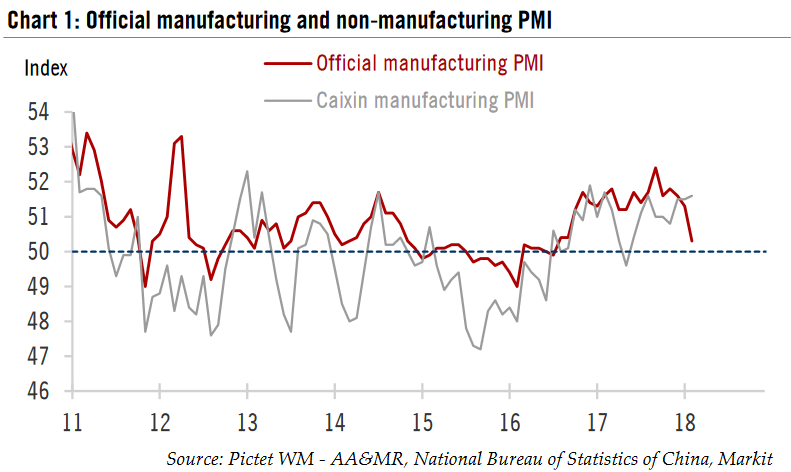

| China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month (Chart 1).

Due to the floating date of the Lunar New Year (LNY), Chinese data in January and February are usually quite noisy. Although both the official PMI and the Caixin PMI are supposed to be seasonally adjusted, the actual data series still exhibit a fair amount of seasonality in the first two months of the year. For the official PMI, the month that contained the LNY on average lowered readings by 0.42 points in 2005-2017. In some years the drop can be as big as 2-3 points. So the decline of 1 point in the official PMI in February, when the LNY occurred in 2018, could be partly caused by seasonality. However, we don’t think seasonal distortions can fully explain the weakness in the official PMI figures. Indeed, this gauge started to weaken in Q4 2017 after reaching a cyclical high in September. In our view, this reflects a real deceleration in Chinese industrial activity, which is consistent with our view of a moderation in Chinese growth in 2018 following a strong 2017. |

China Official manufacturing and non-manufacturing PMI, 2011 - 2018(see more posts on China Manufacturing PMI, China Non-Manufacturing PMI, ) |

| Besides some cyclical factors that may have been headwinds to growth (such as cooling property markets and reduced government support for infrastructure investment), another seasonal factor, environmental regulations, may have also taken its toll on Chinese industrial activity, especially in the northern part of the country.

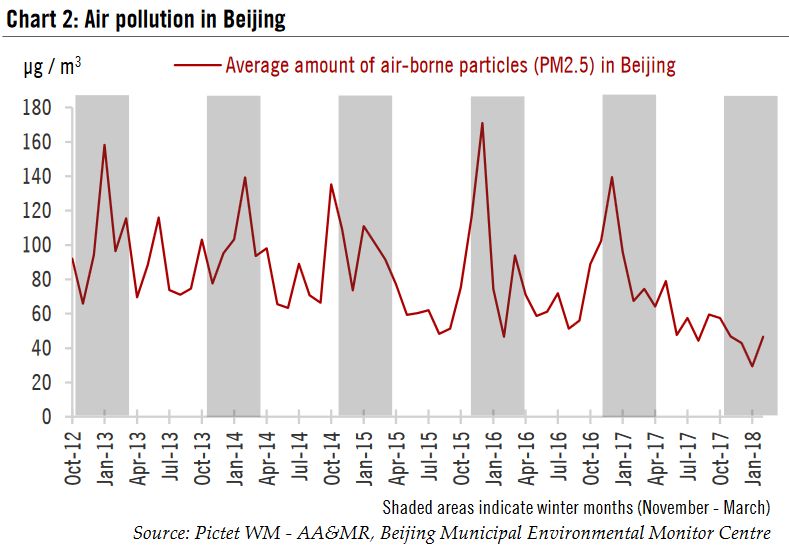

Since last year, the Chinese authorities have been taking a much harder stance against pollution, echoing President Xi’s call to build a “Beautiful China”, included as a strategic objective at the Chinese Communist Party’s 19th Congress. As part of its efforts, the government issued stringent measures and specific targets for air pollution reduction were assigned to local governments, especially during the winter months when pollution tends to be the most severe. To achieve the winter air pollution control targets, large-scale reduction or even suspension of production by polluting companies were introduced in various northern provinces where some of most heavily polluting manufacturers are located (such as Hebei, close to Beijing). |

Air Pollution in Beijing, Oct 2012 - Jan 2018 |

While official data are still not available regarding the impact of these policies on industrial activity, one can gain a sense of the magnitude of the policy measures by looking at Beijing. Usually, during the winter months air quality in Beijing deteriorates significantly due to higher heating demands. Air pollution usually peaks in December or January. In December 2016, for example, the average amount of fine particles floating in the air (PM2.5) reached 140 µg per cubic metre. It was even higher in the previous year (171 µg per cubic metre in December 2015). But air pollution in Beijing has dropped sharply this winter, with only 43µg per cubic metre of PM2.5 in December—suggesting that air quality was better than at any time since 2012, when records began.

In our view, the impact of the environmental protection measures could also partly explain the divergence between the official and the Caixin PMI. The Caixin index relies on a sample that heavily tilts towards small and mediumsized export-dependent firms, while the official PMI is more skewed toward large state-owned enterprises in heavy industries. The stronger readings for the Caixin PMI may suggest that foreign demand is holding up reasonably well thanks to strong global growth, while firms better represented by the official PMI are being hit harder by the strict winter environmental rules.

If this hypothesis is true, then we will likely see growth decelerate fairly sharply in the first quarter of year. but activity should rebound in Q2 when the more stringent winter pollution measures are removed. In any case, to better gauge China’s current growth momentum, one should wait to see the actual activity data for January and February.

In our core scenario, we expect Chinese growth to moderate slightly to 6.5% in 2018 after having risen strongly in 2017. Our forecast remains unchanged following the latest PMI figures.

Full story here Are you the author? Previous post See more for Next postTags: China Manufacturing PMI,China Non-Manufacturing PMI,Macroview,newslettersent