Style Over SubstanceThere are many things that could be said about the GOP tax bill. But one thing is certain. It has been a great show. Obviously, the time for real solutions to the debt problem that’s ailing the United States came and went many decades ago. Instead of addressing the Country’s mounting insolvency, lawmakers chose expediency without exception. They kicked the can from yesterday to today. Presently, there are no good options left to fix the mathematics bearing down on us all. Hence, in the degenerate stage of an overburdened nation-state, style over substance is what counts. Without question, Congress and President Trump played their parts to push the bill with much bravura. On Tuesday, for example, President Trump, Senate Majority Leader Mitch McConnell, and House Speaker Paul Ryan held a White House meeting with two empty chairs. Apparently, Senate Minority Leader Chuck Schumer and House Minority Leader Nancy Pelosi didn’t want to participate in a “show meeting.” Thus, they made a spectacle of themselves and ditched the meeting. Indeed, their absence was all part of the show. Moreover, the entire episode was show; nothing more. At the time of this writing (Thursday night), the show continues on. Last we heard, the Senate vote had been delayed until Friday. By the time you read this it may be a done deal – or maybe not. Regardless, the tax bill is all quite meaningless when you have a fiat currency that’s been stretched out like silly putty. No doubt, this has propagated immense financial speculation while outrunning actual economic growth. The effect has manifested in strange and unexpected ways.

|

The empty chairs meeting – this is slightly reminiscent of the Clint Eastwood skit in which he addressed an empty chair that was supposed to represent Barack Obama. No-one can accuse the current tax reform plan of making a lot of sense, but the problem is that any comprehensive sensible reform package would never make it past the lobbies interested in maintaining the status quo. Given that elections are advance auctions of stolen goods (h/t HL Mencken), any perceived interference with the stealing will tend to be strongly resisted. |

Decentralized CryptocurrenciesIncidentally, following Fed Chair nominee Jay Powell’s confirmation hearing before the Senate Banking Committee on Tuesday, Senator Elizabeth “Pocahontas” Warren remarked that the Fed had the same regulatory attitude going into the crash of 2008 because they haven’t intervened in bitcoin. Naturally, it never occurred to Warren that bitcoin could be a barometer of the Fed’s extreme intervention into credit markets. Without artificially suppressed interest rates and Fed asset purchases, bitcoin would’ve never become the recipient of such speculative fervor. Attempting to regulate it now is like assigning price controls by edict to address a Fed induced bout of consumer price inflation. Besides, what’s Warren’s beef anyway? |

Just in case you actually need another reason to like bitcoin, consider a few members of the clueless gang of douchebags arrayed against it. - Click to enlarge Ms. Warren (left) and Fed bureaucrat Randal Quarles (right) are sad it isn’t yet totally controlled and regulated to death by some government agency (which may actually be impossible to do, considering its distributed and borderless nature), while statist interventionist control freak Joseph Stieglitz (who serves as yet more walking talking proof that getting anointed with a Nobel Prize in Economics is akin to getting the moron-of-the-year badge) wants governments to ban it altogether , because he has graciously determined on behalf of all of us that “it fulfills no useful social function”. Leftist academics suspiciously often find fault with entrepreneurial success in free markets, a stance that is mainly driven by envy as far as we can tell (they think it unfair that uncouth businessmen are making the money that they in their function as society’s “intellectual vanguard” actually deserve to make). |

| Of the many bull markets that have risen from the depths of the Great Recession, none is starker than the bull market in cryptocurrencies. Having a justified ax to grind with the Fed’s policies of mass money debasement, computer geeks, contrarians, geniuses, the enlightened, speculators, hucksters, dreamers, schemers, and all those in between, saw the light of the cryptocurrency revolution.

Perhaps they’re on to something. From what we can tell, the underlying blockchain distributed ledger technology is an innovative means for providing an efficient and permanent transaction record between consenting parties – assuming big brother’s not monitoring the transaction record. We don’t doubt that it is here to stay and will continue to gain further market share within society. In fact, bitcoin and other decentralized cryptocurrencies may ultimately unseat our present fiat money system. As far as we can tell, this would be an improvement. |

Bitcoin Daily, Jan - Dec 2017As far as we are concerned, it is an apodictic certainty that bitcoin would be a vast improvement over the centrally planned fiat currencies extant today. There are a number of reasons for the bubble-like behavior of the cryptocurrency. In the near term, the wildly inflationary policies pursued by central banks over the past decade (actually longer, but particularly egregious over the past decade) are a major driver of the bubble. However, underlying the demand for bitcoin is also a growing recognition that it could indeed serve as a medium of exchange one day. This demand is speculative by its very nature – the buyers and those exercising reservation demand for BTC cannot be certain it will succeed in supplanting other media of exchange (particularly the state-approved kind). But there are a few things they do know, such as the fact that banks and many other financial intermediaries would essentially become superfluous if BTC and/or any of the competing cryptocurrencies were universally adopted as media of exchange. In fact, everything banks and brokers are do today could be done better and cheaper by decentralized “crowd-sourcing” methods, including credit allocation – the blockchain technology makes it possible. As an aside, we suspect Stieglitz didn’t buy any, which is probably another reason for the sour grapes. |

Idiots Get RichYet bitcoin isn’t the only Fed provoked speculative mania. Nearly all financial assets have been pumped up into giant bubbles. Bitcoin just merits the most hyped-up headlines at the moment. Our skepticism, however, is not with the promise of cryptocurrencies. Rather, it’s firmly rooted in the present. Specifically, cryptocurrencies are in the grips of an epic speculative mania. Are we in the first inning or in the ninth inning of the great speculative cryptocurrency bubble? If you listen to cyber-security guru John McAfee, we are in the first inning. He believes bitcoin is going to $1 million by 2020. Is he right? Is he wrong? Who knows? |

Controversial, but always highly amusing, interesting and reportedly “eccentric” millionaire John McAfee, who invented the first commercial anti-virus software and essentially went into early retirement after selling his company to Intel. This is not to say he became inactive, in fact he was quite busy in a wide variety of fields. Currently he is CEO of cyber-security and technology holding company MGT Capital Investments. |

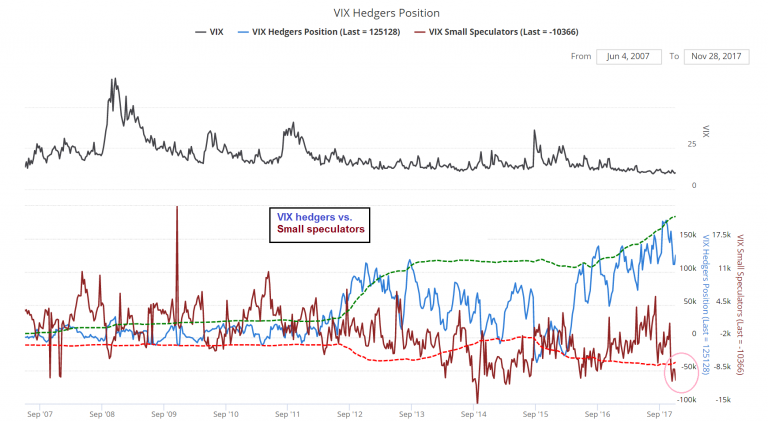

| For now, however, several things are abundantly clear. Everyone [except Joseph Stieglitz, ed.] is getting rich from bitcoin. Everyone is getting rich from FANG stocks too (Facebook, Amazon, Netflix, and Google ). Likewise, everyone is getting rich from shorting the CBOE Volatility Index (VIX). What to make of it?

Without question, there’s a bull market in idiocy. And when there’s a bull market in idiocy, idiots get rich. |

VIX Hedgers Position, Sep 2007 - 2017 |

The Complete Idiot’s Guide to Being an Idiot

Thus, for idiots’ sake, we’ve boiled The Complete Idiot’s Guide to Being an Idiot down to its essence:

One: Buy bitcoin north of $11,000.

Two: Buy FANG stocks at present valuations.

Three: Short the VIX at sub-10.

We consider these to be actions for idiots. But what do we know? Remember, idiots often make the wrong decision at precisely the right time.

So, with a little luck, those who follow this guide won’t just be idiots. They’ll be rich idiots to boot. Such is the poetry of life.

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,Virtual Currencies