Thanks to lockdowns, high unemployment, and general uncertainty and fear over covid-19, the personal saving rate in the United States in October was 13.6 percent, the highest since the mid-1970s. This is down from April’s rate of 33.7 percent, which was the highest saving rate recorded since the Second World War.

Thanks to lockdowns, high unemployment, and general uncertainty and fear over covid-19, the personal saving rate in the United States in October was 13.6 percent, the highest since the mid-1970s. This is down from April’s rate of 33.7 percent, which was the highest saving rate recorded since the Second World War.

Moreover, among those who received “stimulus” checks under the CARES Act, only 15 percent of those surveyed in a National Bureau of Economic Research (NBER) study reported spending it. Thirty-three percent said they saved the payment, and 52 percent said they used the money to pay down debt.

Taken all together, these factors should spell an immense amount of deflationary pressure, both on the money supply, and ultimately on consumer prices as well.1

Central bankers, of course, recoil at the idea of deflation, and hate the idea of Americans saving money and putting actual loanable funds—backed by savings—into the financial system. Rather, the bankers insist we all take every dime we have and spend it on entertainment and on trinkets that are perhaps best called “future landfill.”

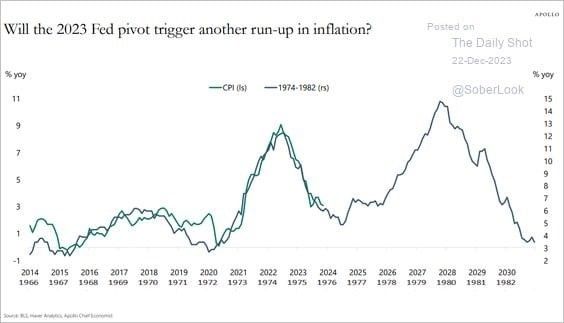

The fact that the Consumer Price Index (CPI) never fell to zero in the midst of all of this—and is now headed to 2 percent—shows central bankers’ power to inflate.

The conclusion that central bankers and vulgar Keynesians want us to draw from tepid growth in consumer prices is that since consumer price inflation is not remarkably high, then central banks have plenty of room to further inflate the money supply in pursuit of avoiding dreaded deflation.

Consider for example, how the Fed’s chairman, Jerome Powell, and other central bankers speak often of inflation targets and how they conclude more credit expansion is prudent and justified so long as price indices aren’t increasing beyond some arbitrarily set “correct” rate of around 2 percent.

“Hey, so long as consumer prices are rising, we have nothing to worry about,” is the general refrain. Thus, central bankers assure the public that central banks must have carte blanche to keep inflating the money supply through efforts to drive down interest rates and to directly inflate the money supply via asset purchases. In America, for example, the central bank has been monetizing the national debt since 2008. And since the covid crash, the Fed has begun monetizing even more than that as it began buying up corporate bonds in June. In spite of all of this, consumer price increases have not exactly skyrocketed upward—the lack of price inflation likely reflects just how much households have scaled back their spending.

But this doesn’t mean everything is okay. Here’s the rub: the extent to which we experience consumer price inflation isn’t really the measure of how much damage is being done by expansive monetary policy. Sure, price inflation tends to accompany money supply inflation, but it’s only one effect. Another effect—perhaps a more damaging one—is the fact that money supply inflation creates bubbles and malinvestment while also redistributing wealth in a political and inequitable way.

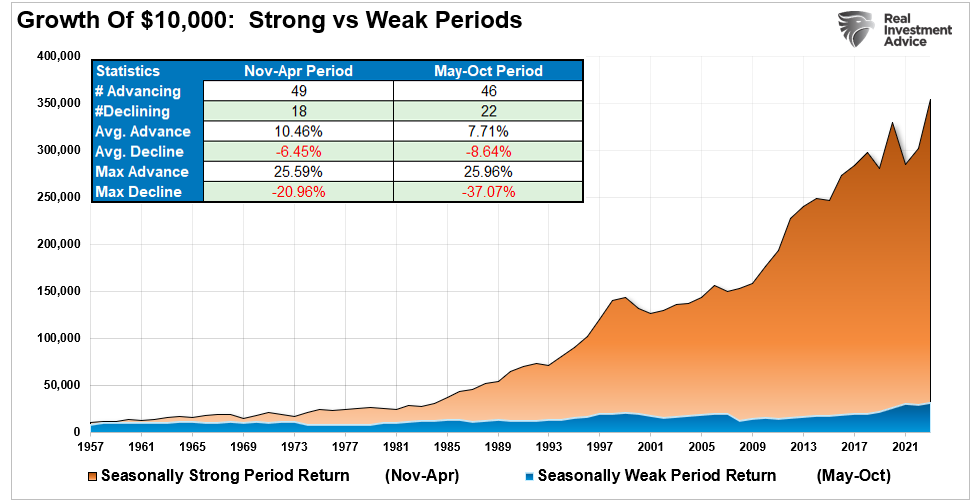

Consider asset price inflation. The Dow Jones has become completely divorced from the economic realities of American households as stock prices rally ever upward. And home prices, according to the Case-Shiller Index, have been heading toward new multiyear highs in recent months.

As Frank Shostak notes:

The emergence of a bubble or a monetary balloon need not be always associated with rising prices—for instance if the growth rate of goods corresponds to the growth rate of money supply, no change in prices will take place.

The real issue—one that’s hard to measure and which leads to sizable problems later, is malinvestment. Shostak continues:

What matters is not whether the emergence of a bubble is associated with price rises but rather the fact that the emergence of a bubble gives rise to nonproductive activities that divert real wealth from wealth generators.

These bubbles represent malinvestment. They are economic activities that would not have occurred—or at least not have occurred to the same degree—without the injection of new unbacked money into the economy. What’s more, they take resources that would have gone to other activities highly valued by consumers and investors, and instead direct them to suboptimal activities less valued.

We can already see the effects of this in the United States today. Although millions of small businesses sit on the brink of insolvency thanks to lockdowns and declines in consumer spending, the portfolios of Wall Street bankers and investors spiral upward. This is in part due to the central bank’s monetary policy. Thorsten Polleit has shown that movement in the stock market tends to follow money creation. Louis Rouanet explains how it works:

We can list four main reasons why the growth of financial markets is triggered by an expansion of the money supply: (1) because financial titles are often used as collateral in debt contracts; (2) because the anticipation of price-inflation, which is a common trait among all fiat money regimes, discourages the hoarding of money thus encouraging both the demand for and the supply of financial titles; (3) because the production of money through central banks is a matter of sheer human will and is therefore prone to developing moral-hazard in the financial world. This leads to an artificially high demand for financial titles and increases the supply of such titles by the same token. And (4) because the manipulation of credit by central banks and banks, by lowering the interest rate in the short run, particularly affects the demand for capital and the capital structure during the course of the business cycle.

One of the most visible consequence[s] of this growth of financial markets triggered by monetary expansion is asset price inflation. In a completely sound money system where credit only depends on the amount of saving rather than on fiduciary credit, there is very little room for generalized and persistent asset-price inflation as the amount of funds which can be used to purchase assets is strictly limited. In other words, the phenomenon of asset-price inflation is a child of credit inflation.

We can see where this leads in terms of who comes out on top. People who are heavily invested in the financial sector will make a lot of money. Those who can’t afford to speculate in stocks will do less well. Those who own a lot of real estate will benefit. First-time homebuyers and renters will be largely out of luck. Moreover, those who directly benefit from government spending—such as government contractors, government employees, and beneficiaries of government lending programs—will do well. But those whose low income and lack of political influence doesn’t win them the benefits of cheap loans and government grants? They’re largely out of luck.

This represents an immense transfer of wealth from some groups to other groups. Most important, as Shostak notes, it is a transfer away from those enterprises most valued in a free market and toward those who benefit from central bank–fueled credit expansion and bubble economies. In our world today, this largely means a transfer of wealth from middle-class business owners, working-class laborers, and anyone who can’t afford to buy a large stake in the new bubble industries. The winners tend to be billionaires, investment bankers, and those who collect a government paycheck, whether they are ostensibly government employees or not.

And this can all happen even without high rates of consumer price inflation. If people are spending less, paying down debt, and saving for the future, we should expect to see deflation in prices at the consumer level. But that sort of deflation doesn’t mean there can’t be big-time growth in asset prices which are strategically positioned to benefit from the central bank’s easy money. In other words, even without obvious consumer price inflation, we’re still living in the midst of immense wealth transfer engineered by government technocrats for the benefit of those lucky enough to be anointed the “winners” by central bankers. An excessive focus on consumer price inflation may lead some to miss this.

- 1. If households pay off debt faster than new loans are made, the money supply would shrink, all else being equal.

Tags: Featured,newsletter