The new year began amid optimism among investors. Equities and bonds rallied in January, clawing back some losses from last year. The dollar traded heavily, falling against most G10 and emerging market currencies. However, after the February 1 FOMC meeting, the dollar's sell-off exhausted the near-term selling pressure. An upside correction may be seen in the first part of February. We see this as a countertrend move and expect dollar weakness to re-emerge.

The reopening of supply chains and the still strong labor markets have seen the pendulum of sentiment push away from the pessimism seen in the waning months of 2022. There is increasing speculation of soft landings in the US and Europe, including by the vocal Fed critic Lawrence Summers and the International Monetary Fund. A relatively warm winter so far in Europe, conservation efforts, and securing ample supplies have averted the crisis that had threatened. The reopening of China and early data from the Lunar New Year holiday also boosted optimism. Still, sentiment is fickle, and the inversion of various parts of the US and European yield curves caution against thinking that the risks have passed.

Four developments are shaping the international economic and investment climate. First, US inflation continues to moderate. This allowed the Federal Reserve to slow its pace of tightening. The market thinks the Fed's tightening cycle that began in March 2022 is nearly over. The Fed funds futures strip continues to price a strong chance of a 5% terminal rate. The market is also confident that a rate cut will be delivered before the end of the year, even after the strong January employment report (flattered by updated seasonal adjustments and benchmark revisions). As the interest rate support weakened, the dollar continued to retrace the gains seen broadly since early 2021. To illustrate the change of trend for the dollar, consider that the 50-day moving average has crossed the 200-day moving average for G10 currency pairs, but the Canadian dollar.

Second, despite the lack of transparency, many are hopeful that the pandemic in China can be brief. Reports suggest increased traffic (pedestrian, auto, and public) in several large cities within a few weeks of the abandonment of the zero-Covid policy. Even though the government will reportedly take "golden share" stakes in Alibaba and Tencent, Beijing is expected to pursue stimulative measures, including boosting quotas for local government borrowing. New video games have been approved, and the crackdown on the tech sector may be over. Foreign investors have returned to Chinese stocks that trade on the mainland exchanges and in Hong Kong. The yuan's gains, in line the dollar's broad weak did not appear to meet much resistance from Chinese officials.

Third, European data mostly surprised on the upside. Even in the UK, where the Bank of England does not anticipate growth returning until next year, the economy is proving more resilient than expected. The European Central Bank delivered the half-point hike President Lagarde pre-committed to in December, and another 50 bp hike is likely at the next meeting in mid-March.

Weaker energy prices lower the cost of fiscal support and ease pressure on trade balances. The EU's ban on imports of petroleum products from Russia begins February 5. The focus of the energy risks is not on natural gas, which has seen the European one-month benchmark fall below 55 euros per megawatt hour from a peak of more than 340 euros at the end of last August. The new concern is about diesel, where supplies are low. It appears that some European buyers were stocking up on Russian diesel ahead of the embargo. The euro extended Q4 22 gains, while sterling consolidated the gains that took it from about $1.0350 in late September 2022 to $1.2450 in mid-December.

Fourth, the Bank of Japan surprised everyone in December by doubling the cap on 10-year Japanese government bonds to 0.50% and surprised again in January by doing nothing. Many remain wary of additional moves toward the exit from its extraordinary monetary policy. The BOJ is the last country with a negative policy rate (-0.10%). A continued unwinding of short-yen hedges and the continued pullback in US rates helped the yen extend its recovery.

After peaking near JPY152 last October, the dollar fell to around JPY127.25 last month, giving back half of its 2022 rally. However, the recent experience and extreme volatility indicate the eventual end of the Yield Curve Control will likely prove tumultuous and expensive. In the four days before last month's BOJ meeting, the central bank spent about JPY14 trillion (~$100 bln) buying Japanese government bonds. The Bank of Japan's balance sheet has risen by almost 20% in the past three months, while the ECB and Fed's balance sheets have been reduced. Nevertheless, the yen is the strongest of the G10 currencies over this period, rising by around 14.3% against the US dollar and around 4.4% against the euro.

The appointment of BOJ Governor Kuroda's replacement and two deputy governors may be one of the biggest political events in February. The latest reports suggest the government may submit its appointments to the Diet around February 10, and the candidate would face both houses in around February 16-21. The market will try to read into Kuroda's successor the trajectory of policy. If the current deputy, Amamiya Masayoshi gets the nod, it is seen as the strongest signal that the current thrust of policy will persist. Still, the spring round of wage negotiations (March) is a critical input. Last year's negotiations resulted in slightly less than a 2% increase. Pay raises are expected to average around 3% this year.

Starting with the January US CPI that will be released on February 14, the Bureau of Labor Statistics that compiles the data will update the weighted in the basket annually rather than its current practice of biennial adjustments, using two years of consumer expenditure data. It will use expenditure data from 2021 for the new weights for this year's basket. We expect US to fall sharply in the first half of this year, beginning with the January report.

A few days before the January CPI is reported, the BLS will also announce its new seasonal adjustment factors to reflect the price movements of the past year. This routine and technical recalculation could include revisions to the seasonal adjustment indices for the previous five years.

The now-customary brinkmanship over the US debt ceiling has begun again. The brinkmanship tactics look scary, but few genuinely think there will be a default. The US Treasury has a playbook to extend the time for the political negotiations, and these are seen lasting until at least late Q2. Investors have also become accustomed to this peculiar expression of American exceptionalism. The spending has been authorized, but the paying for it is used for partisan purposes to extract new concessions.

In the past, T-bills maturing in the period around when the Treasury runs out of room to maneuver have been avoided on the margins, resulting in slightly higher rates. Meanwhile, the cost of insuring against a possible default jumped. The one-year credit default spiked from about 14 bp to a little more than 75 bp, which is around where it peaked in 2013. In 2011, it was slightly higher. Still, the brinkmanship tactics look scary, but few genuinely think there will be a default. At the same time, contrary to a popular narrative about the lack of interest in US Treasuries, the coupon and bill auctions in January were strongly received, generating rates that were often lower than the activity in the when-issued market.

Emerging markets saw renewed interest in January, though flows into Chinese equities seemed to dominate. MSCI's Emerging Market Index rose nearly 9.2% last month. Its index of the developed markets rose a more modest 6%. The premium of JP Morgan's Emerging Market Bond Index over US Treasuries narrowed for the fourth consecutive month in January. Near 370 bp, it is the lowest since March 2022, when the Fed began hiking rates. The JP Morgan Emerging Market Currency Index rose by a little more than 3.5% in January to stand at a seven-month high. With the Federal Reserve perceived to be nearly over with its rate hikes, and China reopening, emerging markets have a favorable backdrop. They are vulnerable to the risks of recession in the US and Europe and weaker than expected growth in China.

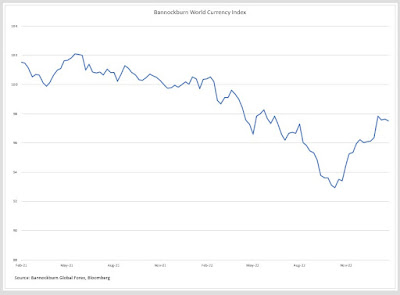

We see the appreciation of the BWCI confirming a significant trend reversal in Q4 22. The dollar's rally that pushed measures of valuation to historic proportions, is over, barring a new shock. The dollar's rally seemed increasingly driven by Fed policy, and that fuel looks spent. Still, the magnitude corrections have been modest at best, and for many pairs, the greenback moved broadly sideways to consolidate its losses. That said, a more significant correction appear to be unfolding. We suspect the BWCI could give back January's gain.

Dollar: The dollar fell against all the G10 currencies in January but the Swedish krona and Norwegian krone. US real sector data mostly disappointed, while price pressures are eased faster than expected. Real final sales to domestic private purchasers (excludes trade, inventories, and government spending), a measure of the underlying momentum of the US economy, ground to a near-halt in Q4 22 (0.2% annualized), even though the headline pace was 2.9%. Economic activity is set to slow further in the coming quarters. The Federal Reserve insists that additional hikes may prove necessary, but the market favors one more quarter-point hike in March. We expect US inflation will fall sharply in the coming months. Recall that CPI rose at an annualized pace of more than 10% in both Q1 22 and Q2 22. This surge will drop out of year-over-year comparisons. The labor market remains resilient, though the 517k rise in January nonfarm payrolls likely overstates the case. Before the Fed meets in March, it will see another employment report. The Dollar Index briefly traded below 101.00 after the FOMC meeting, but this may make a near-term low before corrective forces carry it back toward 103.80-104.00. That said, we anticipate that the dollar's upside correction may end before the January CPI report on February 14.

Euro: One of the most significant changes so far in the

new year has been perceptions of the reduced downside risks in the eurozone. The fear of a full-blown energy crisis has abated by a

relatively warm winter, conservation, shifts by German industry to other

energy sources, and weaker energy prices. Rather than contract in Q4 22, as

economists expected, the eurozone economy eked out a 0.1% expansion. Moreover, concerns about the Italian government under Prime Minister Meloni have eased. Italy's10-year

premiumItaly’s10-yearhas fallen from over 250 bp in late September to around

170 bp in the middle of January, the lowest since last April. Expectations that

the European Central Bank will be more aggressive than the Federal Reserve this

year have also helped underpin the euro. The ECB delivered the 50 bp hike on

February 2 that President Lagarde pre-committed to in December and strongly

signaled another hike of the same magnitude in March. Even though speculators

in the futures market have amassed a significant long euro position and

momentum indicators are stretched, euro pullbacks have been limited to less

than two cents since late November. Still, the move above $1.10 after the

February 1 FOMC meeting may have satiated near-term euro appetites. Key

technical support is seen in the $1.0700-50 area.

(February 3 indicative

closing prices, previous in parentheses)

Spot: $1.0795 ($1.0610)

Median Bloomberg One-month Forecast $1.0745 ($1.0590)

One-month forward $1.0815 ($1.0620) One-month

implied vol 8.1% (8.7%)

Japanese Yen: The Bank of Japan made good on its claim

that the adjustment of the 10-year yield band in December was not an abandonment

of its extraordinary monetary policy. Not only did it stay the course in

January, but it increased the flexibility of the facility that lends money to

commercial banks for their purchases of government bonds. The BOJ also

underscored its macroeconomic assessment that stimulus is still needed by

continuing to forecast sub-2% inflation in the next fiscal years and shaving its

growth forecasts. Many market participants are still skeptical of the

sustainability of Japan's monetary policy. The swaps market continues to

price in a positive target rate in Q2, which currently stands at -0.10%. While

the balance sheet of other major central banks, including the Federal Reserve

and the European Central Bank, have continued to be reduced, the BOJ's balance

sheet grew more than 3.3% last month. Still, the yen rose by about 0.8%

against the dollar last month. It was the third month that the yen

appreciated, and since the end of October, it has risen by by 14.3. With last month’s

losses, the has given back almost half its gains against the yen from the pandemic low in March 2020 (~JPY101.20) to the late October high

(~JPY152). Since the December surprise, the greenback has not traded above

JPY135.00 but looks poised to re-challenge it in the coming weeks.

Spot: JPY131.20 (JPY134.45)

Median Bloomberg One-month Forecast JPY130.55 (JPY134.70)

One-month forward JPY130.70 (JPY134.30) One-month

implied vol 12.2% (12.5%)

British Pound: After recovering from the historic low

at the end of September near $1.0350, sterling has gone nowhere since

approaching $1.2450 in mid-December. It traded roughly between $1.1850 and $1.2450 in January. The inability to rise above there suggests the "bulls" are exhausted. A return to January's low seems likely, and a break of it would significantly damage the technical outlook. Indeed, a downside breakout could spur a move toward $1.1400 as a preliminary target. The British

economy is in the poorest shape of the G7 and was the only major country for

which the IMF cut its outlook. With the 50 bp rate hike on February 2, bringing

the base rate to 4%, the Bank of England was not quite as pessimistic as it had

been. It sees a shallower and shorter recession than it did late last year. The

0.5% contraction now expected is in line with the IMF's projection. However, the BOE is more pessimistic about 2024 and sees a contraction of 0.25%, while the

IMF anticipates the economy growing by 0.9%. While inflation risks are still

seen to the upside, the BOE's newest inflation forecast has CPI falling to around

4% this year from 10.5% at the end of 2022 and warns it could fall below 2%

by the end of 2024. The swaps market anticipates one more hike for 25 bp,

likely at the March 23 meeting.

Spot: $1.2055 ($1.2015)

Median Bloomberg One-month Forecast $1.2080 ($1.1990)

One-month forward $1.2065 ($1.2020) One-month

implied vol 9.8% (10.6%)

Canadian

Dollar: With

the quarter-point hike last month, Bank of Canada Governor Macklem laid to rest

any lingering speculation of a hike at the next meeting in March. His

indication of a pause was explicit, and in so doing, became the first of the G7

central banks to suggest its tightening cycle may be over, provided the economy

evolves as officials expect. It anticipates growth slowing this year to 1% from

about 3.6% last year. Inflation is seen falling back into the 2%-3% range by

midyear as 2% by the end of next year. The housing market has softened sharply,

and business confidence is at a two-year low. Over the past three months, the

US dollar has traded roughly CAD1.3225-CAD1.3800 and averaged about

CAD1.3485. The CAD1.3550 area is a reasonable corrective target for the next couple of weeks. The correlation between changes in the exchange rate and the S&P

500 eased a bit last month but remains high enough (~0.67) not to ignore. Without

encouragement from the Bank of Canada, the market is pricing nearly 50 bp of

cuts before year-end.

Spot: CAD1.3400 (CAD 1.3610)

Median Bloomberg One-month Forecast CAD1.3400 (CAD1.3610)

One-month forward CAD1.3395 (CAD1.3615)

One-month implied vol 7.2% (7.7%)

Australian Dollar: Through the last full week in

January, the Australian dollar appreciated 12 of the 15 weeks since

mid-October. In fact, since then, the New Zealand and Australian dollars have

benefitted from the US dollar's turn (~15.8% and 13.8%%, respectively). January's 3% gain was the best of the G10 currencies and was driven by the optimism

about China reopening and a reassessment, considering the stronger inflation, of the outlook for monetary policy. With inflation still accelerating into the end

of last year (7.8% year-over-year in Q4 22 from 7.3% in Q3 22), the market has

come around a bit more to our expectation that the central bank will hike 25 bp

when it meets on February 7. That would bring the overnight cash target rate to

3.35%. The swaps market sees a peak near 3.75%. With gains to about $0.7140

last month, the Australian dollar has retraced a little more than half of its

losses from the February 2021 high slightly over $0.8000. The technical correction could see the Australian dollar test its 200-day moving average near $0.6800.

Spot: $0.6925 ($0.6735)

Median Bloomberg One-month Forecast $0.6910 ($0.6720)

One-month forward $0.6930 ($0.6740) One-month

implied vol 12.8% (12.5%)

Mexican

Peso: The

dollar not only retested the Q4 low against the Mexican peso (~MXN19.04), but as we

anticipated, it fell to almost MXN18.5665, its lowest level since March 2020

around the middle of January. The general risk-on optimism at the beginning of the year

and softer-than-expected US CPI helped lift the peso. Moreover, even though

AMLO has not pursued investor-friendly policies, its low funding needs,

relative stability, and high-interest rates provide a conducive backdrop. Not only are fixed-income investors attracted to Mexico, but the Bolsa is among the

best performers in January, rising about 12.5% and fully recouping last year's

loss (~-9.0%). The central bank meets on February 9 and is expected to match

the Fed's move, which would lift the overnight rate to 10.75%. The swaps market

expects the terminal rate to be at 11.0%. It is also anticipating a cut later

this year as growth is seen grinding to a halt in the middle two quarters and

inflation falling below 6% from 7.8% at the end of last year. The dollar

snapped back after testing MXN18.50. A near-term correction can see it recover

toward MXN19.30-MXN19.50.

Spot: MXN18.97 (MXN19.4375)

Median Bloomberg One-Month Forecast

MXN19.25 (MXN19.48)

One-month forward MXN19.06 (MXN19.4580) One-month

implied vol 10.1% (11.0%)

Chinese Yuan: Reports of activity during the

Lunar New Year holiday and the jump in the January PMI (composite of 52.9, the

highest since last June) encourage investors to anticipate a strong

reopening. Foreign investors have returned to Chinese equities. The CSI

300 rose nearly 7.4% in January, and the index of mainland shares that trade in

Hong Kong rose by 10.7%. While the US tightens restrictions on China's access to

semiconductor fabrication capability, China is threatening to impose export

controls on solar wafers. The US gets around 80% of its solar panel supply from

Asia. China appears to have toned down its "wolf diplomacy," but its aerial harassment of Taiwan continues, and the "spy balloon" over the US does not "help matters. The National People's Congress is in March. It is the next important event for Chinese policy and personnel changes. The JP Morgan Emerging Market Currency Index has risen by about 6.25% over the past three months. The yuan

rose by about 2.15% against the dollar in January. It was the third consecutive

monthly increase. Over the three months, it has risen by a little more than

8.1%, which is near the median gain of the G10 currencies. The upside correction for the greenback can see it rise toward CNY6.88-CNY6.90.

Spot: CNY6.7980 (CNY6.9820)

Median Bloomberg One-month Forecast CNY6.80 (CNY6.99)

One-month forward CNY6.79 (CNY7.0150) One-month

implied vol 8.9% (7.35%)

Tags: Featured,macro,newsletter