Cyclical Outlook

- Growth to slow

- Inflation sticky

- Dollar firm

- Interest rates peaked but higher for longer

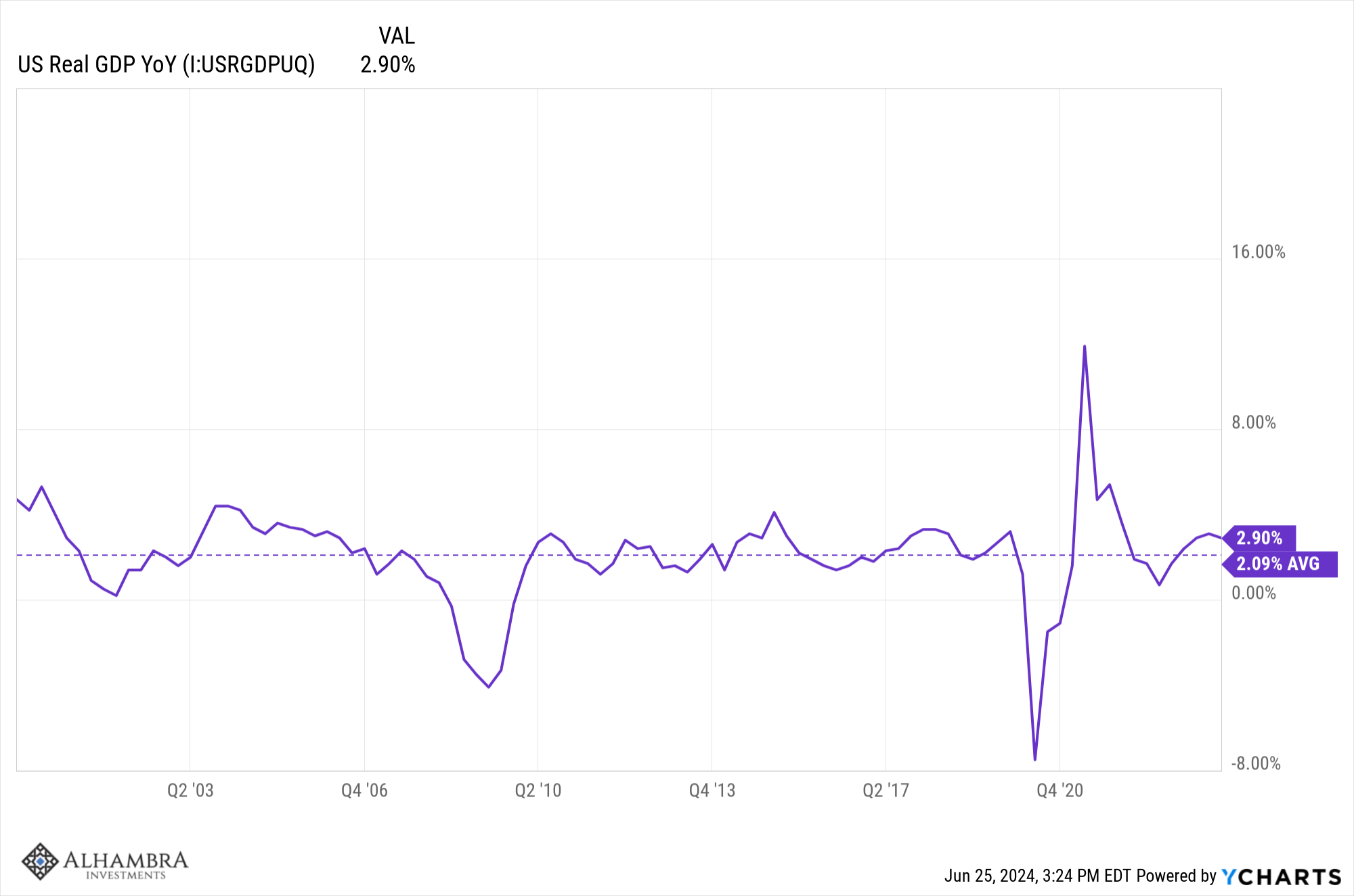

| Growth peaked on a quarter over quarter seasonally adjusted annual rate in Q3 last year at 4.9%. The preferred reading is on an annual basis where growth peaked in Q4 of last year at 3.13%. Growth in Q1 was 2.88% and growth in Q2 has risen some and is trending at right about 3%. Given the recent data trends and the fact that we are comparing against a hot Q3 2023 number, we have growth edging lower in Q3 2024 toward 2.5% and continuing to slow toward 2% (long term trend) over the next few quarters. | |

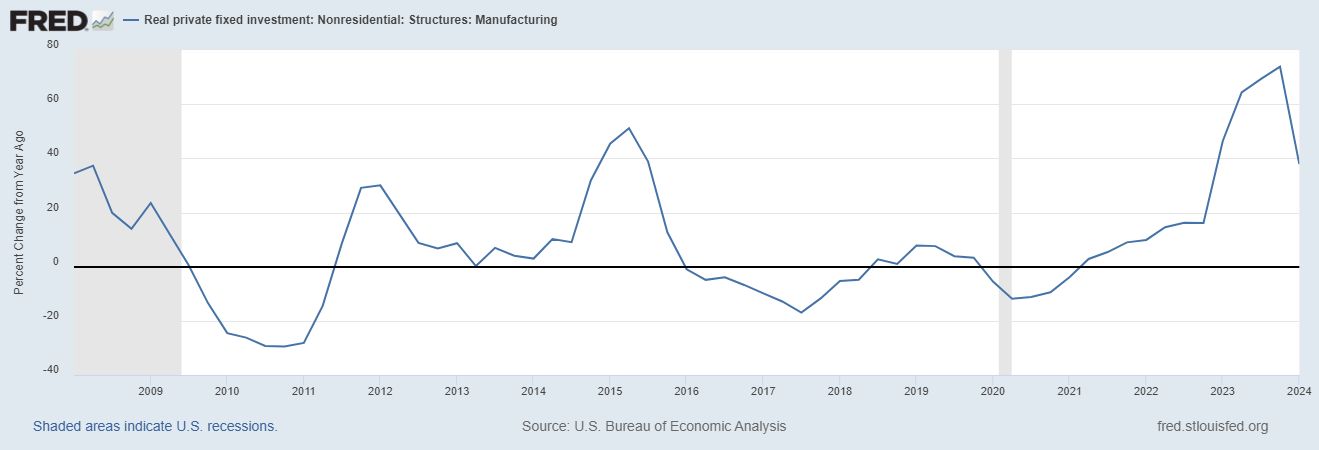

| One area of uncertainty is the spend rate for the IRA and CHIPs Act. While we believe the current administration will keep spending high through the election, next year is more uncertain. Much of this spending has shown up as Non-Residential investment in structures which fell to a mere 0.4% gain in Q1 2024 vs 10.9% in Q4 2023. This spending has offset weak investment in equipment which has been negative 4 of the last 6 quarters. | |

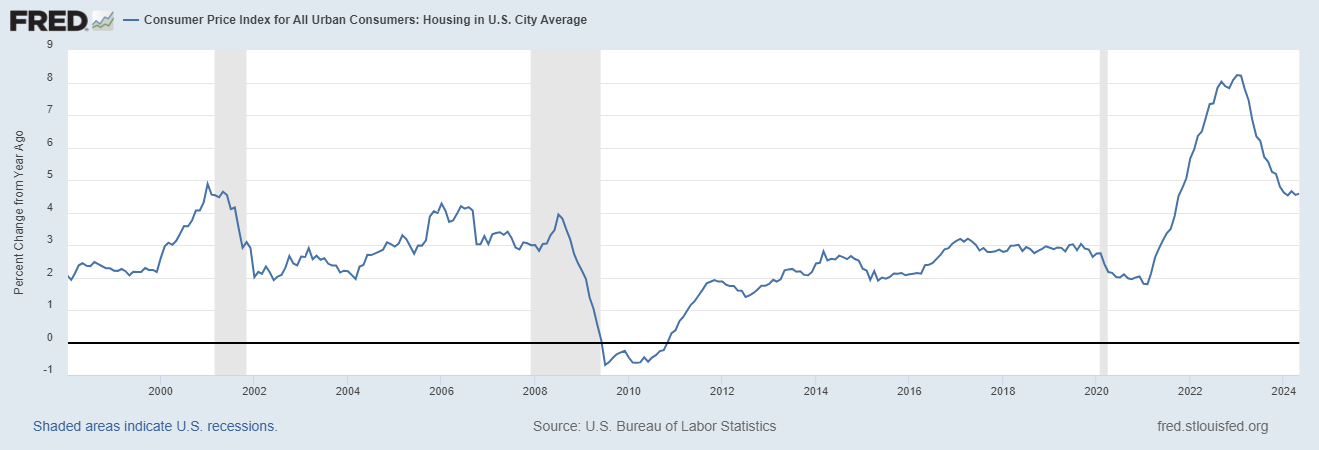

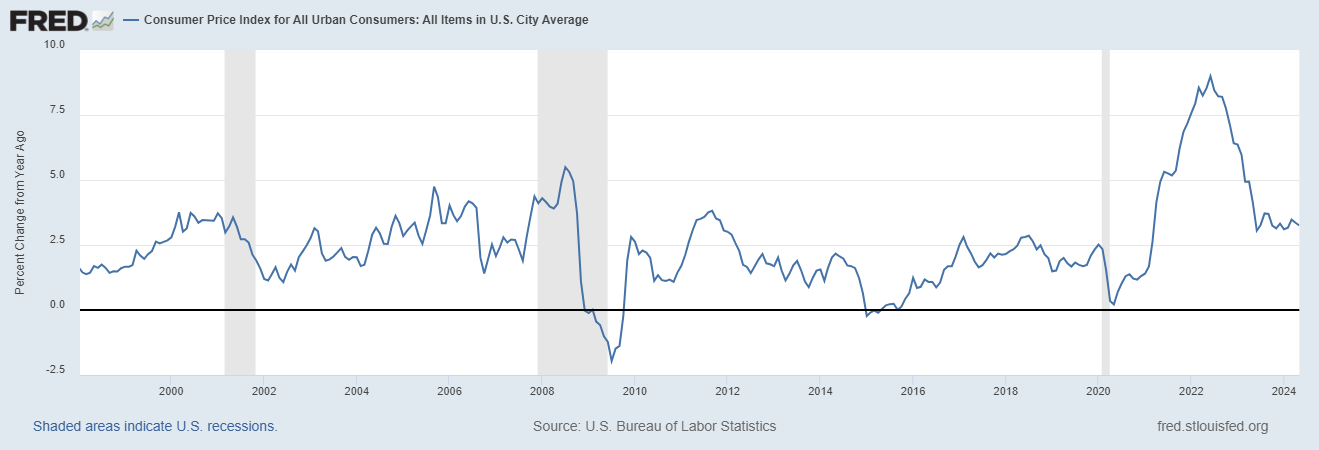

| Inflation on the other hand continues to be firm and looks set to accelerate. CPI in May is running 3.25%. Unfortunately, housing, which is the biggest piece of the pie, is no longer helping the number lower. Home prices continue to rise by more than 6% per year and last month, the cost of housing in the CPI calculation rose 4.55%. For now, we expect CPI to be flat to just slightly higher in Q3. Energy should offset the housing strength in Q3 because Q3 2023 was such a hot quarter for oil and energy. But after that, inflation is poised to move higher as both housing and energy will likely be adding to inflation. | |

| The dollar remains firm. Interest rates likely peaked for the cycle when growth peaked in Q3 last year but should remain higher for longer as inflation is sticky and likely rising by the end of the year.

As of now, the Fed appears set on 1 rate cut. With growth coming down and inflation being steady in Q3, the September meeting appears to be where they’ll get their opportunity. There has been a lot of speculation that the Fed would not move close to the election but we don’t share that view. There is no October meeting and it would take a drastic deterioration in economic growth prospects to cut intermeeting. But we think November is a live meeting because it starts the day after the election. We think the Fed will be focused on the evolution of the inflation data rather than the election. However, because we think inflation could be re-accelerating at the end of the year, we wouldn’t expect them to be able to cut again in 2024. |

The change in growth is reversion to a longer term mean and not concerning. The slowing of growth would only become concerning should there be a shock of some sort. Places to look for a shock are the usual suspects, employment, geopolitical, the financial system. Inflation is going to be the bugaboo. The CBO just put out a revision to its estimates. The deficit for 2024 is now expected to be $1.9T up from $1.5T resulting mostly from executive actions (student loan cancellations) and increased interest costs. If the cost of capital rises faster than growth, this is a problem.

As the US slows slightly, global manufacturing and trade is picking up, especially in Europe. India remains the darling economy. Asia appears to be slowing slightly. International manufacturing and trade was negative in 2023 but is expected to grow more than 2.5% in 2024 and more than 3.25% in 2025 according to the WTO. This will offset the slowing in the US.

Rebalance and favor: Commodities, Gold, ST fixed income, Secular growth, Quality, Momentum, Mid Caps, Energy, Utilities, Tech, Industrials.

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an investment recommendation, investment advice or an investment outlook. The opinions and conclusions contained in this report are those of the individual expressing those opinions. This information is non-tailored, non-specific information presented without regard for individual investment preferences or risk parameters. Some investments are not suitable for all investors, all investments entail risk and there can be no assurance that any investment strategy will be successful. This information is based on sources believed to be reliable and Alhambra is not responsible for errors, inaccuracies, or omissions of information. For more information contact Alhambra Investment Partners at 1-888-777-0970 or email us at [email protected].

Full story here Are you the author? Previous post See more for Next postTags: Alhambra Research,economic growth,economy,Featured,Federal Reserve/Monetary Policy,federal-reserve,FOMC,Markets,newsletter