| President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.

As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting Trump to adopt a mellower stance than before on Chinese trade talks so that he has at least something to show voters for his efforts. There has also been some renewed focus on infrastructure spending, although it is unlikely that the Democrats will agree on the funding of a major spending package. Yet, while Trump and a dovish Fed may help to prolong the business cycle, by keeping corporate costs low and overall market conditions buoyant, it cannot reach all corners of the economy. Consumer credit cycle is worth monitoring, for example. High compound interest rates on credit cards could be an issue in 2020-21 if the current high rates are maintained. The rampant increase in oil prices is good news for the business cycle since it helps underpin investment in the US energy sector. But Trump sees high oil prices are bad for the US consumer, and therefore the US economy at large. (Actually, if the oil boom produces a glut in world production, oil prices could fall sharply. Having become the world’s largest oil producer, this would hurt the US hard). |

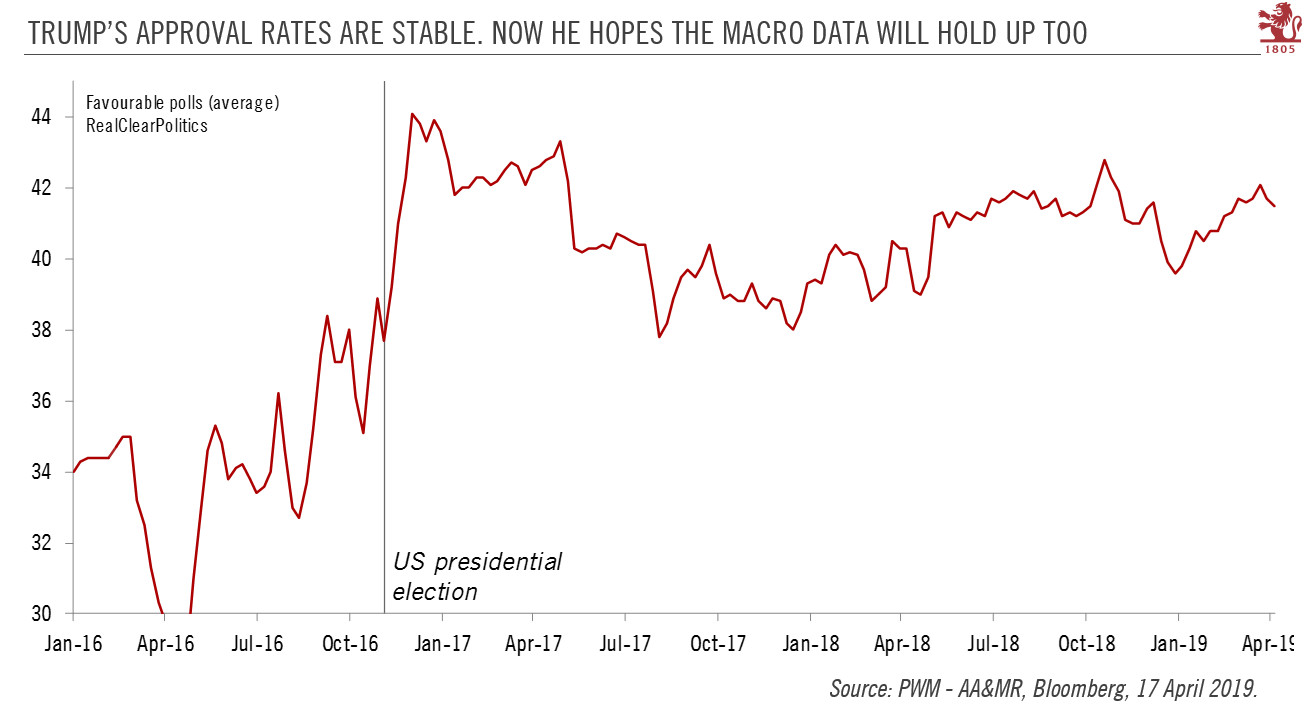

Trump's Approval Rates are Stable, 2016-2019 |

While corporate financing costs have been kept low by the Fed, it is worth watching the recent pick-up in wage growth. While average hourly earnings growth remains modest (3.2% year on year in February), increases towards 4% could be a red light from a business cycle perspective. Annual wage growth of this level has foreshadowed recessions in the past.

Bottom line, the risk of a US recession in 2019 appears quite limited. Based on the evidence so far, it is too early to conclude that a recession will strike in 2020 either, although the business cycle will likely look more fragile by then. Trump’s saviour could be the global economy, which, after a soft patch this year, could pick up in time for his re-election campaign. Or it could do just the opposite. Meanwhile, we do not see the Fed cutting rates just to please Trump, although it could voluntarily stay ‘behind the curve’.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newsletter