Monthly Archive: May 2021

FX Daily, May 31: China Raises Reserve Requirement for FX, Stemming the Yuan’s Rise

US and UK markets are closed for holidays today, contributing to the rather subdued price action today. The MSCI Asia Pacific Index rallied two percent last week, the most in three months, and most markets began off the week with modest gains. Japan, Australia, and Singapore, for notable exceptions.

Read More »

Read More »

Inflation risk takes center stage – Part II of II

A lot of people might be aware of historical cases of hyperinflation, like that of Hungary and the Weimar Republic, or even contemporary ones, like that of Venezuela. And yet, these are taught or reported like extreme cases, very far removed from the daily experience of most modern Western citizens.

Read More »

Read More »

Dishonest Partial Unemployment Claims Alarm Swiss Auditors

The Swiss Federal Audit Office says it is worried by a surge in fraud cases linked to the short-time working system, a key pillar of the country’s economic response to Covid-19. The office’s director Michel Huissoud told public radio SRF on Monday he was “shocked by the number of complaints, mistakes, and abuses” recorded to date.

Read More »

Read More »

Increasingly Chaotic Volatility Ahead–The New Normal Few Think Possible

The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping? The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate.

Read More »

Read More »

Swiss Campaign Heats up ahead of an Emotional Vote on Pesticides

Death threats, insults, posters vandalised or set on fire: the campaign for two initiatives against pesticides to be put to the vote on June 13 is extremely tense. This toxic climate highlights a deep malaise in the Swiss agricultural world.

Read More »

Read More »

Decentralization: Why the EU May Be Better than the US

Over the years, I’ve been pretty hard on the European Union. Both as an editor and a writer, I’ve published articles criticizing its central bank and its unelected, bureaucratic central government. Especially objectionable is the EU ruling class’s propensity for cynical politics built around threatening and intimidating voters and national governments who don’t conform to Brussels’ wishes.

Read More »

Read More »

Covid: new cases down 28% in Switzerland this week

This week, 5,670 new Covid-19 cases were recorded in Switzerland, down 28% from the week before (7,843), continuing the downward trend of new numbers of recorded infections. The daily number of cases on a 7-day rolling average has more than halved (-58%) in 4 weeks falling from 1,924 to 810.

Read More »

Read More »

Malta under Pressure

Malta is a compact archipelago in the Mediterranean Sea, 80 km from Sicily, 333 km from Libya and 284 km from Tunisia. It had a long list of rulers, including the Phoenicians, the Byzantines, the Arabs and later the French under Napoleon and finally the British. The island gained independence in 1964, and in 2004 it joined the European Union.

Read More »

Read More »

Swiss prepare for EU chill after quitting market access talks

In Brussels there was shock and anger. In Switzerland, quiet celebration and relief — but, for some, doubts about what exactly comes next. On Wednesday, Bern announced it was formally withdrawing from negotiations to codify future relations with the EU into a single overarching “framework agreement” — a back-and-forth exchange that has dominated an increasingly fraught relationship with Brussels since 2014.

Read More »

Read More »

FX Daily, May 28: The Yuan Extends Gains, While Sterling’s First Close above $1.42 in Three Years Goes for Nought

The recovery of the US 10-year yield, so it is flat on the week near 1.61% coupled with month-end demand, is helping the US dollar firm. While the yen is bearing the burden on the week, with a 0.8% loss, the Antipodeans are leading the downside on the day.

Read More »

Read More »

Covid: UK now on Swiss risk list

On 27 May 2021, the UK was added Switzerland’s list of risk countries. This means that anyone arriving in Switzerland from the UK from 6pm on Thursday must quarantine upon arrival, with a few exceptions. The UK was added to the Federal Office of Public Health’s (FOPH) list of countries with a worrying variant, alongside Brazil, Canada, India, Nepal and South Africa.

Read More »

Read More »

More Evidence the American Economic “Recovery” Will Disappoint

The University of Michigan consumer confidence index fell to 82.8 in May, from 88.3 in April. More importantly, the current conditions index slumped to 90.8, from 97.2 and the expectations index declined to 77.6, from 82.7. Hard data also questions the strength of the recovery.

Read More »

Read More »

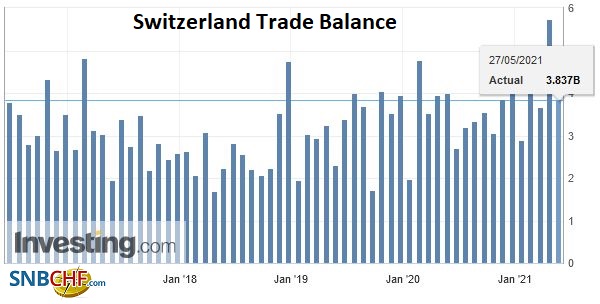

Swiss Trade Balance April 2021: Exports Stagnate at a High Level

After jumping 5.9% in March, exports stagnated in April, however, rising to a high level of 20 billion francs. Imports confirmed their vitality in previous months, up 3.5% to 16.8 billion francs (actual: + 2.2%). The trade balance closes with a surplus of 3.3 billion francs.

Read More »

Read More »

FX Daily, May 27: Narrow Ranges in FX Prevail Amid Month-End Considerations

Dollar demand linked to the month-end gave the greenback a bit of a reprieve, helped by firmer bond yields. Some momentum players may have been forced out of the euro and yen when the $1.22 and JPY109 levels yielded. However, follow-through dollar buying has been limited, and it has come back a little softer but broadly so.

Read More »

Read More »

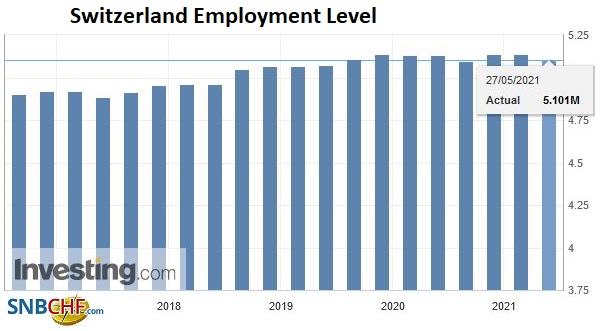

Employment Barometer in the Q1 2021: Fell for the fourth Consecutive Time – but Outlook is Positive

In the 1st quarter 2021, total employment (number of jobs) fell for the fourth time in a row compared with the same quarter a year earlier (–0.6%; –0.2% compared with previous quarter). In full-time equivalents, employment in the same period declined by 0.7%.

Read More »

Read More »

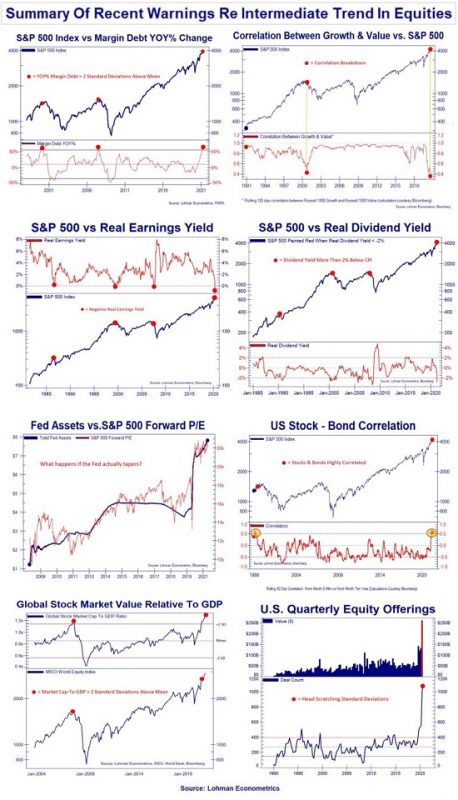

Systemic Risks Abound

For the past 22 years, every time the stock market whimpered, wheezed or whined, the Federal Reserve rushed to soothe the spoiled crybaby. There are two consequential results of the Fed as savior: The Fed has perfected moral hazard. Organic (i.e. non-manipulated) market forces have been extinguished.

Read More »

Read More »

Interview: Candid Coffee – Mid-Year Market Review

Last weekend, I joined Richard Rosso, CFP and Danny Ratliff, CFP to discuss the outlook for the markets for the rest of this year and take questions from our attendees.

Read More »

Read More »

FX Daily, May 26: RBNZ Joins the Queue, while Yuan’s Advance Continues

The decline in US rates and the doves at the ECB pushing back against the need to reduce bond purchases next month have seen European bond yields unwind most of this month's gain. The inability of US shares to hold on to early gains yesterday did not deter the Asia Pacific and European equities from trading higher.

Read More »

Read More »

Taper Is Coming: Got Bonds?

Taper Is Coming: Got Bonds? The solid economic recovery and easing of COVID restrictions lead us to believe a tapering of QE may not be far off. Further supporting our opinion, inflation has fully recovered to pre-pandemic levels, and employment is improving rapidly.

Read More »

Read More »