Money - everybody wants it, but few actually have it. As shown in recent financial statistics, the "wealth gap" in America continues to grow between the "haves" and the "have-nots." That gap has led to a bombardment of narratives explaining why younger generations are financially oppressed. As shown, the top 10% of income earners own roughly 68% of all assets. However, the bottom 50% own just 2.5%. Why is that?

When you see the data, it is easy to understand the frustration. Some call it "corporatism," others call it "Financial Nihilism." Then there are those who point fingers and blame inflation, stagnating wages, student debt, or political policies. Yes, these forces matter.

However, those are just excuses, not the "root cause" of personal financial failure. As individuals, we can choose to remain a "victim" and blame others for our failures. Or, we can take control of our financial future. The hard truth is that wealth accumulates only through time‑tested financial principles:

- Spend less than you earn.

- Save consistently.

- Invest intelligently.

These principles are not new. They worked before the internet, before credit cards, and before retail investors discovered the stock market. Most crucial, those principles still work today, regardless of your employment, education, age, race, or gender. Wealth is not a random event or a meme trend. It is a process.

I am certainly not ignoring or unsympathetic to the issues in 2025. Inflation remains above early‑2000s norms, real wage growth lags behind rising living costs, and mortgage rates have weighed on affordability. However, those issues can all be overcome by following a disciplined approach over the long term.

Anyone can narrate financial oppression. However, what separates those who ARE financially oppressed from those who aren't? Is it luck? Good genetics? In many cases, it is a function of following a workable path to wealth.

This is neither new nor controversial. It is the only path that has worked for generations.

The reality is that we have miserably failed to teach our children the basics of money. I am not talking about stock and bond portfolios, investing, or speculating. Rather, the very basics of spending less than you make, understanding credit, and balancing a checkbook.

With that in mind, let's get to the 10 Immutable Laws of Money

The 10 Laws Of Money

1) Money Doesn't Grow On Trees

My father used to always tell me several things, all of which I have figured out weren't exactly true. Some of my favorites were:

- "When I was your age, I had to walk uphill to school in the snow – both ways."

- "I could go to a double feature and eat all the popcorn and soda I wanted for a nickel and have change left over!"

- "Where do you think that comes from – money doesn't grow on trees!"

The last, however, is the most crucial. What my father was trying to teach me was to respect the effort that goes into making money. My whole life, my father worked two jobs, sometimes three, to support the family and make sure we had everything we needed, not always everything we wanted. As a young boy, of course, I didn't fully understand the impact of what he was trying to teach me until I got a family of my own.

People generally work very hard for their money. However, it is always surprising to me how little they care about the result of that effort - their money. They squander it through poor financial decisions, living above their means, and making poor investment decisions. The truth is, you should respect the money you make, and one of the best ways to do so is to use an "envelope system" for a few months.

The "envelope system" is easy. Simply cash your paycheck and put all the money into envelopes for rent/mortgage, car notes, food, utilities, entertainment, etc. Then go ahead and begin living your life. When an envelope is empty, that is all you can spend for the month. The envelope system will show you where you are squandering your money and bring focus to the areas of financial distress.

Note: The envelope system is for 80% of the budget process we will discuss momentarily. The other 20% will be in savings, but let's take this one step at a time.

2) Wants Always Exceed Needs

It always surprises me when I counsel people on financial planning, the sheer look of horror that comes across their faces when I mention the word "budget". It is almost as if I have just asked for them to amputate both arms.

However, a budget is the only way to achieve financial success in your life - you have to spend less than you make. I hear people breaking this law of money all the time:

- "You don't understand – I needed a new car",

- "...we needed a bigger house," or

- "...we just have to have our annual vacation."

The difference between a "want" and a "need" can sometimes be small and insignificant, but most of the time, they are on different planets. Did you NEED a new car – maybe, but they could have bought a 2-year-old car that looks great and saved 20% on depreciation. Did they really need a bigger house, or could they have gotten by in the one they are already in? These are all the questions that you have to ask yourself.

However, here are your real needs, and the only needs that matter for building wealth.

- FOOD

- SHELTER

- UTILITIES

- TAXES

These are your needs – everything is a "want". Keeping the "wants" under control is a huge first step in your financial wealth. Before you buy something tomorrow, stop and think it over. Is it a "want" or a "need"?

Here is a stat for you:

Your Life Is Worth 70-80%

In planning your life, and spanning the gap between "wants" and "needs", build a budget after analyzing your spending patterns to keep your committed expenses at or below 70-80% of your actual income. That's right, that leaves 20-30% of your gross income just hanging out in the wind, but more on that in a moment.

Now, 70-80% is not a magic number or an irrefutable law of money, but it is a realistic goal to work toward, and, at any rate, it's a good place to start. However, once you start using this method, you won't need to track your expenses, since your checking account balance will generally equal the amount you can spend. The key is keeping a lid on those committed expenses.

What About The Remaining 20-30%?

That is what you just "paid yourself and your family" first. Let's look at an easy example:

Joe makes $100,000 per year and is in a 25% tax bracket. With a 30% savings goal, he needs to save $22,500 a year. Here is where it is interesting. When Joe is paid, $20,000 goes into his company retirement plan, pretax. Technically, Joe has already reached his 20-30% goal but Joe is a bit more of an aggressive savor and deposits another $2,500 annually into a Roth IRA.

Joe then has a final net paycheck he deposited into his bank account which is equivalent to 70% of his gross pay after all deductions. Each month Joe can then spend everything in his bank account. He doesn't have to worry about saving anything because it has already been done and Joe learns not to miss the money piling into his savings accounts because he never got to see it in the first place.

The real secret to building a budget that really works isn't tracking what you spend any more than counting calories is the secret to losing weight. The key is creating a sustainable financial structure that balances spending and income and leaves enough room to handle the unexpected.

3) The Poor Are Debtors

This is a simple rule – "You can not borrow your way to wealth...period."

You will never see a late-night infomercial on how to build your way to wealth by swapping debt between low-interest credit cards.

For many people, part of the difficulty in reducing committed expenses stems from the need to make large monthly credit card payments. If you're carrying a substantial amount of non-mortgage debt, I'd suggest using the 20% that would otherwise go to retirement and long-term saving to aggressively pay down your debt -- but only after you cut up those cards.

Every dollar in interest that you don't pay is just like getting a guaranteed risk-free and tax-free return on your money equal to the interest rate on the debt. When your debts are paid off -- and it won't take long using 20% of your gross income-- immediately redirect that money back into savings.

Here are 15 signs that you are not managing your financial life correctly and are hindering your path to wealth.

You have or are:

- Credit card balances that are rising while your income is decreasing.

- Only paying the minimum amounts required on your accounts, or maybe even less than the minimums.

- Juggling bills. For example, you apply for another credit card and use cash advances from it to pay on an existing card.

- Have more credit cards than a successful gambler has poker chips.

- At or perilously near the limit on each of your credit cards.

- Consistently charge more each month than you make in payments.

- Working overtime to keep up with your credit card payments.

- Don't know how much you owe and really don't want to find out.

- Have received phone calls or letters about delinquent bill payments.

- Using your credit card to buy necessities like food or gasoline.

- Credit cards are no longer used for the sake of convenience, but because you don't have money.

- Dipping into savings or your IRA to pay your monthly bills.

- Hiding the true cost of your purchases from your spouse.

- Playing the card game by signing up for every credit card that sends you an unsolicited offer.

- Just lost your job, or are fearful that you are about to, and are concerned about how you will pay all your bills.

The first step in becoming wealthy is to quit using credit cards – of any type, for any reason. That may sound like "crazy talk," but you can't quit being an addict until you stop doing drugs or drinking alcohol. There is no middle ground.

The Credit Card Rollup Solution

If you want to get rid of your credit card debt – no matter how large – the following method will work relatively quickly. It isn't easy, and you will have to be serious about doing it.

- Sit down and cut up all of your credit cards – ALL OF THEM.

- List the balances for each card from LARGEST to SMALLEST and the minimum payment for each.

- Pay the minimums for each card on the list and 5 times the minimum for the smallest card balance.

- Repeat each month. Don't worry about paying off the debt with the highest interest rate first. This approach gives you some quick wins. It's like losing five pounds in the first week of a diet.

- When the smallest credit card has been paid off, ROLL UP all the money you WERE paying on the smallest credit card and apply all of it to the next card on the list, INCLUDING the minimum payment you were already making on the previous card. By the time you get to your last credit card, which will be the one with the highest balance, you will be putting huge chunks of money on the card each month. Before you know it, you will be debt-free.

- When you are finally free of all of your credit cards, reward yourself. Take the next two months of payments you were using to pay off your last credit card and buy yourself something.

- After you reward yourself, it is time to get back to saving. ALL OF THE MONEY that you used to pay towards the credit cards – now goes into savings. You have a lot of ground to make up, and this is a good way to get there.

4) Moral & Physical Hazards Don't Apply

I remember watching "Fear Factor" with Joe Rogan and realizing that people will do anything for "quick and easy money."

"Sure, Joe, I will eat those South American Hissing Cock Roaches for $50,000."

Yet these same individuals won't do the financially smart things and sacrifice their "wants" to save that $50,000.

In America, we have been raised to be financially lazy. We are unwilling to do what is necessary to become rich, yet we will play the lottery, which is nothing more than a poor man's tax, in hopes of becoming a millionaire. Yet the sad statistic is that 80% of lottery winners are broke again within 10 years due to poor financial management.

Like David Letterman, I should start a segment on "Real Investment Show with Lance Roberts" called "Financially Stupid Human Tricks" and highlight some of the things that we are enticed to do by lenders in the name of "financial management," such as;

Borrow From Your 401(K)

Companies don't have to offer a loan feature with their 401(k) plans, but according to the Employee Benefit Research Institute, most do. 83% of American workers covered by 401(k) plans can borrow against their accounts, and about 2 in 5 participants have an outstanding loan.

People who borrow from their workplace retirement funds, meanwhile, love to think it's a smart move since when they repay the loan, they're essentially paying interest to themselves rather than to a credit card company or other lenders.

This is true, but 401(k) borrowers also could be putting their retirements at risk. If they lose their jobs or get fired, the loan must be repaid, typically within 60 days. If that's not possible, and often it's not since people who lose their jobs don't tend to have a lot of cash sitting around, the outstanding loan balance is taxed and penalized as a premature distribution. That can equate to a penalty of up to 40% or more, depending on your tax bracket, in taxes and penalties, in addition to the amount that you borrowed.

It gets worse since you can't put that money back. Whatever money you borrowed might have earned in future years is gone forever. If you borrowed $7,000 at the average outstanding loan balance and assume an 8% return, that loan could cost you more than $75,000 in future retirement funds.

Never touch your 401(k) plan – like your home equity. If you screw everything else up in life, you will have a roof over your head and food to eat.

Stretch To Buy A House

Beware, homebuyers. Everyone around you is conspiring against your financial best interests.

Your real estate agent wants you to buy the most expensive house you can: the higher the price tag, the bigger their commission. Why do you think they always show you a house that you can't afford first? This is because when they show you the house you CAN afford, you will only remember all the nice things that were in the house you couldn't afford. The next thing you know, you are stretching to buy a home way out of your price range.

Your friends and family may also get into the act, telling you it's okay to stretch for that mortgage because "house is an investment" and that your income will eventually rise. Maybe, maybe not, but anyone who's been house-poor knows the emotional, psychological, and financial stress of stretching too far.

Buying a house you can't afford should mean giving up other things you want: vacations, eating out, a college fund for your kids, and a sufficient retirement kitty. However, for most, it means piling on ever more debt as you borrow to maintain your lifestyle.

5) The Best Things In Life Are Free

Too often, we equate spending time with a loved one or with our family with going somewhere and doing something that can quite quickly become very expensive. However, isn't the purpose of the outing just to spend time communicating and interacting with those that we care about the most?

Learn to be creative.

- Board games at home,

- Sports in the front yard,

- A walk in the park as you listen to music or an audiobook.

- Movie nights and homemade popcorn,

- Just hanging out with friends, gaming, or reading a book.

It really doesn't matter what you do; you can still have a lot of fun, and in a lot of cases, it won't cost you a dime.

Laugh At Your Neighbors' Overspending

Petty? Yes!

Helpful? Definitely!

After all, trying to keep up with the Joneses may be what got you into financial trouble in the first place. Realizing that the Joneses aren't as well off as they seem and are likely struggling with debt-related stress can make keeping up with them a little less attractive.

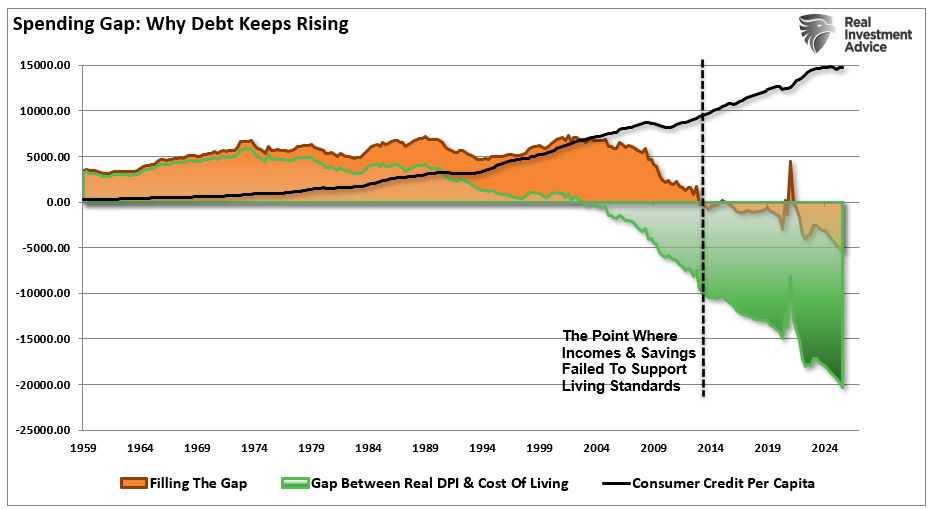

As of mid-2025, the average American carried $104,755 in consumer debt. Consumer debt includes a variety of personal credit accounts, such as credit cards, auto loans, mortgages, personal loans, and student loans. That's the average, which means that 50% of all families have even more than that in debt. Currently, consumer debt, excluding mortgage debt, is at historic highs, while personal incomes are not increasing fast enough to cover the shortfall.

So, using your neighbor's financial stupidity as a measuring stick for your own successful money management is a great way to keep you on track with your goals. Go ahead, deride the neighbors for financing everything they buy, or feel superior for winning a better mortgage rate thanks to lower debt loads.

This isn't as much one of the laws of money as it is a way to entertain yourself. Never underestimate the power of bagging on someone to make yourself feel better – just not to their face. You do still want to be invited to dinner every now and then.

Remember that your peace of mind is, ultimately, what living frugally is all about. You are living today for what you want tomorrow. So, whether you're paying off debt, saving more, or simply living within your means, you're trying to avoid the fear and stress that plague people who aren't in control of their spending. Remembering that can help you avoid burnout, stick to your plan, and reach your goal that much quicker.

6) Money Can't Buy Happiness

That old cliché is only spoken by those who don't have money and are unwilling to go get it. It is true, however, that "Money can't buy happiness," but it can buy a lot of whatever comes in second.

No, money doesn’t buy happiness. But neither does stress, anxiety, or 20% APR.

Financial stability won’t solve every problem. But it solves the ones that eat up your mental bandwidth, unexpected bills, job loss, and emergencies.

A stable bank account is more powerful than another Apple product or the latest iPhone.

7) There Is No Such Thing As Five Easy Payments

Don't get sucked in by financial schemes. Often, people try to rationalize that they will use this credit card or that financing plan because it offers 0% interest. It doesn't matter. Here is a simple rule for buying something: if you can't afford to pay cash for it immediately, you have no business buying it. Most likely, it is a "want" anyway.

Debt is debt in all shapes, forms, and fashions. Ultimately, it is the fine print that traps you and pushes you further away from attaining your financial goals.

8) A Wad In Your Pocket Is Better Than Your Pants In Wad

Unfortunately, 50% of all marriages in America end in divorce. The two primary reasons for divorce or "infidelity" and "finances." Unfortunately, financial stress often leads to infidelity. We all want the good things in life, and we generally make emotional rather than logical decisions. If you want to get out of debt and be free of the financial stress that comes along with it, here are seven radical realities to get your pants out of a wad and put a wad in your pocket.

- Reduce Housing Costs. Do you really need a pool in the backyard? Do you really need two extra bedrooms that are being used to store clutter and junk? People generally buy way more house than they need. Reducing your monthly mortgage payments by dropping the size of your house can put a lot more cash into your pocket.

- Drop A Car, Gas, Maintenance, and Payments -- imagine the money you could save if you gave up one household car, or found other ways to commute and run errands. Or trade in your car for a two- or three-year-old model to reduce your monthly car payments.

- Get (Another) Job. You don't have to work nights and weekends forever, but if a part-time job gave you an extra $1000 a month, that's an extra $12000 you can put toward debt this year.

- Quit Your Vice. Your indulgences can add up fast. Giving up your smoking habit can save you thousands of dollars a year. Eating out can add up fast, too, so brown bag your lunch and start cooking at home. It isn't convenient, but it's the financial smart, and healthier, thing to do.

- Live moderately. Shifting priorities and locations can help downsize your lifestyle.

- Let the kids go public. According to Private School Review, the average cost of private elementary and high school is about $15,000 a year. You are already paying for public school in your annual school taxes, so you might as well get some bang for your buck. Don't think your child will learn as well as they would in a private school? How about taking some time out of your schedule to work with them at home? It's free, and you will create a lot more with your child than just a smart kid.

- Tap Your Crap. Garage sales, EBAY, and a host of other avenues these days offer you outlets to get rid of all that crap you have accumulated over the years, and it may just generate a few extra bucks towards paying off debt.

I understand your initial reactions to most of this, and these are only suggestions; however, once you start adopting some of these guidelines, you will discover other avenues to begin living within your means and the steps required to live a happier, wealthier life.

9) Dress For Success

All too often, I see people driving expensive cars, dressing in trendy outfits, and wearing enough jewelry to make Mr. T jealous, yet they don't have a penny saved to their name and are in so much debt they could declare themselves a federal deficit.

If you ask those who've already become millionaires what their lives are like, you might be surprised. I highly recommend the book "The Millionaire Mind" by Dr. Thomas J. Stanley, author of the bestseller "The Millionaire Next Door." He surveyed nearly 1,000 of the nation's millionaires, and what he found may surprise you.

First, he sorted out those who were "balance-sheet" millionaires and those who simply lived an affluent lifestyle while burdened with debt. Balance-sheet millionaires tended to own their homes without a mortgage, while those who merely lived a wealthy lifestyle carried jumbo loans. Here are some surprising stats for those of you trying to "keep up with the Joneses."

Millionaires with assets between $2 million and $5 million have:

- Median Home Value: In his analysis of data for decedents with an estate valued at $3.5 million or more, Dr. Stanley found the median home value was $469,021.

- Low Percentage of Net Worth: For this population, their personal home accounted for less than 10% of their total net worth.

- General Millionaire Data: The broader research indicated that 90% of millionaires live in homes valued at $1 million or less, with 28.3% living in homes valued at $300,000 or less.

- Investment Real Estate: These individuals typically invest more in income-producing real estate than in their own personal residences.

Dr. Stanley's advice is that the market value of a home should ideally be less than three times the household's total annual realized income. Even among the affluent ($1M-$10M+), they tend to stay in the same, often modest, homes for long periods (20+ years).

Here are some other important notes from his research:

- The millionaires in his survey tend to have started businesses and have built their wealth by finding a profitable niche. They tend to love what they do and are motivated by building the business, not by building wealth.

- They live comfortable lifestyles but are not wasteful. In a fascinating example, most of the millionaires in the survey report buying expensive shoes, but almost all have them resoled.

- For the most part, they remain married to supportive and responsible spouses who run economically productive households, from clipping coupons to buying household supplies in bulk.

Bottom line: They spend less than they earn.

When it comes to investments, these millionaires primarily look to the stock market as a way to grow capital once their businesses have matured. They are not speculators in the markets, rarely visit a casino, and almost never buy lottery tickets. Of course, you might figure that they don't need to speculate since they're already wealthy. But perhaps these stable qualities are the reason they got wealthy in the first place.

However, if you put a pair of pantyhose on your head and ask for money, that generally works as well. And hence we conclude money law #9.

10) Live Like No One Else Today

As Dave Ramsey often states:

"If you live like no one else today – you will be able to live like no one else tomorrow."

Rich is good. Retiring that way is easy. You just have to commit to a lifestyle of financial smarts and good saving practices. This, of course, will cause you to be a sworn enemy of the credit card companies, a villain to the banks, and ultimately ostracized by the "Joneses" for not keeping up with them.

Sacrifice is not a punishment. It’s a strategy.

- If you skip the new car now, you can save money.

- When you save money, you can invest in assets that grow your wealth.

- If you invest consistently, your money works for you over time.

- Compound growth does the heavy lifting, but your savings turbocharge the growth.

That’s how normal people retire with wealth.

Stop blaming the system. Start making smart choices. Because in the end, your future will be built by what you do today.

Not what you feel, or tweet, or envy, or wish.

Only by what you do.

But in the end, it will be you who is laughing all the way to the bank with a wad of cash in your pocket, an emergency fund in the bank, a steady income from your investments to live on, and not a worry in the world.

Now, wasn't the sacrifice at the beginning worth it?

The post Money: The 10 Immutable Laws Of Building Wealth appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,Financial Planning,newsletter