- Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs

- Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities

- The two day FOMC meeting starts today and concludes with a likely dovish hold tomorrow; ADP provides its private sector jobs estimate

- Europe and Asia reported final services and composite PMIs

Markets are likely facing an extended period of uncertainty. US elections results won’t be known for days, and then there are the likely court fights that will likely crop up in the close states. This is arguably the worst outcome possible for investors. Haven assets are likely to be bid, while risk assets are likely to remain under pressure. The situation remains very fluid and so we will put out our thoughts as developments arise.

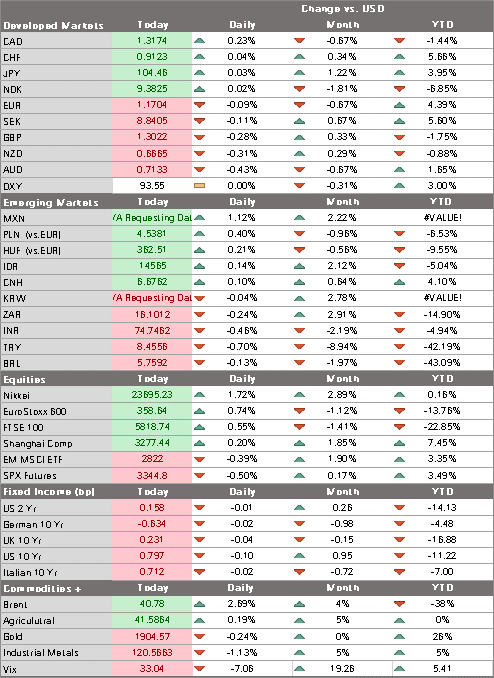

The dollar is seeing some safe haven bid but is well off its highs. DXY again proved unable to break above the 93-94 trading range that has largely held since the start of October. With DXY still apparently capped around 94, the euro is moving back above $1.17 after testing support near $1.16. Sterling will be helped by the positive Brexit vibe and is moving back above $1.30, while USD/JPY remains heavy after being unable to break above the 105 area again. Looking through all the noise, we think the prospects of a split government in the US are high and that argues for dollar weakness once the safe haven flows ebb.

AMERICAS

Election day has come and gone. However, given the huge amount of mail-in and early ballots this year due to the pandemic, final results in a handful of key states won’t be known for several days, if not weeks. As things stand, most news outlets give Biden 224 electoral college votes to Trump’s 213. 270 are needed to win. The states still counting votes are Michigan (16 electoral college votes), Pennsylvania (20), Georgia (16), North Carolina (15), Nevada (6), Arizona (11), Alaska (3), Maine (4), and Wisconsin (10).

Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet. Those votes still being counted were legally cast and there is no reason to exclude them from the final counts. It’s hard to imagine that the Supreme Court would render these votes null and void. Assuming all of these remaining states will be allowed to complete their vote counts, we will come up with possible scenarios whereby both candidates can eke out the 270 needed. There are too many possible permutations to detail here but will be contained in our election analysis out later today. Again, both candidates still have several paths to victory.

Asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities. Let’s try to break down the market reactions to some of the general developments we can point to with a degree of uncertainty.

- Pricing out the Blue Wave: The Senate looks likely to remain in Republican hands. This means that a Democratic-led aggressive fiscal package is off the table, and upside risks to Treasury yields have eased (US 10-year is down 11 bp to 0.79% currently). US equity futures are mixed, as the lack of a large-scale fiscal package will weigh on economic growth next year. No Blue Wave also means that a major renewable energy package becomes very unlikely, leading to heavy losses in that sector as well as gains in oil prices.

- Contested election risks rise: This is driving the underlying risk aversion flows towards Treasuries and the dollar. It’s interesting to see that gold (-1% today) has not benefited much from this, suggesting that it’s more sensitive to the dollar debasement hedging notion rather than offering a safe haven destination, at least for now.

To be clear, the specter of institutional dispute looms. While we do not think Trump’s call to ignore legally cast vote will not gain much traction, close races could end up in the courts a la Florida in 2000. Pennsylvania’s state officials, for example, said a firm result will be ready “within days.” Electoral rules in Wisconsin allow for a recount if the result is narrower than 1 ppt.

More broadly, the elections delivered a strong blow to confidence over the polling process and professional forecasters. Polling errors in many states were larger than they were in 2016, despite efforts to improve the process. This means that going forward, we should expect a semi-permanent political risk premium embedded in the US – and perhaps global – democratic process. This is likely to fuel distrust in the system and possibly aggravate polarization.

The two day FOMC meeting starts today and concludes with a likely dovish hold tomorrow. Policy settings will be kept unchanged even as Chair Powell will likely play up the downside risks to the economy due to rising virus numbers and the lack of another fiscal stimulus package. Of note, monetary policy in 2021 will be driven in large part by fiscal policy via QE. The dollar tends to weaken on FOMC decision days. Of the eight so far this year, DXY has weakened on seven of them. Please see our FOMC preview here.

ADP provides its private sector jobs estimate. Consensus is at 650k vs. 749k in September and comes ahead of October jobs data Friday, where consensus is currently at 600k vs. 671k in September. If so, this would be the fourth month of sequentially smaller job gains. The unemployment rate is expected to drop a couple of ticks to 7.7%, while average hourly earnings are expected to drop a tick to 4.6% y/y. September trade (-$63.9 bln expected), ISM services PMI (57.5 expected) and final Markit services and composite PMIs will all be reported today as well.

| EUROPE/MIDDLE EAST/AFRICA

The reaction in European markets has been in line with that in the US, but the moves in fixed income were probably the most expressive. Yields in Germany, for example, were only down a couple of basis points leading to a 10 bp narrowing of the 10-year spread with the US. At 143 bp, however, it’s still well above the lows seen earlier in the year. Eurozone reported final services and composite PMI readings. Headline services rose to 46.9 from 46.2 preliminary, dragging the composite up to 50.0 from 49.4 preliminary. It was really all Germany, as its readings improved to 49.5 and 55.0, respectively, as France’s services PMI was steady at 46.5 and its composite rose a couple of ticks to 47.5. Both Italy and Spain surprised to the downside. Italy’s readings fell to 46.7 and 49.2, respectively, while Spain’s fell to 41.4 and 44.1, respectively. Elsewhere, UK reported final services and composite PMI readings. Services fell to 51.4 from 52.3 preliminary, dragging the composite down to 52.1 from 52.9 preliminary. ASIA Asia reported PMI readings. Australia reported final services and composite PMI readings. Both fell a tick from the preliminary readings to53.7 and 53.5, respectively. September retail sales came in at -1.1% m/m vs. -1.5% expected. Elsewhere, Caixin reported October China services and composite PMIs. Services rose to 56.8 from 54.8 in September, dragging the composite up to 55.7 from 54.5 in September. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter