Mark Carney, Wrecking BallFor reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). The adulation he receives is really a major head-scratcher. What has he ever done aside from operating the “Ctrl. Prnt.” buttons? As far as we are aware, nothing. As we have discussed previously, his main legacy is that he has left Canada with one of the greatest and scariest real estate and consumer credit bubbles extant in the world today. Some accomplishment! With respect to his economic analysis, it seems not the least bit different from the neo-Keynesian/ semi-monetarist mumbo jumbo we get to hear from central bankers everywhere. This is by the way no surprise: they’re an incestuous bunch and have largely received their education at the same institutions. Most of them seem genuinely convinced that central planning not only works, but is necessary to improve on the alleged drawbacks of an “unfettered market” (i.e., the mythical unhampered free market economy no-one alive today has ever experienced). If one looks closely at what they are actually doing, it soon becomes clear that it is in principle not much different from what John Law did in France in the early 18th century (the difference is one of degree only). |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

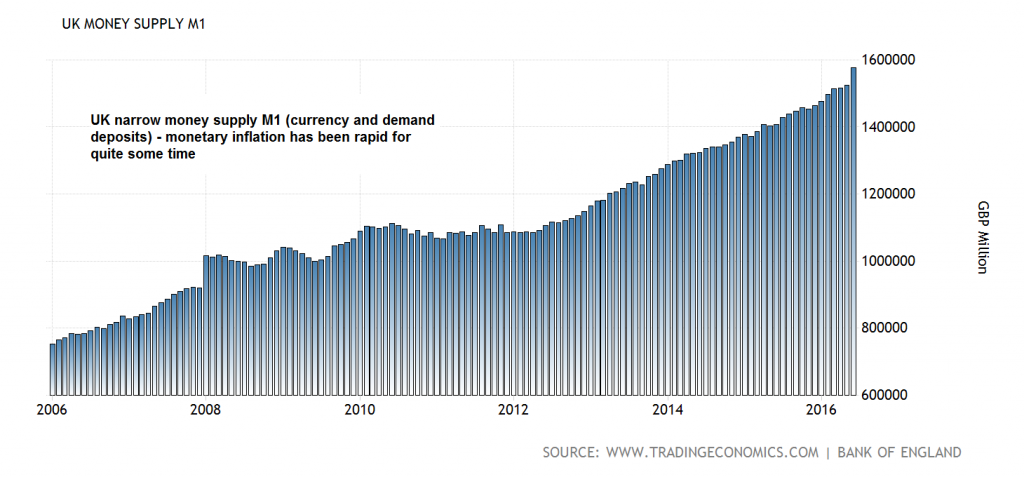

BoE Adopts Loosest Monetary Policy in HistoryThe much-dreaded “Brexit” has now given Mr. Carney the opportunity to do what he does best, namely open the monetary spigots wide. One might as well try to improve one’s health by playing a few rounds of Russian roulette every morning before breakfast. Here is a summary of the measures the Bank of England announced last week (via Reuters):

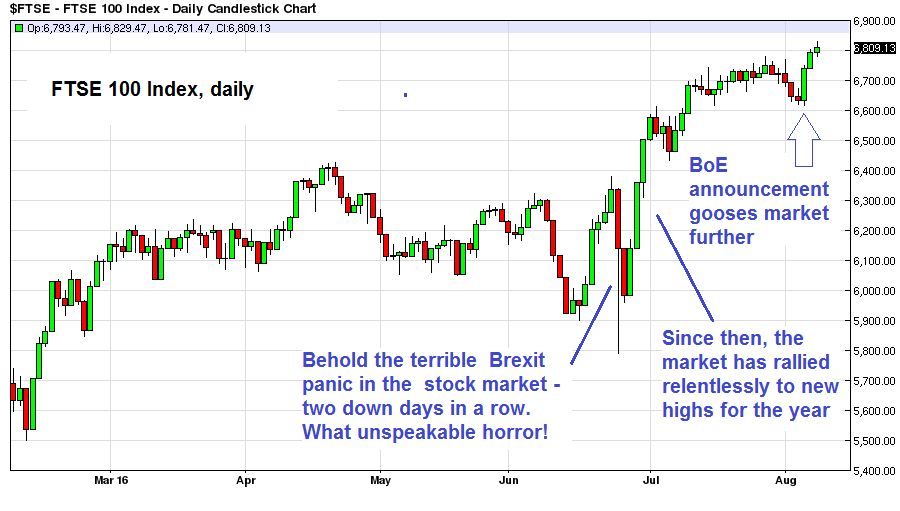

(emphasis added) The first question that suggests itself is: does any of this make even the slightest bit of sense? As one would expect, the announcement boosted stock prices and put pressure on UK gilt yields and the British pound. Below you can see what the markets were doing before and after this renewed onslaught of price fixing and additional money printing. First up, the UK stock market: |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

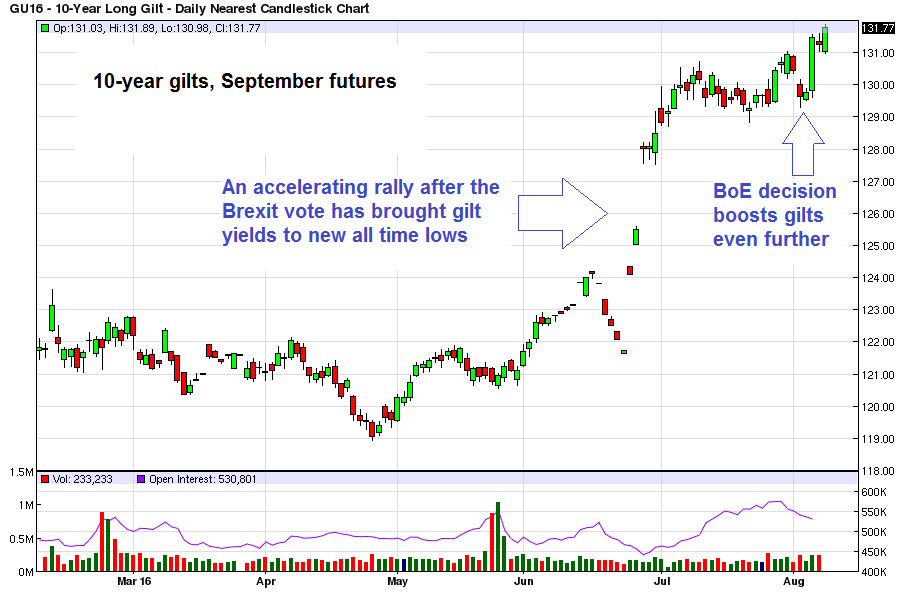

| The next chart shows the price of the September 10-year gilt future. British government bond prices have recently reached record highs (i.e., yields have fallen to record lows): |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

| To illustrate this further, here is a chart of the 10-year gilt yield over the past year: |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

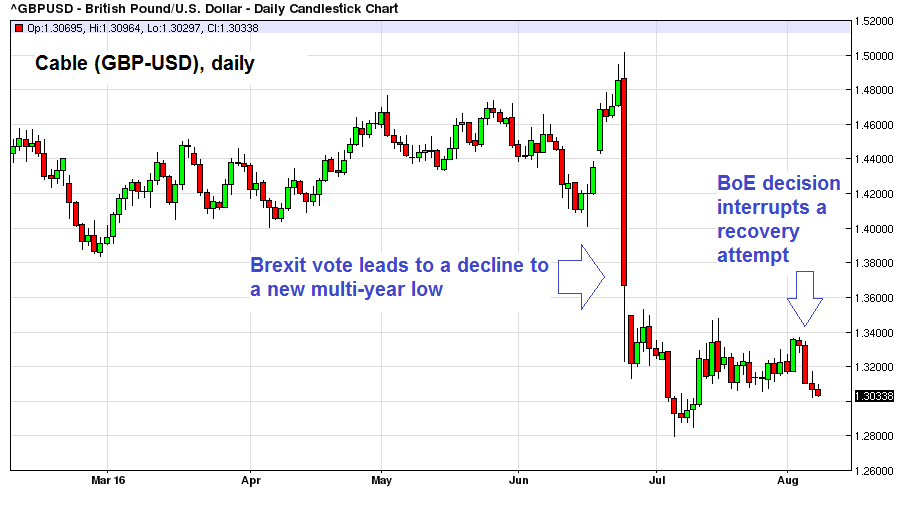

| Lastly, here is the British pound vs. the USD, a.k.a. cable. The BoE decision has weakened it slightly, but has so far failed to push it to a new low. Was the pound “too strong”?

Of course the market moves prior to the BoE decision were partly inspired by market participants anticipating more monetary easing. Nevertheless, it is nigh impossible to argue that any of these markets signaled a “need” for such drastic action. If the markets were to regard Brexit as a serious problem, neither the promise of even looser monetary policy nor its implementation would keep risk asset prices from falling. |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

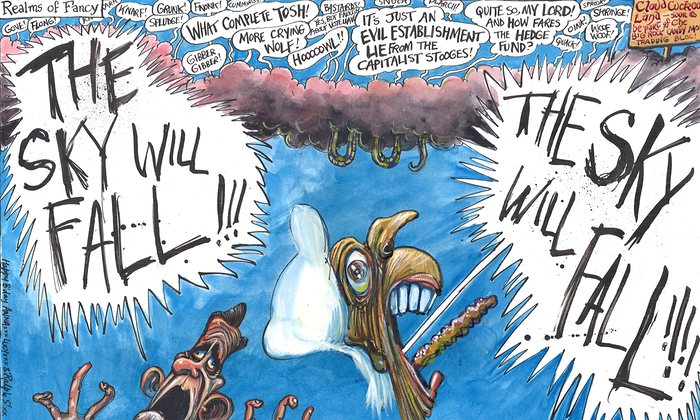

| The idea that the Brexit vote has produced an “economic shock” largely seems to be a reflection of the over-active imaginations of journalists and policymakers. Even if economic activity in the UK is temporarily subdued in coming quarters on account of “uncertainty” (which is mainly fanned by sensationalist reportage anyway), how can such a panicked reaction possibly be justified?

As Frank Shostak recently pointed out, if the UK economy does weaken, one can hardly blame the “Brexit”. The idea that monetary pumping supports the economy is misguided; it may temporarily boost the growth rates of aggregates such as GDP and artificially promote “activity”, but most of this activity will end up consuming scarce capital. In short, what superficially looks like growth will actually destroy real wealth rather than help producing more of it. |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

The Imaginary “Shock”Ever since the Brexit referendum, the press is brimming with apocalyptic lamentations belaboring the dire situation the UK economy allegedly finds itself in as a result of the “leave” campaign winning. Here are a few random examples of what one finds when googling “Brexit, economic shock”: The Washington Post bemoans the “economic shock of the Brexit”, Bloomberg reports that the former chancellor Osborne sees “clear signs of an “economic shock since the Brexit vote” (he probably hasn’t looked at the Footsie lately), Time magazine (a highly reliable contrary indicator) thinks “the worst is yet to come”, the useless, ultra-statist, globalist bureaucracy OECD likens Brexit to a “natural disaster”, while the Guardian informs us that the “UK must endure a short, sharp shock” (if it is short and sharp, what’s the problem?). Really? Lately, we can actually detect a bit of back-pedaling. The Guardian relates that mirabile dictu, “UK consumers keep spending anyway”. What? How dare they! Bloomberg suddenly foresees “a last hurrah for the UK economy”, before it finally succumbs to the “ Brexit shock”. The Financial Times notes that the “global economy is firm as the Brexit shock hits”, and then points out that “the economic shock of the Brexit is the lesser problem” anyway! |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

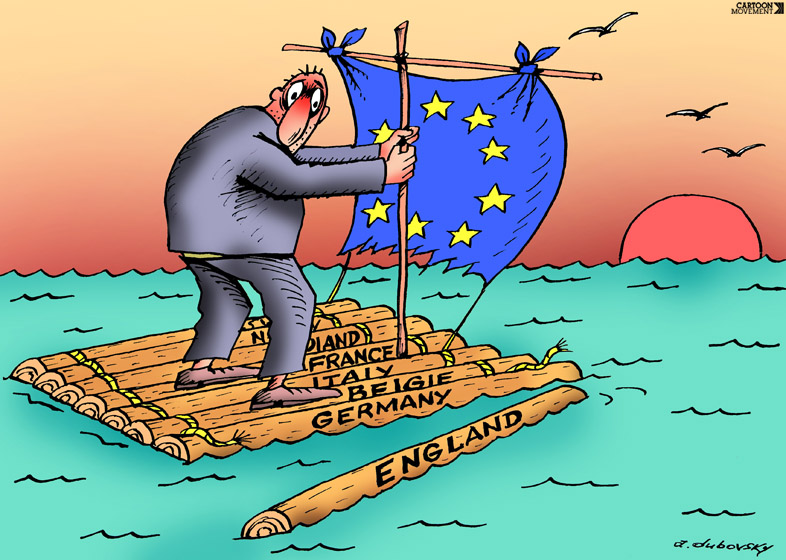

| Allow us to repeat something we have pointed out previously: the Brexit is potentially a far greater problem for the EU than for Great Britain. The UK was inter alia a net payer and increased the EU’s theoretical military heft (the latter is of course only important from the perspective of the bureaucrat-politicians running the show in Brussels, who worry about the EU’s “weight on the international stage”).

It is also a problem for citizens in the remaining EU member countries, as they have lost a strong supporter of subsidiarity and (at least occasional) defender of free market principles. Assorted centralizers in the EU already remarked ahead of the vote that they saw a UK exit as a “chance”, which “would allow France and Germany to push ahead with their vision for an ever closer union”. This definitely sounds like a serious threat. |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

A Look at the Bright SideWe certainly won’t argue that the UK economy is a paragon of health; it is for instance buried up to its eyebrows in debt, which strikes us as a big problem for future economic growth. Still, we are mildly surprised (well, not really…) that there is no mention in the mainstream press of the positive effects the Brexit will produce, or has already produced. The most obvious one is that the UK will be able to wave good-bye to one of the largest mountains of regulations ever piled up in the history of mankind. This applies not only to existing regulations, but also to everything that will be cooked up in Brussels prospectively. Many of these regulations are not only onerous, but downright absurd, and complying with them involves ever greater effort and costs. From the perspective of UK businessmen and citizens, this creates a noteworthy advantage: the UK government no longer needs to fend off the incessant drive toward so-called “harmonization” by waging desperate rearguard battles in Brussels. Instead it is now free to engage in regulatory and tax competition. Politicians usually hate such competition, but naturally it is a great boon for everyone else. |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

| A first step in this direction was already announced by former chancellor of the exchequer George Osborne, who immediately proposed slashing the UK corporate tax rate to “less than 15% in order to create a super-competitive post-Brexit economy”. What’s not to like?

Oh, wait… according to the left-leaning Independent, “economists” (in the form of tenured professors) don’t like it! A more ringing endorsement of the idea can hardly be imagined. New UK prime minister Theresa May has in the meantime taken a few actions that should positively delight the citizenry. For instance, she has appointed chief Brexiteer Boris Johnson to the post of foreign secretary, which should ensure entertainment galore! As we always stress, a politician’s entertainment value is extremely important, and Johnson has plenty as far as we know. Get out the popcorn! Next she decided to simply abolish the superfluous “Department of Energy and Climate Change”. A plethora of authoritarian watermelons has expressed displeasure with the decision, which makes it all the more commendable. This may well be the first time ever that an entire “climate change” bureaucracy has been unceremoniously dumped in its entirety. As Mish notes here, the Brexit also means that London will no longer have to worry about the extremely detrimental “transaction tax” so beloved by capitalism-haters on the continent (for more color on this particular nonsense, readers should take a look our previous articles on the topic: “The Trojan Horse” and “Dumb and Illegal”). We hereby predict that fears that London’s role as a global financial center is under threat will turn out to be misguided – we think it is far more likely that it will continue to thrive. |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

ConclusionOne thing the UK economy surely didn’t need was getting “help” in the form of more money from thin air being pushed down its throat on the behest of bubble-blower Mark Carney and BoE chief economist Andrew Haldane (‘sledgehammer man’). These actions are particularly baffling in light of the fact that no hard evidence of the so-called “economic shock” can be found anywhere – at least not in the UK. One could probably call this latest evolution in central bank intervention “ad hoc policy based on hearsay and wild-ass guesses”. Who knows though – maybe they consulted the magnificent Zoltar. All the dire predictions regarding the calamities the UK economy will allegedly suffer due to the UK exiting the EU seem to be boundless exaggerations. The press simply ignores the countless advantages escaping from Brussels’ diktats will bring. Should the EU prove vindictive and try to “make an example” out of the UK by sabotaging free trade, it will only harm its own economy (the UK has a huge trade deficit with the EU, so we expect European export industries to put a lot of pressure on Brussels to make sure it treads lightly). Meanwhile, British citizens and businessmen can look forward to an increase in regulatory and tax competition making their lives a lot more pleasant. Believe it or not, the world will keep turning and economic success certainly doesn’t depend on being a member of the EU. |

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame). - Click to enlarge |

Charts by: BarChart, BigCharts, TradingEconomics

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Canada,Bank of England,Boris Johnson,British Pound,central-banks,Chart Update,European Union,Mark Carney,Monetary Policy,newslettersent