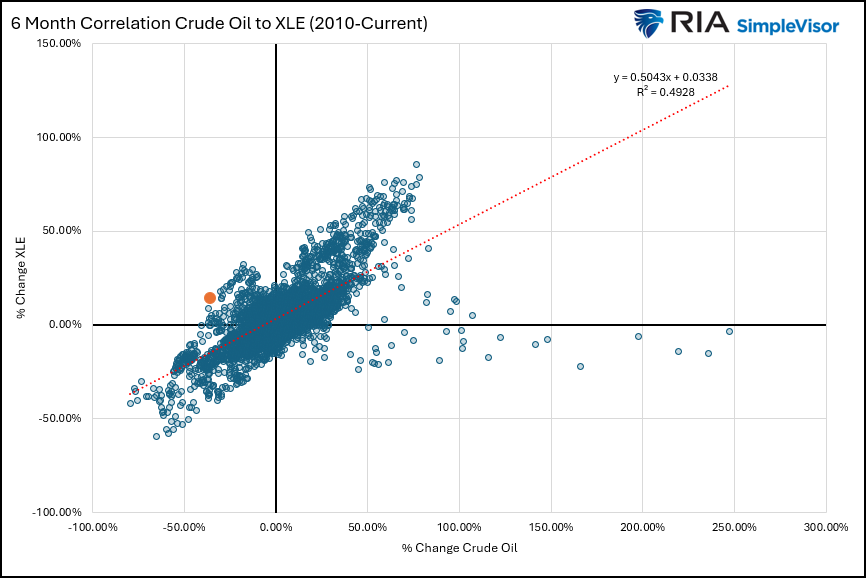

Over the last year, energy stocks have traded well despite crude oil prices languishing. For instance, over the last six months, XLE, the energy ETF, has risen 14%, while crude oil prices have fallen by 12%. The two largest components of XLE, Exxon and Chevron, which account for 40% of the ETF, are up 30% and 14%, respectively, over the past six months. This begs the question: Are energy stocks signaling an increase in oil prices, or are they getting ahead of themselves and susceptible to a sell-off?

If you buy into the economic reflation narrative, we should expect energy prices to rise as economic activity increases. In this scenario, energy stocks may be correctly priced. If you think the economy will grow at its potential rate of around 2.0-2.5%, crude oil prices are fairly valued, which might portend weakness for energy stocks. Recession forecasts that argue for $45 oil would likely foster weakness in energy stocks.

We constructed the scatter plot below to better quantify the relationship between energy stocks and crude oil prices. Based on a decent R-squared of 0.49 of the six-month percentage changes in XLE and crude oil prices, XLE is currently overpriced by 17%, or crude oil prices are undervalued by 21%. Likely, the truth lies somewhere between. However, if an economic slowdown or recession occurs and crude oil slips to $45, XLE could fall 30% to reach fair value. This analysis is not a forecast for oil or energy stock prices but an assessment of the potential risk for energy stocks.

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed the importance of buybacks in relation to market returns and earnings over time. Over the next few days, the market will be driven by both a slate of S&P 500 earnings and the market's reaction to yesterday's FOMC policy rate announcement. Technically, the market is doing fine. Breadth has improved, and the market is challenging all-time highs while triggering a momentum "buy" signal. This suggests the bulls remain in control of the market for now, keeping the portfolio weighted toward equities for now.

As we have noted before, with economic growth showing some strength and earnings reports coming in mostly better than expected, support for the market remains close to current levels. However, as shown above, the 20- and 50-day moving averages remain key supports for trend strength in the near term.

On the other hand, Emerging Markets are extremely divergent from their long-term moving averages, suggesting a reversal is likely. Look to take profits and rebalance risk, as the expected economic growth rate for many of these economies depends on that of the U.S.

As always, our goal as investors is to "buy low and sell high." However, the biggest problem that plagues investor returns over time is that they chase what is overbought and don't buy what is oversold. As a contrarian investor, such behaviors are indicative of late-cycle behaviors, suggesting risk management is becoming more important this year.

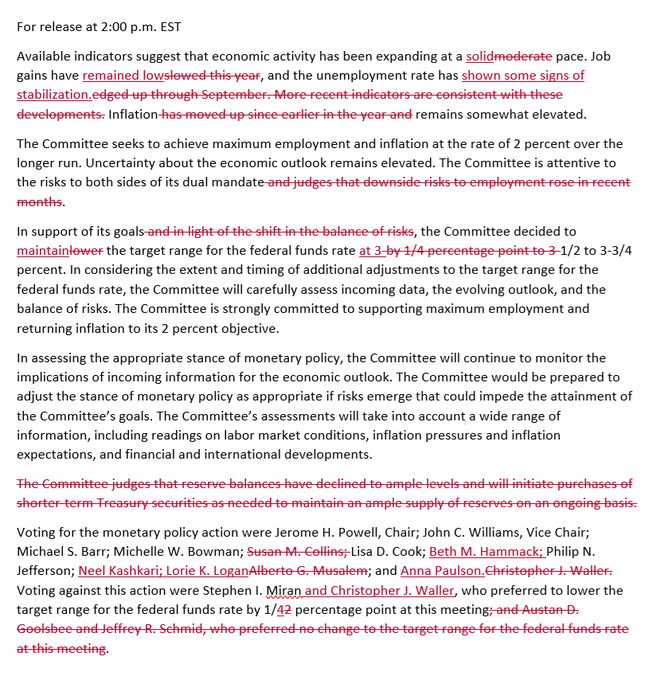

The Fed Does The Expected- Nothing

As was widely expected, the Fed left rates unchanged. As we share in the redlined statement below, the FOMC upgraded its economic outlook from "moderate" to "solid" and improved its labor-market outlook. To wit, the Fed removed language from the prior statement that noted “downside risks to employment rose in recent months.” At the bottom of the document, note that the voting regional Fed bank presidents allowed to vote at the FOMC meeting changed this month. Moreover, Christopher Waller and Stephen Miran sought to reduce rates by 25 bps. While there are many changes to the statement, it is broadly in line with market expectations that the Fed will pause rate cuts for the time being.

During his press conference, Chairman Powell stated the following:

- Powell believes there are distortions in economic data due to the government shutdown, but they are dwindling quickly.

- The outlook for economic data has improved since the last meeting, which is why they removed the "downside risk" caveat regarding the employment picture.

- Powell has no comment on the dollar because it's the Treasury Department's role. "We don't talk about the dollar or what moves it around."

- "This year starts off on a solid footing for growth." Thus, policy is "well-positioned" at the moment.

- "Its hard to look at the data and say policy is overly restrictive." That said, there may be more policy normalization if inflation rates move toward their target.

- Powell believes the inflationary impacts are peaking. To wit, he claims CPI without tariffs is near 2%.

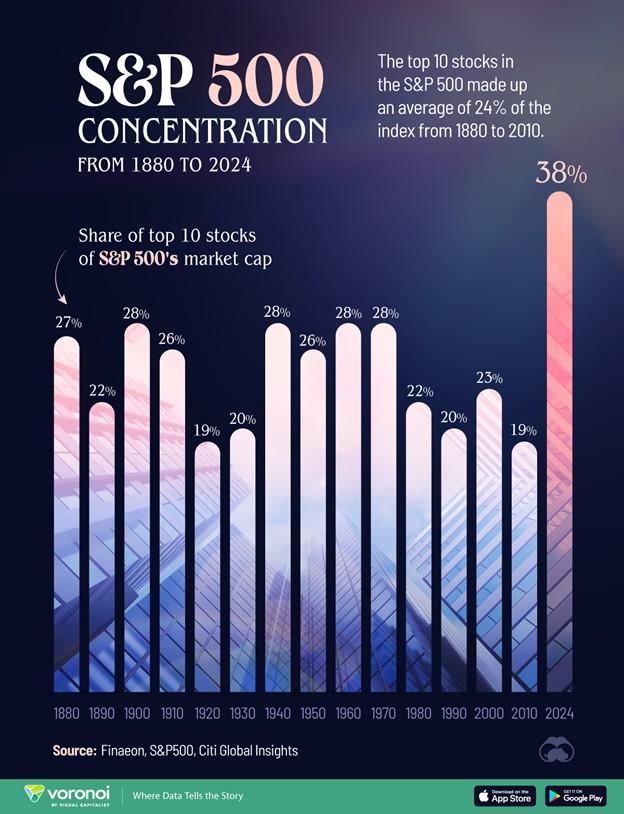

AI Bubble: History Says Caution Is Warranted

Our concern about an AI financial bubble is grounded in the work of innovation economist Carlota Perez and her acclaimed book, Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Although written in 2002, well before the AI boom, her book offers a clear explanation of why speculative financial bubbles often accompany significant technological innovations.

The biggest and most sustainable profits tend to be made after the bubble has collapsed, not during the speculative frenzy.

— Carlota Perez, Technological Revolutions and Financial Capital

Financial capital is by nature footloose, impatient, and speculative, while production capital is tied to the long-term accumulation of capabilities.

— Carlota Perez, Technological Revolutions and Financial Capital

Technological revolutions do not necessarily bring immediate profits to investors; on the contrary, they often involve massive destruction of capital.

— Carlota Perez, Technological Revolutions and Financial Capital

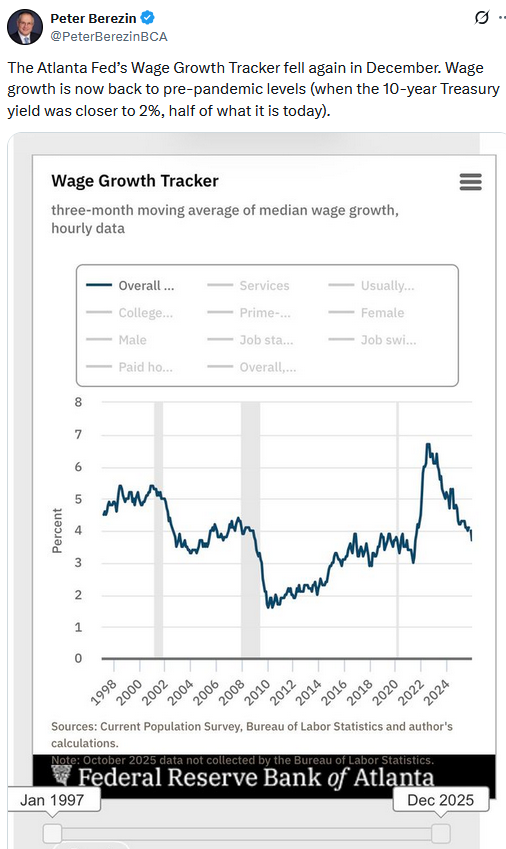

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post The Energy Sector Is Outpacing Energy Prices appeared first on RIA.

Full story here Are you the author? Previous post See more forTags: Featured,newsletter