| $BITO, the first Bitcoin ETF was issued Tuesday morning. The ETF provides retail investors their first true access to Bitcoin without having to open up a crypto wallet account. BITO tracks bitcoin futures and is expected to track the cryptocurrency much closer than the Grayscale Trust (GBTC).

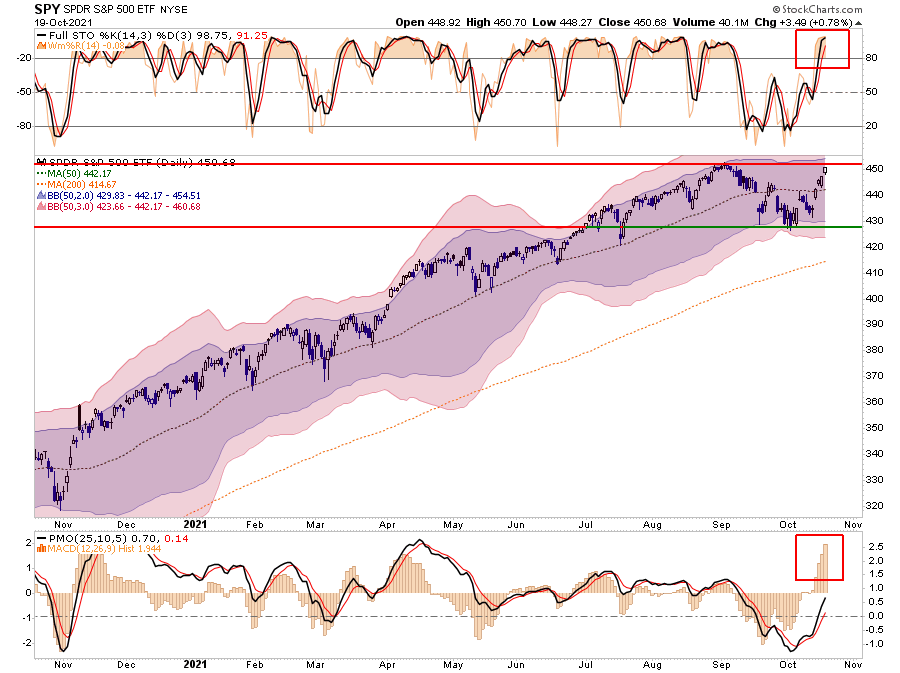

Stocks rallied alongside BITO and posted a fifth straight green day. The index is now well established above its 50dma and aiming for new record highs. However, not surprisingly, the market surge has quickly taken the index back to overbought conditions short-term. Such suggests we could see some consolidation, or a potential retest of the 50-dma, before attempting all-time highs. |

What To Watch Today

Economy

- 7:00 a.m. ET: MBA mortgage applications, week ended Oct. 15 (0.2% during prior week)

- 2:00 p.m. ET: Federal Reserve releases Beige Book

Earnings

Pre-market

- 6:00 a.m. ET: Anthem (ANTM) to report adjusted earnings of $6.37 per share on revenue of $35.39 billion

- 6:25 a.m. ET: Citizens Financial Group (CFG) to report adjusted earnings of $1.17 per share on revenue of $1.64 billion

- 7:00 a.m. ET: Biogen (BIIB) to report adjusted earnings of $4.10 per share on revenue of $2.68 billion

- 7:00 a.m. ET: Nasdaq (NDAQ) to report adjusted earnings of $1.73 per share on. revenue of $830.82 million

- 7:00 a.m. ET: Baker Hughes (BKR) to report adjusted earnings of 21 cents per share on revenue of $5.34 billion

- 7:15 a.m. ET: Abbott Laboratories (ABT) to report adjusted earnings of 94 cents per share on revenue of $9.54 billion

- 7:30 a.m. ET: Verizon Communications (VZ) to report adjusted earnings of $1.36 per. share on revenue of $33.24 billion

Post-market

- 4:00 p.m. ET: Las Vegas Sands Corp. (LVS) to report adjusted losses of 23 cents per share on revenue of $1.16 billion

- 4:05 p.m. ET: Tesla (TSLA) to report adjusted earnings of $1.67 per share on revenue of $13.91 billion

- 4:05 p.m. ET: Kinder Morgan (KMI) to report adjusted earnings of 22 cents per share on revenue of $3.2 billion

- 4:10 p.m. ET: IBM (IBM) to report adjusted earnings of $2.53 per share on revenue of $17.83 billion

- 4:15 p.m. ET: Equifax (EFX) to report adjusted earnings of $1.71 per share on revenue of $1.18 billion

Courtesy of Yahoo!

20-Strongest Relative Strength CandidatesUsing RIAPRO’s Active Trade screen, I ran a screen on the 20-strongest relative strength stocks in the S&P 500 to look for some portfolio candidates. |

|

Johnson & Johnson (JNJ) EarningsJNJ reported third-quarter earnings today before the open. GAAP EPS of $1.37 missed the consensus estimate of $2.17. However, non-GAAP EPS of $2.60 beat expectations of $2.35. Revenue of $23.3B (+10.7% YoY) missed the consensus of $23.7B. According to the CFO, the revenue miss was just a matter of the timing of shipments in the COVID vaccine and medical devices businesses. That revenue should be made up for in Q4 results. JNJ increased guidance for FY21 revenue at the low end to a range of $92.8B-$93.3B from $92.5B-$93.3B, but guidance remains below the consensus estimate of $93.97B. Guidance was also boosted for FY21 adjusted EPS to $9.77-$9.82 from $9.50-$9.60 previously. This is well above the consensus estimate of $9.64. The stock is trading 2.6% higher on the results. We hold a 1.5% position in the Equity Model. |

|

Proctor & Gamble (PG) EarningsPG reported third-quarter earnings this morning before the open. GAAP EPS came in slightly above expectations, at $1.61 (-1% YoY) versus the consensus of $1.59. Revenue of $20.3B (+5.3% YoY) also beat expectations of $19.9B. Organic sales growth of +4% YoY was driven by increased volume (+2%), increased pricing (+1%), and a positive sales mix (+1%). Gross margin, however, decreased by 3.7% YoY due to increased commodity and transportation costs as well as a less profitable sales mix. PG is planning to raise prices on certain beauty, oral care, and grooming products to offset increasing costs. According to the Wall Street Journal, “‘We do not anticipate any easing of costs,’ P&G Finance Chief Andre Schulten said in an interview. ‘We continue to see increases week after week, though at a slower pace’”. The article continues, “Despite the higher expenses, P&G maintained its sales and profit outlooks for the year, saying increased revenue and cost reductions will enable the company to stay on track”. The stock is trading roughly 2% lower this morning in light of the margin concerns. We hold a 2% position in the Equity Model. |

|

For more on how cost pressures are affecting PG and many other companies, check out this article from the Washington Post.

The Crash of 1987

The quote comes from an article we wrote on the stock market crash of 1987. Today, being the 34th anniversary of the crash of 1987, we revisit some important lessons from that era. Read The Article. |

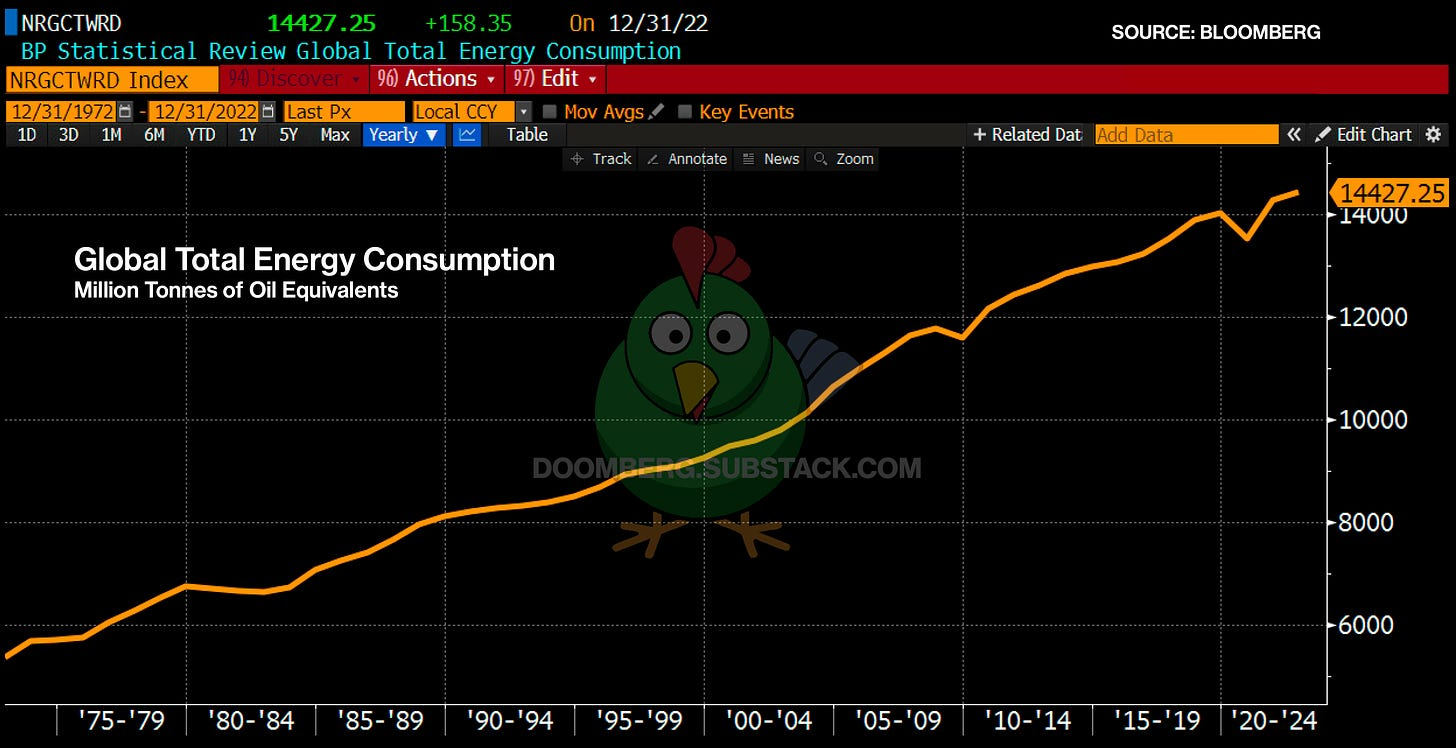

Will Higher Oil Prices Become The Norm?

The Wall Street Journal ran an article discussing a growing investment deficiency into traditional and renewable energy sources. As a result oil prices may stay high until the industry closes the gap.

Per the article:

“Global oil and gas exploration spending, excluding shale, averaged about $100 billion a year from 2010 to 2015, but dropped to an average of around $50 billion in the years that followed after a crash in crude prices, according to Rystad Energy. Total global oil and gas investment this year will be down about 26% from pre-pandemic levels to $356 billion, the IEA said Wednesday.”

Green investments are not growing quickly enough to offset reduced CAPEX in the energy industry. Per the article:

To meet global energy demand, as well as climate aspirations, investments in clean energy would need to grow from around $1.1 trillion this year to $3.4 trillion a year until 2030, the Paris-based agency found. Investment would advance technology, transmission, and storage, among other things.

The bottom line: “The world isn’t investing enough to meet its future energy needs, and uncertainties over policies and demand trajectories create a strong risk of a volatile period ahead for energy markets,” the IEA report said.

Labor MarketOver the last six months, the Fed has been dragging its feet and delaying the inevitable tapering of QE due to perceived weakness in the labor market. The graph below shows the unemployment rate less those labeled “quitters” is near 20-year lows. Quitters are those that left their jobs voluntarily and, in theory, are in search of better or higher-paying jobs. The current quit rate at 2.9% is the highest in its 20-year history. A high quit rate is a signal of labor market strength. Between 5.4% inflation and the graph below, is it any wonder the market is starting to think the Fed is behind the eight ball in tightening? The post Bitcoin and $BITO Mania Grip the Stock Market appeared first on RIA. |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter