Lacy Hunt at Hoisington Management has some interesting thoughts regarding the inflation debate and the potential for decelerating inflation.

Case For Decelerating InflationIn its Quarterly Review and Outlook for the First Quarter of 2021 Lacy Hunt makes a case for decelerating inflation.

Lacy said 5. I added a 6th bullet point from his discussion, then added 2 more points of my own. |

|

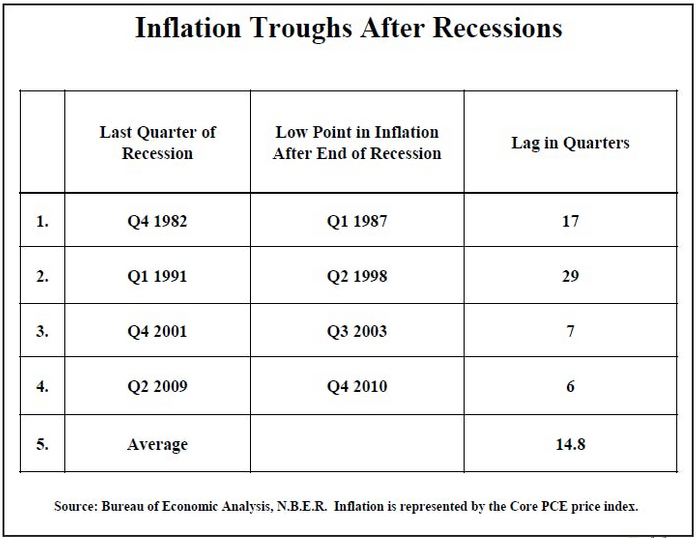

Six Reasons to Expect DisinflationInflation is a lagging indicator. The low in inflation occurred after all of the past four recessions, with an average lag of almost fifteen quarters from the end of the recessions. Productivity rebounds in recoveries and vigorously so in the aftermath of deep recessions. This pattern in productivity is quite apparent after the deep recessions ending in 1949, 1958, and 1982. Productivity rebounded by an average of 4.8% in the year immediately after the end of these three recessions and unit labor costs were unchanged. The rise in productivity held down unit labor costs. |

Deflationary Forces Abound

Restoration of supply chains will be disinflationary. Supply chains were badly disrupted by the pandemic. Low-cost producers in Asia and elsewhere were unable to deliver as much product into the United States and other relatively higher-cost countries. This allowed U.S. producers to gain market share. As immunizations increase, supply chains will be gradually restored. Thus, the pandemic cost the low-cost producer’s market share which was shifted to domestic producers. The pandemic did far more for domestic firm’s

Accelerated technological advancement will lower costs. Another restraint on inflation is that the pandemic greatly accelerated the implementation of inventions that were in the pipeline. Necessity is the mother of invention, as has been demonstrated in earlier crisis situations like wars. Thus, the technology du jour is not the same as the technology of a year ago. This will also serve to act as a restraint on inflation. Much of the technology substitutes machines for people, communication without travel, and work without offices.

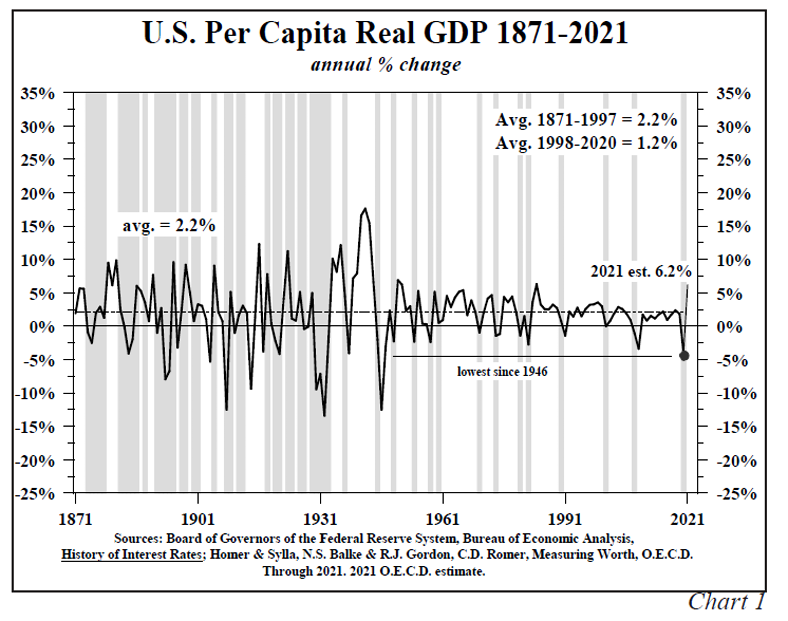

Eye-popping economic growth numbers, based on GDP in present circumstances, greatly overstate the presumed significance of their result. This is where the fallacy of broken glass comes into play. Many businesses failed in the recession of 2020, much more so than normal. As survivors and new firms take over their markets, this will be reflected in GDP, but the costs of the failures will not be deducted.

The two main structural impediments to traditional U.S. and global economic growth are massive debt overhang and deteriorating demographics both having worsened as a consequence of 2020.

Mish Comments

Lacy is talking about “inflation” as measured by the BLS.

I am in 100% agreement with every point.

Thus I expect bond yields to soon peak if they have not done so already.

Year-Over-Year Inflation Spike Coming

The above viewpoint is not incompatible with my March 12 post Inflation is Poised to Soar, 3% by June is “Almost Certain”

Year-over-year comparisons produce very large numbers, up and down, heading in and out of recessions.

I commented “It’s not that inflation will be rampant. Rather, it’s the impact of year-over-year comparisons, goosed by a huge Covid-related dip in energy prices in April and May of 2020.”

I also commented A Producer Price Index Inflation Spike Is On The Way Too

The rationale is the same. And as noted Gas Prices Are Soaring, I Pay $3.28, How Much Do You Pay?

Hello Fed, Inflation is Rampant and Obvious, Why Can’t You See It?

On March 30, I commented Hello Fed, Inflation is Rampant and Obvious, Why Can’t You See It?

Q: Has my view change?

A: No.

Q: Is it inconsistent?

A: No.

Q: Why?

A: Lacy is talking about “inflation” as measured by the BLS. I addressed home prices in detail substituting home prices in the CPI for Owners’ Equivalent Rent (OER) in the CPI.

I stand by that measure of inflation and it’s out of control.

The Fed blew another set of bubbles and did so on purpose.

Two Bonus Reasons to Expect Lower Inflation

- Bubbles Pop

- Higher Taxes

Lacy came up with six excellent reasons to expect lower inflation. To those we can easily add two more.

Bubbles Pop

The expansion of bubbles is highly inflationary and popping is the reverse.

Please note the Largest Increase in Margin Debt Since 2007 Fuels Stock Market

What happened in 2000 and 2007? I think you know the answer to that question.

Bubbles inevitably pop and the result, by definition, is not inflationary.

Higher Taxes

Tax hikes are hugely disinflationary. Look at where we are headed.

- IMF Joins the Choir Singing the Holistic Praises of Higher Taxes

- Prepare for 3 Things: Big Government, Huge Boondoggles, Massive Taxes

- Biden’s Divide and Conquer Tax Plan Strategy Is Likely to Succeed

- ‘Millionaires Tax’ in NY Likely a Done Deal, Expect a Big Exodus

- A Single Democrat Senator Stands in the Way of a Very Progressive Tax and Spend Agenda

Not all of those tax hikes will pass but some of them will.

Biden wants to increase the corporate tax rate to 28% from 21%. Look for a compromise at 25% or so.

Progressives want huge tax hikes, via reconciliation, some of them will get through.

These tax hikes are very recessionary and disinflationary.

Recovery in Low Paying Jobs

Finally, please note It’s Been One Heck of a Recovery in Low-Paying Zoomer Jobs

That’s not a big inducement to higher inflation either.

Add Things Up

Add it all up and you have 8 reasons to expect inflation will soon peak.

Full story here Are you the author? Previous post See more for Next postTags: Economics,Featured,newsletter