Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up:

Only that isn’t real, just like it wasn’t three or seven years ago. Emotions don’t seem to be tracking well with reality, and in Japan it is no different. There isn’t even much of lingering popular belief in QQE to at least give these broad feelings the appearance of substance; global growth is coming because, well, it just has to, right? |

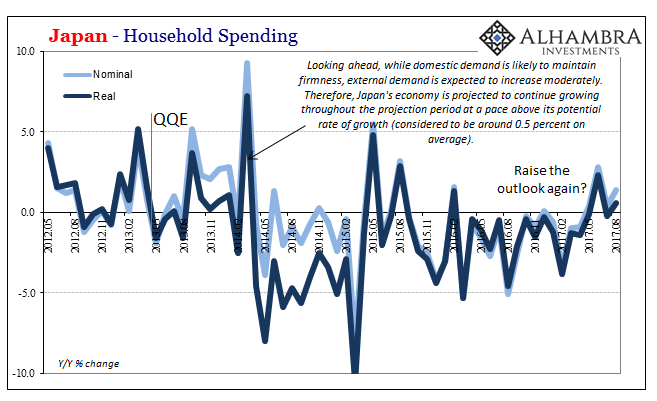

Japan Household Spending, May 2012 - Aug 2017(see more posts on Japan Household Spending, ) |

| Like here, or anywhere for that matter, stocks are up but the economy is not. Belief still clings to what is always over the horizon. You would think given the breathless coverage in the worldwide media that Japan is utterly booming, jumping with so much activity the island can’t contain it all. It just isn’t true, the story being wildly distorted as always to fit the (technocrat friendly) narrative.

Household spending in Japan, for example, has turned slightly positive in the past few months. It sounds like more than it is, less of a positive than in the middle of 2015 when all the same things were being said about the subject by the same people. Like anywhere else, even the Japanese economy is prone to the occasional upturn. What really matters is that those brief moments of positive never come close to making up for the more widespread and sustained negatives. |

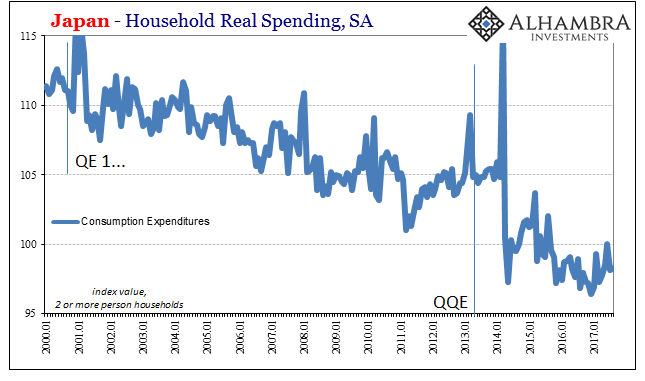

Japan Household Spending, Jan 2000 - 2017(see more posts on Japan Household Spending, ) |

| It’s another relative change that is mistaken, quite often intentionally, for a categorical one. In other words, Japan is experiencing little more than a reprieve from continued contraction rather than any actual turn toward actual growth.

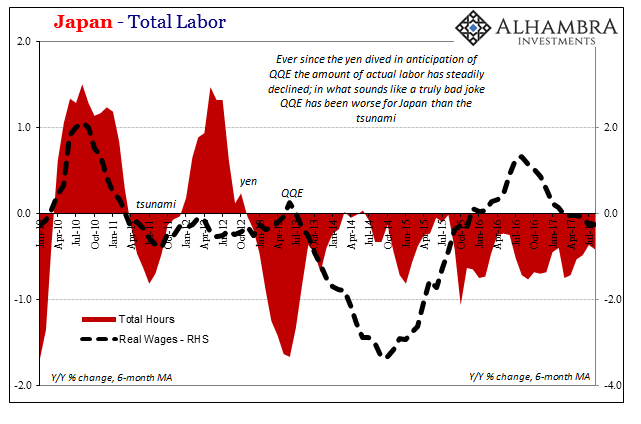

That verdict is given to us by Japan’s labor market. The more positive anyone is about the economic circumstances there, the more likely it is that the labor market shows the opposite. Total hours worked continue to decline despite the rise in relative activity (again, proving its relative not categorical). Wages that had looked seemed like they were on the rise really were impacted more by base effects and statistical irregularities (the transitory rise, then fall, of the CPI) than anything tangible. Real wages have contracted year-over-year in each of the past three months, and have been zero or negative in ten of the last eleven. And still economists point to Japan’s unemployment rate as if it matters. |

Japan Total Labor, Jan 2010 - Jul 2017 |

But because the media is selling the future of “global growth”, the charade will/can only continue:

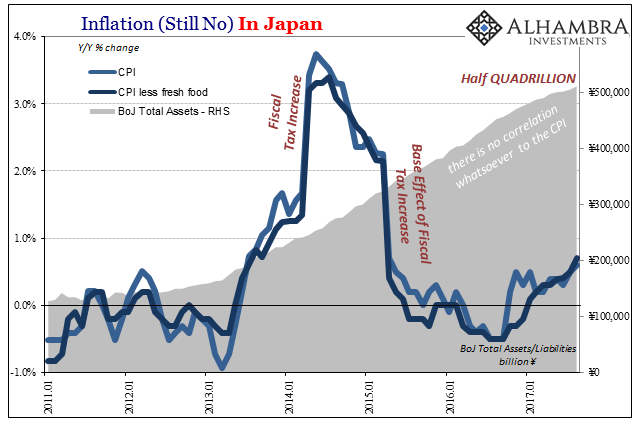

It’s the appearance of hyper-easy monetary policy, not actual or effective accommodation. No matter how many times the other is claimed and will be claimed, that doesn’t just make it true. In Japan, like everywhere else in the world, there isn’t the slightest hint that QE, QQE, or QQE with YCC underwrites even a little positive economic difference. Japan’s small upturn has nothing to do with QQE and everything to do with minor (and relative) “reflation” after the “rising dollar.” |

Inflation in Japan, Jan 2011 - 2017 |

At now more than half a quadrillion yen on its books, both sides assets and liabilities, obviously, what is the Bank of Japan’s QQE actually doing? It has been reduced to questionable histrionics, the necessary part of every media story on Japan that makes it seem like authorities are doing something helpful.

I believe instead that Abe’s successful election gambit is somewhat of a parallel to other political processes being played out in places like Austria, Germany, and even to some degree China. The Japanese people have resigned themselves to this economy as it really is, and pay very little attention to QQE or whatever else like it. They have to know by now that it has made no positive contribution, so why not vote on the basis of other matters if the grand economic designs that swept Abe into office the first time in 2012 can’t move the needle after five years.

Abenomics or not Abenomics, there has been no difference. The economy is as bad or worse than it was before, and it doesn’t look like either party will do anything that can change matters. Therefore, increasingly, other issues become the centerpiece for what is really economic dissatisfaction channeled into alternate formats.

Earlier this year, in the face of an increasingly hostile North Korea, Abe set a deadline of 2020 to revise Japan’s constitution, which contains language that bans the country from maintaining armed forces. It is a controversial proposal that strikes at the heart of the country’s post-war identity.

If that post-war identity includes hapless technocratic monetarism, then why not change it if only to be able to change something? Maybe the Japanese do have a limit, and that a quarter-century is more than enough of one feckless scheme after another. The old way of doing things just doesn’t work anymore, a judgment that is being applied all across the world. North Korean or Chinese provocations suddenly matter more now perhaps because the Japanese worry about Japanese strength in economic terms.

It’s almost political contagion, where people in Japan or the UK see others voting for “that’s enough” and want to make the same bold, dissenting statement however they might. You vote for something very big and very different because there is no vote on monetary or economic protest that either political party will give you. It explains quite a lot, including the backlash against the backlash.

The world is treading a dangerous path primarily because the official parts of it won’t admit there is a problem; or, in places like Japan, that they might not have the will and understanding to do anything about it. It’s the worst part of this zig zag, where nothing, even stagnation (depression), ever goes in a straight line. Each of these all-too-brief upturns are always mischaracterized as far more than they ever could be, and so any urgency about addressing the real issue falls by the wayside.

The growing unrest doesn’t, of course, and instead gets funneled into often unproductive directions. We collectively look in the wrong place because the right answers are really hard to see.

Full story here Are you the author? Previous post See more for Next postTags: Abenomics,Bank of Japan,currencies,economy,Federal Reserve/Monetary Policy,household income,household spending,Japan,Japan Household Spending,Labor Market,Markets,newslettersent,total hours worked,unemployment rate,wages,Yen