|

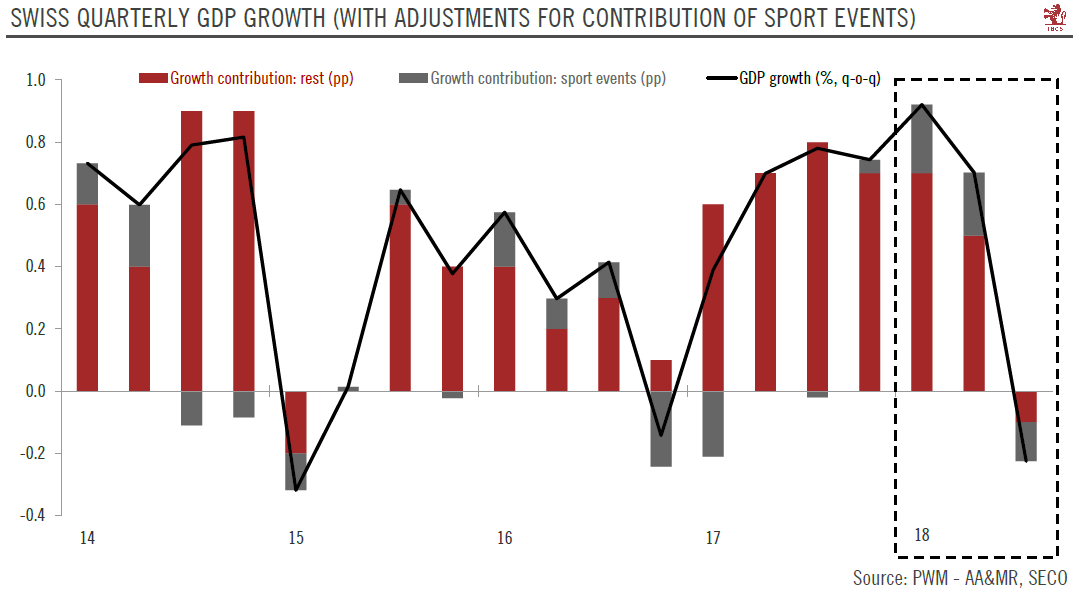

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast for 2018. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB. The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised). This is much lower than consensus expectations of +0.4% and is down from an average of +0.8% in H1 2018. Details show that the contraction was mainly due to weak domestic demand and a sharp drop in exports. Looking ahead, the strengthening of the Swiss franc, somewhat weaker euro area growth and uncertainty around global trade create a challenging external environment for a small and open economy like Switzerland. On the domestic front, weak real wage growth will continue to weigh on household consumption. Moreover, the growth effect of some specific factors (namely sporting events) will continue to fade, as was already the case in Q3. We therefore expect the Swiss economy to slow to 1.7% GDP growth in 2019 from 2.6% in 2018 (down from our previous forecast of 2.9% this year). At its next meeting on December 13, we expect the Swiss National Bank (SNB) to leave its monetary policy unchanged. Our baseline scenario sees a first SNB rate hike in September 2019, assuming that the ECB raises its policy rate just before in the same month. Nevertheless, the risks to this scenario are clearly tilted to the downside as recent data weakness in the euro area may mean that the ECB treads much more cautiously than we have been expecting when it comes to policy normalisation. |

Swiss Quarterly GDP growth 2014-2018(see more posts on Swiss GDP, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newsletter,Swiss economy,Swiss GDP,Swiss monetary policy