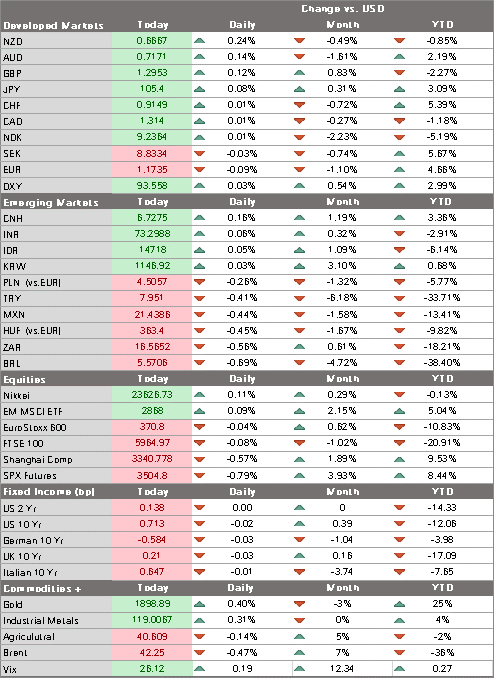

- The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September

- Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country

- The EU recovery fund has hit some speed bumps; the Netherlands is the latest country to impose stricter measures; eurozone IP came in slightly lower than expected

- China reported strong money and loan data; Singapore and Korea kept monetary policy unchanged, as expected

The dollar is making a modest comeback. Friday saw the biggest down day for DXY since August 28, but it has since risen three straight days and is stabilizing just above the 93.50 area. It has traded largely in a 93-94 range this month. With the US outlook softening, that 94 area will be very tough to break. Once this period of consolidation ends, we look for dollar weakness to resume. The euro is likely to find some support near $1.17, while sterling continues to be buffeted by Brexit-related headlines. Despite lack of concrete progress on a Brexit deal, sterling is holding up well and could test the $1.30 again.

AMERICAS

Stimulus talks have hit a dead end. House Speaker Pelosi has reportedly asked the White House to revamp its latest offer of $1.8 trln. The problem here remains that Senate Republicans are not on board with anything close to that amount. In fact, Senate Majority Leader McConnell is planning a vote next week on an even skinnier bill than the one previously passed by the Senate. Talks are said to be continuing this week but with both sides dug in, this really seems to be the end of the line.

We get more US inflation readings for September. PPI will be reported today, with headline and core inflation expected to accelerate to 0.2% y/y and 1.0% y/y, respectively. CPI came in as expected yesterday, with headline rising a tick to 1.4% y/y and core inflation remaining steady at 1.7% y/y. If price pressures rise further, this could provide further fuel to the recent curve steepening trade by hurting demand for USTs. Barkin, Clarida, Quarles, and Kaplan all speak.

| EUROPE/MIDDLE EAST/AFRICA

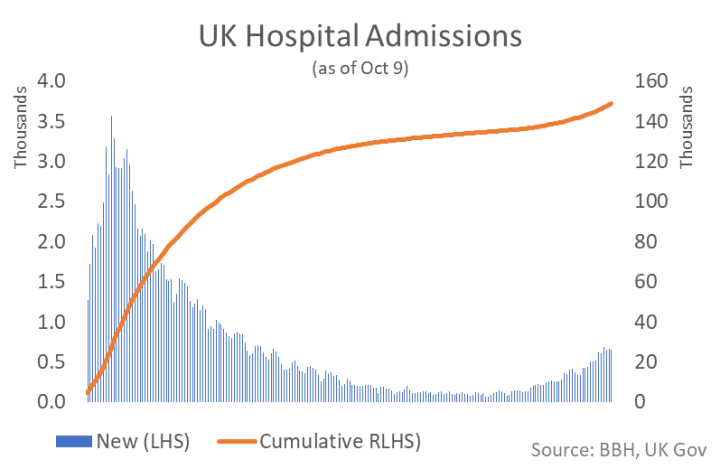

Brexit talks continue ahead of the EU summit Thursday and Friday. Irish Deputy Prime Minister Varadkar said yesterday that there is a better than 50% chance of a Brexit deal. More interestingly, he thinks it will be a skinny deal. We believe this is the first time that it’s been raised, as market pricing has been totally binary – either no deal or a comprehensive deal. To us, a skinny deal is better than no deal and so sterling would probably rally if this happens. A skinny deal would allow both sides to claim victory, avoid a no deal Brexit, and continue talks on the other contentious areas in 2021. A new bill by the UK government could change the investment landscape in the country. The National Security and Investment Bill, which has been discussed for some time, will give policymaker the power to act pre-emptively and retroactively (!) on foreign investments in critical sectors such as defense and infrastructure. China, and 5G technology, are likely the primary implicit targets here. But the bill might do broader damage sentiment for inbound investment in the country, especially once it’s no longer bound by the more predictable EU rules. UK government seems to be digging itself into an ever deeper political hole. In our view, the Internal Markets Bill (to rewrite elements of the Withdrawal Agreement with the EU) was a big miscalculation. It complicated its domestic political situation – by causing a rebellion within its party – and its external position – by creating another hurdle in the negotiations with the EU. To make things worse, the government’s recent 3-tier Covid reaction plan has been seriously criticized by MPs and parts of the scientific community. The Scientific Advisory Group, for example, is now arguing for a 2-week lockdown. The death rate in the UK remains comparatively low, even as cases rise, but hospitalization rates are rising fast. |

UK Hospital Admissions |

| The EU recovery fund has hit some speed bumps. Spain’s Economy Minister Calvino said negotiations are “still ongoing” but added that “We are doing our utmost to accelerate this process so that we can start the implementation of the recovery plan on January 1, 2021.” Poland is gumming up the works by threatening to veto the EU budget and recovery plan. The core of the dispute lies with the so-called rule of law clauses that seek to link democratic standards to any funds disbursed by the EU. Hungary and Poland are the main culprits here as their “illiberal democracies” appear to run counter to EU ideals. We do expect an eventual compromise after the bluster dies down.

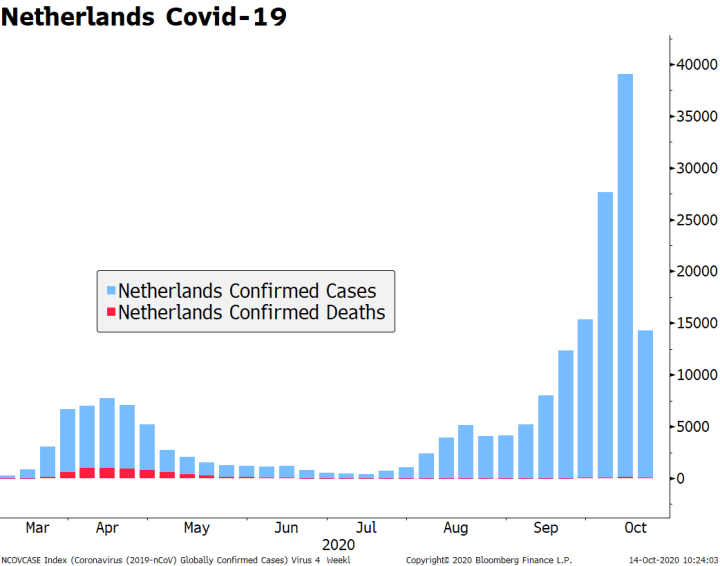

The Netherlands is the latest country to impose stricter measures. The government mandated obligatory use of masks in public and a partial lockdown, with restrictions on gatherings to four people and closure of bars and restaurants. The measures are expected to last four weeks. |

Netherlands Covid-19, 2020 |

| On the data front, eurozone industrial production came in slightly lower than expected. August IP rose 0.7% m/m vs. 0.8% expected, grinding slowly back towards pre-pandemic levels. July was revised up to 5.0% m/m from 4.1% previously. The recovery is likely to continue, but at a much slower pace, especially with pendulum swinging towards further restrictive measures in the region. As such, there will be pressure on the ECB to provide more stimulus. We see an increase to its PEPP before year-end. Next meeting is October 29 but we suspect the bank will wait until the December 10 meeting to move, as new macro projections will be released then. |

Euro Area Industrial Production, 2005-2020 |

|

ASIA China reported strong money and loan data. Its rapidly expanding credit numbers are consistent with the solid recovery narrative we are getting from other data points. Aggregate financing beat expectations at RMB3.48 trln, roughly the same as the previous month, but new loans jumped to RMB1.9 trln from RMB1.28 trln. The numbers reinforce our view that the PBOC won’t enact any meaningful changes in the current policy stance as liquidity seems to ample enough for recovery to continue. Of course, external demand remains a potential downside risk, even though the latest trade figures were decidedly strong. Monetary Authority of Singapore kept policy unchanged, as expected. It provided dovish forward guidance, stating that “As core inflation is expected to stay low, MAS assesses that an accommodative policy stance will remain appropriate for some time.” It warned of a weak recovery and downside risks from still-challenging global demand, limited travel, a soft labor market, and ongoing public health concerns. Policymakers have signaled that fiscal policy will carry much of the load going forward. Q3 GDP was also reported and grew 35.4% SAAR vs. 33.5% expected and a revised -43.3% (was -42.9%) in Q2. |

EM FX YTD Performance, 2020 |

| The Bank of Korea left rates on hold at 0.5%, as expected. We think further monetary stimulus is unlikely unless we get a dramatic change in global landscape. The BOK expects GDP at -1.3% for this year, but the substantial fiscal effort will continue helping the economy move along as external demand picks up. Officials didn’t seem particularly concerned about the local bond market, suggesting ad-hoc purchases (or any more aggressive measures) are unlikely for now. The decision shouldn’t have any impact on asset prices. We expect appreciation pressure on the won to continue given the country’s favorable position for this part of the cycle. The currency is the best performing in the region over the last month (+3.2% against the dollar), but it’s still only 0.5% stronger year to date, underperforming the likes of TWD, PHP, and CNY. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter