The ECB meets Thursday and is widely expected to stand pat until the next meeting. Macro forecasts won’t be updated until the December 10 meeting, but the bank will have to acknowledge the deteriorating outlook now. There’s a small risk of more jawboning against the stronger euro, but it should otherwise be an uneventful meeting. We expect the ECB to increase QE in December but another rate cut seems very unlikely, as does activation of OMT.

POSSIBLE NEXT STEPS

- Jawbone the euro weaker – POSSIBLE NOW, POSSIBLE IN DECEMBER. Madame Lagarde downplayed concerns about the strong euro at her September 10 press conference, only to be immediately corrected by several of her senior colleagues, including Chief Economist Lane. While the ECB professes not to target the exchange rate, that never prevented Trichet or Draghi from making comments that worked to weaken the euro. Of course, without any underlying shift in relative monetary policy stances or economic fundamentals, jawboning typically has limited impact. In any case, Madame Lagarde has started to incorporate the exchange rate into her official commentary since the last meeting and she will surely get lots of questions about the euro this time around. That said, the euro has traded sideways since the September meeting and has yet to test that month’s cycle high near $1.2010. As such, there is likely to be a bit less urgency about the euro this time around.

|

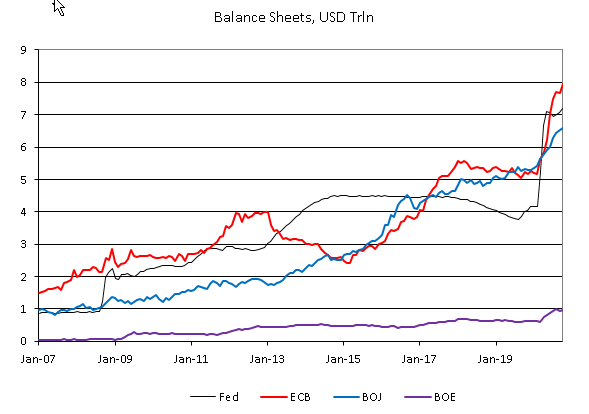

Balance Sheets, USD Trln 2007-2020 |

| INVESTMENT OUTLOOK

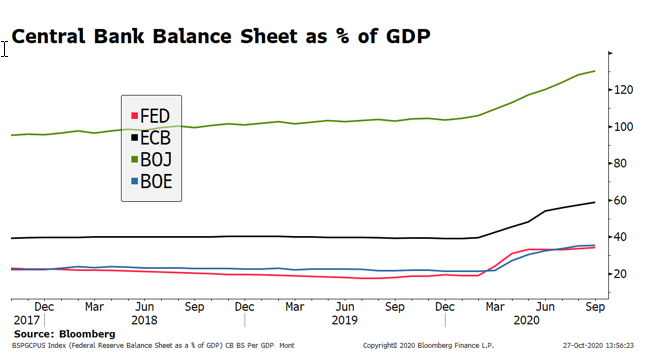

Our long-standing bearish dollar call remains in place. The fundamental story is still negative, with an ultra-dovish Fed, a faltering US economy due to the pandemic, and the risk of a very large fiscal stimulus package after the elections. Once this current bout of risk aversion settles down, we expect the weak dollar trend to resume, eventually leading to a clean break above the $1.2010 cycle high from September 1. After that, there really aren’t any significant targets until the April 2018 high near $1.24, followed by the February 2018 high near $1.2555. With the rising virus count leading to increased restrictions across Europe, the pace of euro gains is likely to be much slower than it was over the summer. However, the fact that Europe succeeded in crushing the curve in the past gives us hope that it will do so again. Here in the US, we are already seeing a third peak in infections that so far shows no signs of abating. Pardon us for sounding grim, but investors will ultimately be trading virus-differentials. Our dollar-negative view seems impervious to the US election outcome, at least over the short-term horizon. There are two scenarios that would likely lead to fiscal expansion. Biden plus a Democratic Senate would most likely lead to very aggressive stimulus, which we think will be dollar-negative given the greater twin deficits and accelerated Fed balance sheet expansion needed to mop up record UST issuance to prevent a spike in long-dated yields. Trump plus a Republican Senate would likely deliver fiscal stimulus but on a smaller scale. This would also be dollar-negative over the short-term, but both would set the table for a dollar recovery if the US can start to outperform again. The last potential outcome of a split government (Biden plus a Republican Senate or Trump plus a Democratic Senate) would likely lead to gridlock and forced austerity, translating into a weaker dollar though a worse growth outlook (perhaps after a knee-jerk risk-aversion dollar rally). |

Central Bank Balance Sheet as % of GDP, 2017-2020 |

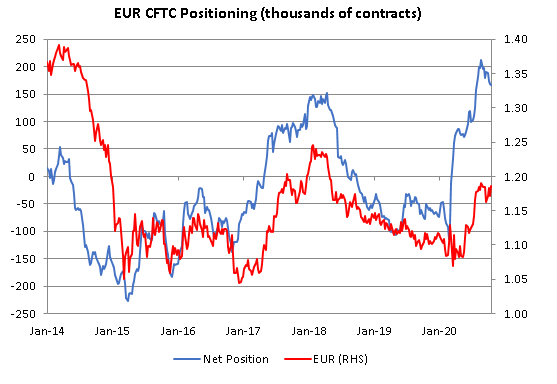

| Euro positioning is not as overextended as it’s been in the past. The latest CFTC data shows net euro longs for non-commercial accounts stand at 166k contracts for the week ended October 20, down slightly from 169k the previous week and well below the record high of 212k from late August. As a result, we believe further euro gains won’t be as tough from a positioning standpoint. |

EUR CFTC Positioning, 2014-2020 |

| Since July 1, the euro has gained about 5.5% vs. the dollar, 2% vs. the yen, and is basically flat against sterling. All three currency pairs have traded largely sideways since the September 10 ECB meeting. Overall, the moves have been neither excessive nor “brutal” but eurozone policymakers will remain vigilant. Draghi often pushed back at euro strength during his tenure, let’s see how Lagarde approaches it going forward. A significantly stronger euro is the last thing the eurozone needs as it flirts with deflation again. However, it is often more about the pace than the level and so recent price action would seem to warrant limited concern.

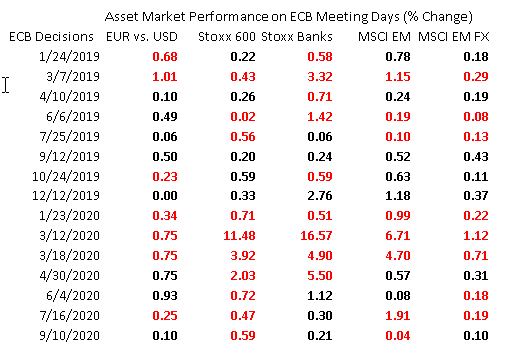

Looking at various asset classes, the behavior on ECB meeting days this year has been mixed. So far in 2020, the euro has weakened on 4 of the 7 decision days. However, it has strengthened on 3 of the past four. STOXX Europe 600 has fallen on all 7 ECB decision days so far, while STOXX Banks has mirrored the euro and fallen on 4 and risen 3. Both MSCI EM and MSCI EM FX have fallen on 5 of the 7 decision days, suggesting that risk assets typically perform poorly on those days. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,developed markets,Featured,newsletter