developments in market liquidity and the reaction these will elicit from central banks. Often this involves very long lead times. |

|

| If one looks at long term charts of gold, one can see that meaningful rallies usually start as technical short covering moves, which often are still at odds with at least some of the macroeconomic fundamentals. The starting points of these rallies often involve divergences with associated markets or data points. If the market is too far ahead of itself, these moves will be given back again quickly.

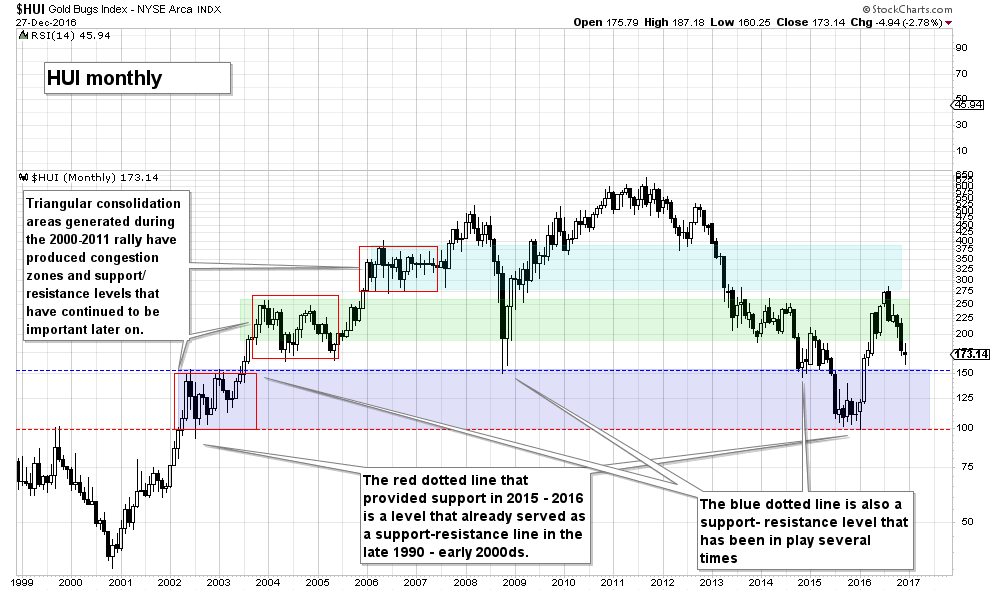

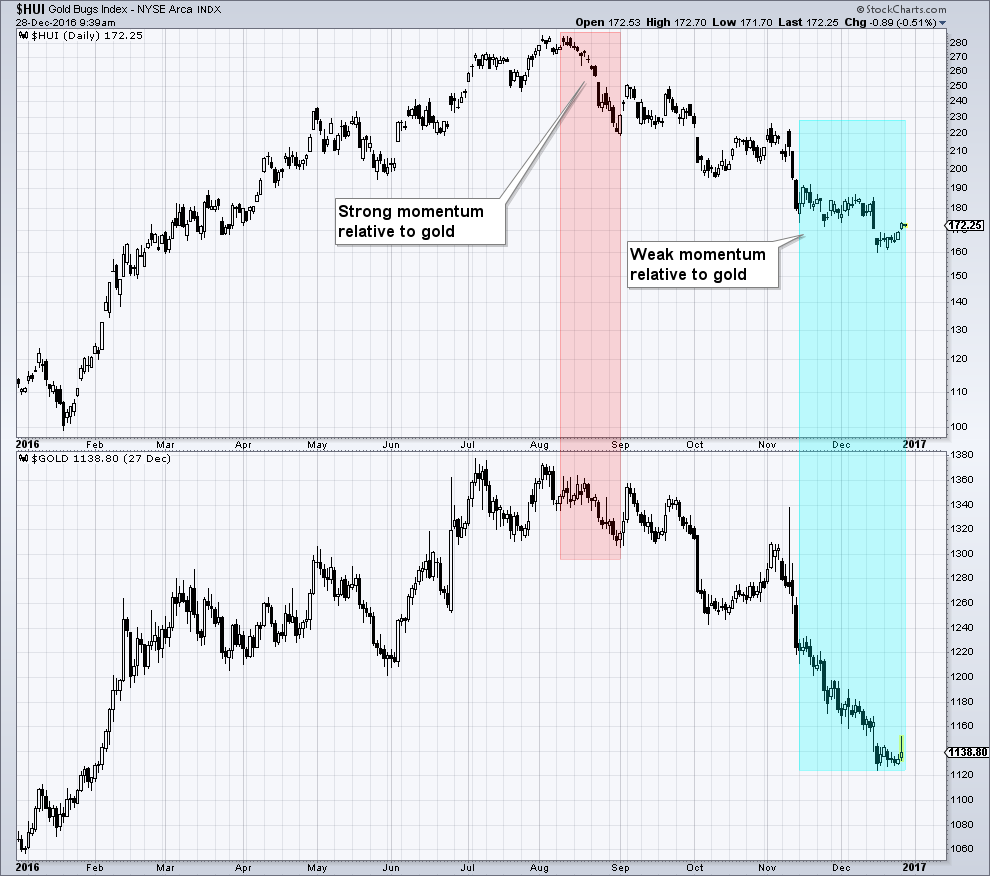

If a meaningful move has indeed begun though, the fundamental drivers will begin to fall into place as it continues, and it will become clear in hindsight that the market has anticipated these developments. It is therefore definitely worthwhile to pay attention to sentiment extremes and inter-market divergences. One thing that has struck us as noteworthy lately is that the momentum of the decline in gold stocks has decreased significantly during the the most recent phase of the decline in the gold price – contrary to the much stronger relative momentum seen in the August sell-off. |

HUI Gold Momentum Divergence During the move in gold prices from $1220 to the current level of approx. $1135, the HUI Index has only lost less than 8 points (as we write this, the loss has actually been reduced to just 5 points). That is remarkably mild compared to preceding selling squalls (the first of which is highlighted above). - Click to enlarge |

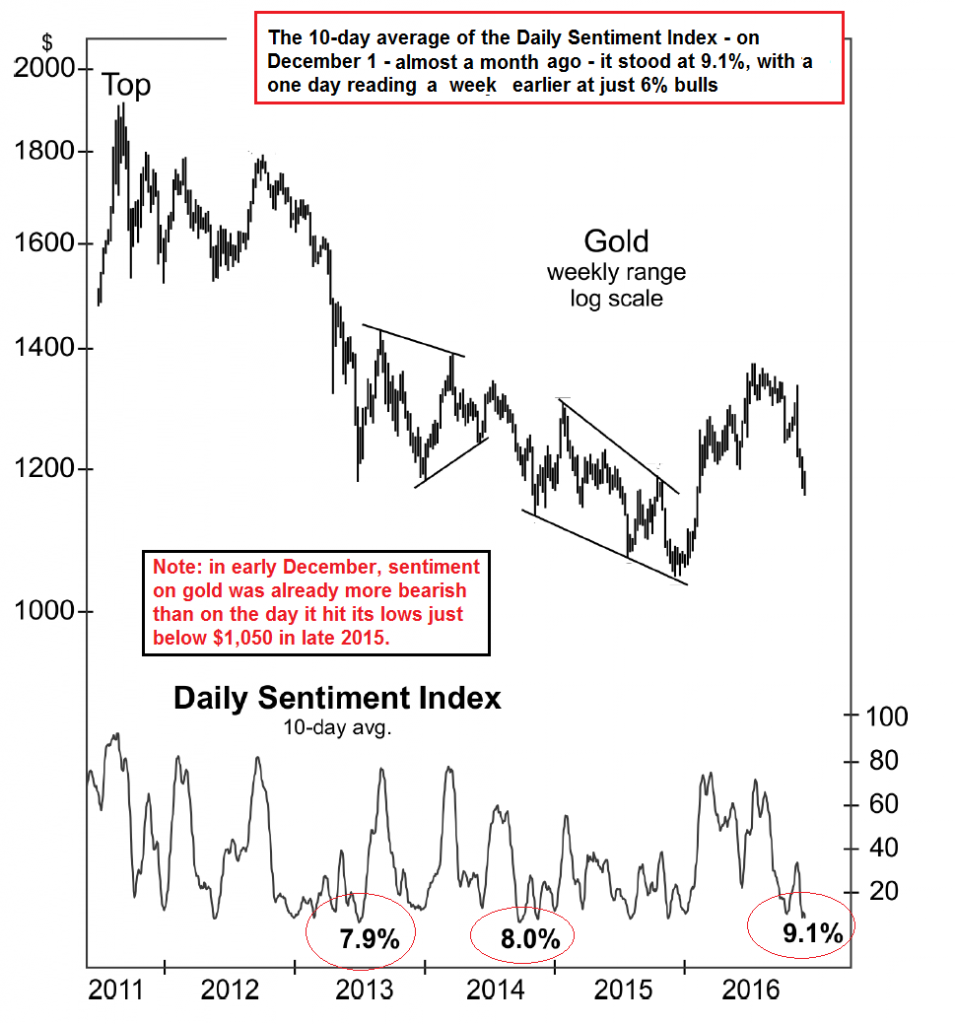

| Despite the increasing reluctance of gold stocks to weaken further in the face of gold’s ongoing swoon, sentiment on gold has become quite bearish. The next chart is actually a bit dated by now. It shows the short term sentiment situation as of December 1, with gold trading at around $1180. At the time the HUI was actually unchanged from its level of two weeks earlier (when gold still traded at $1220).

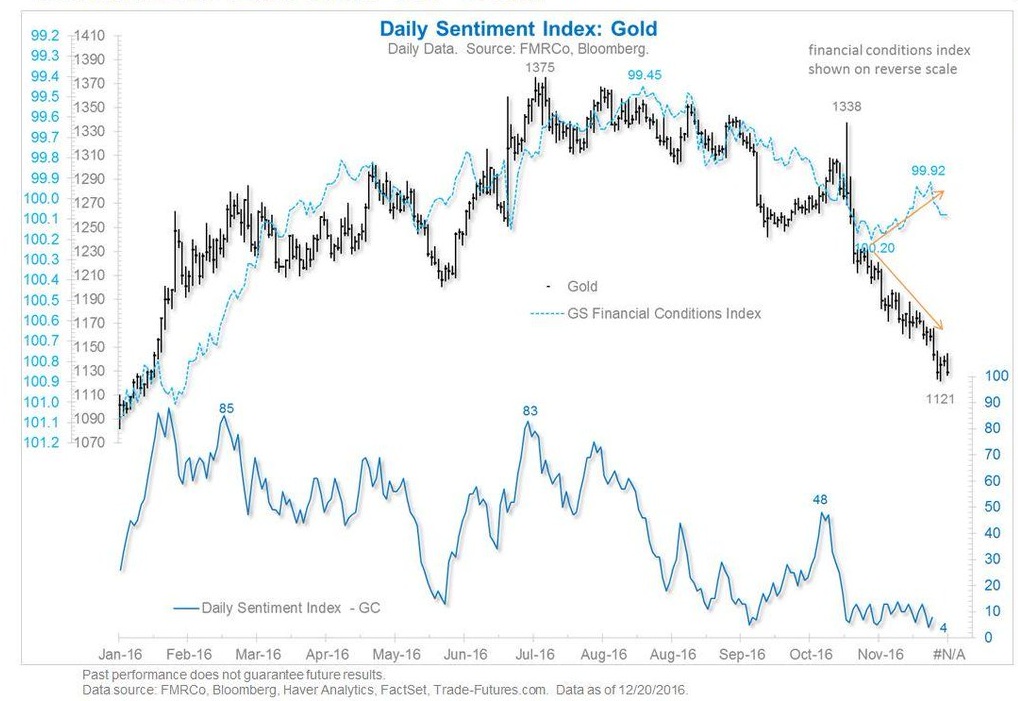

The chart was originally shown in the monthly issue of the Elliott Wave Financial Forecast and depicts a 10-day average of the DSI (daily sentiment index of futures traders) compared to gold prices. We have removed the wave labeling from the chart. The historically very low 10-day average of 9.1% bulls included a single day reading of 6%, which was just 1% above the previous all time low. A new all time low of just 4% bulls in the daily DSI was posted in mid December. |

Gold Sentiment |

| Here is a chart of one day DSI readings that shows the 4% all time low in the bullish consensus posted in mid December. In addition it shows a recent divergence between the gold price and the Goldman Sachs financial conditions index, which indicates that gold has moved down too far too fast, probably due to sheer momentum:

These sentiment readings are not only at odds with the relative performance of gold stocks in the preceding weeks, they are also diverging from the higher late 2015 DSI readings which coincided with a lower gold price. In recent years, gold has exhibited strength early in the year and has been weak in the normally seasonally strong period at year end. The usually strong showing early in the year may be a hint that the seasonal pattern in silver remains operative. It also shows that the short term effect of seasonal jewelry demand on gold prices has been very small in recent years; this effect is far more obvious when it is aligned with a bullish macro-trend driving gold. Given the pattern seen in recent years, the fact that such strong bearish sentiment is seen right at the end of the year is definitely a heads-up indicating that another bout of surprise strength in gold is likely in early 2017. This is supported by anecdotal evidence as well. As Mish notes here, both Barron’s and the Financial Times have recently seen fit to pronounce gold “dead”. It has “died” many times in the mainstream financial press in recent years and such stories tend to proliferate near turning points. There is certainly no shortage of bearish articles on gold lately – even many long term bulls are currently bearish on the short term outlook (the opposite situation can be found in the stock market, see further below). |

Daily Sentiment Index: Gold |

US Dollar DivergenceThis brings us to another well-known anecdotal contrary indicator, namely the Economist magazine. The uptrend in the US dollar is one of the negative macro fundamentals currently putting pressure on gold, but the dollar index is also one of the price series from which gold is diverging at the moment. Whether the US dollar is rising or falling, the Economist is always worrying about it. Up or down, it’s always bad (Google Economist covers on the dollar and try not to laugh out loud!). Economist cover stories on the dollar not only have that in common though, they also represent warnings of an imminent change in trend, usually of at least the medium term variety. As forecasts go, the magazine’s pronouncements on the dollar are unblemished by success. Here is the cover that appeared in the first week of December (note, the rising dollar is a “problem”…:)) |

|

| Here is the chart showing the divergence between the dollar index and gold:

Anecdotal sentiment as well as dollar positioning data (in currency futures) are buttressing the idea that the divergence shown above is actually meaningful. Admittedly, it would not take much to negate it, but that seems unlikely to happen in the near term. |

Gold vs Dollar Index The dollar index vs. gold, weekly, since 2012. The two periods highlighted show that gold tends to anticipate moves in the dollar. In late 2012 – mid 2013 gold sold off sharply, even though the dollar index didn’t move much – but it rallied sharply 6 months later. Recently the dollar index has broken out to new high ground, but gold has not “confirmed” this move so far. - Click to enlarge |

Gold Stocks – Long Term Support and Resistance LevelsBelow is a chart we have shown before, which shows important trading ranges and the associated lateral support and resistance lines in the HUI Index over the long term. We have made the annotations on this version of the chart about two or three months ago, when it was still uncertain how deep the ongoing correction would become (it has become deeper than we thought it would, but one of the levels shown on the chart seems to have come into play): Perhaps it will be sufficient that the line has been almost reached. In early January 2016 an important support line at 100 was slightly undercut intraday before the index reversed (a more pronounced break was evident in the equivalent XAU support line), and sometimes a market finds support slightly above an obvious support line. We wouldn’t necessarily be surprised if this support is revisited before the market reverses and stages a significant rebound, but it certainly doesn’t have to happen. |

HUI Long Term Support Resitance Areas |

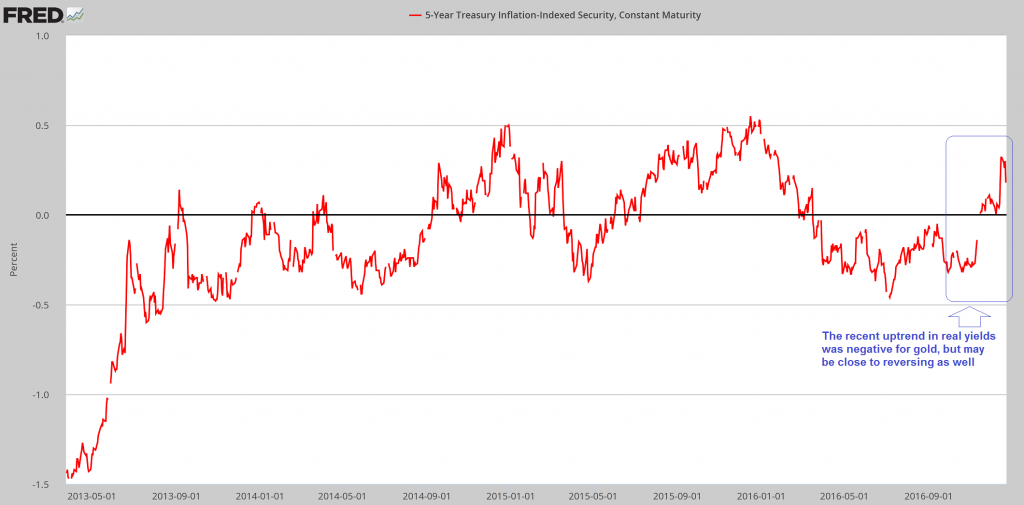

Fundamental DriversApart from the uptrend in the dollar, other currently gold-bearish macro drivers consist of the ongoing decline in credit spreads, the strength in stock prices, as well as the surge in real yields (in the form of TIPS yields). On the positive side, we find strength in commodity prices and a noticeable steepening of the yield curve. Real yields are currently probably the most important of these drivers, as a very pronounced and very tight negative correlation between TIPS yields and gold has been in evidence for quite some time. A renewed decline in real yields will probably be needed for a sustainable reversal in the gold price. The uptrend in 5-year TIPS yields has actually stalled a bit lately – from a high of 32 basis points in mid December they have decreased to 20 basis points as of last week. |

5 Year TIPS Yield |

| The steepening yield curve indicates that inflation expectations are rising, which is confirmed by a recent 27-month high in the 5-year inflation breakeven rate. This usually tends to be bullish for gold, but is currently outweighed by other considerations. |

Yield Curve |

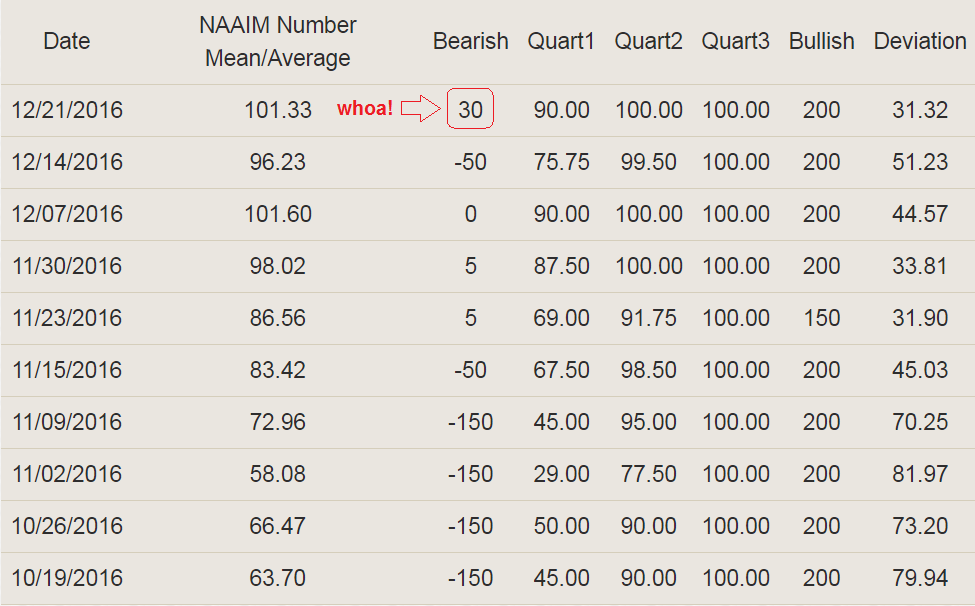

| As for competing asset classes such as stocks, we have recently discussed the NAAIM exposure index in these pages (see “The Exiling of Risk” for details). The average net stock market exposure of fund managers taking part in the survey remains above 101%, but what is really remarkable is that the most “bearish” manager was net long by 30% last week. As far as we know, this is yet another unprecedented datum:

Since the correlation between stocks and gold has been strongly negative of late, the proliferation of sentiment and positioning extremes in stocks is also supporting the notion of a turnaround in the gold price in the not-too-distant future. |

NAAIM Exposure Table NAAIM survey data details: responses may range from -200% leveraged short to +200% leveraged long. The average exposure currently stands at a historically very high 101.33%, but the most astonishing data point is the +30% net long position of the “most bearish” respondent highlighted above. - Click to enlarge |

Conclusion:

It looks like gold is close to staging a playable rally again early in the new year. Whether it will be durable or just a technical rebound is hard to say at the moment – that will have to be determined as it unfolds. If a rally does get underway in early 2017, one thing is definitely going to be different from previous years though: it will be the first time in the past four years that gold and gold stocks deliver a new year rally from a higher low (the 2014, 2015 and 2016 rallies all started from progressively lower lows).

That would represent further subtle confirmation that the market’s character has changed. Consider in this context that the first correction in a new bull market can retrace a significant percentage of the initial rally – in the worst case, up to 100%. Such significant early corrections usually have in common that they generate greater bearishness than was evident shortly before the initial rally phase, which seems to be the case with gold at this juncture.

Charts and tables by: StockCharts, Elliott Wave International, CSinvesting, St. Louis Federal Reserve Research, NAAIM

Full story here Are you the author? Previous post See more for Next post

Tags: Chart Update,newslettersent,Precious Metals