Central to any good investor’s decision-making process is determining the degree to which the target of investment is “robust to the downside.” Can the investment maintain its value—or even continue to provide sufficient return on capital—in the event of a pullback in the broader economy or a specific sector?

Warren Buffett has aptly referred to this feature as “margin of safety.” While critical to rational decision-makers, margin of safety seems quaint in today’s era of speculation and central bank front-running. Rather, in place of acquiring expertise and performing rational due diligence, speculators in capital markets rely on perpetually loose monetary policy and periodic bailouts.

Markets worldwide, but particularly in the US, now exhibit a profound lack of robustness. Central banks—the Federal Reserve foremost among them—have become enablers of the political and crony classes, responding to any material drop in asset prices with swift jawboning, followed by enactment of loose monetary policy until speculators’ nerves are settled.

The problem is that easy money entails a constant behind-the-scenes destruction of what’s truly important to an economy—sound money, low time preference, personal productivity, and quality of life—while emphasizing the frivolous and absurd.

The Greenspan-Fed Put

A put option or “put” is a contract that allows the holder to sell a security or asset at a specific price (“strike price”), regardless of the current price (“spot price”) of the underlying security or asset. Put options are actionable when spot prices decline below the strike price, allowing holders to exercise their put at the higher strike price, thus limiting their downside.

While the Federal Reserve had been acting as a backstop to capital markets for decades prior, the genesis of the Greenspan Put was 1987. October 19 of that year, now known as “Black Monday,” saw a single-day 20 percent drop in the US stock market. Invoking the familiar rationale of “systemic concerns,” newly-appointed Fed Chairman Alan Greenspan swiftly opened the monetary floodgates and lowered interest rates, reversing the prior trend of rate hikes. Perhaps more importantly, Greenspan issued a statement the day following Black Monday in which he expressed the Fed’s “readiness to serve as a source of liquidity to support the economic and financial system.”

Despite the “systemic concerns” canard, the stock market crash was the only noteworthy event on Black Monday. Credit markets did not seize up and the US Main Street economy was unimpacted. Greenspan’s Fed reacted exclusively to the drop in the stock market. Actions taken by Greenspan’s Fed led to an immediate rebound in stock prices, and all-time highs were reached soon after. Similar actions were taken by Greenspan multiple times during his tenure, including the absurd Fed-supervised bailout of Long Term Capital Management—a hedge fund comprising too-clever-by-half bond traders, academics, and other Wall Streeters who attempted to leverage and arbitrage their way into financial stardom but ended up losing billions.

Over the years, the Greenspan Put has morphed into the Fed Put, with successive Fed chairmen employing the same techniques as Greenspan in propping up stock prices, namely, loosening monetary policy at any hint of a downturn by injecting liquidity and lowering interest rates while jawboning the markets so as to settle nerves and allow institutional speculators to front-run such policy.

Current Fed Chairman Jerome Powell is of course guilty of this, even before the hyperbolic actions taken during the covid panic of 2020. In 2018, shortly after his appointment, Powell suggested he would raise interest rates and embark on a path of quantitative tightening—taking liquidity out of the banking system by selling off the Fed’s treasury portfolio. The stock market responded with a 20 percent decline, at which point Powell immediately reversed his position. Sensing the continuation of the Fed Put indefinitely, stock markets soon reached valuations not seen since the dot-com bubble of 1999 and capital markets across the board bid up valuations to all-time highs.

A study published in 2020 determined that not only does the Fed respond directly to stock market declines—particularly since Greenspan’s tenure in the 1990s—but such concerns are explicitly discussed in FOMC meetings. The authors of the study state:

We show that since the mid-1990s the Fed has engaged in a sequence of policy easings following large stock market declines in the intermeeting period.…

The structure of the Fed documents allows us to measure how frequently actual decision makers at the FOMC…mention the stock market…these mentions are strongly predictive of future policy and do so in an asymmetric way: mentions of stock market declines predict monetary easing, whereas there is no relationship between mentions of stock market gains and tightening. We verify the robustness of these findings using the FOMC transcripts.

The authors note further:

The statistical fact is that, since the mid-1990s, the Fed has tended to lower rates by an average of about 1.2 percentage points in the year after a 10 percent stock market decline…

Fed actions since the publication of this study in 2020—including the massive liquidity dumps of the covid panic era—only confirm these conclusions.

Zombie Companies

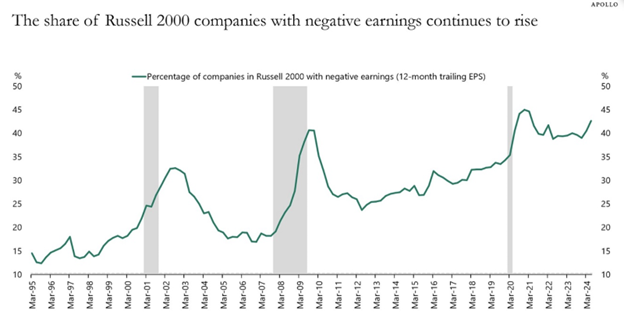

One result of permanently loose monetary policy is a profusion of “zombie companies”—those that can only survive in an environment where interest rates are artificially lowered. As evidence, consider the share of Russell 2000 companies (publicly-traded small-caps) with negative earnings, and notice how the percentage peaks shortly after each bubble burst, when interest rates are temporarily increasing. Despite decades of loose monetary policy, nearly half of these companies have negative earnings today.

Source: https://www.apolloacademy.com/40-of-companies-in-russell-2000-have-negative-earnings/

This phenomenon is not isolated to publicly-traded small-cap stocks. Myriad types and sizes of companies that shouldn’t exist—because they can’t provide sufficient value to compete in the free market—are propped up by cheap debt and other forms of subsidy. The existence of zombie companies is one concrete reminder of the profound weakness prevalent in our markets. Higher rates and a cessation of easy money policies would kill them all.

Contents are Fragile

Recently, the Japanese stock market index experienced a one-day drop of 12.4 percent, marking its worst day since Black Monday in 1987. The reason? A few days earlier, Japan’s central bank raised benchmark rates from 0.10 percent to 0.25 percent! Soon after this stock market tantrum, bashful and shamed Japanese bureaucrats reversed course and pledged to nervous investors that no more big, bad rate hikes would be forthcoming. The index recovered immediately.

If Japan is a dysfunctional and fragile zombie economy, the US is hardly better. After decades of coddling stock market speculators, crony bankers, and politicians greedy for asset bubbles to appease their voter base, the Fed is now stuck with an economy that lacks durability, to put it mildly. Real earnings and productivity growth through the free market have been sacrificed for increasing asset prices measured in a dollar that is rapidly and constantly losing value. Combined with record amounts of leverage in the system, this state of affairs can only devolve into chaos.

There is no politically viable way out, only the hard road back to sound money and fiscal discipline where interest rates are set by the market, not a central bank—a likelihood on par with pigs flying. Unlike bubbly asset prices propped up by a continually inflated dollar, robustness to the downside is a sign of genuine economic well-being. The ability of a market to tolerate downturns with resilience is what underlies its true strength. By that standard, the US economy is made of glass.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter