According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Once upon a time, Switzerland was the stronghold of monetarist theories: the central bank quickly reacted to indications of higher money supply with higher interest rates. But these times are finished: today the central bank does everything to reduce the tiny output gap to zero and bring the whole labour force to work, including 50000 new immigrant workers per year that Swiss companies “so desperately” need. Sure, company margins are high enough to afford higher labor expenses, visible in the continuous rise of the SMI. But they still insist on the implicit state subsidy called the “minimum exchange rate to the euro”.

After the massive increases in 2012, recent monetary data has shown that the SNB had to increase the monetary base M0 and the FX reserves again. M3, which is not directly linked to M0 any more, is also edging up. This M3 measure has been rising by 7.7% per year since 2008. The Fed decided to cut its asset purchases after the first indicators of a boom showed up, but the SNB does not care at all. In several recent posts (here and here), we were warning about the upcoming Swiss boom and the risks of inflation. The difference between the euro zone and Swiss HICP inflation has fallen to 0.5%. The reasons for still lower price inflation are related to the late effects of the higher franc, but not slow internal demand. For the first time in years, the Swiss economy exhibited indications of a boom, a historically normal phenomenon after an increase in money supply.

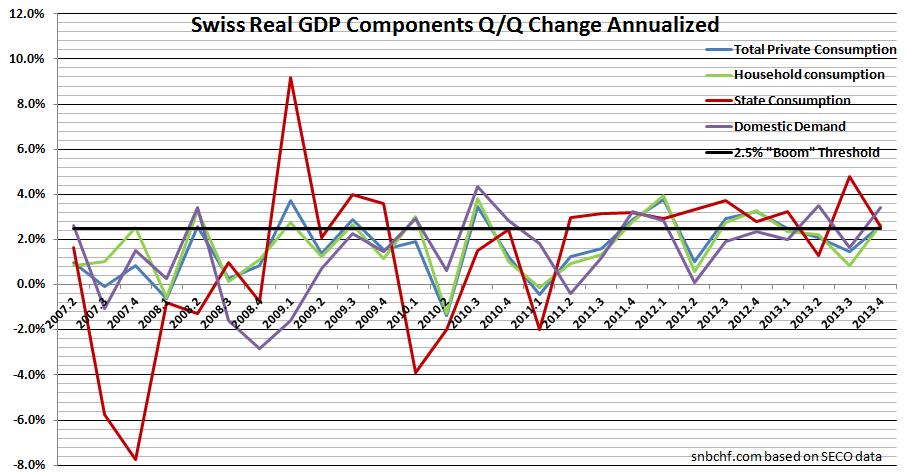

In years of slow growth in Western economies, we consider it a “boom” when at least 3 out of the following 4 criteria are fulfilled:

- An increase in personal consumption of more than 2.5% annualized.

- Higher domestic demand (this is consumption plus change of inventories) of more than 3% annualized.

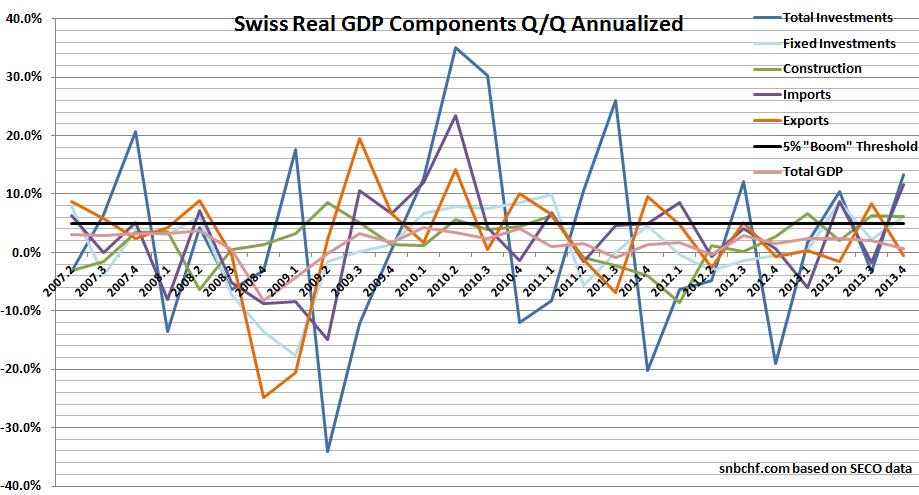

- Investments expand by more than 5% annualized.

- An increase in imports by more than 8% annualized. Imports are often a precursor of future consumption and investments. The threshold is higher due to volatility of trade figures.

The Swiss have fulfilled all four criteria in the fourth quarter 2013:

- Personal consumption was up 0.7% – or 2.8% annualized.

- Domestic demand rose up by 1.2% – or 4.9% per year.

- Investments inched up by 1.5% – or 6.1% annualized.

- Imports increased by 3.5 – or a massive 14.7% per year.

Usually Swiss state consumption works anti-cyclically, as visible below. But this time, despite the upcoming boom, state consumption was up 0.6% – or 2.5% annualized. Not only that, Swiss banks are currently implementing huge Too Big To Fail projects on behalf of the FINMA, the Swiss regulator. Consequently imports of services rose by 7.6% (or 34% annualized) in Q4. Examples of those are IT and consultancy services,e.g. from India and Germany.

Two referendums, one “against mass immigration” (approved) and the second one for a minimum wage (pending), might further increase Swiss inflationary pressure.

Booms not only leads to excessive spending and higher imports, but also to misallocation of resources, like big real estate investments that despite the referendum, continue.

Total GDP only rose by 0.2% or 0.8% annualized. The reason was the massive breakdown in exports, due to slow global growth. As for its inflation mandate, the SNB will be happy about it. Continuing weak demand in Europe, in Emerging Markets and recently also in the United States may slow the Swiss boom dangers and its consequence, price inflation, again. But the central bank will not be happy about the Swiss franc. Investors globally are piling in the franc because they want to take part in the success of Swiss companies when Switzerland will be in a boom.

Read also:

Some call it cost, but at least initially a factor that favors the boom: The Extra Cost of Swiss Banking Regulation

Are you the author? Previous post See more for Next post

Tags: GDP,imports,Swiss National Bank,Too Big To Fail,U.S. Consumer Spending