Meta And Microsoft: Great Earnings But Different Results

Meta And Microsoft: Great Earnings But Different Results

2026-01-30

On the heels of strong fourth-quarter earnings reports, Microsoft is opening down 8%, while Meta is trading up 10%. Microsoft topped expectations for earnings and revenues. However, there is some concern about its total cloud revenue. They reported cloud revenue of 26% versus expectations of 28-29%. That said, their leading cloud computing product, Azure, grew …

Continue reading »

Is Japan In A Death Spiral?: A Contrarian Take

Is Japan In A Death Spiral?: A Contrarian Take

2025-12-09

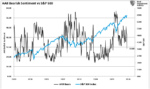

A day doesn’t seem to go by without a market pundit asserting that Japan is in a monetary and fiscal death spiral. It’s easy to come to such a conclusion given: Based on those stats and others, it’s easy to see why many think it’s only a matter of time before Japan’s economic system collapses. …

Continue reading »

12-8-25 Bullish Case or Bearish Backdrop? The Real Market Setup for 2026

12-8-25 Bullish Case or Bearish Backdrop? The Real Market Setup for 2026

2025-12-08

Lance Roberts looks at both sides of the Market Cycle—the bullish liquidity-driven momentum and the bearish fundamental weaknesses. With support and resistance levels tightening around the S&P 500, and the Fed meeting, economic data, and major earnings directly ahead, investors must prepare for a market that could swing in either direction in 2026.

0:00 – INTRO

0:18 – Markets Set up for Santa Claus Rally

5:30 – Expect Sloppy Trading This Week

11:22 – Economic Summit, Elf on a Shelf, & Baylor Dating

14:42 – Market Outlook for 2026

16:36 – The Case for Bullishness

21:29: The Bullish Backdrop

24:13 – The Case for Bearishness

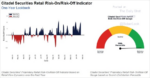

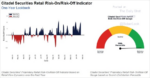

27:52 – Stress in Credit markets

28:36 – The Risk for Lower Returns

29:59 – Investing Strategies for 2026

35:06 – Cash Provides Optionality

38:16 – The Cost of

10-20-25 The Illusion Of Zero Risk: When Volatility Returns, This Market Will Break

10-20-25 The Illusion Of Zero Risk: When Volatility Returns, This Market Will Break

2025-10-20

Years of easy money trained investors to believe markets have no risk. Buying every dip still works because volatility is low, but this illusion of safety won’t last.

In this Short video, I argue that when volatility returns, this “zero-risk” market will break.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

10-22-25 Teaching Kids About Money – Lessons From Investing’s Biggest Mistakes

10-22-25 Teaching Kids About Money – Lessons From Investing’s Biggest Mistakes

2025-10-17

How do we raise the next generation to be financially wise in a world obsessed with “getting rich quick”?

Lance Roberts and financial writer Benjamin Gran discuss teaching children about money, work, and investing.

#FinancialEducation #TeachingKidsAboutMoney #InvestingWisely #FinancialLiteracy #MoneyLessons

Liquidity Warning: SOFR Raises The Red Flag

Liquidity Warning: SOFR Raises The Red Flag

2025-10-17

In our Daily Commentary from October 9th, we alerted readers to the fact that the Fed’s Overnight Repurchase Program was warning that the financial system was running out of a reliable store of excess liquidity. While not a concern, as we share in our quote below, it was worth monitoring. Said differently, after years of …

Continue reading »

Start Your Financial Journey with Real Investment Advice | Wealth Management That Works

Start Your Financial Journey with Real Investment Advice | Wealth Management That Works

2025-08-25

Discover how RIA Advisors can help guide your financial future with confidence.

We have a unique approach to financial planning, portfolio management, and real-world economic insight—all tailored to help you achieve long-term success.

Whether you’re planning for retirement, growing your investments, or just getting started, RIA offers the tools, expertise, and personalized support to make a difference.

Start your journey today: https://realinvestmentadvice.com/connect-with-us/

Subscribe for market insights, financial education, and strategies that put you in control of your money.

Services we offer:

* Personalized Wealth Management

* Financial Planning

* Investment Strategies

* Economic Commentary & Research

#FinancialPlanning #WealthManagement #InvestmentAdvice #RIA

2 pings