🔎 At a Glance

- Bears Are An Endangered Species

- Market Brief & Technical Review

- From Lance's Desk: The South Park Market Of 2026 - RIA

- Market stats, screens, and risk indicators

🏛️ Market Brief - Market Volatility Returns

Markets ended the week mixed as investors processed the Federal Reserve’s latest policy decision, rising geopolitical tensions, and the early results of the S&P 500 earnings season. The Fed held the federal funds rate steady at 3.50–3.75 percent, as expected. Chair Jerome Powell maintained a neutral stance, noting that inflation is moving toward the target, but the labor market remains tight enough to avoid immediate policy shifts. There was no indication of a near-term rate cut, but Powell left the door open for adjustments later in the year if inflation continues to ease and economic activity slows.

The most notable event this week was President Trump's nomination of Kevin Warsh to succeed Jerome Powell as Federal Reserve Chair. Warsh is viewed as more hawkish, favoring a tighter monetary stance. That nomination led to the most striking market development this past week as precious metals prices collapsed. Silver futures dove over 30% on Friday to settle near $84.63 an ounce, marking one of the largest one‑day drops since the early 1980s. Gold also tumbled, reversing the January rally. Analysts and traders attributed the metal selloff to a rapid reassessment of inflation and monetary expectations after the Warsh nomination, which boosted the U.S. dollar and undercut the “debasement trade” that had driven safe‑haven flows into precious metals.

We forewarned of this risk and have written several articles discussing that the parabolic run in silver was “driven by narrative and speculative positioning,” and cautioned that such extensions often end in “violent mean reversion” once sentiment shifts and liquidity is withdrawn. Specifically, we noted that “when price is driven more by psychology than fundamentals, reversal becomes inevitable.” Such is particularly the case in markets as thin and sentiment‑driven as precious metals. That warning proved prophetic as leveraged long positions unwound en masse.

Turning to the S&P 500, there were signs of strain as the largest tech names reported earnings. Microsoft, one of the first of the “Magnificent 7” to report, posted strong results in cloud and AI-driven services. Revenues from Azure and enterprise subscriptions outpaced expectations, but investors sold into strength amid conservative guidance. Tesla disappointed with weaker deliveries and margin compression, but the stock rallied as investors focused on $20 billion in spending on transformational initiatives. Apple also reported strong results with a surprise surge in iPhone sales from China; however, the stock traded mostly flat following the announcement. Meta surged 10% after stellar results combined with strong guidance.

Alphabet and Amazon are set to report next week, but early signs point to a bifurcation in tech performance. Strong fundamentals are not being rewarded uniformly, and valuations are beginning to face resistance. The market remains highly concentrated in a small number of large-cap tech names, leading to outsized earnings reactions. That leaves index-level performance vulnerable to disappointing results, even if the broader economy is stable.

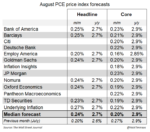

Elsewhere, economic data came in stronger than expected. GDP growth remains robust, driven by resilient consumer spending and a boost in exports. Initial jobless claims remained near historic lows, and continuing claims declined. Inflation readings showed progress, with core PCE in line with the Fed’s target path. These data points reinforce the “soft landing” narrative but don’t yet warrant a shift to easing policy.

With Fed policy steady, earnings mixed, and geopolitical risks rising, markets remain in flux. Next week will be pivotal. Heavyweight earnings and additional labor data will determine if the recent consolidation holds or if risk appetite recedes further.

Which brings us to the market.

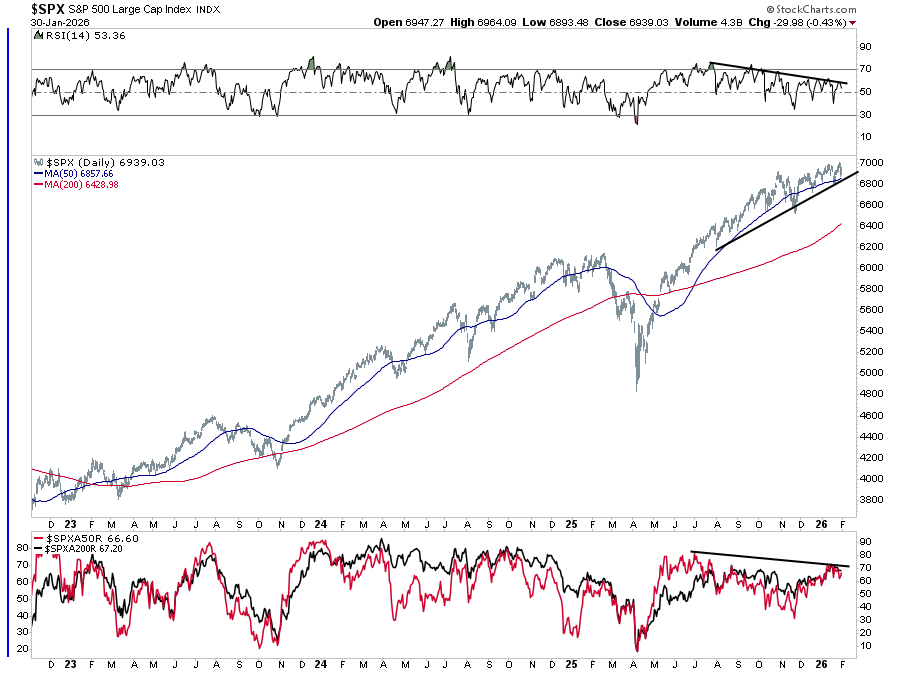

📈Technical Backdrop - Bulls Remain In Control

The S&P 500 closed the week at 6939, pulling back slightly from the highs it tested earlier in January. Price action remains constructive and in a bullish uptrend. However, recent sessions reflect continued resistance at all-time highs. Furthermore, market internals have softened, with relative strength negatively diverging from the bullish market trend. Such divergences typically precede weaker market outcomes, particularly when leadership has narrowed as earnings reactions from large-cap names have turned more mixed. While the index still holds above its key moving averages, the slope has flattened.

We are also closely monitoring market momentum, which has cooled in recent days, and breadth weakened under the surface. The percentage of S&P 500 stocks trading above their 50-day moving average declined over the past two weeks, while relative strength indexes are trending lower.

Volatility picked up last week, with daily intraday swings widening. The VIX remains suppressed, but skew has risen, suggesting investors are hedging downside risk. Options markets show increased demand for protection heading into this coming Friday’s January Employment Report. Technical support now sits near 6857, the 20-day moving average. A decisive break below would shift the short-term bias from neutral to defensive. Resistance remains firm at 7000. That range has rejected the price twice this month. A close above that level would suggest renewed upside momentum, especially if supported by strong earnings and macro data.

For now, the market is range-bound, waiting for confirmation. We have a lot of earnings reports this coming week, which could shift market sentiment. However, weak guidance or a hot jobs number could tilt sentiment more defensive. Positioning remains cautious, and until breadth improves, rallies may struggle for follow-through.

| Index/Level | Level (Approximate) | Notes |

|---|---|---|

| S&P 500 | 6939 | Month end closing level |

| Immediate Support | 6929 | 20-day moving averge |

| Intermediate Support | 6857 | Rising 50-day moving average, structural trendline |

| Major Support | 6782 | 100-day moving average |

| Initial Resistance | 7000 | Psychological level, tested twice in January |

| Major Resistance | 7076 | First Fibonnaci Extension Zone |

🔑 Key Catalysts Next Week

This week brings several critical economic reports that will shape expectations for growth, inflation, and labor market strength. Monday kicks off with the ISM Manufacturing PMI and Construction Spending data. These releases will help clarify whether factory activity is stabilizing after recent softness and whether the housing and commercial sectors are holding up amid tighter financial conditions. By Wednesday, attention shifts to the ISM Services PMI and the ADP Employment Report, both of which will provide a clearer picture of broader economic momentum heading into Q2. Services account for the majority of U.S. economic activity, so any slowdown here would raise concerns about the durability of the expansion. Initial jobless claims and the January employment report round out the week.

In addition to economic data, markets will be watching for any movement on the political and geopolitical front. President Trump’s nomination of Kevin Warsh to succeed Jerome Powell as Federal Reserve Chair introduces uncertainty around future monetary policy direction. Warsh is seen as more hawkish, which could shift expectations for rate cuts in the second half of the year. Meanwhile, global investors remain alert to any escalation in Middle East tensions following last week’s rise in crude oil prices. Disruption in energy markets would renew inflation concerns and complicate the Fed’s path forward. There are no scheduled central bank meetings next week, but speeches from Fed officials could still move bond yields and risk assets if they reinforce or challenge the current pause narrative.

With markets already reacting to a heavy earnings season, these data points and events could amplify volatility, especially if they diverge from soft-landing expectations.

Need Help With Your Investing Strategy?

Are you looking for comprehensive financial, insurance, and estate planning services? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

💰 Bears Are An Endangered Species

Just recently, my colleague, Doug Kass, published an interesting note suggesting that "bears are now an endangered species." As he notes:

"Equities continued to advance on Monday — and that ascent continues in the futures market this morning. The northerly move seems uninterested and oblivious to uninspiring market breadth."

"Nor is the market concerned about fatuous/feckless policy (erratic tariffs, absence of fiscal discipline et al), uncooperative and highly partisan politicians in Washington, D.C. (likely leading to a government shutdown in February), very expensive valuations, a equity risk premium that has become an equity risk discount, parabolic moves in precious metals, a breakout (to the upside) in other commodities (leading, in part, to sticky inflation), evidence of rising levels of speculation, investor complacency, a narrowing in the internals, rising JGB yields, the precarious state of AI capital spending vs. projected returns (on that investment) and a host of other headwinds (often mentioned in my Diary).

Bears are going the way of the flightless and extinct dodo bird - rapidly becoming an endangered species:"

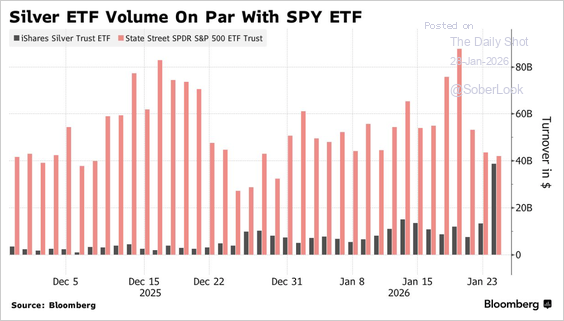

The shift in market tone is hard to ignore. Bullish sentiment has overwhelmed any bearish concern. Retail investors are back in force, chasing the hottest assets. Just like in 2021, when retail investors were chasing GameStop and AMC, they are now chasing silver. As shown, Silver’s parabolic rally has driven the trading volume of iShares Silver ETF to nearly match that of the SPDR S&P 500 ETF.

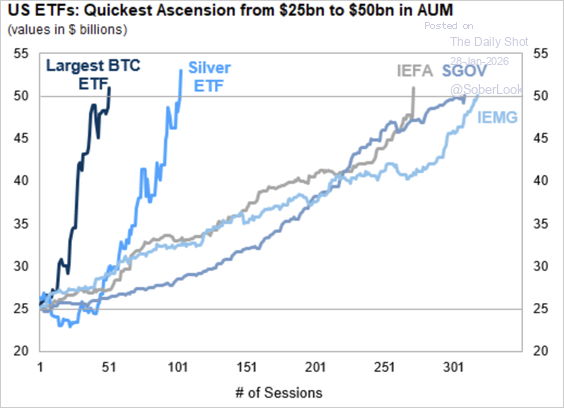

Furthermore, the rush to gain exposure to silver pushed the ETF's AUM past $50 billion, with the majority of its growth occurring in the last 100 trading days. Unfortunately, as seen on Friday, those parabolic advances can reverse quickly. While I would expect to see a bounce in metals prices, as narratives are very hard to kill, Friday's price action should serve as a solid reminder of the perils of chasing risk assets.

Lastly, margin debt has surged as the demand for leverage has increased. As shown, margin debt as a percentage of the money supply has surged to levels not seen since the "Dot.com" crisis.

However, it isn't just the leverage levels; it is also retail investors buying leveraged ETFs or options on leverage to further expand that leverage. In 2025, the U.S. ETF market saw a record-breaking year for both new launches and the adoption of high-risk strategies. Approximately 200 to 340 new leveraged ETFs were launched, representing a significant portion of the 1,110 to 1,167 total new ETFs introduced in the U.S.

Unsurprisingly, since virtually every risk asset class continues to move higher, Doug is correct in saying that bears have become an endangered species. This isn’t a footnote. It is an important view that shapes risk, valuation, and capital allocation. To make sound decisions, investors need to understand where sentiment stands, why it's occurring, what history tells us, and how to manage risk when optimism becomes the rule.

No Bears Here

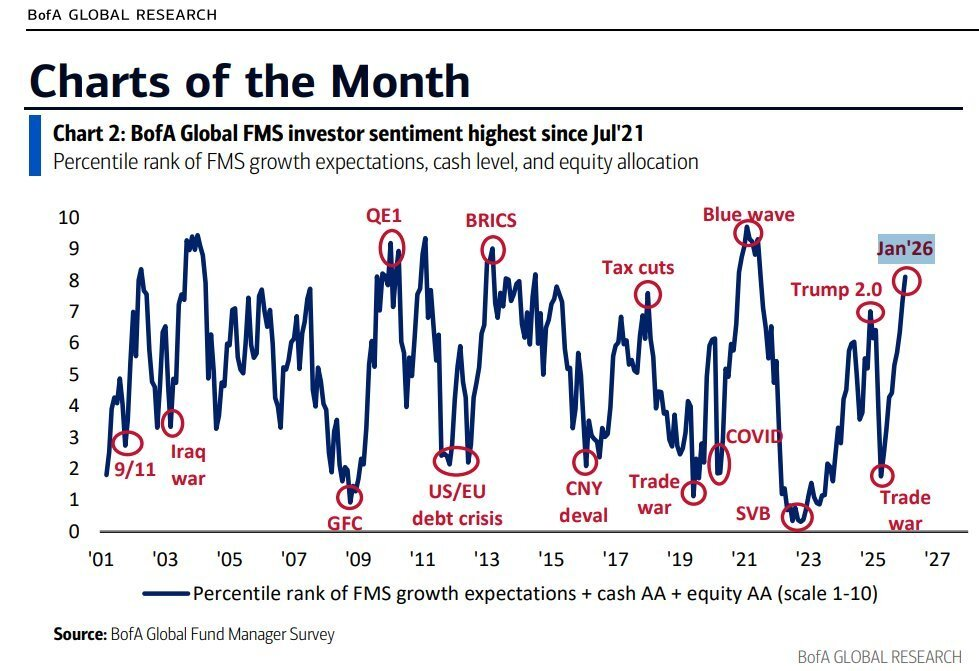

Currently, investor sentiment is very bullish on various levels, from positioning to raw sentiment. Our Fear/Greed index is currently in extreme greed territory and is a good proxy not only for how investors feel, but also for how they are allocating their investment dollars.

Survey data from individual investors shows optimism above long-term averages. Furthermore, weekly sentiment readings recently neared 50 percent bullish, while bearish views fell well below historic norms. Professional sentiment has followed a similar arc.

Furthermore, fund managers have ramped up equity exposure while cash levels have dropped near record lows. Clearly, there are no bears in that group.

Retail flows have played a significant role in the current market rally, as daily trading activity on retail platforms has surged. Option volumes, particularly in zero-day contracts, have also risen sharply, comprising more than 60% of all option contract trading. These short-term bets often reflect a speculative outlook rather than long-term investing, which is why, as shown above, margin debt has reached new highs, now exceeding $1.23 trillion.

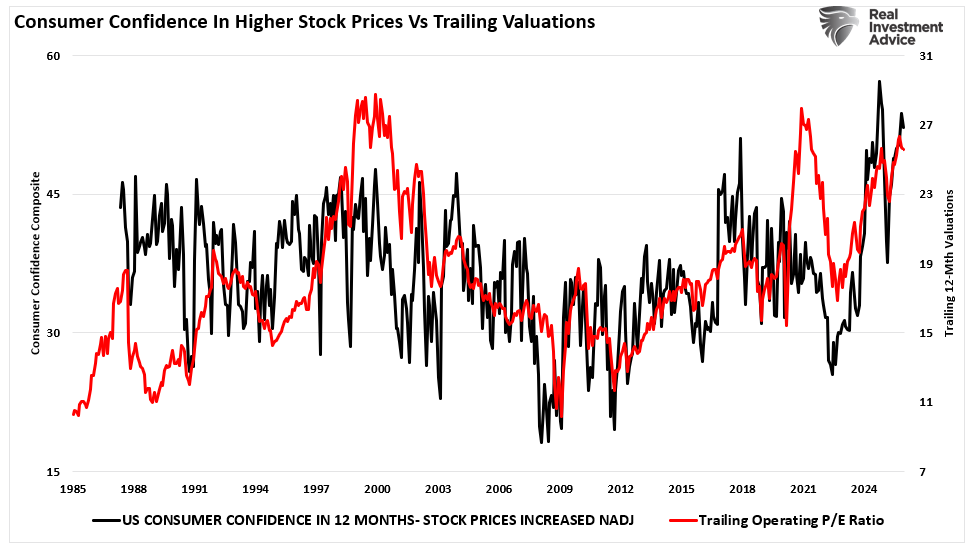

This broad wave of bullish behavior isn’t isolated to sentiment surveys. Positioning data, equity fund inflows, and trading behavior confirm the lack of bears in the market. Markets are rising not because of strong earnings or economic acceleration, but because of optimism about future prices. In this environment, price momentum drives buying, not fundamentals. We see that in the overlay of consumer sentiment about higher prices versus valuations. Simply, investors are willing to overpay on expectations that things will continue to improve.

Of course, this is happening because of the collision between fiscal and monetary stimulus, and the ease of market access through trading apps has increased participation. Furthermore, social media narratives and a rising belief that "markets only go up" and to "buy every dip" continue to fuel market momentum. Stories of fast gains spread quickly through websites like Reddit and social media apps like TikTok. Then, as price momentum continues, retail investors mimic what works, and what has worked is betting on upside.

Professional money managers have also been sucked into the frenzy. "Career Risk" is a real and present danger for portfolio managers who lag their benchmark index. That pressure to keep pace with benchmark returns has increased funds' risk profiles, prompting managers to step outside normal boundaries to add exposure to higher-risk assets. When markets rally, and peers remain fully invested, holding cash becomes a career risk. That herding behavior reinforces the bullish cycle: as sentiment improves, more capital flows in, driving prices higher.

Psychologically, this is a textbook feedback loop.

- Rising prices validate optimism.

- Optimism attracts more buyers.

- More buying pushes prices even higher.

- Few question the rally when accounts are in the green.

However, as Bob Farrell once noted, "when everyone agrees, something else tends to happen."

The lack of bears in the market is not a sign of safety. It’s a warning.

What History Tells Us About Euphoria

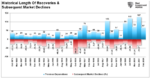

History has shown that elevated sentiment and valuations precede poor forward returns. Bullish sentiment above two standard deviations from the mean has often resulted in weak 6- to 12-month performance. This doesn’t mean a bear market crash is imminent. But it does mean risks are skewed, particularly when the market decouples from underlying earnings.

In the late 1990s, tech stocks decoupled from earnings as the Dot.com mania roared. Retail investors, who believed they were "smarter than the market," drove prices based on stories rather than fundamentals, pushing valuations to more extreme levels. The same occurred in 2020, as the stimulus-fueled market surged well above "fair market value," leading to disappointing outcomes in 2022. During those periods, there was also a lack of bears.

Today is the same: valuations are stretched, sentiment is excessively bullish, and fundamentals are ignored for the sake of narratives. The new crop of "young investors" adamantly believes that this time is different, and the lack of bears is notable. When the narratives previously cracked, the decline was swift and deep, particularly for those "long on confidence and short on experience."

The common thread is that extreme optimism often signals rising investment risk. Such conditions do not necessarily mean a "crash" is imminent, but it doesn't rule one out either. A market that is overvalued, overleveraged, and excessively bullish has all the ingredients for a mean-reversion. All that is lacking for a bear market is a catalyst, which can range from credit-related events to earnings misses, economic weakness, or rate shocks. Whatever the catalyst that sparks a bear-market reversion, sellers will be in the driver's seat.

The lesson is clear. When "bears are on the endangered list," the risk of adverse market outcomes increases. Sometimes slowly, sometimes violently, but the outcome is never gentle for those who chased euphoria without a plan.

Portfolio Tactics When Everyone Is Bullish

Therefore, if bear market risks are rising, what should you do? In such an environment, investors must focus on defense. That doesn’t mean selling everything; it just means tightening discipline.

- Start with diversification. Concentrated bets in high-beta stocks expose portfolios to sudden drawdowns. Broaden exposure across sectors, asset classes, and geographies. Add bonds or cash to reduce volatility.

- Position sizing is critical. If your portfolio depends on one theme working out, you’re taking too much risk. Size positions based on downside risk, not upside hopes. Have predefined exit points. Stick to them.

- Use hedges where appropriate. Protective puts or inverse ETFs carry costs but can cushion downside in sharp corrections. They are insurance policies. When markets are smooth, you won’t need them. When volatility returns, you’ll be glad you paid the premium.

- Watch liquidity. Avoid tying up capital in assets that can’t be quickly exited. Hold cash to take advantage of future dislocations. When speculative excess cools, bargains emerge. But only for those with cash and patience.

- Focus on quality. In speculative rallies, low-quality stocks lead. But when the tide turns, these same names drop the hardest. Companies with strong balance sheets, consistent earnings, and real cash flow survive downturns. Own them.

- Finally, tune out noise. Social media and short-term headlines often exaggerate trends.

While sentiment can’t tell you what markets will do tomorrow, it does tell you how much risk is being ignored. Your job isn’t to follow the crowd. It’s to stay solvent when the crowd runs off a cliff, and when bears are hard to find, the cliff may be closer than you think.

Trade accordingly.

🖊️ From Lance’s Desk

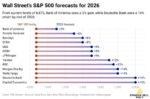

This week's #MacroView blog digs into the current, very bullish, mainstream analysts' expectations for markets in 2026 and the inherent risks underlying them.

Also Posted This Week:

- AI Bubble: History Says Caution Is Warranted - RIA - by Michael Lebowitz

- 2026 Economic Summit Recap: Where Investing, AI, And Digital Assets Converged

- The Bullish And Bearish Case For 2026 - RIA- by Lance Roberts

📹 Watch & Listen

Market risk is climbing as markets continue to push towards the psychological level of 7000.

Subscribe To Our YouTube Channel To Get Notified Of All Our Videos

📊 Market Statistics & Analysis

Weekly technical overview across key sectors, risk indicators, and market internals

💸 Market & Sector X-Ray: Pullback To Support

The reflation narrative remains intact, but we are already seeing early signs of deterioration. Basic Materials and Energy have been the clear winners since the beginning of the year. Staples, an area that was hated last year, has also risen as investors expect a resurgence in economic activity. These sectors are now very overbought, so profit-taking and rebalancing make sense.

📐 Technical Composite: 75.39 – Bullish Bias Remains

The overall technical condition remains bullish, but has weakened slightly over the last month. After hitting more extreme overbought conditions heading into October, the market has continued to consolidate, working off some of that state. While not bearish, some further weakness early next week would be unsurprising, providing a better entry point for a rally at some point.

🤑 Fear/Greed Index: 80.03 – Extreme Greed Remains

Positioning in equities remained strong this week, despite the relatively sloppy price action. Retail investors continue to remain aggressively invested, and professional managers increased net exposure this past week. However, we will see if a follow-through on the weakness on Thursday and Friday reduces the "optimism" next week.

🔁 Relative Sector Performance

About two months ago, we noted that Energy was deeply out of favor and unloved, which made it a prime candidate for a rotation. That is precisely what has happened since then, and now, Energy is grossly overbought. Will the next trade be back into Financials and Healthcare, which are oversold again?

📊 Most Oversold Sector Holdings

As noted above, one of the more oversold sectors is Healthcare. Such occurred this past week as news from the Government on Medicare subsidies weighed heavily on companies like UNH. However, ABT, ISRG, and LLY have also been under pressure and are likely in a better position for a rotational trade.

📊 Sector Model & Risk Ranges

Over the last month, we have noted a sharp advance in Basic Materials, Industrials, Energy, Transportation, Small and Mid-Cap, and Gold and Gold Miners, which has pushed deviations from long-term means toward extremes that are ultimately unsustainable. We also noted that those extremes can persist for a while; therefore, it is important to maintain exposure while managing risk along the way. On Friday, particularly with precious metals and mining stocks, the reason for risk management remains clear. Even with the pullback on Friday, many sectors and markets continue to trade well outside historical norms, which suggests February may be a rougher month to navigate.

Have a great week.

Lance Roberts, CIO, RIA Advisors

The post Bears Are An Endangered Species appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter