A recent article co-authored by Stephen Miran and Dr. Nouriel Roubini, aka Dr. Doom, accuses the U.S. Treasury Department of using its debt-issuance powers to manipulate financial conditions. They liken recent Treasury debt issuance decisions to stealth QE. Per the first paragraph of the article’s executive summary:

By adjusting the maturity profile of its debt issuance, the Treasury is dynamically managing financial conditions and through them, the economy, usurping core functions of the Federal Reserve. We dub this novel tool “activist Treasury issuance,” or ATI. By manipulating the amount of interest rate risk owned by investors, ATI works through the same channels as the Fed’s quantitative easing programs.

Is their accusation reasonable?

Given the significant impact that liquidity has on financial markets, the answer is much more important for investors than it may appear.

Reviewing The Allegation

The authors claim that recent Treasury debt issuance patterns were intentionally implemented to boost economic activity and support the financial markets, thus easing financial conditions. Even more damning, the article insinuates the Treasury is using ATI “to stimulate the economy into election season.“

Below, we share a few quotes and our summarization of the article to bring you up to speed on their thesis.

Whereas Treasury has historically striven for “regular and predictable”-read: boring-issuance, recent aggressive changes to the relative levels of long- and short-term security auction sizes have made issuance irregular and unpredictable. Because Treasury is using this novel tool for managing financial markets and through them, the economy, we dub it “activist Treasury issuance,” or ATI.

Essentially, they assert the Treasury has purposely issued less long-term debt in favor of more short-term bills. The authors hypothesize its actions equate to an approximate one percent cut in the Fed Funds rate.

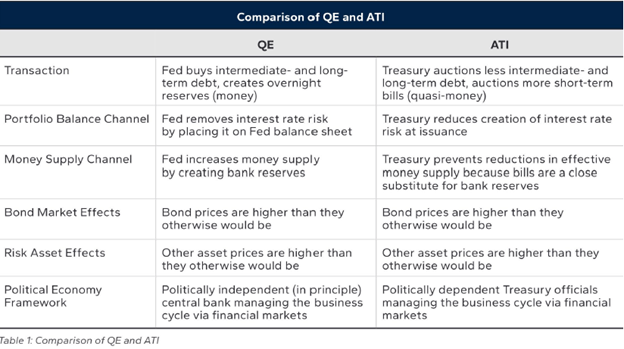

The article likens ATI to QE as follows:

Whereas QE works by removing interest rate risk from the market and hiding it away on the Fed’s balance sheet, ATI works by limiting the production of interest rate risk at the source. The net effect, however, is similar.

The paper states there are two channels through which ATI and QE operate.

The Portfolio Balance Channel

The portfolio balance channel argues that the financial markets have a fixed amount of total risk investors can hold in aggregate. If the Treasury were to issue bonds, thus adding duration risk to the market, investors would have to reduce other risks, i.e., sell different assets, to buy Treasury bonds. Therefore, investors can more easily absorb Treasury debt if the Treasury reduces or limits sales of its longer-term notes and bonds, which possess more duration risk.

Money Supply Channel

The money supply channel says issuing bonds instead of bills requires a more significant drawdown in bank reserves. Ergo, because Treasury bills require fewer reserves than bonds, the banking system retains more reserves when it owns bills versus bonds. Therefore, banks are less restricted in making loans that stimulate the economy and financial markets.

The following table summarizes their argument that ATI is stealth QE.

Historical Precedence

To further make their case, the article introduces “historical precedent.” They claim ATI is like the Fed’s “Operation Twist.”

Operation Twist, which originated in 1961, involved the Fed buying long-term Treasury notes and bonds and offsetting the purchase by selling short-term notes and bills. Such activity doesn’t change the Fed’s balance sheet size, but it has a market and economic impact.

Similarly, the paper argues that the Treasury can accomplish a comparable feat by issuing fewer bonds and more bills.

The authors deem such an act a “creative issuance policy to achieve unorthodox economic goals.” They believe that because the Fed has done Operation Twist numerous times with some success, the Treasury certainly appreciates the same game plan.

Debt Issuance Patterns

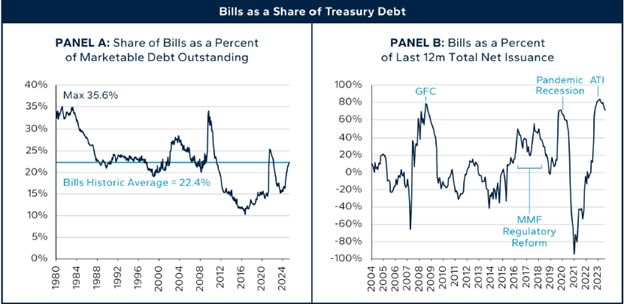

The authors write that in 2015, the Treasury decided to increase its share of bills to total debt issuance to 15% for various reasons. In 2020, they extended it to 15-20%. Per the authors, the motivation for the changes was not interest rates or the business cycle.

The graphs from the article show that bills as a percent of debt outstanding have recently risen to their long-term average of 22.4% due to significantly more bill issuance than other debt, as shown on the right. While the percentage of bills outstanding is only slightly above the 15-20% target, in dollar terms, the difference is substantial.

Our Take On Stealth QE

At first blush, the article makes an excellent case the Treasury is conducting stealth QE.

However, before drawing conclusions, let’s consider what the U.S. Treasury Department is tasked with regarding government funding. Per its website:

The Treasury Department’s primary goal in debt management policy is to finance the government at the lowest cost over time. To meet this objective we issue debt in a regular and predictable manner, provide transparency in our decision-making, and seek continuous improvements in the auction process. In creating and executing our financing plans, we must contend with various uncertainties and potential challenges, such as unexpected changes in our borrowing needs, changes in the demand for our securities, and anything that inhibits efficient and timely sales of our securities. To manage

Simply put, the Treasury Department is responsible to the taxpayers for funding the country as efficiently and cost-effectively as possible. To do so, it must foster healthy markets.

Let’s address their primary low-cost goal and “uncertainties and potential challenges” that they face in their task.

Reducing Debt Costs

In trying to fund the nation at the lowest cost over time, the Treasury Department always tries to determine how current interest rates compare to expected future rates. They have skilled market personnel and a committee of Wall Street executives to help them in this endeavor.

As shown below, short- and long-term Treasury yields have been decreasing for the last 40+ years. This is the result of slowing economic growth and lower rates of inflation. Suppose the numerous factors impacting yields over the previous 40 years continue to exert themselves as we and many economists expect. In that case, the pre-pandemic rate levels and trends are likely still intact. Accordingly, it’s fair to assume that short-term and long-term rates will gravitate back to pre-pandemic levels.

Let’s revisit the debt issuance graphs we showed earlier.

From 2012 through 2022, the issuance of Treasury bills as a percentage of all debt was well below average. During this period, longer-term note and bond yields were at or near historical lows. The Treasury was smartly terming out its debt needs instead of issuing short-term debt and risking reissuing it at higher interest rates when the debt matures.

That was an opportunistic funding decision that proved wise. It was not manipulation.

Borrowing Needs and Market Demand For Treasury Securities

Federal Deficits have been running well above average, forcing the Treasury to issue more debt than typical. Accordingly, the Treasury must carefully distribute its debt so they don’t overwhelm the demand for a specific maturity while not meeting the demand for another.

Money market balances have been soaring, causing retail and institutional investors to clamor for Treasury bills. At the same time, longer-term bond investors have been shying away from bonds due to inflation and worries that yields will increase further.

The Treasury doesn’t manage demand for its products; it only controls the supply. Given market conditions, it has made the most sense to meet the insatiable demand from short-term investors and try to limit the supply to longer-term bond investors choking on what could be deemed an oversupply of bonds.

Again, shifting issuance amongst different debt maturities constitutes smart funding decisions, not manipulation.

Fostering Healthy Markets

Headlines like the ones below occurred regularly through most of 2023 and the first half of 2024.

- “30-Year Treasury Auction Breaks Bad, Sinks Stock Market”- Barron’s November 2023

- “10-year Treasury yield rises above 4.5% following weak auctions” CNBC March 2024

- “Treasury yield end at four-week highs after another poorly received auction” Morningstar May 2024

- “Why Treasury Auctions Have Wall Street on Edge” WSJ December 2023

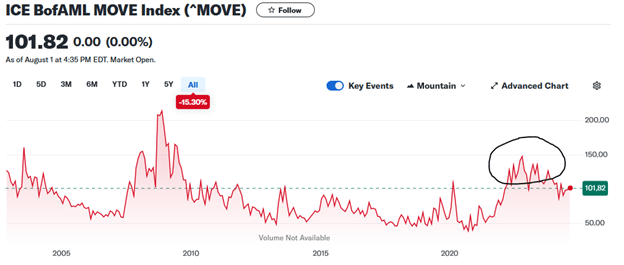

Large Treasury auctions, particularly longer-term maturity ones, overwhelmed the markets, resulting in poor auctions and extreme volatility. The graph below highlights that bond market volatility (MOVE) in 2022 and 2023 was the highest since the financial crisis. Volatility is a sign of market instability.

Should the Treasury have been issuing even more notes and bonds into a market exhibiting signs of instability?

From a market perspective, the Treasury was trying to limit the volatility in the bond markets, not elevate it. Taking such responsibility for market conditions is appropriate, not manipulation.

Rebuttal

Joseph Adinolfi of MarketWatch recently wrote about the Miran and Roubini article: Is the Treasury Conspiring to Manipulate Markets and the Economy? Within the article, he provides the following rebuttals to the paper’s assertions.

Lou Crandall, chief economist at Wrightson ICAP and a longtime follower of the bond market, rejected the paper’s conclusions in a report shared with MarketWatch. “The bottom line is that Treasury issuance over the past year has evolved in ways that are consistent both with its historical behavior and with more recent Treasury guidance,” Crandall said. “The Treasury is simply doing what it said it was going to do.“

“I can assure you 100% that there is no such strategy. We have never, ever discussed anything of the sort,” said Treasury Secretary Yellen in a comment shared with MarketWatch.

One Treasury official who spoke with MarketWatch but asked for anonymity said the paper misrepresented the importance of guidance issued by the Treasury Borrowing Advisory Committee. The paper’s authors used this guidance as a benchmark when calculating excess bill issuance by the Treasury.

Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott, said in an interview with MarketWatch. LeBas made a similar point about the impact of the Treasury’s bill issuance. “The authors are claiming when Treasury issues more short-term debt, that’s constructive for financial conditions, and when they issue more long-term debt, that’s negative for financial conditions,” he said. “Nothing in the world is that simple.”

LeBas added that the more likely scenario is that the Treasury is simply issuing debt along the segment of the curve where there is the most demand. Right now, that is on the short end.

Summary

Is the Treasury manipulating the bond market with stealth QE to boost the financial market and economy to help the Democrats win the election in November?

While it’s certainly possible, we think Treasury Secretary Janet Yellen did what was best for the taxpayers and the financial markets by adjusting its issuance patterns. Had the Treasury Department ignored troubling market signals and its low-cost funding objective, it would have significantly raised borrowing costs and possibly introduced bond market turmoil that could have easily spread to the equity and currency markets.

Recent Treasury debt issuance patterns are appropriate and will likely have and will save the nation significantly.

The post Stealth QE Or Rubbish From Dr Doom? appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,Investing,newsletter