In early 2015, a contract dispute between dockworkers’ unions and 29 ports on the West Coast of the US escalated into what was a slowdown strike. Cargoes piled up especially at some of the largest facilities like those in Oakland, LA, and Long Beach, threatening substantial economic costs far and away from just those directly involved. Each side predictably blamed the other for it.

Management’s view:

The ILWU has crippled what were fully productive terminals in the Pacific Northwest and Oakland, and exacerbated a difficult congestion issue at the ports of Los Angeles and Long Beach by intentionally withholding dozens of essential skilled workers each shift for the past 10 weeks.

The union response:

The PMA appears to be abusing public ports and putting the economy at risk in a self-serving attempt to gain the upper hand at the bargaining table, and create the appearance of a crisis in order to score points with politicians in Washington.

A tentative 5-year contract deal was struck on February 20, 2015. Though there were some additional wrinkles, particularly in Oakland, the ports were in March 2015 working heavily to clear out that backlog of goods.

The effects of the stoppage were clear in statistics provided on both sides of the Pacific. The Chinese reported for February 2015 a massive 48% year-over-year increase in exports (almost all the additional activity going to the West Coast of the US). Golden Week holiday distortions made it difficult to parse, but for March 2015 the US Census Bureau reported a massive jump in imported goods received in the US from China. Surging 32% year-over-year, it was at least in the same ballpark to largely confirm the Chinese figures and what might have really led to them (not economic growth).

Last month, the Chinese again figured a huge increase in exports. In dollar terms, February 2018 was 45% more than February 2017; a similar growth rate estimated for goods shipped to the United States. Golden Week comparisons and the difficulties surrounding them still apply.

The Census Bureau yesterday reported that US imports from China rose only 19% in February. Maybe the difference between the American data and the Chinese will be made up next month. Still, there is a substantial enough difference that does nothing to quell certain questions about what’s going on with China, global trade, and more importantly dollars.

With HKD on the move lower, starting toward the end of January, there’s every indication of heavy “dollar” movement out of the city and into China, likely via a variety of methods.

| Hopefully statistics released next month for this one will clear up any possible discrepancies.

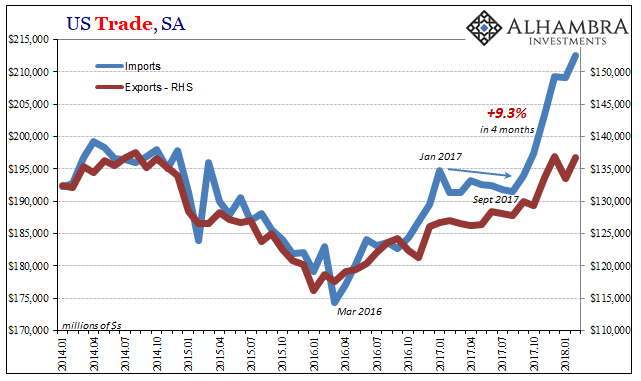

Even if they do, it looks as if the acceleration in activity is artificial with respect to the brewing trade wars. A huge surplus of goods was moving here almost certainly in anticipation of them. Combined with the effects of last year’s hurricanes, import volume has continued to outpace export growth leading the country’s merchandise deficit into a nosedive. |

US Trade Balance, Jan 2014 - 2018(see more posts on U.S. Trade Balance, ) |

| Where import growth may have further cooled down (as exports) this last month, the anticipated trade dispute seems to have kept the imbalance moving in the wrong direction – ironically supplying a greater surface rationale to act on tariffs and restrictions on Chinese goods. |

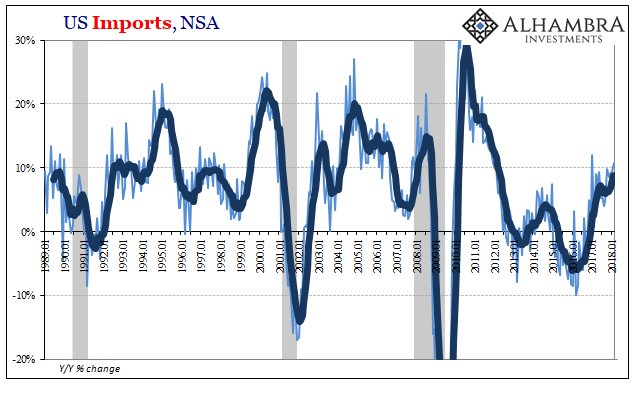

US Imports, Jan 1989 - 2018 |

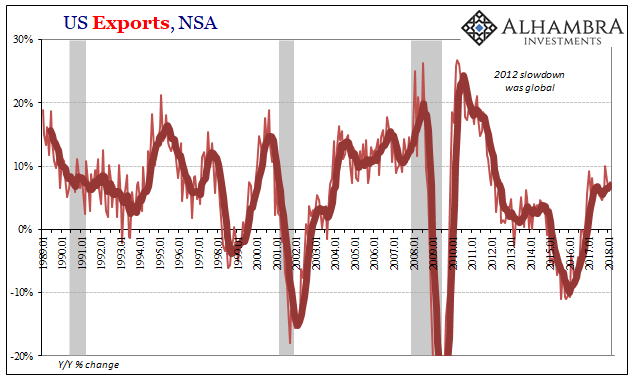

US Exports, Jan 1989 - 2018 |

Overall outside of those factors, there just doesn’t seem to be much organic demand growth in either direction. Emblematic of the past six or seven years, what’s left over are the same low level positive numbers that serve to further cloud the economic issue. The global economy looks like it might be growing again, claimed as evidence to some who then predict much bigger things as imminent, but by and large it isn’t and too many people (including those in and more so out of the US labor market) feel that way.

We hear regularly about this growth and recovery that far too many just don’t experience. It’s a further weakened state left off for the next downturn (that may already be starting or have started). What happens in trade as restrictions register in both directions? Having sent already a lot of goods in advance, that would have just pulled forward activity that in the coming months will have to be paid back by a substantial lull.

On the global trade front, what happens over the next several months will be absolutely critical.

Tags: China,currencies,dollar,economy,exports,Federal Reserve/Monetary Policy,global trade,Hong Kong,imports,Markets,newslettersent,Trade War,U.S. Trade Balance