Monthly Archive: March 2022

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

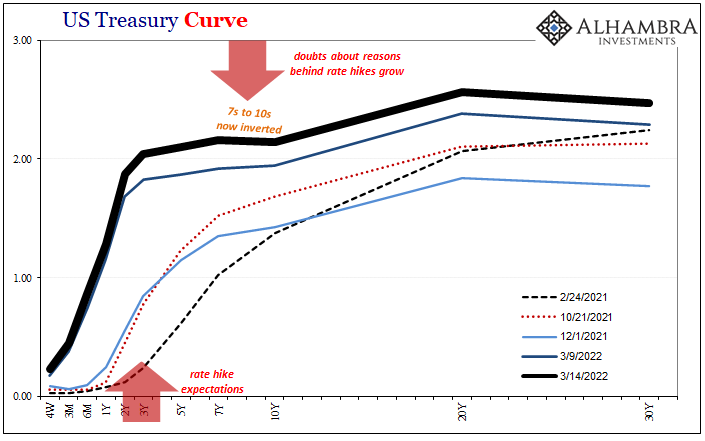

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place.

Read More »

Read More »

Risk Accumulates Where No One Is Looking For It

All this decay is so incremental that nobody thinks it possible that it could ever accumulate into a risk that threatens the entire system. The funny thing about risk is the risk that everyone sees isn't the risk that blows up the system. The mere

fact that everyone is paying attention to the risk tends to defang it as everyone rushes to hedge or reduce the risk.

Read More »

Read More »

The forgotten art of Debate

One quick glance at different news headlines or just 5’ switching between TV networks suffice to convince even the most naive news consumer that there is something seriously wrong with the way public discourse was (d)evolved in our societies over the last years. Of course, journalism was never entirely devoid of bias, not even in its “golden age”.

Read More »

Read More »

Fed Delivers Hawkish Hike

The Federal Reserve hiked the Fed funds target rate by 25 bp as widely anticipated. It clearly signaled it was beginning an ongoing hiking cycle. The FOMC statement also indicated the balance sheet roll-off would begin at a coming meeting. The uncertainty posed by Russia's invasion of Ukraine was acknowledged, but the FOMC recognized that in the first instance it boosts price pressures while also weakening growth.

Read More »

Read More »

Russian clients have up to CHF200 billion in Swiss banks

Swiss banks hold between CHF150 billion and CHF200 billion ($160-$214 billion) in assets belonging to Russian clients, according to the Swiss Bankers Association.

Read More »

Read More »

China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated.

Read More »

Read More »

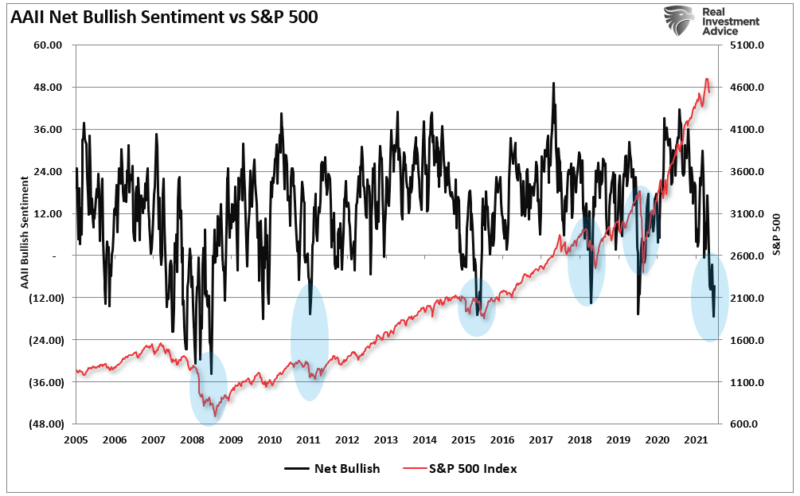

Market Perspective Is Important To Avoid Mistakes

Market perspective is essential in avoiding investing mistakes. With CNBC airing “Markets In Turmoil” every time the market dips, it’s no wonder investor sentiment is now the lowest we have seen financial crisis lows.

Read More »

Read More »

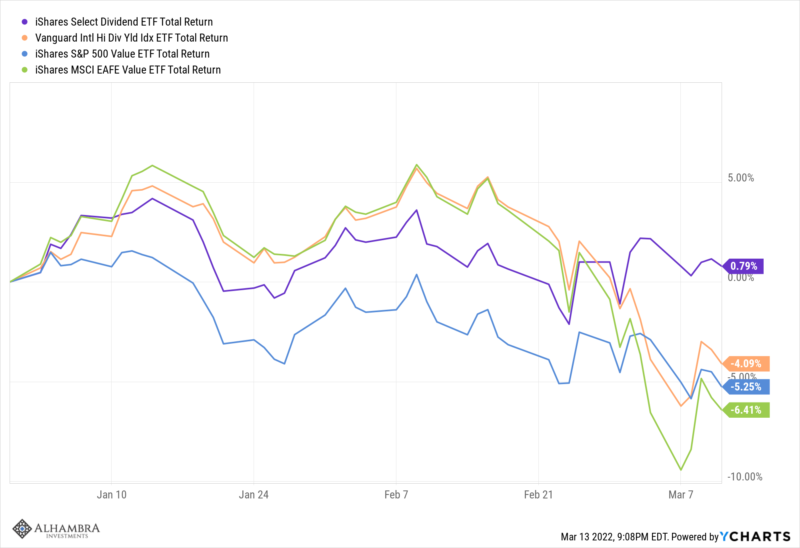

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

Experts warn of hit to economy without Russian oil and gas

Renouncing Russian oil and gas would have serious consequences for the Swiss economy, an expert from the KOF Swiss Economic Institute has told a Sunday newspaper.

Read More »

Read More »

Whales investieren in Shiba Inu Cryptocoin

Die Zeit der Memecoins schien vorerst vorbei zu sein, sowohl Dogecoin als auch SHIB (Shiba Inu) konnten ihren Höhenflug 2021 nicht mit ins neue Jahr nehmen. Doch in einer allgemeinen Bärenphase beobachteten Analysten aktuell eine Whale-Bewegung, die einen neuen Kursanstieg andeutet.

Read More »

Read More »

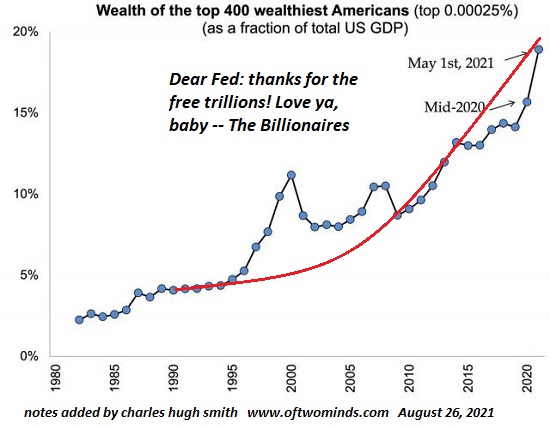

Serf-Expression

Eventually the "flock of timid and industrious animals" changes their minds about how much exploitation by the few is acceptable.

Read More »

Read More »

Devisen: Euro legt in etwas weniger trübem Umfeld zu

Auch gegenüber dem Franken hat der Euro am Montag über die erste Tageshälft angezogen. Derzeit kostet er 1,0244, am Morgen waren es noch 1,0213 und am Freitagabend 1,0200. Der US-Dollar zeigt sich bei 0,9348 Fr. relativ stabil.

In Marktkreisen gilt es als ziemlich sicher, dass die SNB zur Stützung des Euro auf Höhe der Parität zum Franken eingegriffen hat.

Read More »

Read More »

A Need for National Soul-Searching

Suppose that John, in an act of pure political gamesmanship, threatens to corner Peter. In response, Peter says to John, “If you corner me as part of your political game, I will shoot and kill Mary. So don’t corner me.” John has no doubt whatsoever that Peter is telling him the truth and that he’s not bluffing. John knows as an absolute certainty that if he corners Peter as part of his political game, Peter will shoot and kill Mary.

Read More »

Read More »

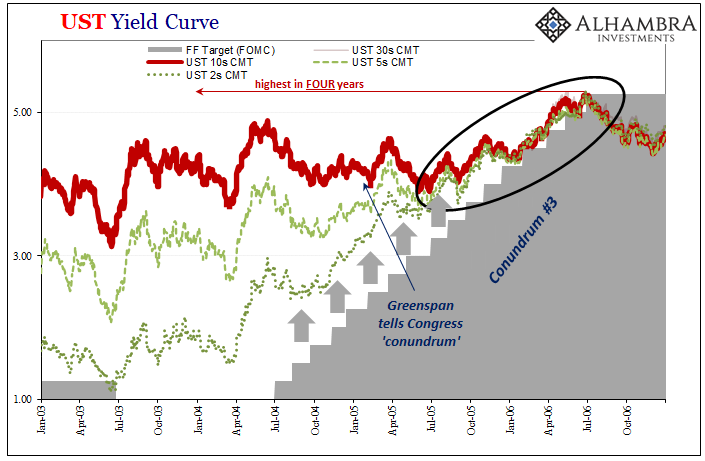

Another One Inverts, The Retching Cat Reaches Treasuries

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite.

Read More »

Read More »

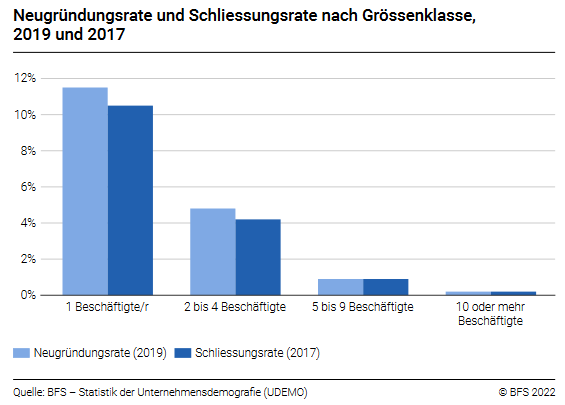

A record number of new businesses in 2019

14.03.2022 - In Switzerland, 42 606 businesses were started from scratch in 2019. This figure, the highest ever recorded, represents growth of 8.0% compared with the previous year. In the same year, the number of high growth enterprises also reached a record, with 4803 units (+8.1% compared with 2018).

Read More »

Read More »

China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China's CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%.

Read More »

Read More »

Switzerland approves CHF80 million in emergency aid for Ukraine

The Swiss government has boosted its humanitarian support to victims of the war in Ukraine. On Friday it approved CHF80 million ($86 million) as an “expression of its solidarity with Ukrainians in need”.

Read More »

Read More »

How the IRS Taxes Your Retirement Income

Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.”

Read More »

Read More »

UK deklariert Bitcoin-Geldautomaten als illegal

Sogenannte Crypto-ATMs werden derzeit in vielen westlichen Ländern hochgezogen. Mit ihnen kann Fiat-Geld in Cryptocoins umgewandelt und übertragen werden. Was in den USA bereits flächendeckend eingesetzt wird, wurde nun von der FCA im Vereinigten Königreich als illegal eingestuft. Bitcoin News: UK deklariert Bitcoin-Geldautomaten als illegalDie FCA ist die Financial Conduct Authority, eine offizielle Stelle des staatlichen Finanzsystems im UK. Auf...

Read More »

Read More »