Monthly Archive: June 2022

Foreign currencies going off Swiss central bank menu

Switzerland’s central bank is buying lower volumes of foreign currencies to support the franc as it balances the needs of exporters with the rising cost of goods.

Read More »

Read More »

Stocks Hit as Central Banks Brandish Anti-Inflation Efforts

Overview: Central banks are committed to combatting inflation even as the economies weaken. This is taking a toll on investor sentiment and is dragging down equities.

Read More »

Read More »

Russland setzt Mehrwertsteuer für Crypto-Firmen aus

Aufgrund der westlichen Sanktionen verändert sich die weltweite Finanzwelt. Neben der Ukraine ist davon vor allem Russland selbst betroffen. Nun hat die russische Regierung angekündigt, die Mehrwertsteuer für Crypto-Unternehmen in vielen Bereichen auszusetzen.

Read More »

Read More »

International tourism still strongly impacted by the COVID-19 crisis in 2021

The COVID-19 crisis continued to have a major impact on the tourism sector in 2021. After the shock of 2020, there was still no return to the pre-pandemic situation. The number of people travelling remained well below 2019 levels. Revenue (foreign visitors to Switzerland) in the tourism balance increased to CHF 10.1 billion, standing at 43.9% below its 2019 level.

Read More »

Read More »

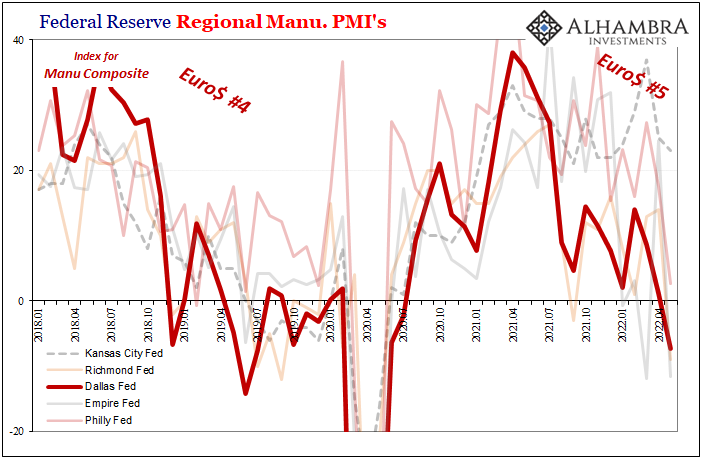

It’s Inventory PLUS Demand

It’s not just the flood of never-ending inventory. That’s a huge and growing problem, sure, as the chickens of last year’s short-termism overordering finally come home to their retailer roost. Being stuck with too many goods isn’t necessarily fatal to the global and domestic manufacturing sectors.

Read More »

Read More »

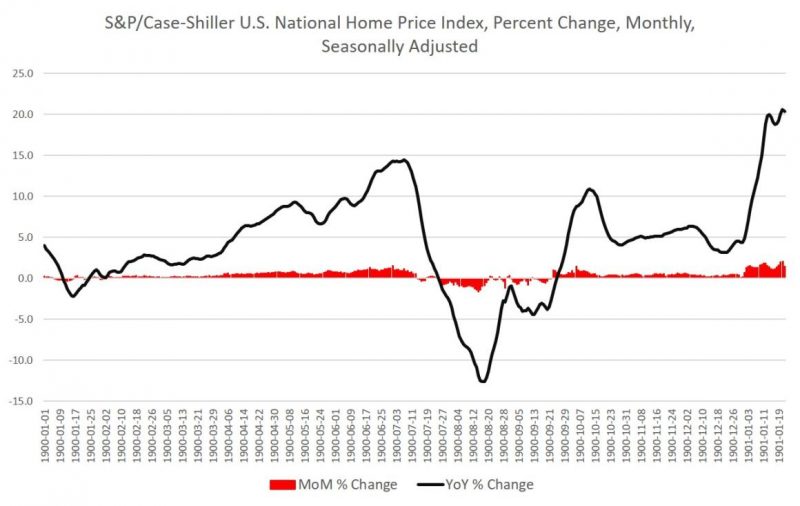

What Will It Take to End Rampant Home-Price Inflation?

Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we'll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession. But when it comes to the latest data on home prices, there's still no sign of any deflation or even moderation.

Read More »

Read More »

‘Hidden’ costs of transport total CHF14 billion

Negative costs on third parties caused by transport in Switzerland amounted to CHF14 billion ($14.7 billion) in 2019. The damage mainly affects the environment and climate, but also health.

Read More »

Read More »

Economic Winter Has Arrived

The average card-carrying Austrian would say that the Federal Reserve is creating money by the bale, with evidence being Consumer Price Index prints of 8.6 percent per the Bureau of Labor Statistics or over 15 percent per John Williams’s shadowstats.com computation based on the way the government calculated CPI back in 1980.

Read More »

Read More »

Spanish Inflation Shocks

Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today.

Read More »

Read More »

Letting Retirees Save for Healthcare Tax-Free

Health Savings Accounts (HSA) for retired folks. Isn’t that a novel idea? But it’s being considered in Congress—The Health Savings for Seniors Act, H.R. 3796.

Read More »

Read More »

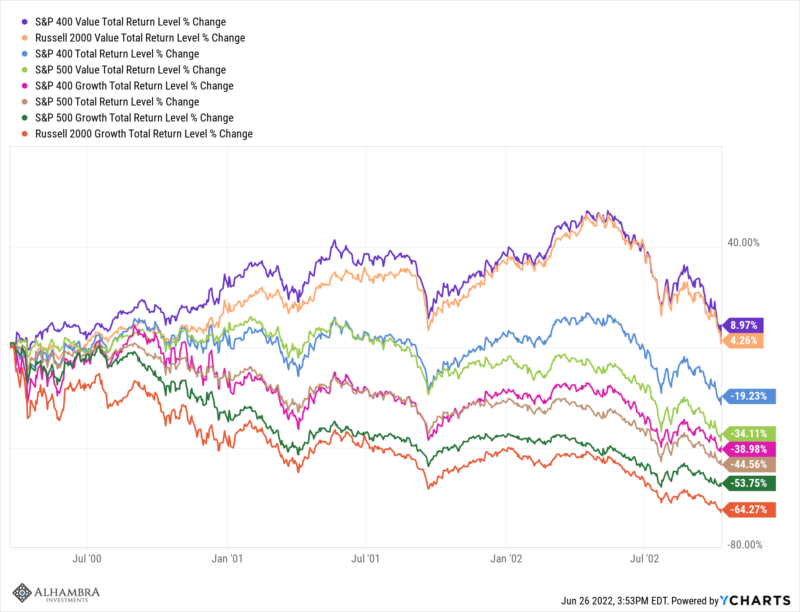

Weekly Market Pulse: Expand Your Horizons

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

Contra Ben Bernanke, the Gold Standard Promotes Economic Stability

Currently the world is on a fiat money standard—a government-issued currency that is not backed by a commodity such as gold. The fiat standard is the primary cause behind the present economic instability, and is tempted to suggest that a gold standard would reduce instability. The majority of experts however, oppose this idea on the ground that the gold standard is in fact a factor of instability.

Read More »

Read More »

Novartis to cut 1,400 jobs in Switzerland

Swiss pharmaceutical company Novartis is laying off more than one in ten employees in Switzerland over the next three years – 1,400 of 11,600 jobs will go. It also plans to cut 8,000 of 108,000 jobs worldwide.

Read More »

Read More »

Crypto Companies Put the Brakes on Sports Sponsorship Amid Market Crash

This year’s cryptocurrency crash, which saw the market lose more than half of its value in the span of six months, is threatening to bring sports sponsorship deals to a halt as crypto companies look to cut costs.

Read More »

Read More »

No Turn Around Tuesday

Overview: The global capital markets are calm today. Most of the large bourses in the Asia Pacific extended yesterday’s gain. Europe’s Stoxx 600 is advancing for the third consecutive session and is near two-and-a-half week highs.

Read More »

Read More »

Crypto.com integriert Apple Pay

Crypto.com gehört zu den größten Playern des Cryptomarktes. Durch großzügige Kreditkarten und Zinsmodelle hat man viele Nutzer angezogen, die mit der Crypto.com Debit Card Cryptocoins für Einkäufe online und auch offline nutzen können.

Read More »

Read More »

How Governments Expropriate Wealth with Inflation and Taxes

In an interview with the Wall Street Journal, Treasury secretary Janet Yellen admitted that the chain of stimulus plans implemented by the US administration helped create the problem of inflation.

Read More »

Read More »

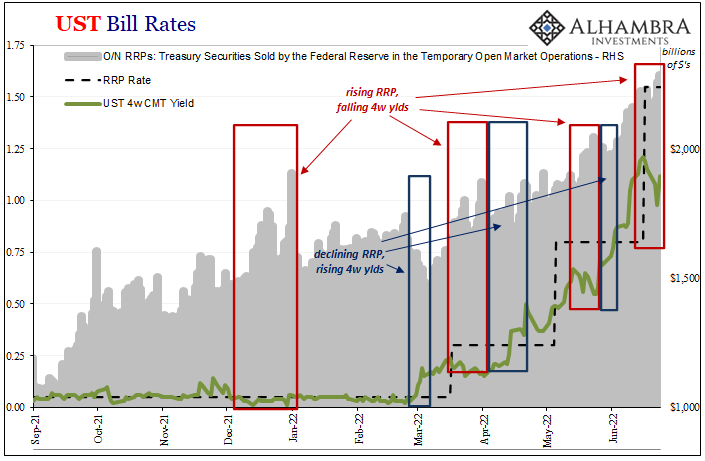

The Biggest Risk, No Surprise, Collateral

It’s not just the 4-week T-bill rate which is defying the Fed’s illusion of control, though that’s where the incidents are most evident. The front bill is nowhere close to the official RRP “floor” which can only mean one thing: collateral shortage, a large and persistent liquidity premium.

Read More »

Read More »

A Critique of Neoclassical and Austrian Monopoly Theory

One of the most controversial areas in Austrian economics, and one where even long-established Austrian theorists differ sharply, is monopoly theory. Indeed, as we shall see below, the differences are not merely semantic, nor are they confined to detail or some minor theoretical implication.

Read More »

Read More »