First quarter of 2022

Report submitted to the Governing Board of the Swiss National Bank for its quarterly assessment.

The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 18 January and 8 March.

Key points

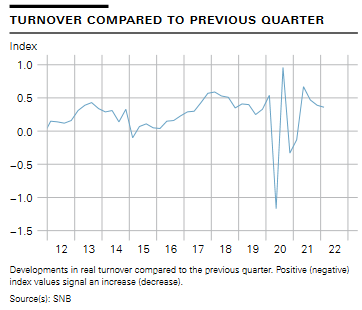

• Companies saw turnover growth continue in the first quarter at only slightly slower pace. The slight weakening was primarily due to those companies in the services sector directly affected by the consequences of the spread of the Omicron variant. The robust increases in turnover in manufacturing continued.

• Only a few companies are directly affected by the war in Ukraine because they have production facilities or trading partners in the region. Company representatives primarily talked about the impact on the energy markets and the procurement situation. There has been a sharp increase in general uncertainty regarding the development of the global economy.

• Despite the uncertain global environment, companies anticipate significant increases in turnover in the coming quarters. Now that measures to contain the pandemic have largely been lifted, this applies especially to the services sector.

• Shortages of staff became even more pronounced in the first quarter. Companies plan to employ more staff in the coming quarters. Recruitment difficulties continue to mount and are now seen as one of the greatest risks.

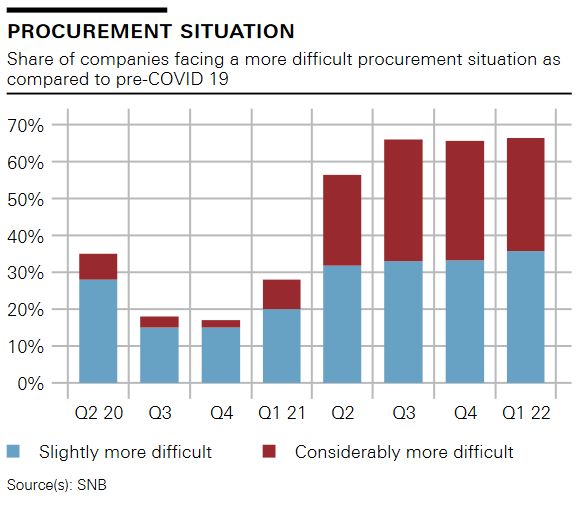

• Procurement bottlenecks also remain problematic. In some cases, restrictions and delays in production cannot be avoided. The tight supply situation and higher energy prices are leading to significant increases in purchase prices. In many places, companies are planning to pass these increases on to their customers.

• Against the backdrop of cautious salary adjustments last year, higher inflation and the tighter employment market, companies report somewhat stronger but still moderate wage growth overall for the current year.

| Sustained growth in turnover

In the first quarter, companies saw turnover continue to increase at only slightly slower pace (cf. chart 1; for guidance on interpreting the charts, refer to the relevant section at the end of this report). The somewhat lower growth compared to the previous quarter was primarily due to those companies in the services sector directly affected by the consequences of the rapid spread of the Omicron variant. In manufacturing, by contrast, turnover again increased significantly. The situation in Ukraine was already seen as a potential risk in the discussions at the beginning of the quarter. After Russia’s attack on Ukraine on 24 February there was a massive increase in uncertainty regarding global economic development. The immediate concern is the impact on the energy markets and the procurement of raw materials and agricultural produce from the region. On the other hand, there are hardly any discernible effects on demand, and in only isolated cases are companies directly affected because they have production facilities or trading partners in the region. In manufacturing, makers of chemical and pharmaceutical products, as well as companies in the mechanical engineering, electrical engineering and metals industries, are profiting from the sustained positive development of demand from abroad. The main drivers are still Europe and the United States. Another factor supporting the positive development is firming demand from Asia, particularly China. While production losses owing to ongoing procurement bottlenecks cannot be prevented everywhere, in most cases companies are finding ways of maintaining production, even if this often entails additional work and expense. In the first weeks of the year, some companies in various industries reported that staff were absent because of the quarantine rules, leading to more organisational and financial expense. There were hardly any declines in turnover, however. The situation eased significantly in mid-February with the lifting of the quarantine regulations and the shortening of the isolation period. |

|

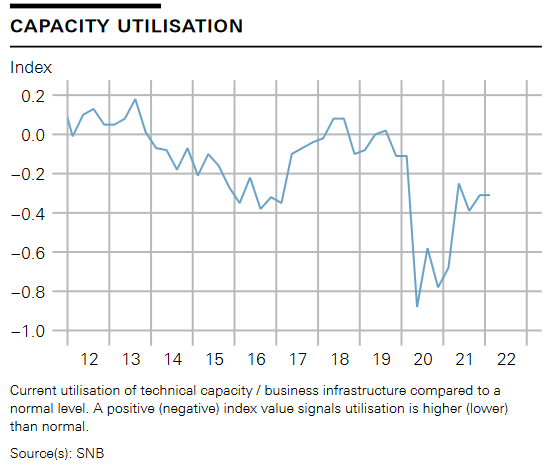

| Production capacity underutilised

In manufacturing and construction, technical capacity utilisation is close to normal. However, overall capacity utilisation remains below average because of the underutilisation of infrastructure in the services sector (cf. chart 2). Many companies report overcapacity in office space, given that they expect the proportion of homeworking to remain higher. Furthermore, reduced international travel is still having a curbing effect on tourism and associated industries such as food services, passenger transport and, in specific instances, retail. |

|

| Procurement bottlenecks continue

Procuring intermediate products remains a challenge. As had already been the case the previous quarter, around two thirds of companies were affected by supply difficulties (cf. chart 3). Above all, procuring IT and electronics products still entails great challenges, which have even become somewhat more pronounced. This particularly affects products procured from the Asian region. Supply problems also remain pronounced for companies trading in motor vehicles, and in some cases for consumer goods as well. While there were initial signs of a reversal in the trend in the case of raw materials, the war in Ukraine is likely to have brought this positive development to an abrupt end. As a result of supply bottlenecks, prices are continuing to increase. In addition, delays are impairing the efficiency of production processes, increasingly leading to reductions in production. Some companies report that because of the uncertain global supply situation, orders are being shifted back to Switzerland, a situation from which these companies are profiting. Whenever possible, companies are endeavouring to increase their inventories to boost their resilience to supply chain delays. International travel restrictions remain an obstacle The ongoing travel restrictions in Asian countries are still seen as having a severe impact, and are slowing demand in the hotel industry. They are also preventing certain manufacturing companies that export to Asia from ensuring the usual on-site presence when delivering products and spares or providing services. At the same time, acquiring new customers is still proving difficult. Continued tight staffing levels and more challenging recruitment Recruitment difficulties continue to worsen, to the extent that a growing number of companies name staff shortages as their main concern. The companies are observing an increasing shortage of job-seekers with a medium to high level of specialisation. The process of digital transformation accelerated by the pandemic continues to result in greater shortages of IT specialists. Also noticeable are a further increase in hiring difficulties in logistics, and persisting problems in this regard in the hotel and hospitality industry, where finding staff is only possible with considerable effort and high starting wages. The reasons cited by companies are the reorientation of skilled workers to other industries during the pandemic and greater difficulty in recruiting from nearby foreign countries. Little change in profit margins The majority of companies report stable profit margins at what is at least a sustainable level. On the one hand, margins are being underpinned by higher turnover, while costs are lower due to the still reduced levels of travel activity and to events not being held. On the other hand, supply chain delays are hindering efficient production processes, which is increasing production costs and reducing margins. The effects of rising purchase and sales prices are manifold. Some companies are finding that given the general price dynamics, higher sales prices are easier to push through, and that this room for manoeuvre can be used to increase margins. On the other hand, higher purchase prices are having a curbing effect on margins at companies that cannot fully or immediately pass the increases through to sales prices. This can be due to intense competition or contractual agreements. Frequently affected by this are construction companies, which are increasingly attempting to build automatic price adjustment clauses into their sales contracts. |

|

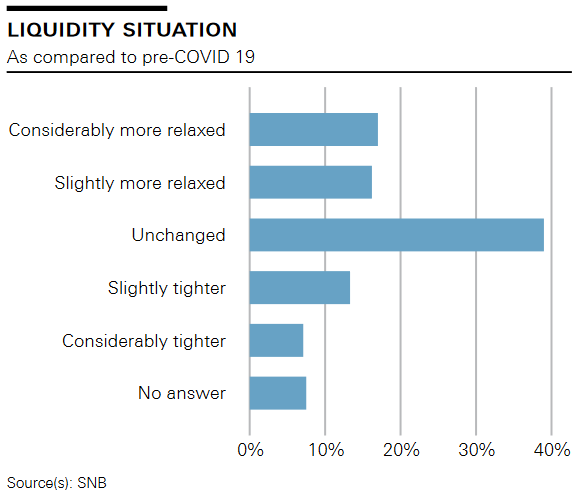

LIQUIDITY AND FUNDING CONDITIONSLiquidity situation stable Companies’ liquidity situation remains stable. Just under than 40% of companies describe the current liquidity situation as being the same as before the coronavirus crisis. One third even describe the liquidity situation as more relaxed (cf. chart 4). This percentage has increased slightly. The improvement in business activity is having a positive impact on the liquidity of these companies. At one fifth of companies the situation is tighter than before the coronavirus crisis. Some of these companies report delays in payment on the part of customers. Against the backdrop of ongoing supply chain delays, some companies report that they are increasing their inventories. They say that this is tying up more capital and putting a greater strain on their liquidity. |

|

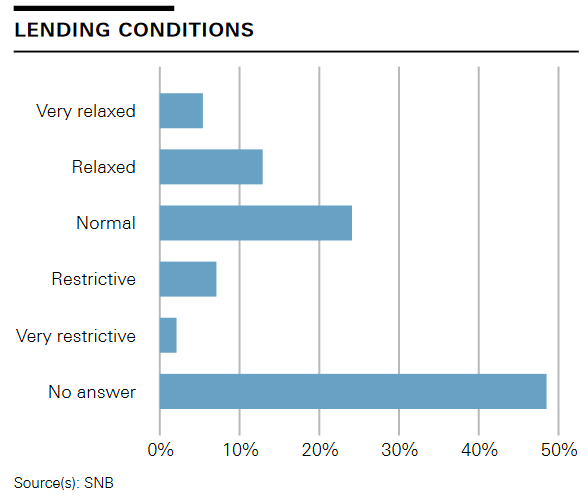

| Little change in lending conditions

Most representatives assess the banks’ lending conditions as similar to previous quarters. Only few companies are confronted with more restrictive credit conditions. 91% of companies have not noticed any problems with lending – either judging lending conditions to be normal or even relaxed, or not requiring bank loans in the first place (cf. chart 5). On the other hand, just under 9% of companies report tighter conditions, a slight increase versus the previous quarter. For the most part, representatives of industries that have been hard hit by the pandemic and whose prospects remain uncertain are experiencing greater restraint on the part of the banks. |

DEVELOPMENTS IN INDIVIDUAL INDUSTRIES

Business activity in the trade industry remained lacklustre in the first quarter. Overall, real turnover was at around the same level as the previous quarter. While some wholesale operations are profiting from sustained positive demand from manufacturing and construction, procurement bottlenecks are having a curbing effect. This especially applies to the motor vehicle trade. At the same time, the procurement bottlenecks in retail have become more pronounced, reflected in appreciably lower turnover.

The lifting of measures to manage the pandemic in the course of the first quarter has had a positive impact on turnover in hospitality, as well as in the entertainment and leisure industry. In food services in particular, companies are benefiting from a renewed increase in customer frequency. Turnover at hotels geared to an international clientele, by contrast, has remained muted. The spread of the Omicron variant at the beginning of the year and the associated rise in uncertainty led to a decline in guest bookings. International travel is picking up only slowly, and is also likely to be curbed again by the war in Ukraine.

In the financial sector, business volumes have grown further despite declining stock market prices in the course of the quarter. Banks are seeing sustained growth in mortgage volumes. They view the low interest rate environment, and increasingly the hiring of specialist staff, as a challenge.

The ICT industry continues to gain momentum after what was already a positive development in the previous quarters. The most important driver is still digitalisation, with persistent growth in demand for efficient, stable IT infrastructure, often in conjunction with cloud solutions. Also increasingly relevant in this regard are demand for cybersecurity and connections for working from home, as well as online commerce.

Business in many manufacturing industries, too, is developing positively. Manufacturing is profiting on a broad basis from growing demand from abroad. The development of turnover in the chemical and pharmaceutical industry is particularly dynamic. The positive dynamic in the mechanical engineering, electrical engineering and metals industries also continues, thanks among other things to orders from the defence and medical technology industries, as well as to developments in the area of electric vehicles. Supply chain bottlenecks are slowing growth in some industries. Hard hit are companies reliant on electronics components, as well as the packaging industry. To counter supply bottlenecks, manufacturing companies are endeavouring to increase their inventories on a broad base.

In the construction sector, turnover has continued to rise. Construction companies, as well as architecture, engineering and planning firms, are profiting from a high level of investment in the residential segment. Companies operating in civil engineering and the finishing trade, by contrast, report a slight levelling off, albeit at a high level. Owing to continued increases in the prices of raw materials, supply bottlenecks, challenges in logistics and what is still described as intense competition, construction companies’ margins remain slightly below what is considered normal. Furthermore, a growing number of construction companies are pointing out that the market for specialist labour is increasingly drying up.

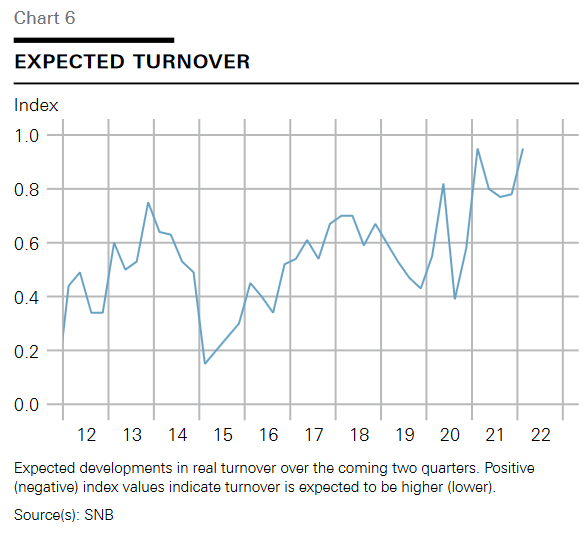

OUTLOOKCompanies remain confident despite high level of uncertainty Companies expect turnover to continue to rise in the next two quarters (cf. chart 6) despite ongoing challenges in hiring staff and procuring intermediate products. This confidence is based on the positive development of the global economy and sustained robust domestic demand, supported by the lifting of most of the measures to contain the pandemic. The war in Ukraine is exacerbating the uncertainty in many respects, although the concrete effects are still difficult for companies to assess. In keeping with expectations of higher turnover, company representatives expect utilisation of their technical production capacity and infrastructure to increase. Against this backdrop, companies’ appetite for investment continues to grow. By comparison with 2021, companies in the manufacturing and services sectors are planning appreciably higher capital expenditure on both equipment and buildings over the next twelve months. Construction companies are expecting the level of investment to rise slightly. |

|

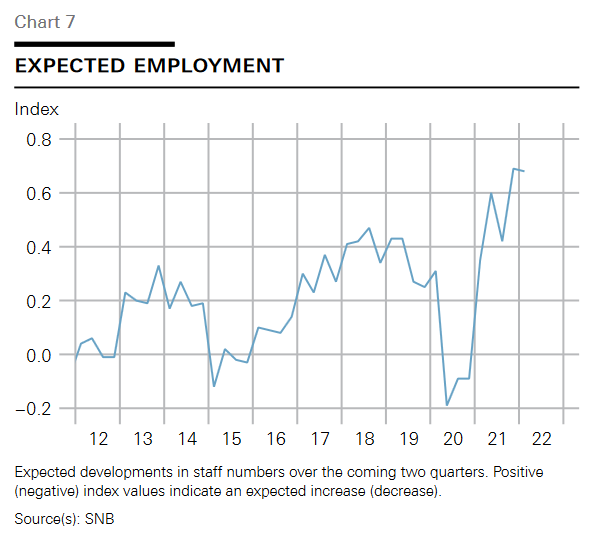

| Increased demand for personnel and moderate increases in wages

Significant increases in staff numbers are planned in the next two quarters (cf. chart 7), owing to business prospects remaining favourable and to many companies still considering current staffing levels to be too low. The following industries are planning particularly pronounced increases in staff numbers: information and communications technology, the chemical, pharmaceutical, mechanical engineering, electrical engineering and metals industries, insurance and financial services, and architecture and engineering firms. Added to this, companies in wholesale, logistics and food services plan to increase staff levels. Against a backdrop of muted wage developments last year, growing inflation and an increasingly tight labour market, companies expect growth in wages to pick up somewhat this year. Companies are raising wages by an average of 1.6% after increases of 0.8% last year. Similar to the situation in the more recent past, the most pronounced rises in wages are for particularly sought-after specialists in IT, finance and manufacturing. As a result of the increasingly acute hiring difficulties, wage rises in hospitality are also markedly higher than in previous years. Sustained upward pressure on purchase and sales prices Given sustained robust demand, the continuing tight supply situation and higher transport costs, company representatives anticipate further increases in the purchase prices of a broad range of products in the next two quarters. In particular, the scarcity of electronic components will result in a further rise in their prices. While there were certain signs at the beginning of the year that developments in energy and raw material prices were flattening off, the war in Ukraine, however, put an abrupt stop to this incipient return to normal. At the same time, companies expect sales prices to rise. Companies in manufacturing, and especially in the trade industry, are passing increases in purchase prices through to their sales prices. In addition to this, prices in the tourism industry, which has been hard hit by the pandemic, are expected to return to normal as demand recovers. |

ENVIRONMENT AND RISKS

War in Ukraine causing uncertainty Companies describe the war in Ukraine as a substantial risk to what is in itself a positive business outlook. Besides the situation on the energy and raw materials markets, a key concern is the generally uncertain development of the global economy. Representatives also talked about the appreciation of the Swiss franc. This is worrying a number of companies, and they see further appreciation of the Swiss franc as a risk. At the same time, they note that the strong development of prices and wages abroad somewhat mitigates the effects of the appreciation.

The direct effects of the war are deemed to be moderate. For instance, only a small proportion of the companies maintain trading relations with Russia or Ukraine or have production facilities in the region. An exception to this is commodities traders, who could be affected by potential declines in trading volumes and, in some cases, by difficulties with financing or payments. Furthermore, the tourism industry fears that the uncertain situation will reduce the desire to travel to Europe, particularly among Asian and American tourists. This is happening just as the easing of many of the restrictions connected with the coronavirus pandemic was leading to signs of a gradual recovery in many countries all over the world.

Hiring and procurement situation still major challenge

Many companies see the greatest challenge not in declining demand, but on the supply side: in the timely manufacture of products and provision of the services offered.

Staff shortages are frequently cited as the most significant concern. Some companies report that they are unable to accept all orders. Since the market for specialist labour is said have dried out, the majority of companies do not expect the situation to ease in the coming quarters. Against this backdrop, a certain degree of uncertainty prevails as to whether plans to increase staff numbers at many companies can be fully realised.

The majority of companies still also see procurement as a risk. A lack of freight capacity is making this more difficult in general. Delays in the supply of electronic components are also increasingly affecting production. To be able to continue ensuring the ability to deliver in the coming quarters, companies are endeavouring to expand their inventories.

Digitalisation and sustainability trend as opportunity and risk

The majority of companies see ongoing digitalisation as an opportunity to make production processes more efficient. At the same time, closer interconnectedness – including via online sales channels – means that cybersecurity is becoming a key challenge.

With a somewhat longer forecast horizon, climate change and the trend to sustainability are also seen by many companies as opportunities for new business models. This particularly applies to the broad field of energy efficiency. Providers of products perceived as being less sustainable, however, view the same trend as a risk, and see their business activities increasingly affected by regulations. Some representatives express concerns regarding security of supply in connection with the transition to renewable energy.

| INFLATION EXPECTATIONS

The delegates also ask company representatives about their short and long-term inflation expectations. There has been a further increase in short-term inflation expectations as measured by the consumer price index: The average for the next six to twelve months (cf. chart 8) is 2.3%, compared with 1.9% in the previous quarter. A reason frequently given for this is observed increases in producer prices, which, according to representatives, will gradually be reflected in consumer prices. Expectations are additionally influenced by the rise in inflation observed abroad in the recent past. There is growing expectation that after rising in the short term, inflation will not immediately level off again and that it will remain slightly higher. Inflation expectations over a three to five-year horizon have thus risen from 1.5% to 1.6%. |

Tags: Featured,newsletter