It’s that time of year when Wall Street polishes up its crystal balls and begins predicting returns for 2026. Since Wall Street never predicts a down year, which would be unwise for fee-based product revenues, these forecasts are often inaccurate and sometimes significantly wrong. Let's review some previous years. For example, on December 7th, 2021, we wrote an article about the predictions for 2022.

“There is one thing about Goldman Sachs that is always consistent; they are ‘bullish.’ Of course, given that the market is positive more often than negative, it ‘pays’ to be bullish when your company sells products to hungry investors. It is important to remember that Goldman Sachs was wrong when it was most important, particularly in 2000 and 2008. However, in keeping with its traditional bullishness, Goldman’s chief equity strategist David Kostin forecasted the S&P 500 will climb by 9% to 5100 at year-end 2022. As he notes, such will “reflect a prospective total return of 10% including dividends.”

The problem, of course, is that the S&P 500 did NOT end the year at 5100.

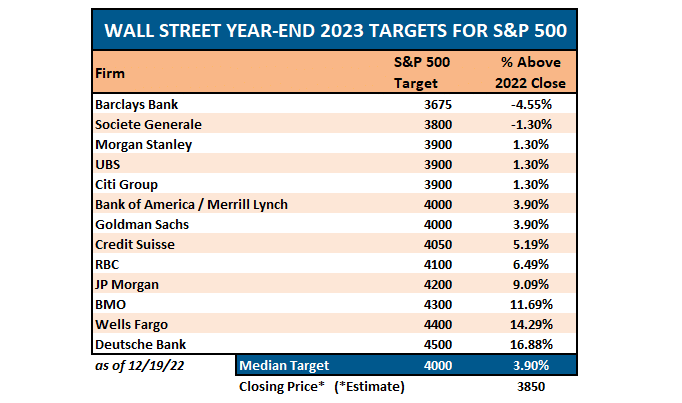

Then, in 2022, Wall Street predicted a modest return of just 3.9% for 2023.

Of course, reality turned out to be markedly different.

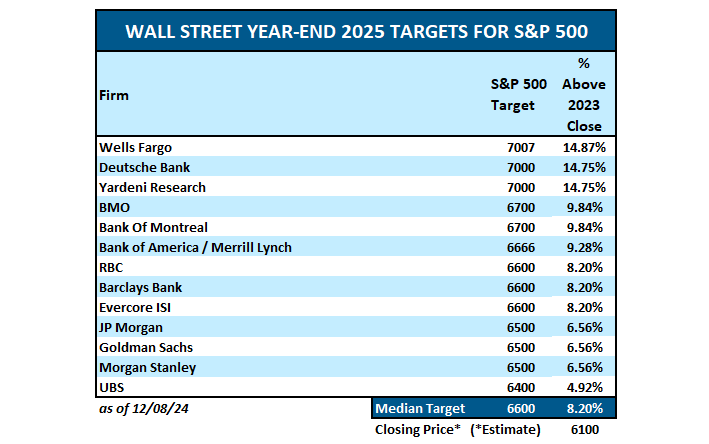

The same trend was observed in 2023, 2024, and 2025 as Wall Street grossly underestimated the forward market return. Heading into 2025, Wall Street predicted a median return of just 8.2% with the highest estimate of nearly 15%. As we wrap up the year, the market is again closing in on a 20% return, marking the third consecutive year of such performance.

However, while analysts repeatedly fail at the guessing game, Wall Street’s annual tradition is always of higher returns. To borrow a quote:

“(Market) Predictions Are Difficult…Especially When They Are About The Future” – Niels Bohr

Okay, I took a little poetic license, but the point is that while we try, predicting the future is difficult at best and impossible at worst. If we could accurately predict the future, fortune tellers would win all the lotteries, psychics would be more prosperous than Elon Musk, and portfolio managers would always beat the index.

However, this is never the case, and as investors, we must rely on our data, analyze past events, filter out the current noise, and discern possible future outcomes. The biggest problem with Wall Street today and in the past is its consistent disregard for the unexpected and random events that inevitably occur, like the "Liberation Day" tariff event that sent the market plunging by nearly 20%. However, even when such events occur frequently, from trade wars to Brexit to Fed policy and a global pandemic, Wall Street analysts were often convinced that such things would not happen.

So what about 2026? We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are primarily optimistic for the coming year. The median estimate for 2026 is for the market to rise to 7500 next year, which would be a disappointing return of just 9.3% after three years of 20% gains. However, the high estimate from Deutsche Bank suggests a 15% return, while the low estimate from BofA is just 4%. Notably, not one firm forecasts a negative return.

There are several risks to these forecasts.

The Challenge For 2026

As of this writing, the market appears poised to close the year above 6,800. That’s roughly a 17% percent gain for the year based on price appreciation. That advance was a combination of AI-fueled enthusiasm, softening inflation, and hopes of Fed rate cuts and increased liquidity. However, under the surface, the setup for 2026 looks increasingly fragile. Valuations are stretched, expectations are optimistic, and earnings have little room for error.

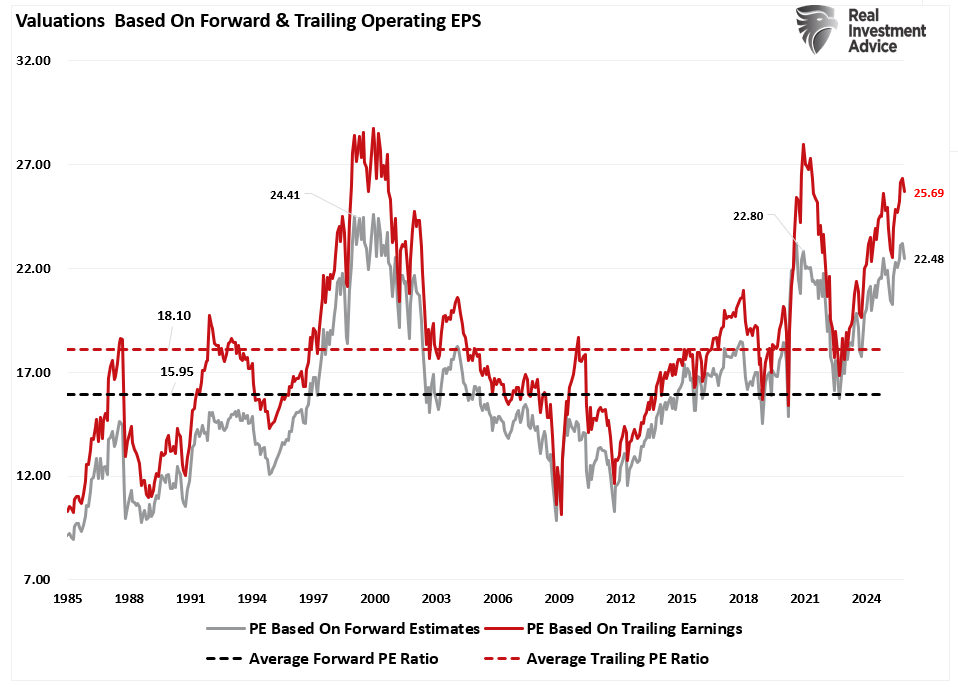

Let's start with the data. The current trailing twelve-month price-to-earnings ratio sits at 26, near historic extremes. The Shiller CAPE ratio, which adjusts for inflation and smooths cycles over a decade, stands near 39. Forward P/E estimates for 2026 earnings are in the 23 range. By almost every measure, equities are priced at levels that historically limit future returns.

However, this also presents a risk that investors need to be prepared for. At current valuation levels, stocks don’t need a crisis to fall; they only need disappointment. If growth falls short, or if the Fed doesn’t deliver the cuts the market expects, equities face pressure. In other words, a "recession" is not the risk; it is just anything that is "less than perfect."

Wall Street, of course, is bullish. That’s the default setting. Morgan Stanley is calling for a 14 percent gain. Goldman Sachs projects double-digit earnings growth. Deutsche Bank has a target of 8,000 for the S&P 500. But look closer. These forecasts assume strong profit growth, stable inflation, and rate cuts starting in mid-2026, which is a very tight window.

However, investors have heard this before, but have also seen what happens when markets get ahead of reality. That leaves the setup for 2026 a little less bullish, as elevated expectations and high valuations leave minimal margin for error.

Valuation Math: What the Numbers Suggest for 2026

To make sense of where the S&P 500 could go in 2026, we don’t need a prediction, just a calculator. Rather than guessing, we prefer to let "valuations do the talking." The reason is that valuations represent investor sentiment based on the outlook for earnings growth. If forward earnings growth is strong, investors can overpay for equities today, anticipating that earnings will justify the overpayment. However, if earnings expectations start to fall, investors will reprice the markets for lower premiums.

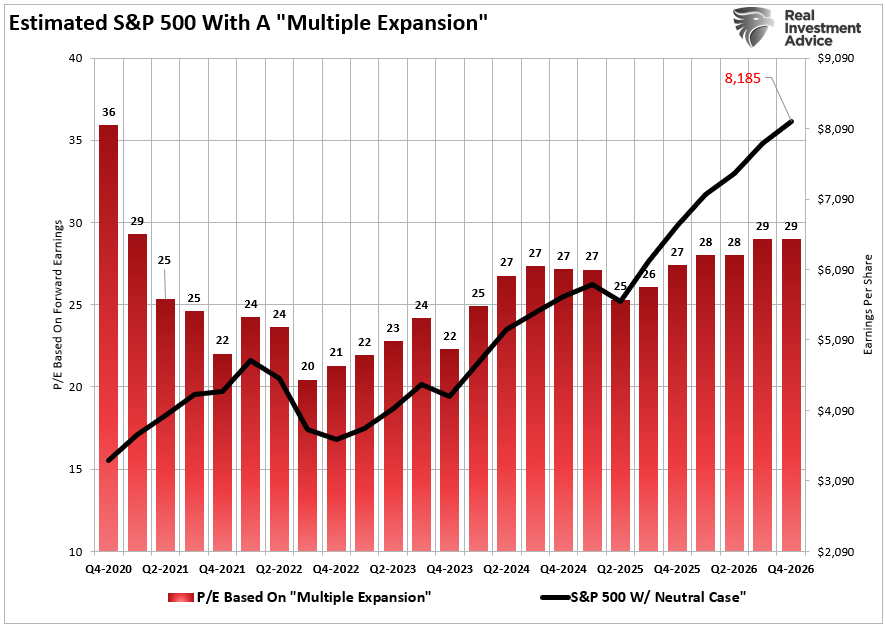

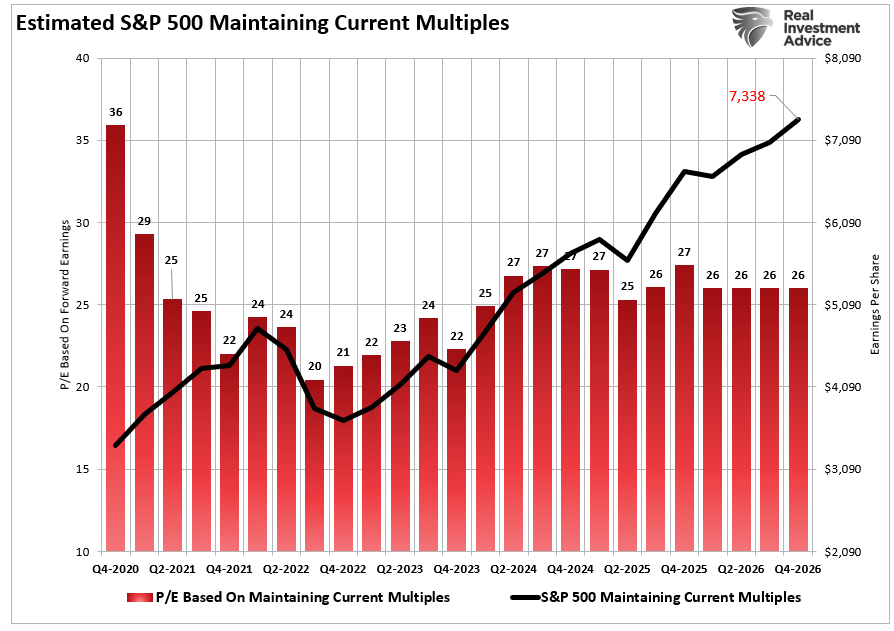

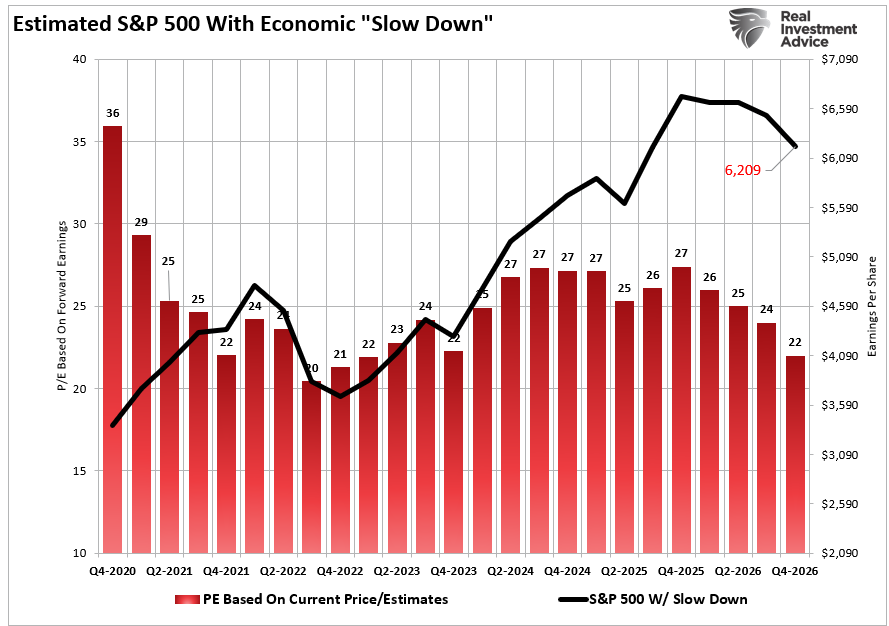

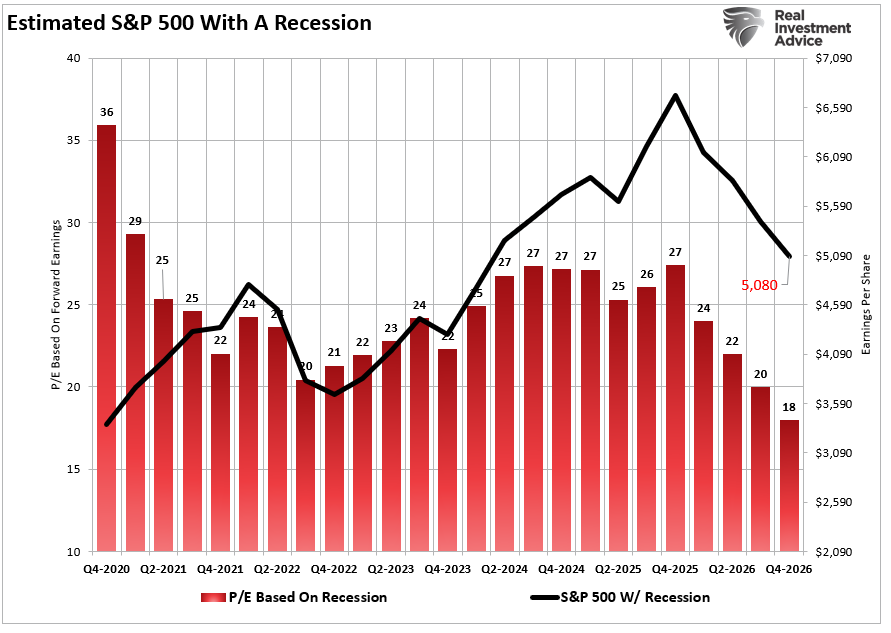

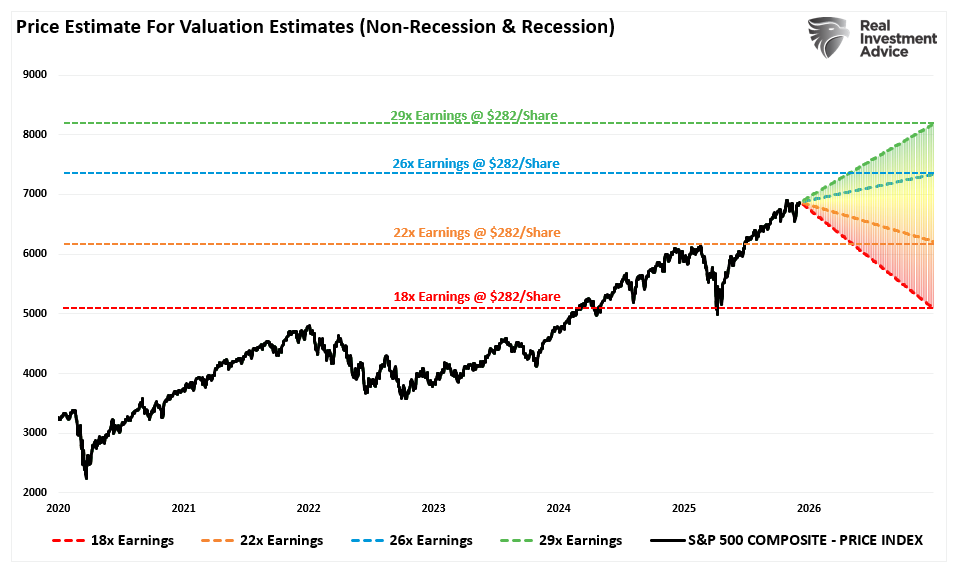

As shown below, we ran multiple scenarios based on forward earnings estimates, valuation ranges, and historical outcomes. The S&P 500 begins the year near 6,900, our base case, and from there, outcomes depend on whether multiples expand, hold, or contract. For the earnings analysis, we are using S&P Global's forward 2026 reported earnings per share estimate of $282, which will likely be the high-water mark for 2026. Therefore, we will assume that these estimates are accurate, and we can then incorporate valuation multiples and predict forward market returns.

Here are the scenarios, based on $282 per share: (Note: There are an infinite number of possibilities that could occur in 2026. The point of the following discussion is to understand the math of valuations as it relates to market risk next year.)

Optimistic Case (Multiple Expansion): Bullish investor sentiment persists, and risk-taking intensifies, resulting in a multiple expansion to 29x. Such a prediction would suggest a figure close to Deutsche Bank's current 2026 estimate of 8,000 as a year-end target. As shown, at 29 times earnings, the year target would be $ 8,185, or a roughly 18% gain.

Neutral Case (Maintain Current Multiples): This scenario assumes that, while the bullish market persists, concerns over monetary policy, inflation, or earnings growth rates will keep multiples stable at 26x forward earnings. Such a scenario would allow the index to rise to 7,338, representing a more historically normal 6% gain in 2026. Such a muted return will be very disappointing after three years of nearly 20% gains.

Slow-Down Case: If we assume an economic slowdown that impacts forward earnings expectations, such a scenario would potentially lead to a reversion in valuations toward its 5-year average of 22x. Such a decline would likely result in a market value of 6,209, or a negative return of approximately 10%.

Recession Case: The most likely worst-case outcome, barring a financial or credit-related event next year, is the onset of a mild recession. While such an event is likely a low-probability occurrence in 2026, a scenario like this would likely lead to more severe earnings disappointment and market repricing. If such were to occur, a valuation contraction toward 18 times earnings is possible, with a price decline in the index towards 5080, taking markets back to the 2021 peak, or a 26% correction.

Notice this: even a mild reversion in valuations creates downside. If earnings flatten and multiples fall to 20, that’s enough to limit or erase gains. If both earnings and valuations fall short, returns turn negative fast. This makes managing risk less simple in 2026. While high valuations reduce forward returns, they do not guarantee losses. However, high valuations leave "no cushion" if things go sideways.

This is not a time for aggressive positioning. It’s a time to respect the math.

Risk Factors: What Could Go Wrong in 2026

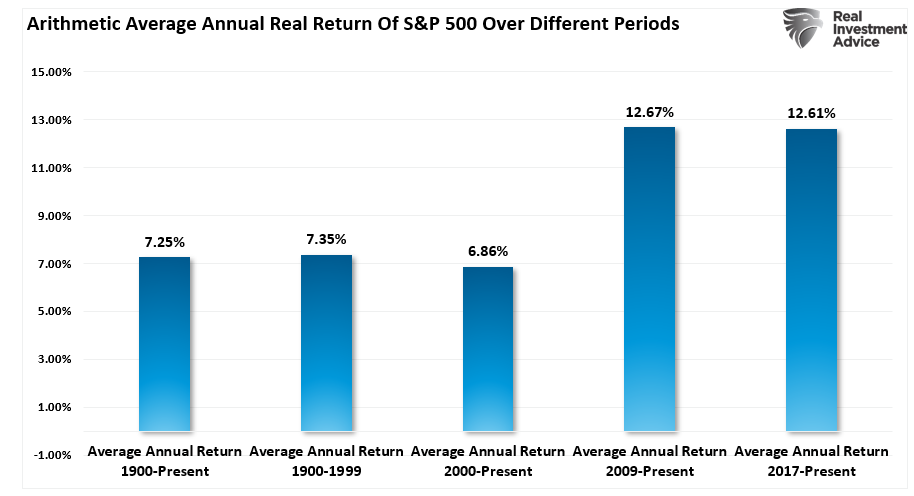

Markets don’t move in straight lines. The problem with 2026 isn’t a forecast. It’s the imbalance between expectations and risk. Everything must go right for stocks to deliver strong returns from current levels. But there’s plenty that could go wrong. As shown in the table below, since 2009, investors have enjoyed annualized real returns in the market that are 50% higher than the historic returns from 1900 to the present. Those returns were a function of near-zero interest rates, massive liquidity injections, and a valuation reversion following the 2008 crisis. None of those supports is currently available as we head into 2026.

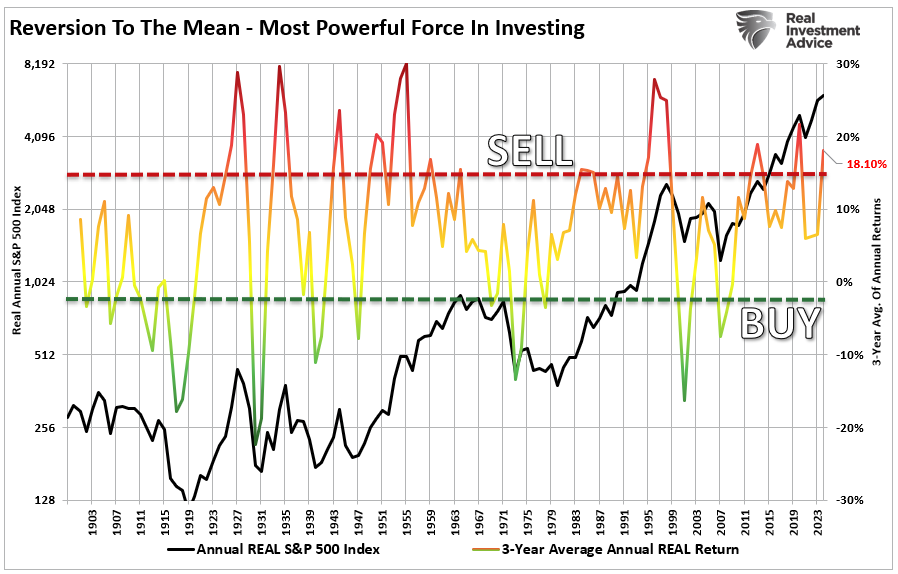

Here is another risk. The current 3-year return is 18% above its 3-year average. While that is not the highest level on record, when the index trades significantly above its moving average, volatility tends to rise. These periods often see sharp drawdowns, and corrections become more frequent, with increased variance in returns leading to larger losses in downturns, which compounds the problem. Secondly, there are declining risk-adjusted returns. When returns deviate significantly from the trend, future returns tend to revert toward the mean. This mean reversion is driven by stretched valuations resetting. Over time, high volatility and large price swings reduce compound returns. Even if average returns remain positive, the math of compounding is compromised by losses, weakening full-cycle gains.

Secondly, the economy is forecasted to grow around 2 percent, but there are signs of slowing. With consumer debt levels rising, delinquency rates on credit cards and auto loans inching higher, and student loan repayments resuming, those factors weigh on discretionary spending.

Third, while the Fed is cutting rates, investors have already priced those cuts into the market. However, inflation remains sticky, wage growth is still elevated, and jobless claims remain near lows. As such, if the Fed hesitates or signals fewer cuts, this could pressure valuation multiples, especially for growth stocks.

Fourth, consensus earnings remain extremely optimistic in relation to expectations for economic growth and inflation. That requires strong margins, global stability, and continued AI-driven demand. If any of these falter, earnings estimates will fall, and investors will reprice markets for lower multiples.

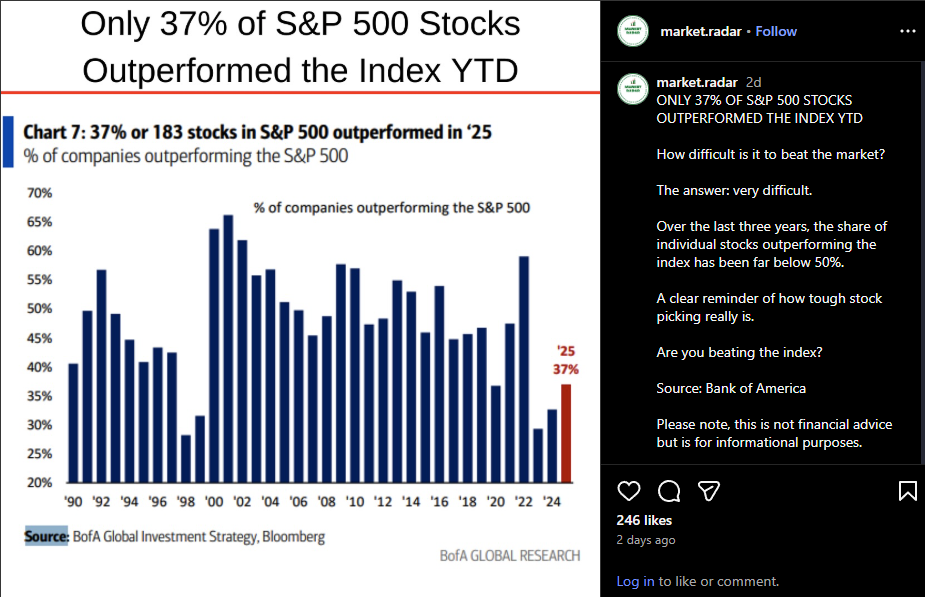

Finally, the 2025 rally was led by a small group of stocks with only about 37% of all issues outperforming the index. If leadership narrows or stalls, the index could struggle even if broader conditions remain stable.

Investors should also watch geopolitical risk. U.S. midterm elections, global conflict, or supply chain issues could disrupt assumptions; however, these are secondary concerns. The core issue remains earnings versus valuation. The higher the price you pay, the smaller the margin for error.

While this market is priced for a smooth glide path, the odds of turbulence are rising.

Strategy: What Investors Should Do Next

The playbook for 2026 isn’t about guessing market direction. It’s about managing risk, and understanding that with valuations high, earnings uncertain, and monetary policy in transition, your best move is preparation, not prediction.

The chart below combines the four potential predictions to show the possible market range for next year. Of course, you can analyze, make valuation assumptions, and derive your targets for next year based on your views. This analysis is an exercise in logic to develop a range of possibilities and probabilities over the next 12 months.

Valuations matter. At this stage of the cycle, you need to be more cautious—not more aggressive. Here’s how to position:

- Lower your return expectations. If you’re assuming another 15 to 20 percent gain next year, you’re betting against the data. Valuation history suggests forward returns will be lower, especially if earnings growth slows. A more reasonable expectation is mid-single-digit returns, with higher volatility.

- Reduce exposure to sectors with extreme valuations. AI might be real, but prices already assume perfection. Don’t abandon growth, but rotate toward quality. Look for companies with real cash flow, low leverage, and strong pricing power.

- Focus on quality. Companies with strong cash flow, low debt, and pricing power are likely to outperform in slower-growth environments.

- Increase Fixed Income. High-quality fixed income will shield portfolios against increased market volatility.

- Hold some cash. Not because you’re timing the market, but because flexibility matters. If volatility spikes, you want dry powder. That also gives you a chance to buy quality at a discount if the market pulls back.

- Most importantly, stop chasing narratives. AI is real, but that doesn’t make every AI stock a buy. The same goes for the “soft landing” story. Focus on the numbers. Stick with fundamentals.

In 2026, outcomes will depend on earnings, inflation, and the actions of the Fed. However, your results will vary based on your risk-management discipline, allocations, and portfolio structure. As such, it is important not to overreach, not to assume past returns will repeat, and to respect valuations.

That’s how you protect capital, and ultimately stay in the game when others can't.

The post 2026 Market Outlook Based On Valuations appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter