“Japan Bond Meltdown Sends Yields to Record High on Fiscal Fears,” read a January 2026 Bloomberg article. Headlines like this, and many others, warn that Japan’s abrupt interest rate increase is an omen of dire trouble. While that may be the case, given decades of economic woes, declining demographics, and extreme levels of outstanding debt, we have an alternative view.

Might the recent sharp rise in Japanese yields simply reflect the normalization of its economy, inflation, and interest rates following decades of stagnation and very aggressive monetary and fiscal policies?

Whether you follow Japan or not, its situation is incredibly important for investors because it is a major provider of global liquidity. Instead of being overly dramatic about the slim chance of a near-term Japanese crisis, we prefer to focus on how Japan normalizes policy after years of artificially suppressed interest rates and how it will impact the yen carry trade.

Japan’s Lost Decades

To help appreciate Japan’s current situation and why some pundits claim that Japan is near the end of its fiscal line, we share the links to prior articles: Japan’s Lost Decades & Are We on Japan’s Path Of Stagnation? The following quotes from the articles summarize Japan’s plight.

Japan’s prolonged stagnation traces back to the collapse of one of the largest asset bubbles in history in the late 1980s. As we explain, enormous real estate and stock market valuations imploded, leaving banks burdened with bad loans and unable to lend effectively. For example: “from 1956 to 1986 land prices in Japan increased by 5000% even though consumer prices only doubled in that time,” and its Nikkei stock index P/E was close to 70 at its peak.

The government chose to support failing banks and extend the economic pain over decades through massive government spending and near-zero interest rate policies rather than take a short-term, deeper contraction.

They elected the latter, saving their banks and relying on massive government spending to insulate the economy.

This response contributed to a fragile financial system with “zombie” banks, suppressed lending, and a private sector unable to drive robust growth, leading to deflationary pressures and very low economic growth for decades.

Demographics and structural factors have compounded the issue. Japan’s population has been aging and declining, with low birth rates and minimal immigration dampening labor force growth and consumption, making growth harder to achieve. Additionally, long-standing fiscal dominance — where policy focuses on funding government debt and supporting markets — along with weak incentives for productive private investment, have kept economic activity subdued.

Japan Removes Its Financial Support

Prior to the last few years, Japan experienced decades of economic malaise. The post-WWII economic boom was spectacular, and the echo payback was equally stunning.

A recent uptick in inflation, GDP, and interest rates has allowed Japan to gradually remove the monetary policy crutch that has supported its banks, economy, and financial markets for decades. This primarily entails the Bank of Japan (BOJ) reducing its balance sheet and letting interest rates gravitate toward normal market levels.

Some investors watching the sharp increase in interest rates warn that rates are rising because investors are pricing in rising default risks. Others, including us, think this is the normalization process.

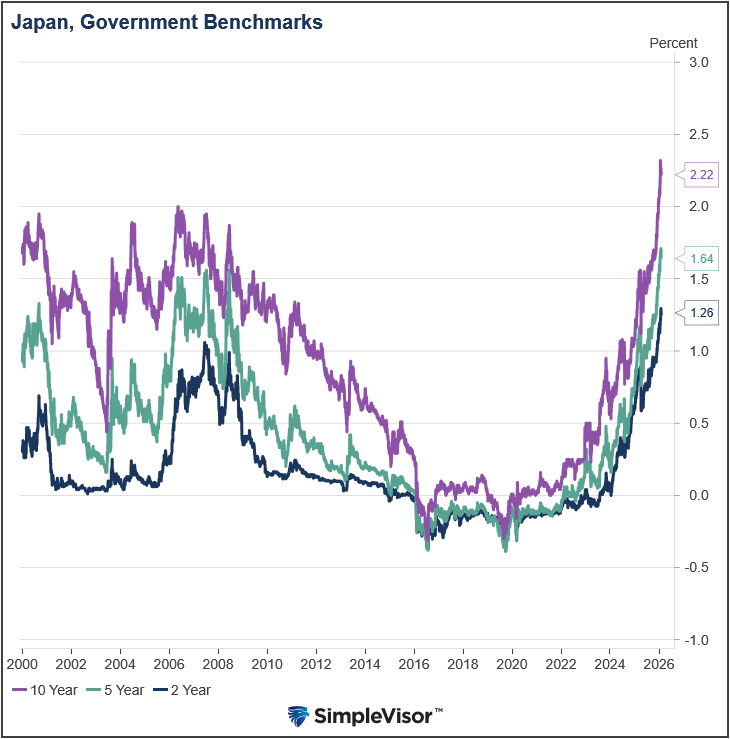

The first graph below shows the current benchmark interest rates for Japanese 2-year, 5-year, and 10-year bonds.

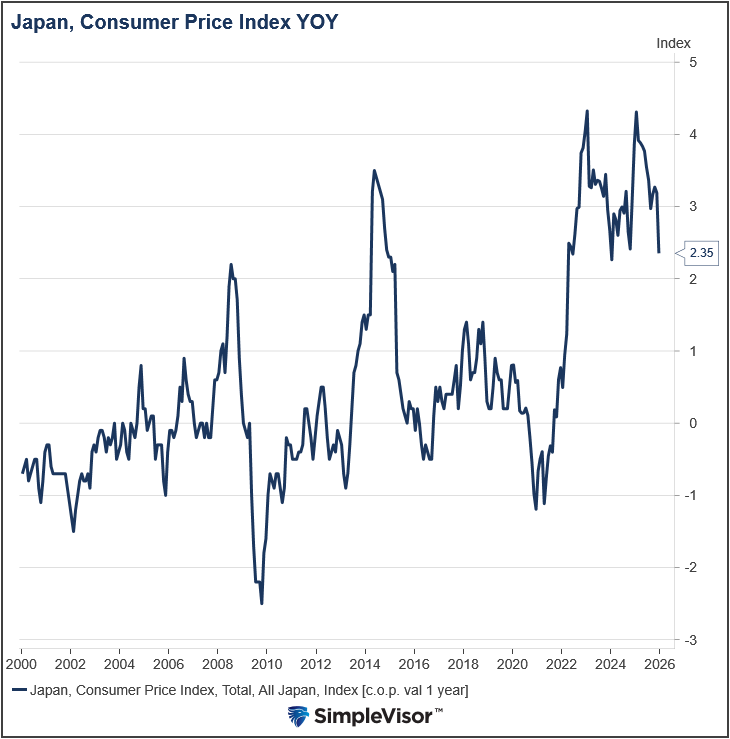

The recent increase in interest rates from negative levels is significant. The next graph shows that the inflation rate has recently been much higher than in the pre-pandemic era.

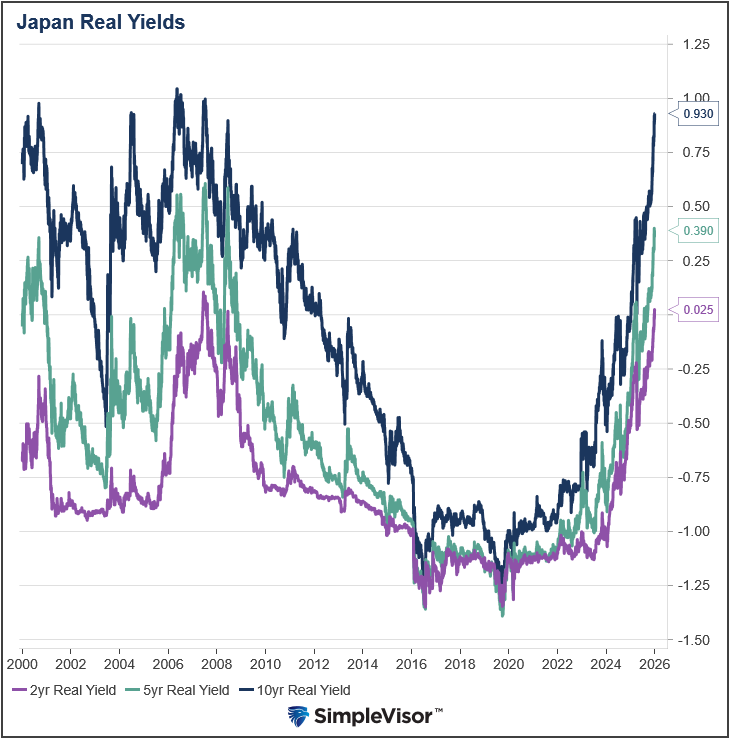

Next, we combine the two graphs to arrive at real (inflation-adjusted) yields. As shown, the 2-year, 5-year, and 10-year real yields are below 1%, albeit well above the -1% real yields that persisted from 2016 to 2022. They are now in line with the pre-financial crisis period.

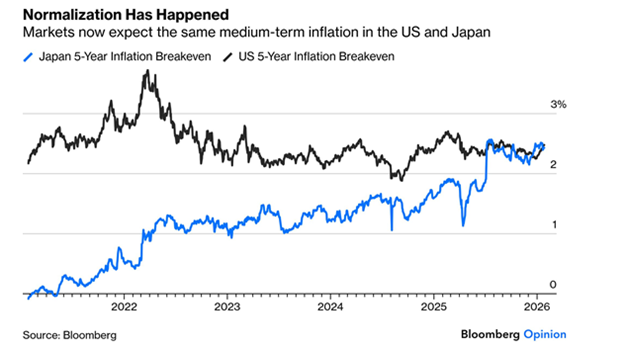

The takeaway from the three graphs is that Japan has allowed yields to gravitate toward a normal spread relative to the inflation rate. The next graph, courtesy of Bloomberg, provides global context. Inflation expectations are very similar for Japan and the US. However, Japanese yields, despite the recent increase, are about 2% below US Treasury yields.

The charts signal that Japanese interest rates and inflation are moving toward levels more in line with those of other large economies.

Economic Signs Of Normalization

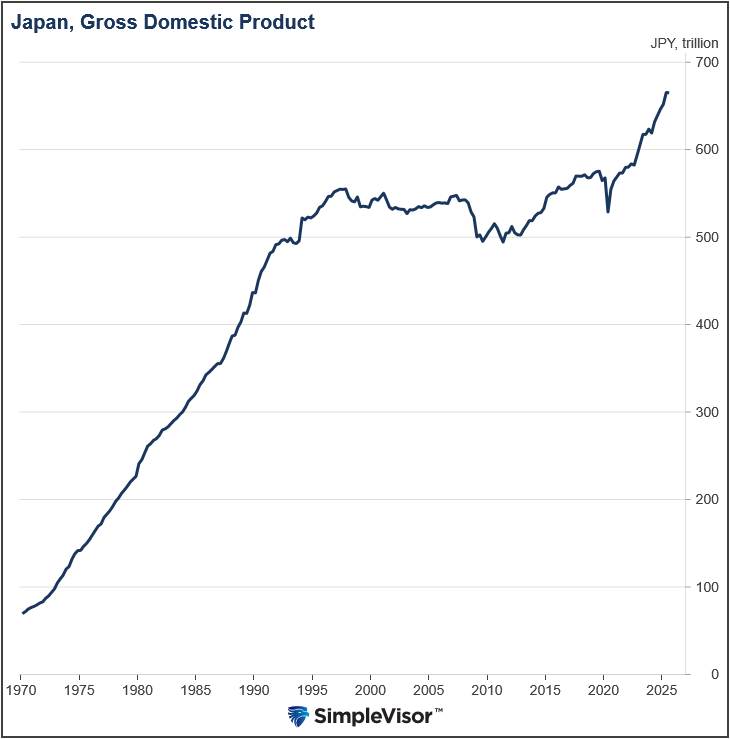

The normalization argument is further supported by a recent spurt in economic activity. The graph below shows Japan’s economy was stagnant for 23 years, ranging from 1997 to 2020. However, economic activity has accelerated in earnest since the second half of 2022.

Furthermore, the Nikkei 225, Japan’s primary stock index, broke to new record highs, finally eclipsing the prior peak seen at the end of 1989.

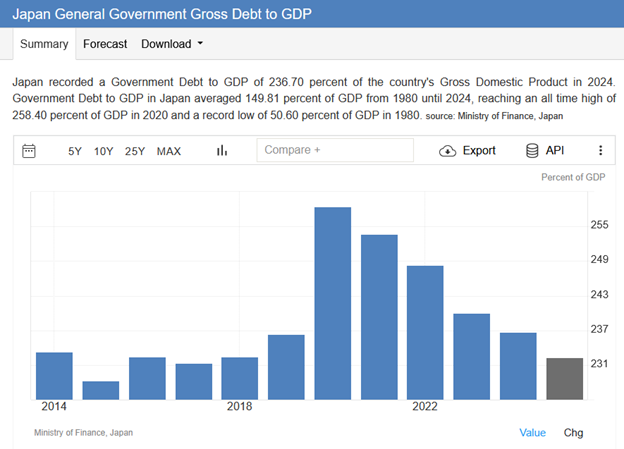

Lastly, Japan’s debt, while rising nominally, is falling as a percentage of economic activity. As we share below, its Debt-to-GDP ratio peaked at 2.58x and has since moderated to 2.32x. It is still exceptionally high but trending in the right direction. For context, the US debt-to-GDP ratio stands at 1.21x, which is considered problematic by some economists.

Japan Is In A Pickle

Normalization after years of significant fiscal and monetary stimulus will not be easy. For example, the public, used to near-zero inflation, is growing uneasy about inflation and unhappy with calls for fiscal austerity. Its policymakers, fiscal and monetary, are being forced to decide between economic growth and inflation.

Policymakers could contain inflation by raising interest rates and implementing fiscal austerity, thereby resulting in yen appreciation. The risk is that they reduce economic growth in the process. Conversely, they could keep rates at current levels and increase fiscal spending, as some politicians want, but risk that inflation keeps increasing.

As if that decision isn’t hard enough, they must also manage interest rates to accommodate the funding of Japan’s excessive outstanding debt. As we noted earlier, Japan has a debt-to-GDP ratio almost twice that of the US. Higher interest rates increase the government's interest expense. In turn, they must issue more debt to fund existing debt. This is the trap noted by Japan’s bond vigilantes.

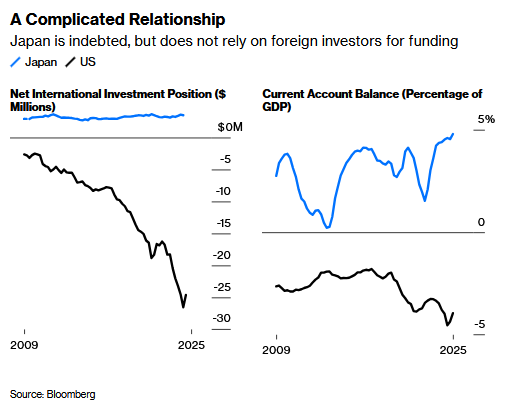

However, Japan’s debt situation is not comparable to the US's. To wit, John Authers of Bloomberg recently reminded us why Japan can maintain higher levels of debt than most other countries. Per his missive, Japan Needn’t Drive An International Crisis:

Another key argument against a crisis is that, despite its huge pile of debt, Japan is stable. It maintains a current account surplus (unlike the US). Also, unlike the US, it has a positive net international investment position, meaning that it holds more foreign assets than foreigners hold assets in Japan:

Further, he argues:

Moreover, fears of an imminent fiscal accident appear overstated. Political constraints may limit aggressive fiscal expansion, the primary deficit has been shrinking, and authorities retain extensive tools to manage yield volatility. Unlike sudden crises driven by foreign capital flight, Japan’s challenge is one of gradual adjustment, not sudden loss of confidence.

Global Liquidity- Yen Carry Trade

As we led the article, we think the most important aspect of Japan’s normalization path is its impact on global liquidity through the yen carry trade. Thus, before discussing tough decisions facing Japan and their potential impacts on the yen carry trade, we share a basic example of how the yen carry trade works.

- A US-based hedge fund borrows ¥15.3 billion yen ($100 million) at 0.75% for one month.

- They convert the yen to $100 million and purchase shares of IBM.

- The return on the trade depends on three components. First, the borrowing cost (0.75%). Second is the change in the yen-dollar exchange rate. Lastly, there is IBM's price change.

Recently, borrowing costs in Japan have risen but remain well below US rates. Despite higher rates, the yen has depreciated against the dollar, which benefits the carry trade returns and more than offsets the higher interest costs. However, bear in mind that an appreciating yen can easily offset the interest rate differential, making the yen carry trade less favorable.

If Japan can gradually normalize its interest rate and support its currency with minimal volatility, the yen carry trade can unwind in a market-healthy fashion. But, as we saw in 2024, sudden shocks to the yen can trigger a swift reversal of the carry trade, harming global stock and bond markets.

Summary

In our opinion, Japan’s rising yields and currency volatility reflect an economic normalization. We do not think Japan is on the verge of fiscal collapse. However, the transition from a monetary- and fiscal-policy-dependent economy to a free-market economy could significantly affect a major source of global market liquidity. Policy decisions that cause sharp, sudden changes in rates and or the yen can have a notable effect on stock and bond markets worldwide.

We witnessed this in August 2024, when the BOJ unexpectedly raised interest rates. As a result, the Nikkei 225 fell by over 12% in one day, and the S&P 500 corrected by 6% over a few days. The BOJ and government seem more aware that their decisions have a significant impact on global markets. We trust they will aim for a smooth normalization process, free of market shocks. But understand that their endeavor to return to a free-market economy entails significant risks for Japanese and global markets

The post Japan Is Normalizing: Risks To The Yen Carry Trade appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter