Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days. That still leaves the market 13.7% from the intraday high and most investors still down double digits on the year (-11.5% for the standard 60/40 portfolio). For Alhambra investors, the typical moderate risk account is down 4 to 5% or less than half the 60/40. That fact is something to be proud of I suppose but frankly, I hate being down at all. But drawdowns are part of being an investor and the best you can hope for is to minimize them when they happen. Alpha across a full cycle is made during the down phases so we’re getting ahead of the game this year.

We’ve been able to outperform this year because of how we positioned our portfolios last year. We don’t own the S&P 500 or much in the way of growth stocks. Our equity exposure is in dividend and value funds and individual stocks. A typical moderate account (that’s the vast majority of our accounts) holds nearly 15% cash. Those were tactical decision but our strategic framework also deserves a lot of credit. We have a strategic allocation that always includes some commodities and gold. Those have been a huge assist this year even though we weren’t carrying a full allocation of either. So, we have a solid strategic framework and we made some good tactical decisions.

To continue outperforming though, we will need to make more good tactical decisions which is what prompts the question in the title of this post. If the bear market is over, we need to get fully invested – we need to put that cash to work – but if it isn’t we need to stand pat or get even more defensive. Unfortunately, no one can tell you when the market has hit a top or a bottom with any degree of accuracy. There are many indicators you can use but none of them are infallible. Markets are groups of individuals making independent decisions, influenced by a myriad of factors, from politics to personal experience to personal financial condition to the latest Tweet by their favorite guru and well, just about anything else you can think of. Most people in markets are not making cold calculated, rational decisions and oh by the way, if there are actual people who can pull that off, they are probably lousy investors. Investing decisions are always made with a large dose of uncertainty; there is no calculation you can make that will allow you to buy or sell at just the right time.

There have been many times in my career when I looked at a stock or a market and knew it was over or undervalued. But that knowledge isn’t useful until others – many others – start to see what I see. In the meantime, the price of those over or undervalued assets can and do continue to defy rational calculation, sometimes even to the point of absurdity. Finding that point where an asset has reached a peak or trough is a psychological question, not an economic one, especially when we’re talking about markets more generally

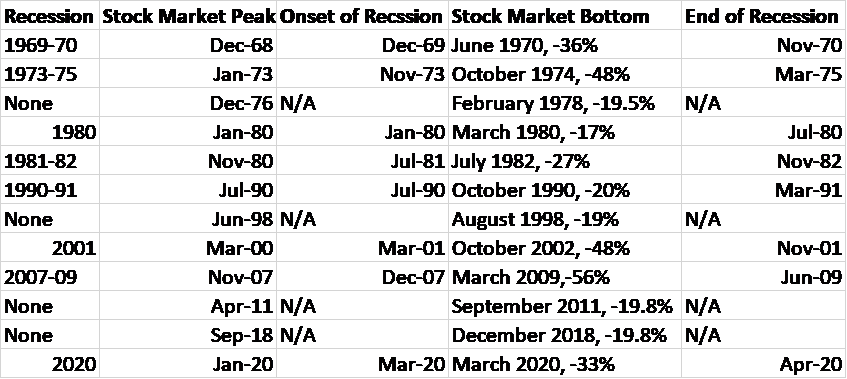

| We have had bear markets without recessions and we’ve had near bear markets without recessions. We have had stock markets peak as much as a year before the onset of recession and markets peak coincident with the onset of recession. We’ve had stock markets bottom 6 months before the end of recession and 11 months after recession ended. In general, the most common pattern is for the stock market to peak before the onset of recession and hit bottom before the recession is over. How far in advance of the beginning and end is a WAG but 6 months before the start and end is probably close enough. And that makes sense if markets are indeed the discounting mechanisms we think they are. Given that, you’d probably be better off trying to predict the economy based on the stock market than the other way around. But neither is very accurate. | |

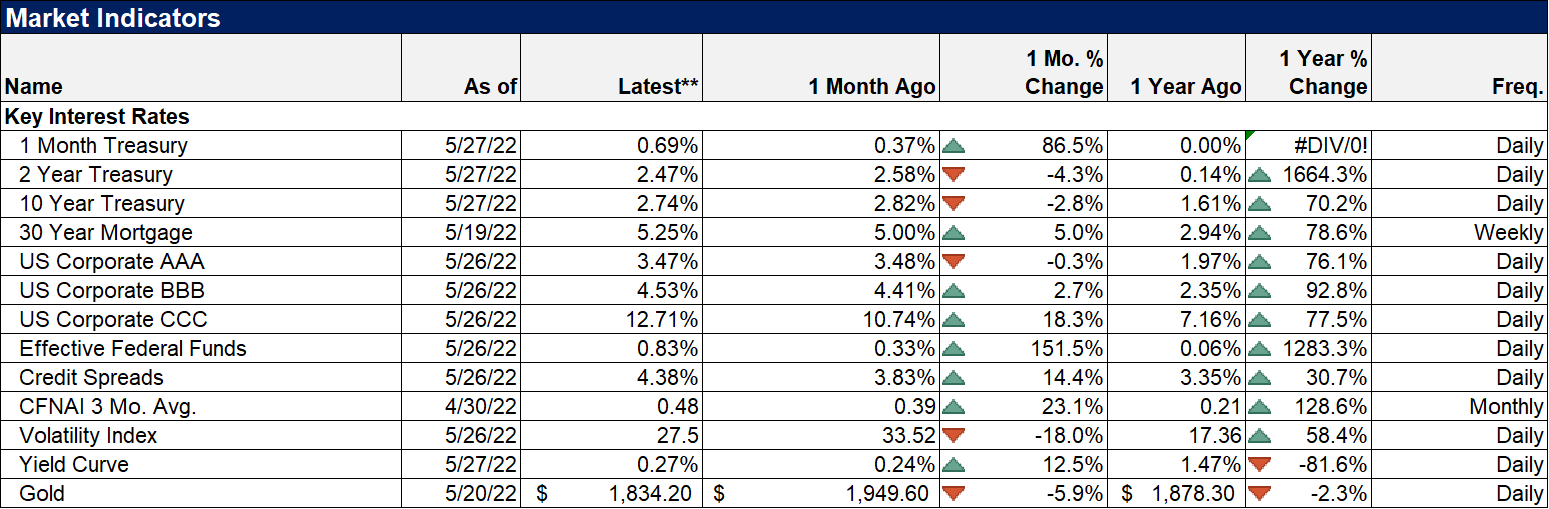

| If we assume the bear market is not over, we have to make a choice as to whether and when we might get more defensive. Getting more defensive from our already defensive posture would mean raising bond allocations (and probably extending duration further). So, a moderate account with a strategic allocation of 30% bonds would shift to 40% bonds, etc. Our process calls for that type of maximum defense when we see recession as inevitable and imminent. We define that by certain indicators that have proven effective in the past with minimal false positives. For instance, we know that the 3 month average of the CFNAI has turned negative prior to all recessions except the 1973-75 recession. | |

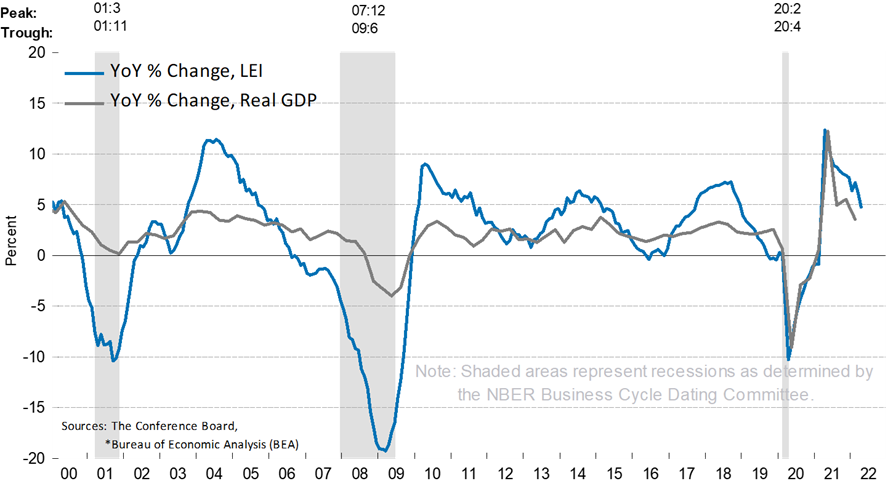

| It is currently at 0.48. We also know that, with the exception of the COVID recession, we have never had a recession start with the Conference Board’s LEI change positive year over year.

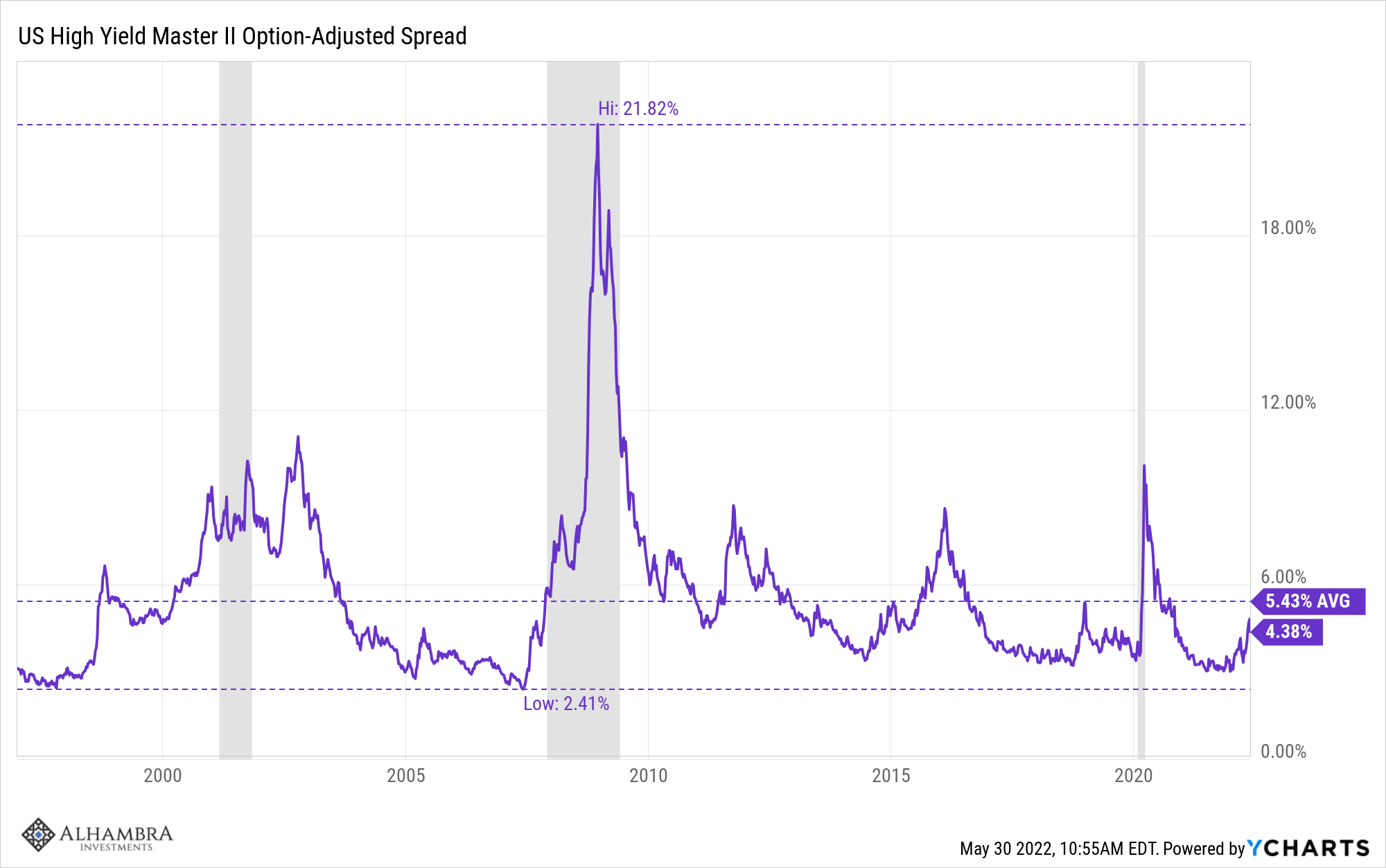

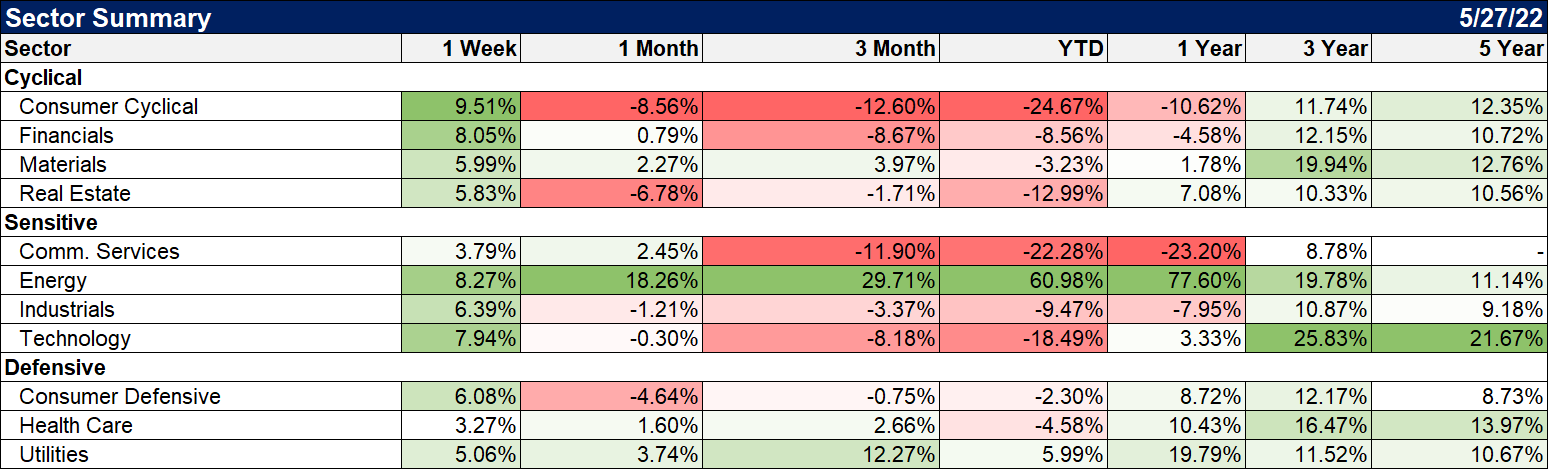

We also watch credit spreads, which tend to rise to an above average level prior to recession, subject to a lot of false signals, as you can see. Spreads have certainly risen recently but are still below average. |

|

| There are other indicators we watch but none of them at present warrant a change in our strategic portfolio positioning. That doesn’t mean recession isn’t on the way. It very well may be and our Jeff Snider has made some very strong arguments to that effect. But tactical changes to our strategic allocation require concrete evidence that just isn’t available right now. We are running long term portfolios with a strong strategic foundation and tactical changes to the strategic framework – temporary deviations – require a very high hurdle. Why? Because responding to what turns out to be a false signal has a very high cost and such missteps are psychologically very hard to recover from.

Besides, a strategic asset allocation should be one that will allow the investor to stick to it even if no tactical changes are made. Your strategic allocation is your fallback position. But what if the bear market is over? How can we tell if we should be raising our risk exposure, putting our cash to work? Well, that is a much trickier proposition, one that really doesn’t allow for firm, concrete economic evidence to develop. If we wait until the all clear on the economy or inflation or whatever is worrying investors, the market will likely have already discounted that outcome. Remember that stock markets generally make their lows before the end of the recession so we want to be buyers of risk assets (stocks) when the economy has reached its nadir, when it is as bad as it is going to get. For more routine tactical changes we have to rely on sentiment, trend and valuation with most of the emphasis on the first two. |

|

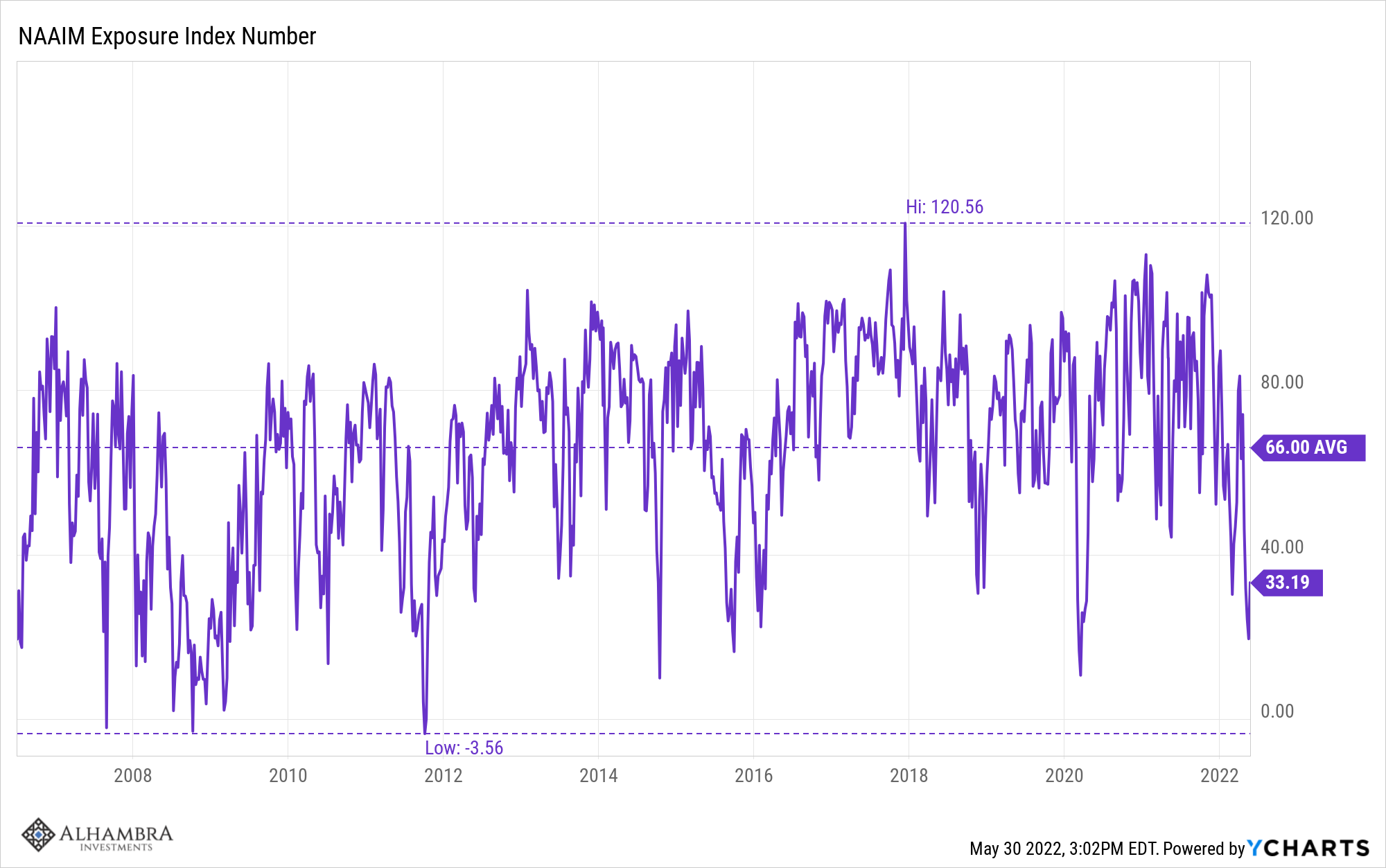

| Sentiment is certainly negative right now by several measures. Sentiment surveys (AAII, Investor’s Intelligence, etc.) are universally negative because it is easy to say you are bearish on a survey. Market based indicators are less clear but still predominantly negative. The NAAIM (National Association of Active Investment Managers) index exposure level hit 19.5 at the low and is currently at a below average level of 33. The potential range of responses is

200% Leveraged Short As I noted a couple of weeks ago, the Bank of America fund manager survey also shows their cash levels are at the highest level since right after 9/11. Fund managers are quite bearish. The Volatility index hit 39 in late January but is currently at only 25.72. Neither number is particularly compelling for a bottom. A mid 40s number, at least, would make me more confident the bottom is in but 39 may be close enough. |

|

| The low VIX is related to another indicator I watch, put/call ratios. Put/call ratios tend to spike during drawdowns and the higher the better. And high demand for puts is expressed by the price of those puts which feeds into the level of the VIX (at the money options). So a low VIX means there really isn’t huge demand for puts and we see that in the put/call ratios as well. The total put/call ratio for the CBOE is currently 0.90 and the high this year is 1.33, well below the 1.50 I want to see at bottoms. The peak in 2020 and the 2018 selloff was over 1.8. The index-only ratio is currently 1.19 – neutral – and the high for the year is just 1.79. I’d like to see a reading of 2 or more for a bottom.

There is one last sentiment indicator I keep tabs on that is pointing to a potential bottom – insider activity. |

|

| Insiders have started buying their own stock at rates last seen at the lows of 2020. The ratio of insiders buying to insiders selling is at 0.95 which is double the average of 0.47 since 2016 (insiders are usually sellers). These are real, out of pocket buys of company stock, not just option exercises.

As for valuations, well, the markets are certainly cheaper than they were at the beginning of the year. The S&P 500 trades for about 17 times forward earnings estimates, about the 10 year average. The S&P 500 growth index is still trading for over 21 times next year’s estimates; cheaper than it was but not cheap yet in my opinion. Earnings estimates are notoriously wrong at turning points though so take those P/Es with a giant grain of salt. S&P small and midcap indexes both trade around 12 times forward earnings, well below the long term average. In general, foreign stocks are still quite a lot cheaper than their US counterparts. Europe trades for about 12 times, while the global ACWI trades for about 15 times. International value, which I’ve mentioned many times over the last few months, trades for less than 10 times earnings – and has outperformed the S&P 500 this year despite the headwind of a strong dollar. Overall, valuations are average to below average, assuming no recession soon. Last we look at trend across multiple time frames. The short term trend for the S&P 500 is still down despite the rally last week but the intermediate and long term trends are still up. By the way, I’m not doing any kind of technical analysis here mostly because I find it fairly useless. This is just a simple observation of the trend and it is pretty obvious. |

|

| If you look past the S&P 500 there are markets in uptrends and ones that are closer to their long term averages and look more attractive than the S&P. No, I’m not going to share them just yet.

Overall, I question whether this bear market in US stocks is over. I’d love to see some of my favorite market indicators get to the levels I associate with long term bottoms. But that’s what I want and I may not get it. If we manage to avoid recession, we’ve probably seen the lows but we won’t know that except in retrospect. We will have to watch economic developments very closely over the next few months. In the meantime, I will probably start to buy some of the things that are already cheap. But I’m not in a rush and I surely don’t want to spend all our cash. |

|

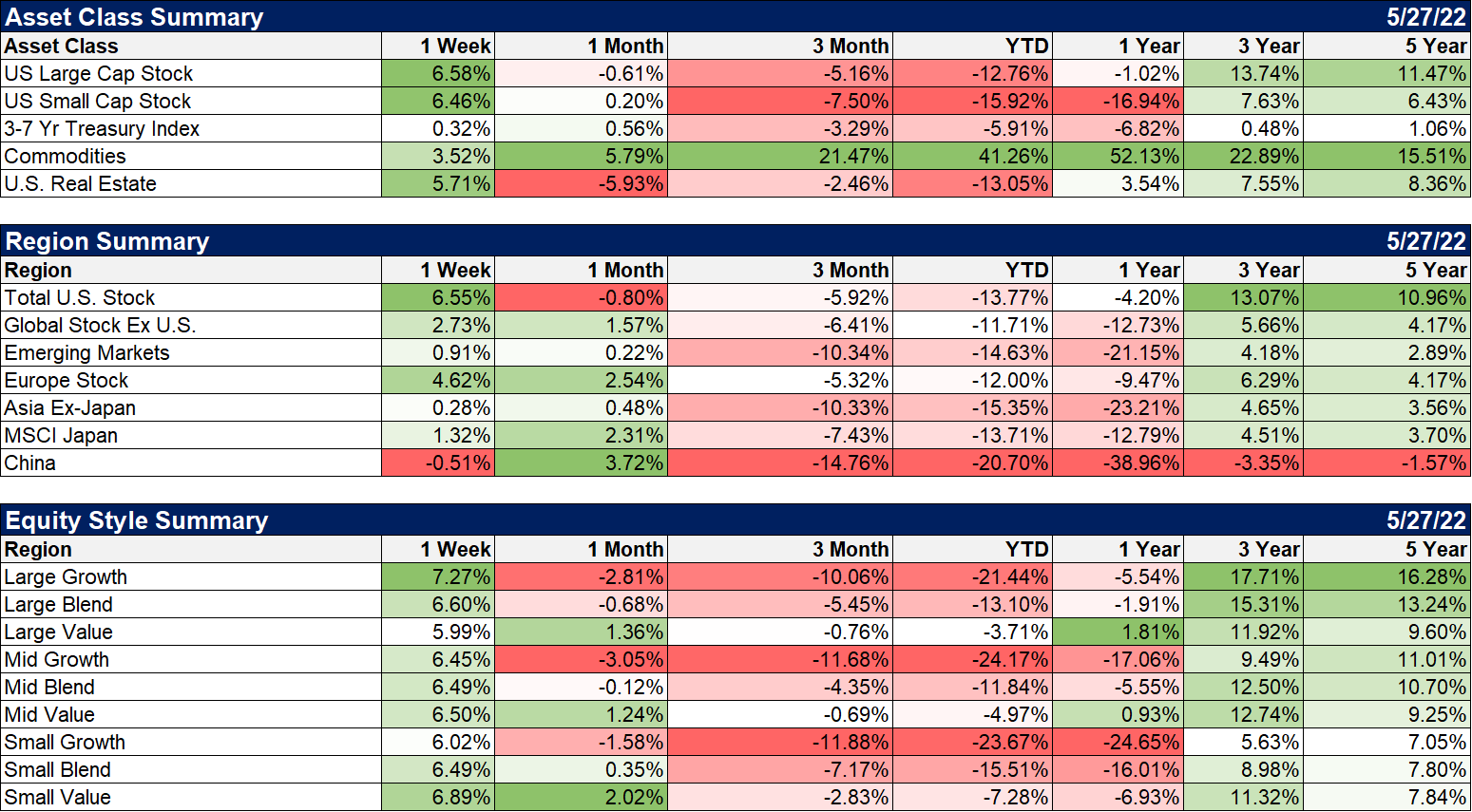

EnvironmentThe rising dollar, rising rate environment is still intact but both are stalling a bit. The 10 year and 2 year yields have both recently pulled back but they’ve come down together so the yield curve hasn’t done that much. The 10/2 curve was 19 basis points when the 2 year peaked at the beginning of May and it’s 27 now. If the 2 year – and shorter maturities – start to fall more rapidly that would be a major warning sign. I’d expect the curve to steepen as the 10 probably won’t fall as quickly but my confidence level on that is quite weak. The focus should be mostly on the short end at this point. The dollar has pulled back rather rapidly but is still in a strong uptrend. In the short term, if the dollar keeps falling, non-US markets should play some catch up to the US. A move lower, even to under 100, would be normal market behavior in the context of the existing uptrend. MarketsNote: The percentages below are based on closing values so won’t match what I wrote above about intraday lows. Obviously, stocks had a good week and if the sentiment I saw among the pundits last week is any indication it probably has more to go. The overwhelming consensus was that this was just a bear market rally that was surely doomed to fail. Maybe, probably but I bet it goes further than the skeptics think. Growth stocks led last week but value is still leading over the YTD and 1 year time frames. Small and mid cap value continued to outperform. Non-US stocks were up as well but generally less than the US. |

|

| If the dollar keeps falling that will likely change. Heck, everything was up last week. | |

Having navigated this bear market in pretty good fashion so far, our biggest risk right now is probably overstaying our welcome in the bear camp. Everyone is on recession watch so my focus is on whether we can avoid it. Certainly we will have another recession but when is an important consideration. If it’s coming by the end of the year the things we watch for warnings will start to show that pretty soon. If not, if it comes a year from now or 18 months from now, well then markets can do lots of things between now and then. I keep thinking back to the bear market of 2000-2002 when the S&P 500 peaked in March of 2000 and fell 14% by April. By September the index was back to within 1.5% of the high before resuming the bear market that didn’t end until October of 2002 (with a retest of the lows in early 2003). The NASDAQ 100 fell harder – just like today – down 34% to its initial low in May 2000. It rallied back to within about 14% of its all time high by September. You know what happened after that. Recession didn’t hit until March of 2001, a full year after the stock market peak.

More important I think are the similarities in the bull markets that preceded the bears. Both were marked by a reckless degree of speculation on new technologies. Both saw a large number of unprofitable companies come public. Both involved a lot of fraud. And today, like back then, the first leg down (assuming that’s what we just saw) was not enough to kill the speculative impulses. It took Enron and Worldcom and all the other scandals to finally kill the dot com frenzy. With new crypto frauds seemingly uncovered on a daily basis, I don’t think we’re done with this mania yet either.

I’m not saying we’re in for that kind of market again but if recession is a next year item it wouldn’t surprise me if stocks rallied back near their old highs this year. There weren’t a lot of places to hide back in that 2000-2002 bear market but there were some. Our moderate strategic allocation (30% bonds) made money across that bear market with no tactical changes. The only down year was 2001, down 0.58% (that is gross of fees). There are a lot of differences between today and two decades ago so it probably wouldn’t work exactly the same but it proves the point that a sound strategy is probably your most important decision. Getting tactical changes right is a great feeling. Not needing to make many is even better.

Full story here Are you the author? Previous post See more for Next postTags: Alhambra Portfolios,Bear Market,Bonds,cfnai,commodities,credit spreads,currencies,economy,Featured,Interest rates,Market Sentiment,Markets,newsletter,Real Estate,recession,S&P 500,stock market,stocks,US dollar,valuations,value stocks,VIX,Volatility