The number of residential construction workers has almost doubled since the aftermath of the financial crisis and housing bust. The graph below on the left shows that after a brief hiccup during the early days of the pandemic, the number of jobs in residential construction continued to rise despite higher interest rates. Moreover, the job count is approaching the levels of 2006, the peak of the early 2000s housing boom.

It has taken a while, but high interest rates are finally starting to impact new home builders negatively. This is a good example of the drawn-out lag effect of higher interest rates. Residential construction flourished despite higher rates as builders offered lower-than-market mortgage rates to draw in buyers. As a result, homebuilding jobs continued to rise. That may be ending based on the graph on the right courtesy of 3Fourteen Research. It shows that housing completions have outpaced new housing starts by the most since 2008. As we elaborate on below, with fewer new homes under construction and weaker homebuilder profits, homebuilders will likely have to start laying off workers in the coming months.

In our Commentary last week, we noted DR Horton's (DHI) poor earnings results, further confirming that new homebuilding is slowing rapidly and the number of residential construction jobs is likely to decline. To wit:

DHI’s earnings and revenue fell short of expectations. More importantly, its number of completed but unsold homes rose 17% over the quarter to 10,300. This is especially concerning as it is going into a seasonally slow selling period, and mortgage rates are up by over 0.50% over the last month. Further, making matters worse for shareholders, DHI reduced its revenue guidance from $39.4 billion to $36-37.5 billion.

What To Watch Today

Earnings

Economy

Market Trading Update

As noted yesterday, the market continues to derisk, unsurprisingly, heading into today's Presidential Election. As polls tightened over the last few days and the certainty of a Trump victory waned somewhat, investors took bets off the table. The MACD "sell signal" remains intact for now, but the market is holding support at the 50-DMA as the previous overbought conditions are reversed. The selloff was needed to "set the table" for a year-end rally post-election, regardless of who wins the White House.

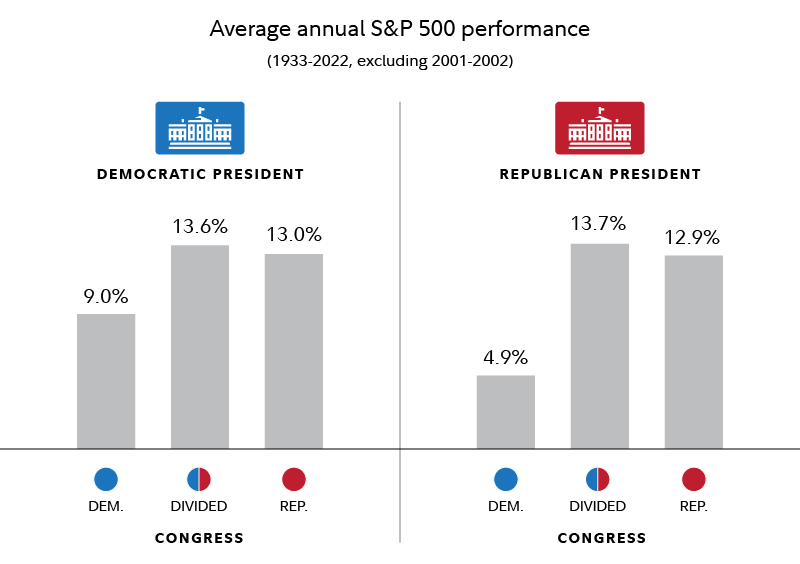

The only question is what sectors rally more: Technology, Financials, and Energy based on a Trump victory or Healthcare, Biotechnology, Green Energy, and Infrastructure with a Harris win. Regardless, Technology, due primarily to buybacks and market weightings, should do well under both candidates, with the best historical market outcomes coming from a split Congress. Such was noted in this past weekend's Bull Bear Report:

"Furthermore, there is a decent probability that the House and Senate will be divided regardless of who wins the presidency. Such an outcome limits the aggressive political policy changes that could impact corporate earnings. Unsurprisingly, Wall Street likes such outcomes."

This is a particularly charged election, emotionally speaking. There will be a lot of angst with whoever wins and a plethora of media headlines predicting the worst of possible outcomes. As investors, it is our job to look past the noise and realize that what drives the market is earnings and expectations, not extraneous headlines. The worst outcomes never materialize, and regardless of the President-elect, the markets tend to perform better than not over time.

Keep focused on the bigger picture in the long-term, and manage risk in the short term.

Small Business Are Feeling The Heat of High Rates

Our lead article indirectly discussed the lag effect of higher interest rates, which is finally weighing on new homebuilders and will likely result in layoffs for those with residential construction jobs. The graph and commentary below, courtesy of The Kobeissi Letter, further the argument that the lag effect is still in play and jobs in smaller companies may be at risk.

The average interest paid on US small business short-term loans spiked to 10.1%, the most in at least 13 years. Interest rates have now doubled in just 3 years. To put this into perspective, prior to the pandemic, interest rates on these loans averaged around 6.0%. Largely due to higher rates, small business earnings are now at their second-lowest level since the 2008 Financial Crisis, according to NFIB data. Small businesses need help.

Small And Mid-Cap Stocks Lead The Way

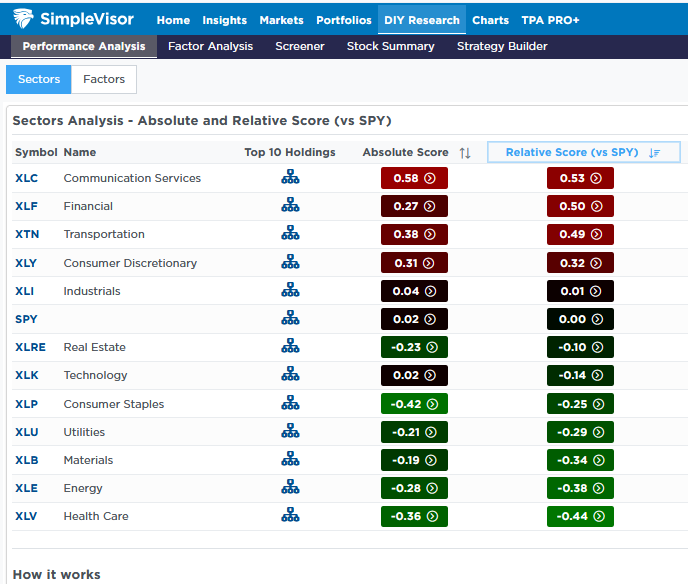

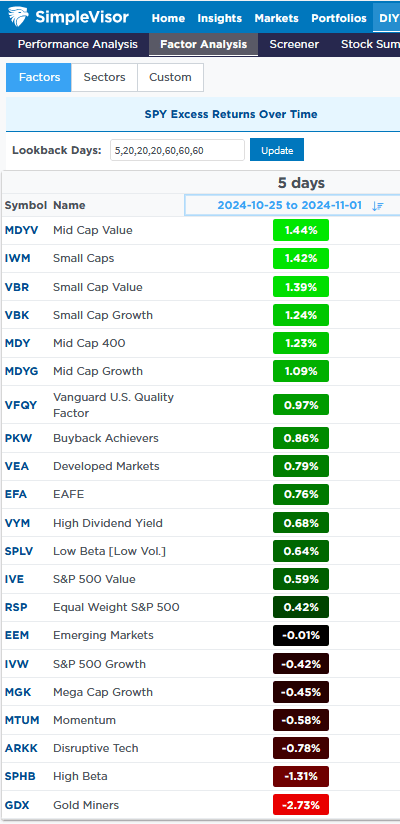

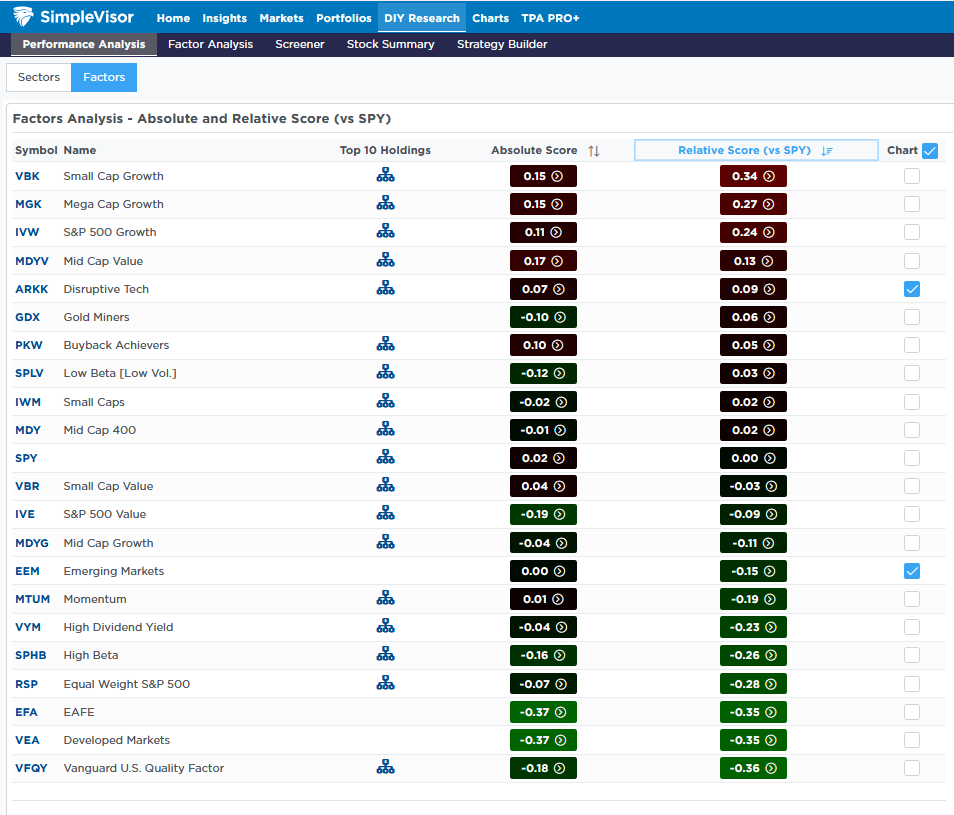

This week's SimpleVisor sector and factor analysis help show the benefits of the multiple tools in the DIY section. The first graphic below shows the S&P 500 conservative sectors tend to be the most oversold versus the market. Conversely, the cyclical sectors are overbought. The divergence is no doubt jockeying in front of the election. Ergo, take it with a grain of salt. Lacking from the sector analysis below is the fact that smaller companies led the way last week. We show this in the second graphic. The third screenshot is also interesting. It highlights that the top three most overbought sectors are growth, with small growth companies the most overbought.

Sector analysis is somewhat blind to factor analysis because it is comprised solely of S&P 500 companies. Furthermore, some sectors, like technology and communications, are primarily driven by a few of the largest growth stocks. Factor analysis uses stocks from multiple indexes. The combination of sector and factor analyses provides a broader view of the market, particularly on the type of stocks that are overbought or oversold.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Residential Construction Jobs At Risk appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter