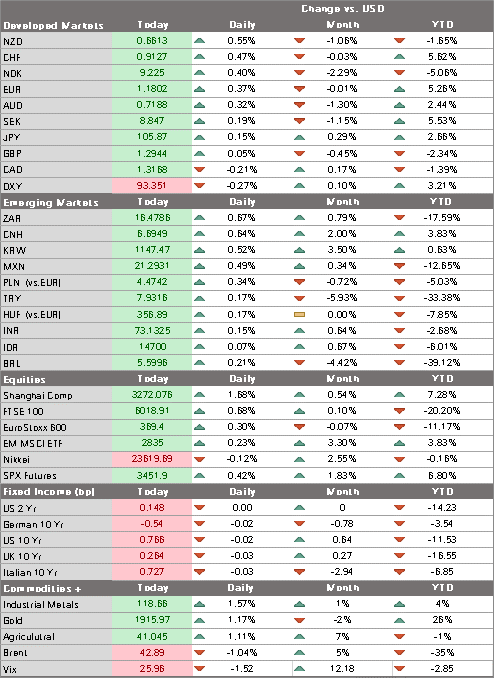

- The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals

- This is another quiet day in terms of US data; Canada reports September jobs data

- We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield

- UK data came in significantly weaker than expected; Japan reported weak August real cash earnings and household spending

- Chinese assets had a strong re-opening after a week-long holiday, helped by a strong services PMI reading; India delivered a dovish hold, as expected

The dollar remains heavy. DXY is trading at the lowest level since September 21 and is on track to test that day’s low near 92.749. A break below would set up a test of the September 1 low near 91.746. The euro is testing the $1.18 area and a break above would set up a test of the September 21 high near $1.1870. After that, the next target would be the September 1 high near $1.2010. Sterling is having trouble breaking above the $1.30 area with Brexit still hanging over the UK. Lastly, USD/JPY is trading back below 106 area after trading above it this week for the first time since September 14.

| AMERICAS

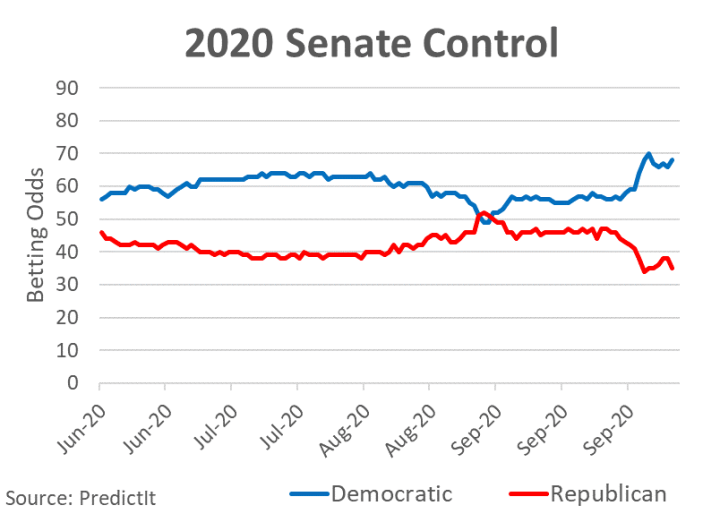

Stimulus talks may or may not be dead. House Speaker Pelosi said there will be no standalone bill to support airlines or any other industry without a broader aid plan. She added that she’s hopeful for more stimulus but noted that she has yet to get a full counteroffer for the last $2.2 trln package passed by the House. Our take is that Trump blinked first and now Pelosi feels she has the upper hand. It remains to be seen how she plays it. We think she wants to get a big deal done so she is likely taking a hardline stance now to extract more concessions from the Republicans. The two sides remain far apart and so we are skeptical that a deal can be reached. Stay tuned. The White House is still sending mixed signals. Treasury Secretary Mnuchin reportedly told Pelosi that Trump wants an agreement on a comprehensive stimulus package. However, White House spokesperson Alyssa Farah later said, “we’ve made very clear we want a skinny package,” though she later said the administration is “open to going with something bigger” but reiterated opposition to the $2.2 trln plan passed by House Democrats. It is remarkable to us that a party that is down in the polls so much ahead of an election is resisting fiscal stimulus. Besides possibly losing the presidency, Republicans may also lose control of the Senate as betting odds are giving Democrats a near 70% chance of taking the Senate. This is another quiet day in terms of US data. August wholesale trade sales and final wholesale inventories will be reported. The only Fed speaker is Barkin. Fed officials have been unified this week in calling for more fiscal stimulus. Without another aid package, the US economy faces even stronger headwinds on top of the rising virus infections. This economic underperformance is likely to continue feeding into dollar underperformance. Canada reports September jobs data. A gain of 150k is expected, down from 245.8k in August but still strong. Unemployment is seen falling to 9.8% from 10.2% in August. USD/CAD is trading at its lowest level since September 18 and a break of the 1.3155 area would set up a test of the September 1 low near 1.2995. |

2020 Senate Control |

| EUROPE/MIDDLE EAST/AFRICA

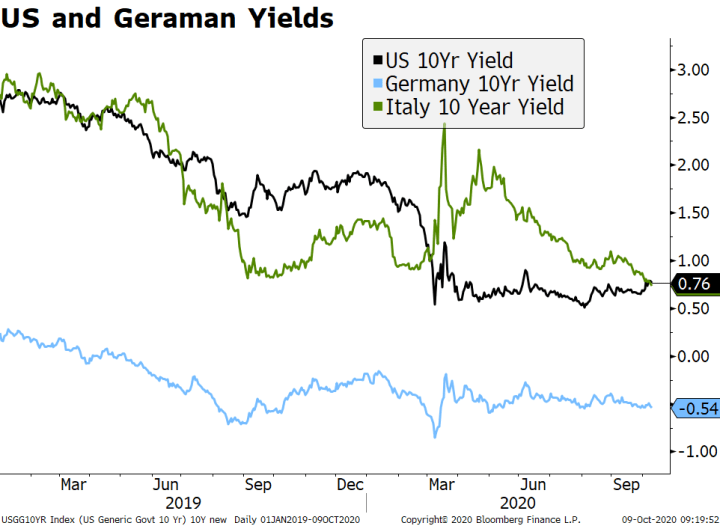

We got some more eurozone IP readings for August. France’s rose 1.3% vs. 1.7% expected while Italy’s jumped 7.7% vs. 1.4% expected. Eurozone aggregate IP for August will be reported next Wednesday and is expected to rise 0.6% m/m vs. 4.1% in July. Earlier this week, Germany IP came in weaker than expected at -0.2% m/m while Spain came in slightly better than expected. Momentum in Europe is clearly slowing, which supports our view that the ECB will add more stimulus before year-end. Following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield. Also, the Italian 10-year around 0.75% is now lower than the US 10-year Treasury for the first time since the pandemic started taking its grip on markets. There seems to be quite a few tailwinds in play from ECB buying to positive political news. Recall last month the ruling alliance scored an important victory in local elections against opposition forces led by Matteo Salvini. UK data came in significantly weaker than expected. August GDP, IP, construction output, services index, and trade were all reported. GDP rose 2.1% m/m vs. 4.6% expected, IP rose 0.3% m/m vs. 2.6% expected, construction output rose 3.0% m/m vs. 5.0% expected, and services rose 2.4% m/m vs. 5.0% expected. What’s worse, the July readings revised lower. Looking ahead to this fall, a more abrupt deceleration may be seen when many government support programs end. Viral infections are surging, which makes the need for further fiscal and monetary support even greater. We continue to expect the BOE to increase its asset purchases before year-end. |

US and Germany Yields, 2019-2020 |

| ASIA

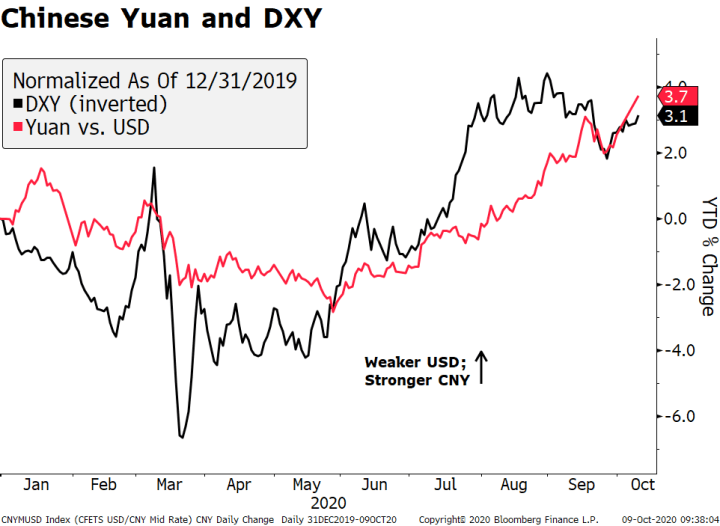

Japan reported weak August real cash earnings and household spending. Earnings fell -1.4% y/y, as expected and compares to a revised -1.5% (was -1.3%) in July. Elsewhere, spending fell -6.9% y/y vs. -6.7% expected and -7.6% in July. The savings rate rose to 44% in the five months through August this year, up from 33% for the same period in 2019. Overall, recent data suggest the economy is improving slightly but still facing strong headwinds. We continue to expect another slug of fiscal stimulus from new Prime Minister Suga in the coming months. Chinese assets had a strong re-opening after a week-long holiday, helped by a strong services PMI reading. The Shanghai Comp was up 1.6% today and the spot CNY appreciated over 1% to the strongest level since April 2019. The yuan has an appreciated about 3.5% this year, but the move has been largely in line with the broad dollar trend. The news flow from China remains supportive. The Caixin services PMI for September ticked higher to 54.8 vs. 54.3 expected and 54.0 in August. Elsewhere, reports from the Tourism Agency claim that travel during the holiday has normalized about 80%. When all is said and done, the mainland economy remains on firm footing and is leading the recovery in the region. |

Chinese Yuan and DXY, 2020 |

| Reserve Bank of India delivered a dovish hold, as expected. It kept the repo rate steady at 4.0%. However, the bank doubled the amount of open market bond purchases to INR200 bln, offered to buy state debt, and provided cheap long-term funding to banks to invest in corporate bonds and commercial paper. Governor Das said the bank would remain accommodative “as long as necessary, at least through the current financial year and into the next year to revive growth on a durable basis and mitigate the impact of Covid-19 while ensuring that inflation remains within the target going forward.” The bank cuts its GDP forecast for the current FY to – 9.5%, the first official forecast since the pandemic hit. Das hinted at further rate cuts, which we think are likely in the coming months. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter