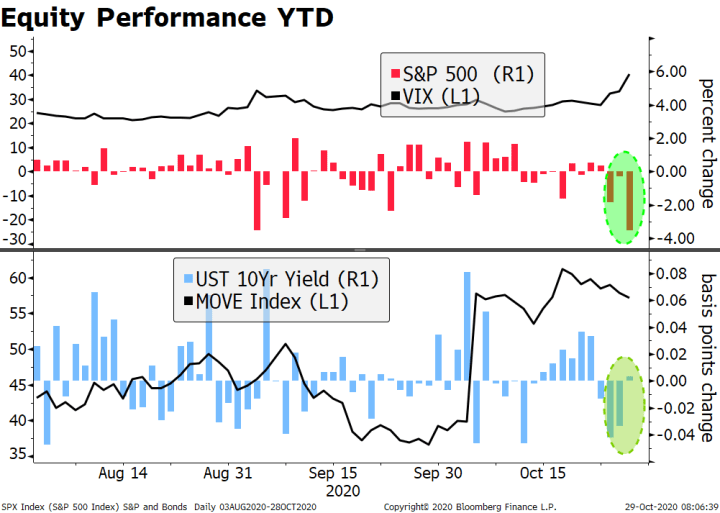

Global equity markets are gaining limited traction today after yesterday’s bloodbath. Asia was mostly lower but Europe is slightly higher while US futures point to a higher open. Of note, DJIA is leading this move down in US stocks. It’s retraced nearly 2/3 of the H2 rally and break of the 26586 area sets up a test of the June 26 low near 24971. Contrast this with the S&P 500, which has retraced just over half the H2 rally, and NASDAQ, which has retraced slightly less than half. Yesterday’s sell-off helped test a now prevalent hedging thesis for investors. That is, US Treasuries are not working that well as a hedge, and neither are the other likely candidates. Yesterday’s 3.5% drawdown in the S&P500 was met by virtually unchanged 10-year Treasury yields. The US Treasury implied volatility index (MOVE) ignored the entire event, while the VIX spiked from 33 to 40. Gold, another hopeful portfolio hedge, was down 1.6%, perhaps in sympathy with falling inflation breakeven rates and/or the stronger dollar. Bitcoin (-3%) didn’t fare any better. Lastly, the yen and Swiss franc barely budged. As we have been saying since last week, implied volatility markets (especially in equities) seem to be the best way to hedge the myriad of risks over the next few weeks. |

Equity Performance YTD, 2020 |

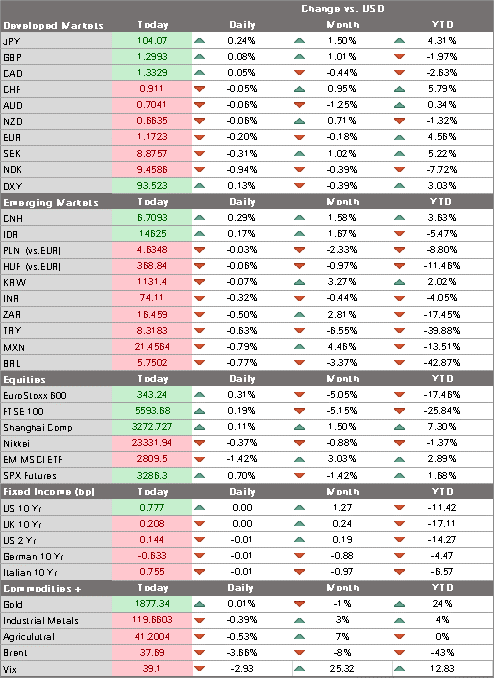

| The dollar remains bid. Yet the lack of a really large-scale move higher in the dollar in the midst of this week’s risk-off environment is telling. DXY has moved back into the 93-94 range that held for most of October but is struggling to remain above 93.50. With DXY likely capped at 94, the euro is likely to see continued near-term support near $1.17 while sterling is testing support near $1.30. USD/JPY continues to sink and is testing the September low near 104. If risk-off sentiment persists, a break below is likely and would set up a test of the March low near 101.20.

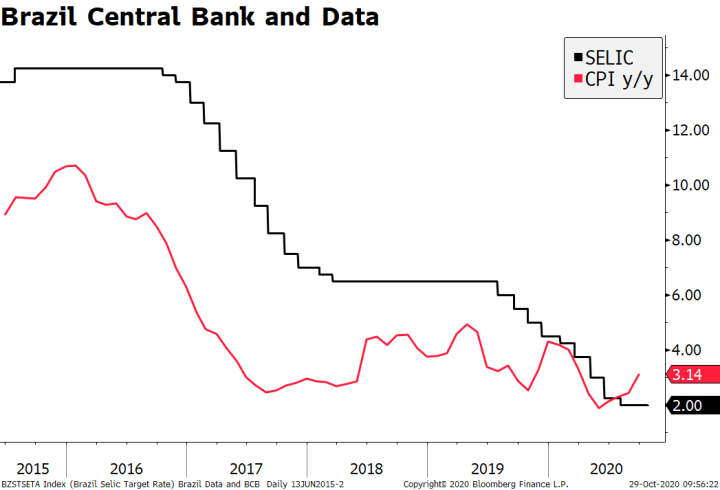

AMERICAS US Q3 GDP data will be the highlight. Consensus sees Q3 GDP growth of 32.0% SAAR vs. -31.4% SAAR in Q2. The NY Fed’s Weekly Economic Index (WEI) suggests the economy contracted around -6% y/y in Q3, a bit worse than the Bloomberg consensus of -3.5% y/y. If the y/y rate were to come in at -6%, this would likely take the SAAR down to around 16% or half the consensus. Of note, the Atlanta Fed’s GDPNow model suggests Q3 growth of 37.0% SAAR while the NY Fed’s Nowcast model suggests 13.75% SAAR. The truth is likely somewhere in between but in truth, this is old news. Looking ahead, the NY Fed’s Nowcast model suggests Q4 growth is tracking around 3.46% SAAR while Bloomberg consensus sees 4.0% SAAR. The NY Fed’s WEI is currently tracking around -5.03% y/y through the week ended October 24. Weekly jobless claims will be reported. Regular initial claims are expected at 770k vs. 787k the previous week, while continuing claims are expected at 7.775 mln vs. 8.373 mln the previous week. The drop in weekly claims last week reflected the revisions and cleared backlog in California, which resumed reporting actual unemployment claims data. PUA initial claims rose slightly to 345k and the two together total around 1.1 mln, which remains elevated. Regular continuing claims have fallen by around 1 mln per week for the past three weeks but PUA continuing claims remain stuck above 10 mln. Still, the labor market overall appears to be improving again after a stall in much of Q3. The only negative is that extended claims are rising, meaning that many unemployed workers cannot find a job and have exhausted normal unemployment benefits. Consensus for the October jobs report out November 6 is currently 635k vs. 661k in September. September pending home sales (3.0% m/m expected) will also be reported today. The Bank of Canada delivered a dovish hold yesterday. The policy rate was kept at 0.25% and new forward guidance sees it kept at this lower bound until 2023, when the output gap is expected to close. It noted that “ongoing slack” in the economy should hold inflation down into 2023, and forecast the output gap at between -3% and -4% in Q3. The bank shifted its QE buying towards long-term bonds, noting that household and corporate borrowing are most closely linked to bond yields in the 3- to 15-year range. Governor Macklem said the bank could also buy 30-year bonds. The only surprise was that the bank will reduce its purchases to CAD4 bln per week from CAD5 bln previously, while stressing that this was not any withdrawal of stimulus. For USD/CAD, clean break of the 1.33 area sets up a test of the September 30 high near 1.3420. Canada Finance Minister Freeland used her first major speech to defend the government’s aggressive fiscal stimulus plans. She stressed that “The upshot is that we are living today in a world where the risks of fiscal inaction outweigh the risks of fiscal action. Doing too little is more dangerous and potentially more costly than doing too much.” In closing, Freeland pledged to return to its pre-pandemic fiscal anchors as soon as the crisis ebbs, noting “We will resume the long-standing, time-tested Canadian approach, with fiscal guardrails and fiscal anchors, that preceded this pandemic.” Brazilian central bank left rates unchanged, as expected. However, it didn’t shut the door as firmly as some had expected for additional cuts. The bank kept the forward guidance mostly unchanged. Their inflation forecasts still point to mostly below-target readings, though officials acknowledged the recent CPI upticks and ongoing fiscal risks. Of course, the currency is also much weaker than the previous meeting. All in all, we think it’s safe to ignore any risk of further easing implied from the communique – the next move in rates will almost certainly be up. That said, we think the curve is showing an overly aggressive tightening schedule, with nearly 50 bp already priced in over the next few months due largely to concerns on the fiscal/political side. |

Brazil Central Bank and Data, 2015-2020 |

| EUROPE/MIDDLE EAST/AFRICA

The European Central Bank is expected to deliver a dovish hold. Please see our preview here. New macro projections won’t come until the December meeting. However, we expect the ECB to acknowledge now that the economic outlook has worsened since the September meeting and to set the table for additional stimulus. We could see some stronger jawboning about the exchange rate this time, as Lagarde’s laissez faire attitude at her press conference last time did not go over very well with many of her ECB colleagues. So far in 2020, the euro has weakened on 4 of the 7 decision days. However, it has strengthened on 3 of the past four. Germany reports October CPI. It is expected to remain steady at -0.4% y/y (EU Harmonized). German state data already reported today have been mixed and give little insight to the national reading. This comes ahead of the eurozone reading Friday, where headline CPI is expected to remain steady at -0.3% y/y and core is expected to remain steady at 0.2% y/y. However, it’s worth noting that Spain reported October CPI (EU Harmonized) today at -1.0% y/y vs. -0.7% expected and -0.6% in September and so there are clear downside risks to the headline eurozone number. Germany also reported October unemployment data earlier at -35k vs. -5k expected and a revised -10k ({was -8k) in September. Unfortunately, downside risks to the data will be seen in Q4 as lockdowns go into effect. Hungary central bank is expected to snug rates higher at its weekly 1-week deposit tender to help support the forint. That rate is expected to be hiked 5 bp to 0.80% as EUR/HUF is approaching the all-time high around 370 from April. The base rate has been kept steady since the last 15 bp cut to 0.60% in July. However, the central bank recently started using the 1-week deposit rate to help support the forint with a 15 bp hike to 0.75% on September 24. It’s a confusing framework, sort of Turkey-lite but with some QE thrown into the mix. Unlike Turkey, the pace of currency weakness has been modest but like Turkey, stronger measures may be needed if weakness accelerates. ASIA The Bank of Japan kept all policy settings unchanged, as expected. Growth forecasts for FY20, FY21, and FY22 were changed to -5.5%, +3.6%, and +1.6% from -4.7%, +3.3%, and +1.5% in July. Core inflation forecasts for FY20, FY21, and FY22 were changed to -0.6%, +0.4%, and +0.7% from -0.5%, +0.3%, and +0.7% in July. That means the 2% target for inflation ex-fresh food still won’t be reached until at least FY23. The BOJ warned that “the outlook for economic activity and prices provided in this Outlook report is extremely unclear” and could change depending on the virus numbers. The bank also said that it will decide, when necessary, to extend its emergency measures whilst maintaining its economic assessment at “severe” after upgrading it in September from “extremely severe.” Japan reported weak September retail sales. Sales fell -0.1% m/m vs. an expected rise of 1.0% and 4.6% in August. What’s worse, the high base effect added to downward pressure on the y/y rate, which plunged to -8.7% vs. -7.6% expected and -1.9% in August. With Japan’s recovery still lagging despite great success in controlling the virus, the BOJ is likely to maintain its easy stance while it awaits the government to deliver a third supplemental budget. Next year is the 100th anniversary of the Chinese Communist Party. As such, this year’s plenum could take on larger significance. The strategy for next five years, as well as the longer-term strategy, seems to be aiming for a shift away from an absolute growth focus to more qualitative measures of development, including inequality, self-sufficiency, environment. This dovetails from the discussion we have recently highlighted (see here) about the “dual circulation” approach and the rebalancing away from external to domestic engines, in part as a reaction to tariffs and the inexorable decoupling from the US. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter