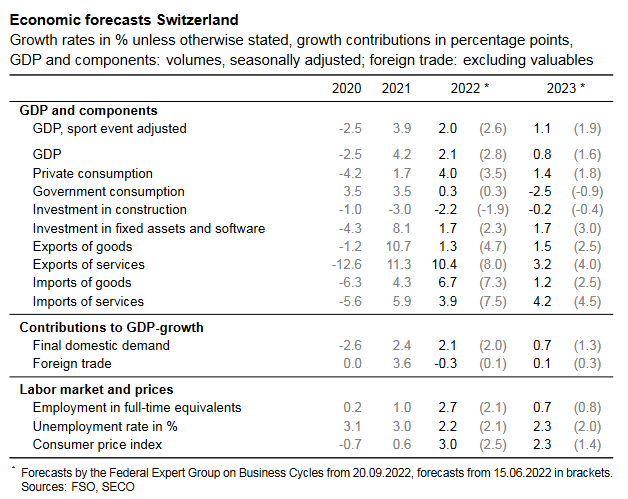

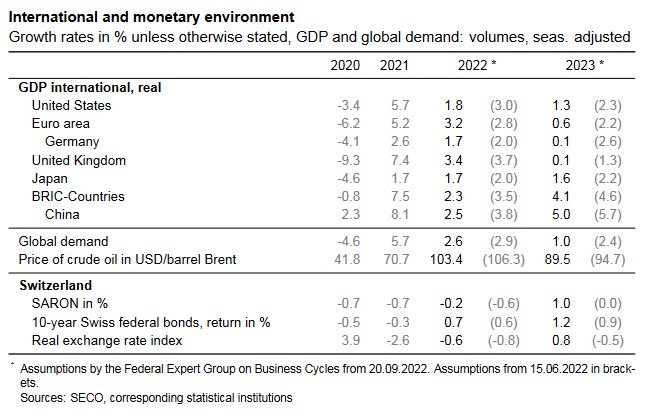

Economic forecast: marked slowdown on the horizonThe expert group on business cycles has significantly downgraded its expectations for Switzerland’s GDP growth to 2.0% for 2022 and 1.1% for 2023 (GDP adjusted for sporting events). After a positive first half of the year 2022, the Swiss economy now faces a deteriorating outlook. A tense energy situation and sharp price increases are weighing on economic prospects, especially in Europe.1 As expected, the Swiss economy continued to recover during the second quarter, if somewhat less vigorously. GDP growth was driven by the service sector. In particular, consumer spending has picked up substantially in leisure, hospitality and travel since the lifting of public health restrictions. However, the current economic indicators present a mixed picture. Favourable employment data should continue to prop up consumer spending, given that inflation in Switzerland remains modest by international standards. Parts of the domestic economy should therefore continue to recover. Nonetheless, the challenging international environment is likely to exert increasing pressure on the more cyclical segments of export-oriented industries. The group of experts has significantly lowered its expectations for global demand; in particular, growth in the euro zone, the United States and China, Switzerland’s key trading partners, is expected to be weaker than assumed in the June forecast. Overall, the expert group expects Swiss economic growth to lose momentum in the near term. Beyond that, the general state of the Swiss economy will depend largely on how the situation evolves in the global economy and in regard to energy supplies. The sharp drop in Russian gas flows and the limited availability of French nuclear power stations have raised the risk of energy shortages in Europe. On the other hand, European gas storage facilities have been swiftly replenished so far, and various energy-saving measures by households and companies are set to lower energy consumption considerably over the coming months. The expert group is basing its forecast on the assumption there will not be a severe energy crisis with widespread production stoppages. Against this backdrop, the expert group projects economic growth for Switzerland of 2.0% in 2022 (GDP adjusted for sporting events). The downward revision since the June forecast (2.6%) is partially explained by the fact that, according to the latest data, the recovery in 2021 was stronger than initially thought, thereby leaving less catch-up potential overall. |

|

| For the year 2023, the expert group has lowered its GDP growth forecast significantly to 1.1% (adjusted for sporting events; forecast from June: 1.9%). In the context of stronger price dynamics and a tighter monetary policy, demand abroad up to the end of the forecast horizon is likely to expand less than assumed in the June forecast. This is a burden on the Swiss export economy. Moreover, rising energy prices means that Switzerland can also expect higher infla- tion rates than originally projected (upward revision of the inflation forecast to 3.0% for 2022 and 2.3% for 2023). In turn, this is likely to result in a cooling of domestic demand.

Following a strong first half of the year, employment growth is expected to wane in line with the economic slowdown, with unemployment starting to edge up in the fourth quarter. The average annual unemployment rate is projected to come in at 2.2% for 2022, followed by 2.3% in 2023. Economic risksThe Swiss economy would be severely affected if there were to be serious gas or electricity shortages in Europe with large-scale production stoppages and a marked downturn. Such a negative scenario2 would likely lead to high domestic price pressures and, at the same time, a downward trend in the economy. In the face of rising interest rates, the risks associated with the surge in global debt are inten- sifying. There is an increased probability of financial market corrections. In real estate, too, risks remain both in Switzerland and abroad. At the same time, there is the danger of inflation proving more persistent than previously assumed. This could make it necessary to adopt a tighter monetary policy internationally. Pandemic-related setbacks cannot be ruled out, for example as a result of new virus variants. In particular, China’s economy could be further weakened by ongoing strict containment measures, with repercussions on the global economy. It is also possible, however, that the economy will fare better than projected. This could be the case, for example, if the energy situation turns out to be milder than expected or eases more quickly. Such a positive scenario2 would likely mean lower inflation rates and more robust demand at home and abroad. |

Tags: Featured,newsletter