Tag Archive: Ukraine

The slow, stealthy but steady spread of absolutism

Part I of II by Claudio Grass, Switzerland

The struggle and rivalry between the “West and the rest” might be grabbing news headlines due to the Ukraine war these days, but in truth, it is anything but newsworthy. This antagonism, this battle for geopolitical, physical dominance, for moral supremacy, and this clash of ideas and fundamental values has been raging for much longer than that, perhaps longer than most of us can recall.

It sowed...

Read More »

Read More »

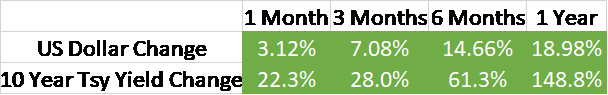

Dollar Comes Back Bid

Overview: The US dollar is recovering today

after it was sold following the jobs report before the weekend. It is enjoying

a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring

best, while the Scandis are off close to 0.5%. Most emerging market currencies

are also softer, with only a few Asian currencies edging higher today,

including the South Korean won, Indian rupee, and Taiwanese dollar. With a

stronger dollar and...

Read More »

Read More »

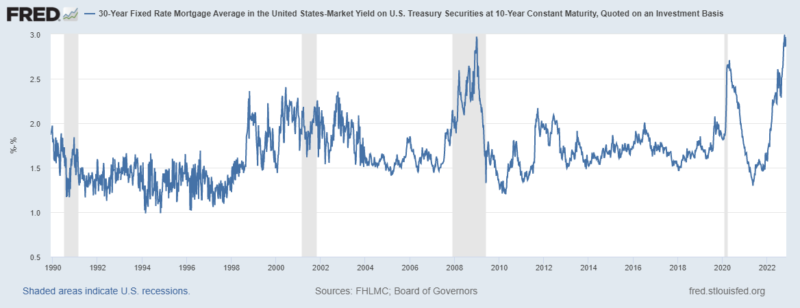

Yen and Yuan Fall to New Lows for the Year

Overview: Some creeping optimism about the US

debt ceiling, easing of pressure on bank shares, and a continued rise in US

rates helped the dollar extend its recent recovery. Over the past two weeks or so,

the US 2-year premium has risen 25-30 bp against Germany and nearly 25 bp

against the UK. The 10-year US Treasury has risen from the lower end of its

seven-month range (~3.30%) earlier this month to approach the upper end of the

range that has...

Read More »

Read More »

Weekly Market Pulse: A Fatal Conceit

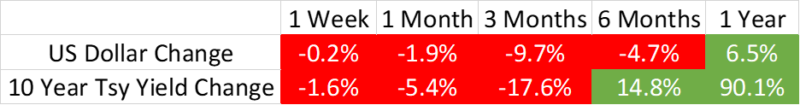

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

A grateful goodbye to 2022, a hopeful hello to 2023

Even though what we saw during the height of the pandemic was shocking enough for most people, what we saw during 2022 was arguably even more astonishing. During the lockdowns and quarantines and the forced business shutdowns, the sheer number of all the rights and freedoms that were coercively “suspended”, as though that’s a thing one can do with true liberty, left so many fellow citizens in disbelief. However, what many people found even more...

Read More »

Read More »

Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

New Week, but same Old Stocks (Heavier) and Dollar (Stronger)

The start of the new week has not broken the bearish drive lower in equities. Several Asia Pacific centers were closed, including Japan, Taiwan, and South Korea. China’s markets re-opened, and the new US sanctions coupled with the disappointing Caixin service and composite PMI took its toll.

Read More »

Read More »

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

Ukraine conflict: A dispassionate analysis

I realize that I shouldn’t be surprised at the way the crisis in Ukraine has divided our societies or at the blind fanaticism the conversations around it have provoked. After all, virtually every other development of consequence has tuned out exactly the same. From covid to the economy and from freedom of speech to science itself, rational, respectful and productive debates are nowhere to be found.

Read More »

Read More »

Calmer Markets: Hope Springs Eternal

Overview: Interest rates continue to rise, but equities are looking through it today and the dollar is drawing less succor. Asia Pacific equities were mostly higher. With half of Shanghai in lockdown, Chinese equities were unable to join the regional advance. Europe's Stoxx 600, led by energy and consumer discretionary sectors, is rising for the third consecutive sessions. US futures have a small upward bias.

Read More »

Read More »

Yields Jump, Greenback Bid

Overview: Yields are surging. Canada and Australia's two-year yields have jumped 20 bp, with

the US yield up 10 bp to 2.37% ahead of the $50 bln sale later today. The US 10-year yield has risen a more modest three basis points to 2.50%, flattening the 2-10-year yields curve. The 5–30-year curve has inverted for the first time since 2016.

Read More »

Read More »

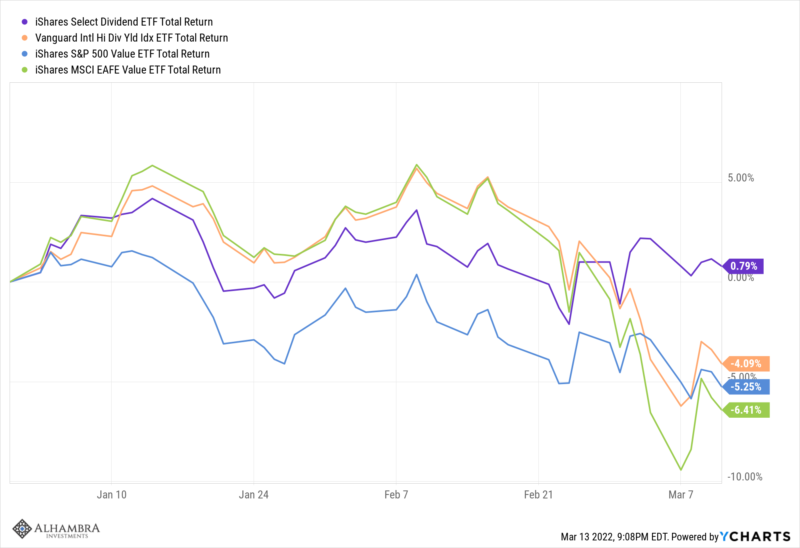

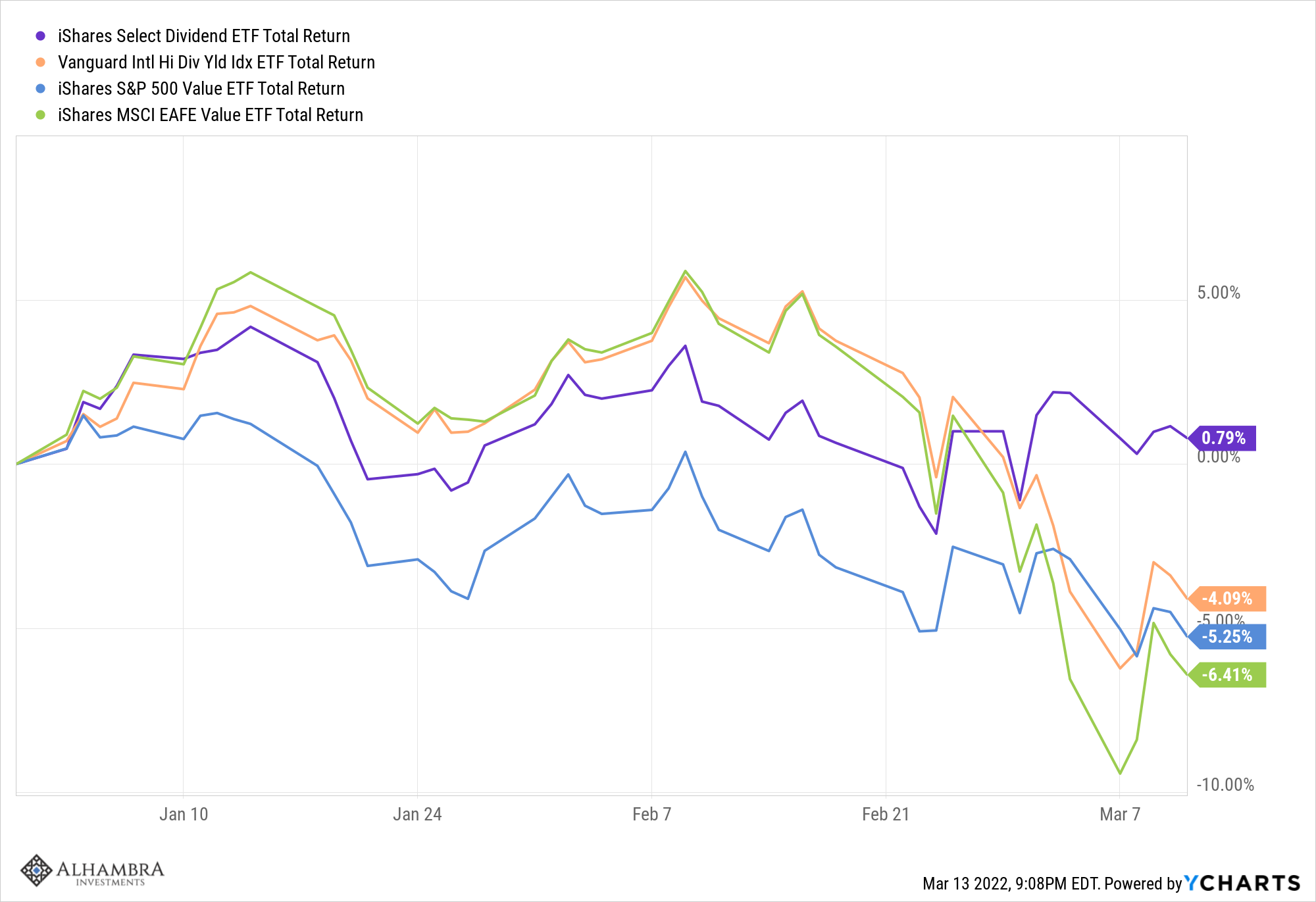

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China's CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%.

Read More »

Read More »

Risk Assets Given a Reprieve

Overview: US equities failed to sustain early gains yesterday, but risk appetites have returned today. Asia Pacific equities had a poor start, with Chinese and Japanese indices losing ground, but the equity benchmarks in Taiwan, Australia, India, and most of the smaller markets traded higher. Taiwan's 1.1% gain is notable as foreign investors continued to be heavy sellers.

Read More »

Read More »

Is The Ruble Backed By Gold Now?

2022-04-16

by Stephen Flood

2022-04-16

Read More »