| As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business.

From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. |

|

Thus, Russia. In fact, the White House’s statement from a few days ago confirms these things. At least, it seems to confirm what most people already believe:

Is any of this true? Yes; SWIFT is, indeed, a messaging system. |

|

Other than that, no.

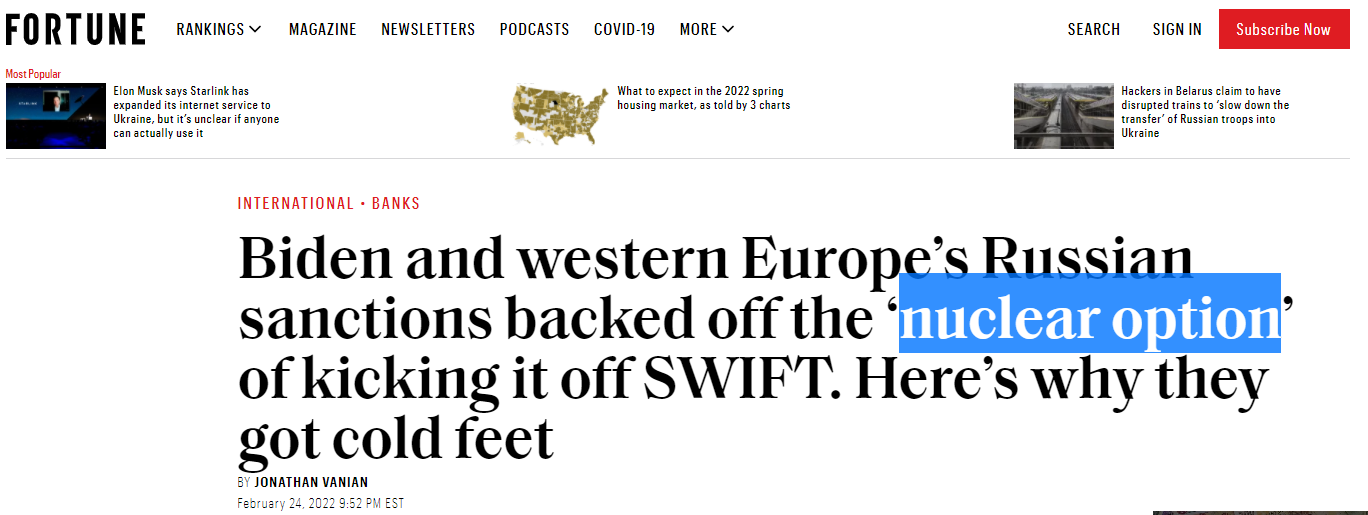

I’m not arguing against the reasons behind these measures; the Russian invasion of Ukraine is an unqualified evil. And, as usual, it will be the peoples of Ukraine and Russia who ultimately bear the brunt of the conflict, in gross economic harm on top of the tragic loss of life. Some legitimate response is far beyond warranted; this just isn’t it. Nor do I have the slightest interest making this into a domestic partisan issue. As I’ve stated numerous times for more years than I care to remember, it’s huge failure to which both parties should and must (eventually) accept blame for not understanding the system, therefore the consequences which have arisen from it. Including: |

|

| Russia and SWIFT in February 2022 is, on these more limited terms, another demonstration of fact versus fiction. The world actually runs on a eurodollar not dollar standard. Like inflation vs. “inflation”, this is no trivial distinction; it is, on the contrary, a categorical difference.

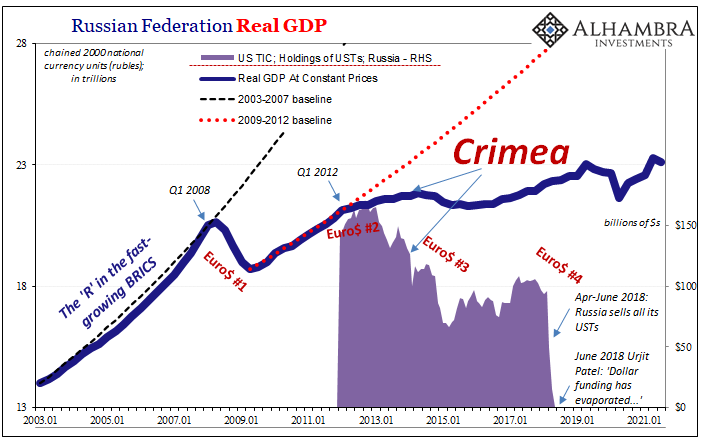

The eurodollar system is a reserve-less ledger money system congregating mostly offshore – not just offshore of the US, but offshore of pretty much everywhere. The keepers of the ledger outside jurisdictional boundaries, meaning global banks, they hold all the monetary keys to the financial and economic kingdom worldwide. This, then, already exposes the first of the White House statement’s fallacies: in announcing sanctions, it was first admitted how these had to be negotiated by a consortium of political authorities from around the world. |

|

| The US government didn’t just cut Russia off SWIFT, it first required joint political pressure from: European Commission, France, Germany, Italy, the United Kingdom, Canada, and the United States.

If the dollar was the dollar, then Treasury’s authority would be the end of it. Instead, because SWIFT is a component of the global banking ledger system, it is controlled and operated by banks from all over the world. To throw “Russia out of it” requires enough of SWIFT’s banks to consent to the concerted and widespread effort. But once achieved, does exile from SWIFT actually lead to, “these banks are disconnected from the international financial system”? Again, not remotely. SWIFT is little more than a messaging system; and it is hardly the only one. Once any message for payment demand is initiated, it must then get cleared and settled in some other fashion/venue. In fact, clearinghouse settlement associations have their own messaging networks which can and do operate independently of SWIFT. For the eurodollar world, one of the most important is something called CHIPS. Around 90 to 95% (depends on who you ask) of all global dollar transactions (about $1.8 trillion per day) get messaged into, cleared then settled upon, the CHIPS architecture. That means hundreds of thousands of daily messages, more than half a million in 2021, on average, and about 70 to 75% (depends on who you ask) of those messages originate from SWIFT. Those which originate from SWIFT can seamlessly and immediately get “mapped onto” standard CHIPS communication. In other words, while easy to use SWIFT, it is hardly a requirement. Let’s use the most extreme of the recent Russian examples. According to Treasury’s February 24 statement sanctioning a particular group of ten Russian banks (so, again, it’s not “cutting Russia off” even in who is being targeted for SWIFT exclusion, only one group of its bigger banks), two of the largest and most important to be singled out are Public Joint Stock Company Sberbank of Russia (Sberbank) and VTB Bank Public Joint Stock Company (VTB Bank). Injunctions against the pair go beyond cajoling the SWIFT banks to cut them off from that particular messaging service. Treasury means to sever all ties, going beyond messages to the transacting heart of the global interbank network via correspondent or payable-through account relationships:

Did you notice the all-important qualification in Treasury’s definitions? It was: “all U.S. financial institutions.” The CHIPS system is run by what used to be called the New York Clearinghouse Association – the very same association what “saved” the US banking system way back during the Panic of 1907 (the one in which JP Morgan famously stepped up, he did so via the NYCA). Nowadays, it’s simply The Clearing House. The Clearing House is owned by 24 banks:

|

|

| CHIPS operations are conducted by a slightly larger group, its 43 total “member” participants. These 43 sponsor many dozens, maybe hundreds (I didn’t count) more who can transact in CHIPS under their behalf.

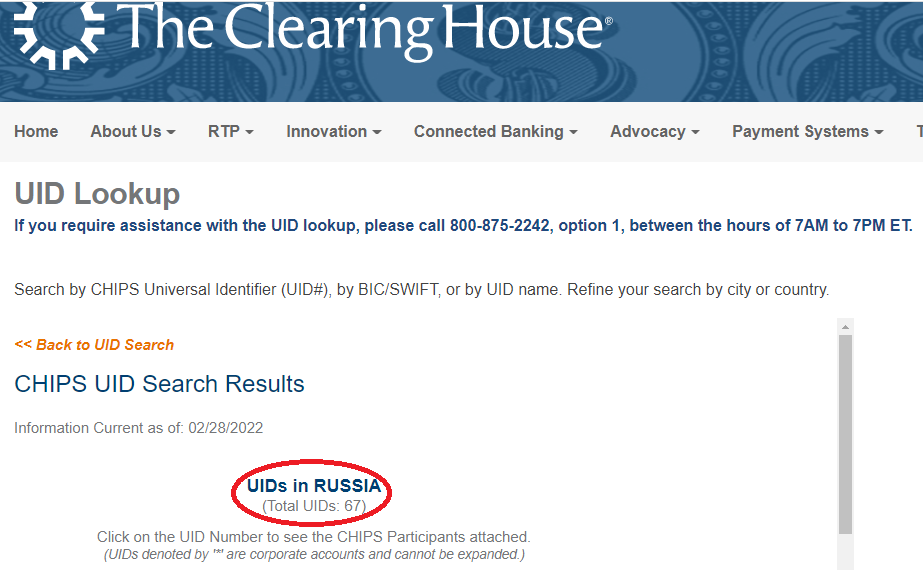

Treasury’s February 24 directive specified that in 30 days US financial institutions must sever even correspondent ties with both Sberbank and VTB. Though not stated, presumably we can include correspondent accounts between US CHIPS members and those two. So, having been booted from SWIFT, and now sanctioned in correspondent accounts, are these two Russian banks done-for? Yet again, no. It took me all of two seconds to pull up their CHIPS UIDs (unique identification numbers used specifically for CHIPS messaging): Sberbank’s is 321233; VTB’s is 306166. |

|

| So, while they can’t originate messages from SWIFT, they can on CHIPS.

But what good is it to message on CHIPS if correspondent ties are to be severed with US banks? This is the eurodollar difference. Of those 43 CHIPS members, only 19 are US firms. The remaining 24 are spread out around the world, several located in Europe and therefore likely to be under political pressure to follow US Treasury’s lead in cutting off correspondent ties, too. Even if that does happen, this still leaves one in Switzerland (UBS), another in the United Arab Emirates (doing a ton of business with Russia), one in India (same), and, of course, four in China. In other words, these two heavily-sanctioned Russian banks allegedly cut-off from the dollar, yet each can still send CHIPS messages to, perhaps, UBS, for example, or any among the quartet of Chinese state-owned behemoths with existing close ties to them for clearing and settlement.

|

|

| And even if authorities in the US and elsewhere do get wise to this workaround, those same Russian banks need only remove themselves one further step by entering into a correspondent agreement with any of the other dozens/hundreds offshore of Treasury’s authority who can be sponsored on their behalf.

They could even initiate some other kind of local correspondent relationship (assuming they haven’t already) with one of 65 other Russian banks with active UIDs currently on CHIPS (above). Message, clear, and settle – in US$ denomination – with only some additional bother for lack of SWIFT access. The same would be true in less high-value, high-volume clearing and settlements. |

|

For small-value transactions – what SWIFT does well – the rest of Russia’s ten banks can still maintain direct correspondent relationships with banks anywhere in the world; those they’ve likely been working with for years if not decades.

While these couldn’t use SWIFT to send payments messages between them, they could still, you know, pick up the phone (or send a text) and voice all the information which might otherwise be encoded in an electronic SWIFT message. Given the direct correspondent relationship between only the two involved, settlement is done informally anyway on site. None other than the Washington Post just yesterday had to concede to reality here:

It’s like a Monty Python skit. Yes, the “nuclear option” is essentially annoying a few Russian bankers by making them have to work their phones quite a bit more (I’m only exaggerating a little here). And that’s only when it comes to low-value transfers. For high-value, high volume stuff, SWIFT can be replaced with other forms of electronic messaging which have to be cleared and settled anyway. Sure, it’s easier and everyone is used to mostly going through that channel (though there are numerous complaints about it), but when push comes to shove, this is what the eurodollar system does.

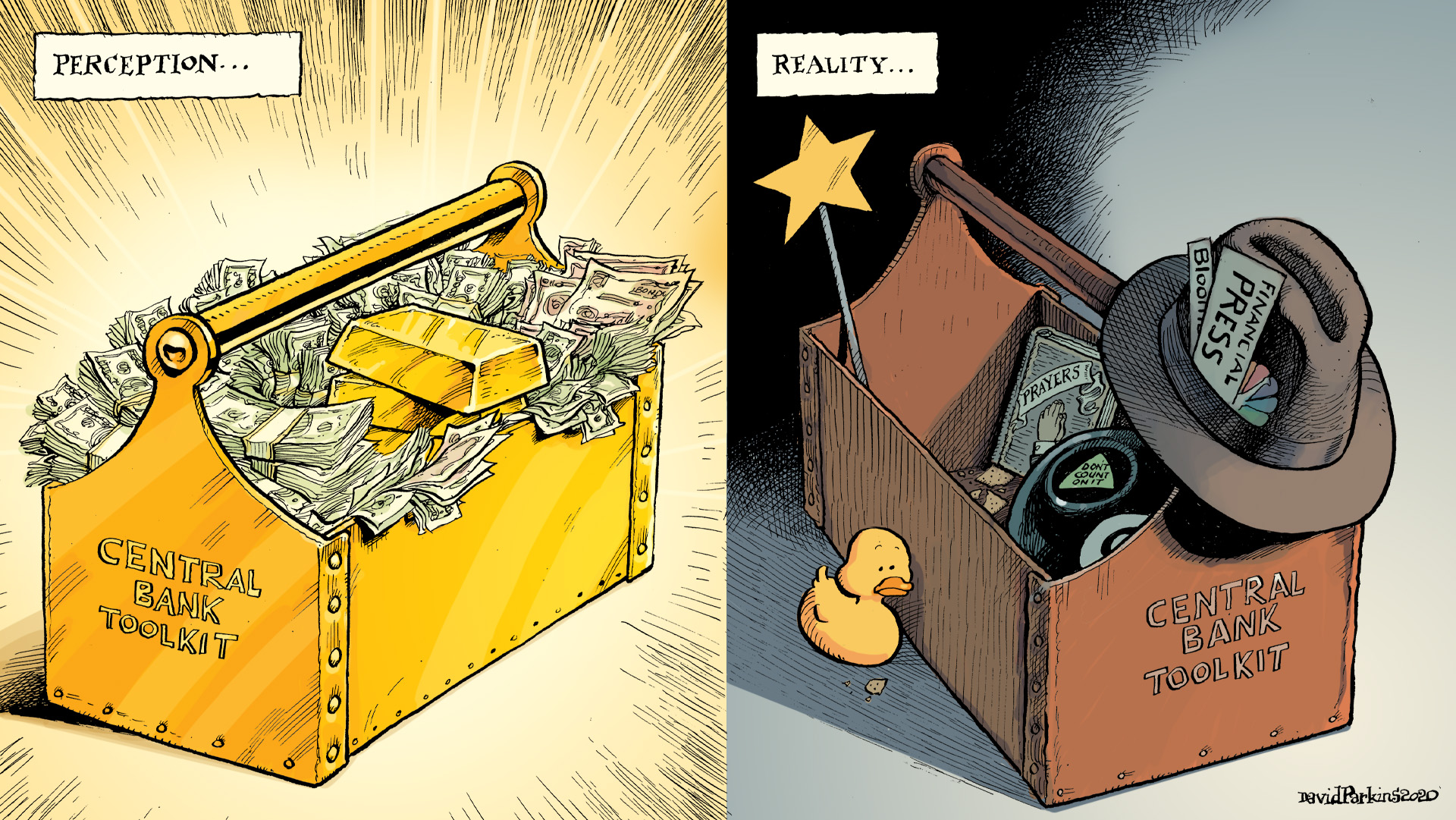

As the man said in 1984 – Roosa wasn’t just “some” guy, he had been Under Secretary of the Treasury for monetary affairs – the real monetary system consists of new networks of interbank relationships. Networks, global networks of banks. Like any good computer network, it effectively responds to potential exogenous interruptions (where even possible) by flexibly rerouting traffic in the most efficient means available. But those aren’t the optics political authorities are trying to project. From the outward-facing perspective, they want to make it seem like there is some plausible non-violent alternative by which to get Putin to stand down and go back. As if “ensure that these banks are disconnected from the international financial system” can force the Russians to the negotiating table. It can’t because no one has actually been disconnected; contrary to every popular perception, it’s not up to the US government, nor any government. |

|

There’s also the inward-facing message swiftly being sent, too (pun intended). To reinforce the idea the public already has how the world is on a US dollar standard directly controlled by some combination of US authority. The same one which is meant to support and maintain the Federal Reserve Myth and its expectations psychology. They can’t afford to have the curtain pulled back to expose their lack of power in the most important realm of money and dollar.

Eurodollar not dollar.

Unfortunately, the Russian example amidst war and tragedy serves as yet another reminder that how it really works just isn’t what they all say. We’re swimming in an international ocean of grossly misunderstanding the biggest, most directly impactful global factors imaginable. No wonder…

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,currencies,dollar,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Russia,SWIFT,Treasury,Ukraine